Momentumindikator und Angstindex-Crossover-Strategie

Erstellungsdatum:

2024-01-23 14:27:23

zuletzt geändert:

2024-01-23 14:27:23

Kopie:

3

Klicks:

619

1

konzentrieren Sie sich auf

1664

Anhänger

Überblick

Die Strategie beurteilt die Marktentwicklung durch die Berechnung der Kreuzung von Dynamik- und Panik-Indikatoren und sendet ein Verkaufssignal bei einer bestimmten Kreuzung der beiden Indikatoren aus, um einen starken Rückgang zu erfassen.

Strategieprinzip

- Berechnen Sie den 50-Zyklus-Dynamik-Indikator. Es zeigt die Veränderung des Preises gegenüber dem Zeitraum vor 50 Zyklen.

- Berechnen Sie die Korrektur des Panik-Index für 22 Zyklen. Es zeigt die Panik-Stimmung des Marktes durch das Verhältnis von Höchst- und Tiefpreisen.

- Wenn der Dynamikindikator den Panikindex unterbricht, zeigt dies, dass der Markt unter Druck steht.

- Wenn die Dynamik weiter in die Gefahrenzone fällt (zwischen 5 und 5), gibt es ein starkes Verkaufssignal.

Analyse der Stärken

- Der Panic Index, ein Indikator für die Stimmung am Markt, ist ein guter Indikator für strukturelle Veränderungen am Markt.

- Die Dynamik-Indikatoren können die Geschwindigkeit und Stärke der Preisänderungen beurteilen und helfen, die Markttrends zu beurteilen.

- Durch die Kombination zweier verschiedener Arten von Indikatoren kann die Genauigkeit der Identifizierung von Notfällen verbessert werden.

- Durch die Anpassung der Parameter kann man sich flexibel an unterschiedliche Marktumstände anpassen.

Risikoanalyse

- Die Kreuzung von Panik- und Dynamik-Indikatoren garantiert nicht, dass jedes Mal ein starker Rückgang eintritt. Die endgültige Entscheidung muss durch die Kombination anderer Indikatoren getroffen werden.

- Es gibt keine Stop-Loss-Einstellungen für den Verkauf, so dass die Verluste nicht effektiv kontrolliert werden können.

- Umkehrungen und Wiedereingänge werden nicht berücksichtigt. Die Strategie ist nur geeignet, um einen plötzlichen Rückgang zu erfassen.

Optimierungsrichtung

- Setzen Sie nach dem Verkauf einen Stop-Loss, um den Verlust zu kontrollieren.

- Um andere Kennzahlen zu erhöhen, erhöht sich die Zuverlässigkeit des Signals. Wie Transaktionsvolumen, Brinline usw.

- Die Erhöhung der Marktrückmeldungen ermöglicht die vollständige Umsetzung der Strategie in den langfristigen Zyklen.

- Optimierung der Parameter, um die optimale Parameterkombination zu finden.

Zusammenfassen

Die Strategie sendet eine Warnung vor einem Marktsturz durch eine Kreuzung von Dynamik- und Panik-Indikatoren. Sie kann einen plötzlichen Marktsturz effektiv erfassen. Die Strategie ist jedoch nur für Short-Line-Anwendungen geeignet, ohne Ausstiegsmechanismen und Risikokontrollen.

Strategiequellcode

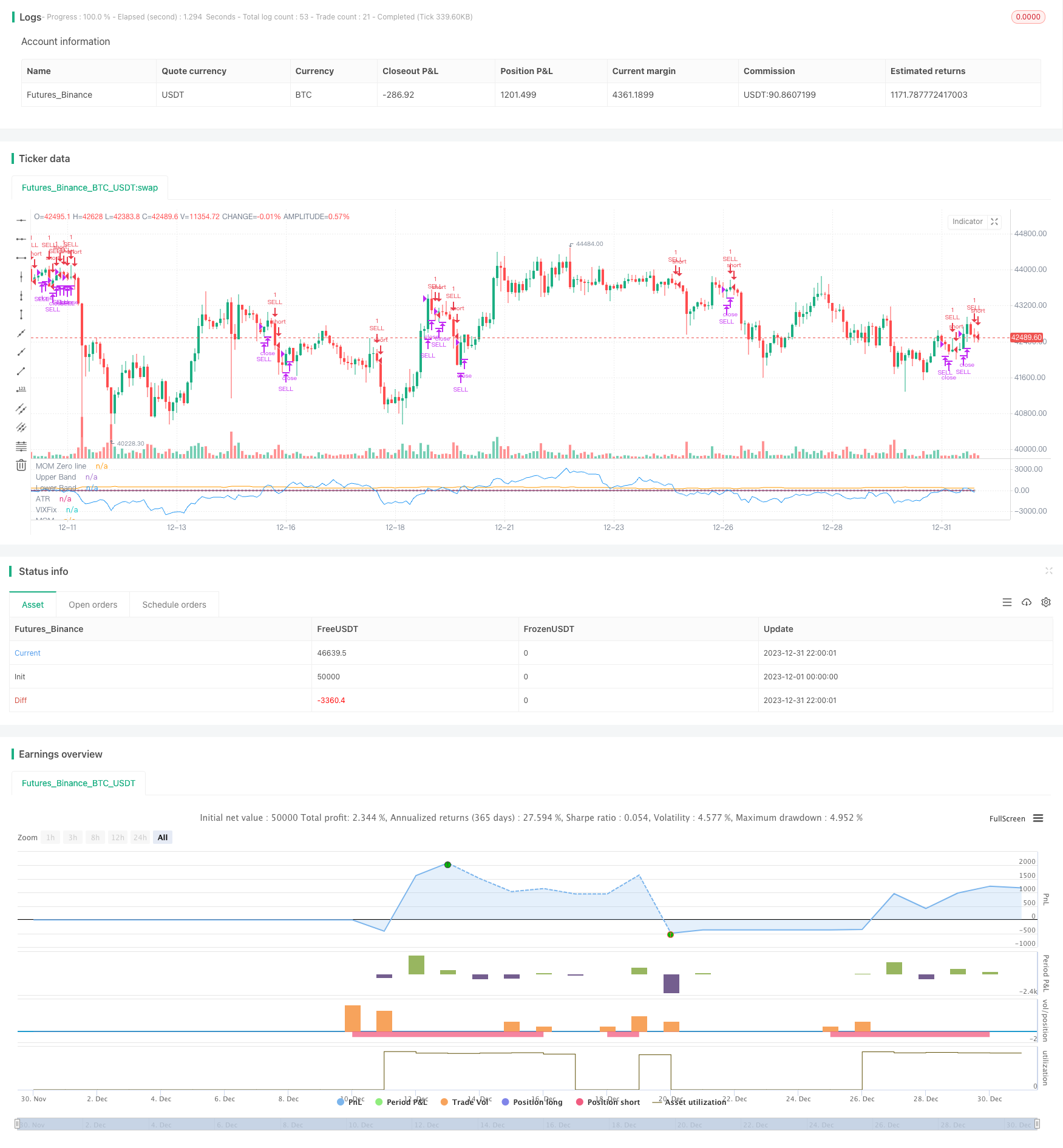

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gary_trades

//THIS SCRIPT HAS BEEN BUIL TO BE USED AS A S&P500 SPY CRASH INDICATOR (should not be used as a strategy).

//THIS SCRIPT HAS BEEN BUILT AS A STRATEGY FOR VISUALIZATION PURPOSES ONLY AND HAS NOT BEEN OPTIMISED FOR PROFIT.

//The script has been built to show as a lower indicator and also gives visual SELL signal on top when conditions are met. BARE IN MIND NO STOP LOSS, NOR ADVANCED EXIT STRATEGY HAS BEEN BUILT.

//As well as the chart SELL signal an alert has also been built into this script.

//The script utilizes a VIX indicator (marron line) and 50 period Momentum (blue line) and Danger/No trade zone(pink shading).

//When the Momentum line crosses down across the VIX this is a sell off but in order to only signal major sell offs the SELL signal only triggers if the momentum continues down through the danger zone.

//To use this indicator to identify ideal buying then you should only buy when Momentum line is crossed above the VIX and the Momentum line is above the Danger Zone.

//This is best used as a daily time frame indicator

//@version=4

strategy(title="S&P Bear Warning", shorttitle="Bear Warning" )

//Momentum

len = input(50, minval=1, title="Length")

src = input(close, title="Source")

bandUpper = input( 5)

bandLower = input(-5)

// ————— Control plotting of each signal. You could use the same technique to be able to turn acc/dist on/off.

showVixFix = input(true)

showMomentum = input(true)

mom = src - src[len]

myAtr = atr(14)

plot(showMomentum ? mom : na, color=color.blue, title="MOM")

plot(showMomentum ? 0 : na, color=color.silver, title="MOM Zero line", style=plot.style_circles, transp=100)

plot(showMomentum ? myAtr : na, color=color.orange, title="ATR", transp=90)

//VIX

VIXFixLength = input(22,title="VIX Fix Length")

VIXFix = (highest(close,VIXFixLength)-low)/(highest(close,VIXFixLength))*100

plot(showVixFix ? VIXFix : na, "VIXFix", color=color.maroon)

band1 = plot(showVixFix ? bandUpper : na, "Upper Band", color.red, 1, plot.style_line, transp=90)

band0 = plot(showVixFix ? bandLower : na, "Lower Band", color.red, 1, plot.style_line, transp=90)

fill(band1, band0, color=color.red, transp=85, title="Background")

//Identify Triggers

//Back Test Range

start = timestamp("America/New_York", 2000, 1, 1, 9,30)

end = timestamp("America/New_York", 2020, 7, 1, 0, 0)

//Momentum

Long1 = mom > bandUpper

Short1 = mom < bandLower

//VIX

Long2 = crossover(mom, VIXFix)

Short2 = crossunder(mom, VIXFix)

//Warning Alert

SellAlert = Short1

alertcondition(SellAlert, title="Sell SPY", message="Warning Selling off {{ticker}}, price= {{close}}")

//Entry and Exit

if true

strategy.entry("SELL", false, when = Short1)

strategy.close("SELL", when = Long2)