Parallele gleitende Durchschnitts- und Infinite-Impulse-Response-Gleitende-Durchschnitts-Strategie

Überblick

Dies ist eine quantitative Strategie, die die Verwendung von Moving Averages, Infinite Pulse Response Averages (IIR) und Adaptive Linear Moving Averages (ALMA) kombiniert. Die Strategie verfügt über eine Kombination aus verschiedenen Indikatoren, die den Händlern reichhaltige Handelssignale liefern können.

Strategieprinzip

Die Strategie besteht aus folgenden Teilen:

Die Kombination verwendet einen einfachen Moving Average (SMA), ALMA und IIR, um ein Kreuzungssignal zwischen ihnen als Eintrittszeit zu erkennen.

Mit drei verschiedenen IIR-Zyklen, die durch die Berechnung der Entfernung zwischen ihnen, um zu bestimmen, ob der Preis in einem squeeze-Zustand. Die squeeze-Zustand bedeutet eine Verringerung der Volatilität, oft ein Hinweis darauf, dass der Preis in der Nähe von größeren Veränderungen.

Die IIR-Schräglage wird in grünen Farben beim Steigen und in blauen Farben beim Fall beurteilt. Die Entwicklung der IIR kann intuitiv beurteilt werden.

Berechnen Sie, ob sich der Abstand zwischen den SMAs erweitert, und wenn ja, verwenden Sie eine spezielle Kennzeichnung, die eine Fan-Ring-Erweiterung darstellt, die normalerweise bedeutet, dass der Preis in einen Trendzustand eingetreten ist.

Das Überkauf-Überverkauf-Signal ergänzt das Handelssignal in Kombination mit dem relativ schwachen RSI.

Durch die Kombination der oben genannten Komponenten kann die Strategie ein umfassenderes und reichhaltigeres Signal für den Eintritt, die Entscheidung und den Ausstieg in den Handel liefern.

Strategische Stärkenanalyse

Der größte Vorteil dieser Strategie besteht darin, dass das Portfolio der Indikatoren umfassend und reichhaltig ist und sowohl Trendurteile als auch Volatilität und Überkauf-Überverkauf-Zustände berücksichtigt, was eine mehrdimensionale Referenz für Handelsentscheidungen bietet.

Ein weiterer Vorteil ist, dass die Parameter und Kennzahlen leicht angepasst und optimiert werden können. Der Benutzer kann die entsprechenden Kennzahlen und Parameter entsprechend seiner Bedürfnisse aktivieren.

Aus Sicht des Risikomanagements konzentriert sich die Strategie auf die schnelle und die langsame Durchschnittslinie, was die Wahrscheinlichkeit von falschen Signalen durch Preisschwankungen verringert.

Risikoanalyse

Die Hauptrisiken dieser Strategie sind:

Zu kompliziert, um zu Konflikten zu führen. Eine Auswahl unter bestimmten Parameterkombinationen kann zu einer Überpassung führen.

Bei einem System mit mehreren Gruppen von Mittellinien kann es zu erheblichen Verlusten kommen, wenn sich der Markt stark verändert (z. B. bei einem großen wirtschaftlichen Ereignis).

Die unzureichende Tiefenaufspürung kann das Risiko einer Survivalship-Bias in der Praxis bedeuten.

Bei der Anwendung müssen wir auf das Risikomanagement achten, die Größe der Positionen entsprechend anpassen und mehrere Rückprüfungen über längere Zeiträume und größere Datensätze durchführen, um die Wirksamkeit der Strategie im Einsatz zu gewährleisten.

Richtung der Strategieoptimierung

Angesichts der Komplexität und der vielen Parameter dieser Strategie kann die Optimierung folgender Aspekte erfolgen:

Vereinfachung der Auswahl der Indikatoren und Entfernung von Indikatoren, die nicht relevant sind oder in Konflikt stehen.

Die Auswahl der IIR-Durchschnittslinie wird optimiert, um die Länge zu wählen, die besser zu den Marktmerkmalen passt.

Optimierung der Kombination von schnellen und langsamen Gleichlinien, um die Stabilität des Kreuzsignals zu verbessern.

Erhöhung der Entscheidungsfähigkeit von Machine-Learning-Modellen und Steigerung der Anpassungsfähigkeit von Strategien

Optimierung der Relevanz zu globalen Indizes und Erhöhung der Erfolgsrate bei der Trendbeurteilung.

Zusammenfassen

Durch die flexible Kombination und Optimierung der Indikatoren kann die Strategie die Marktlage umfassender widerspiegeln und eine mehrdimensionale Unterstützung für die Handelsentscheidung bieten. Es besteht jedoch ein gewisses Risiko einer Überanpassung der Praxis und der Daten.

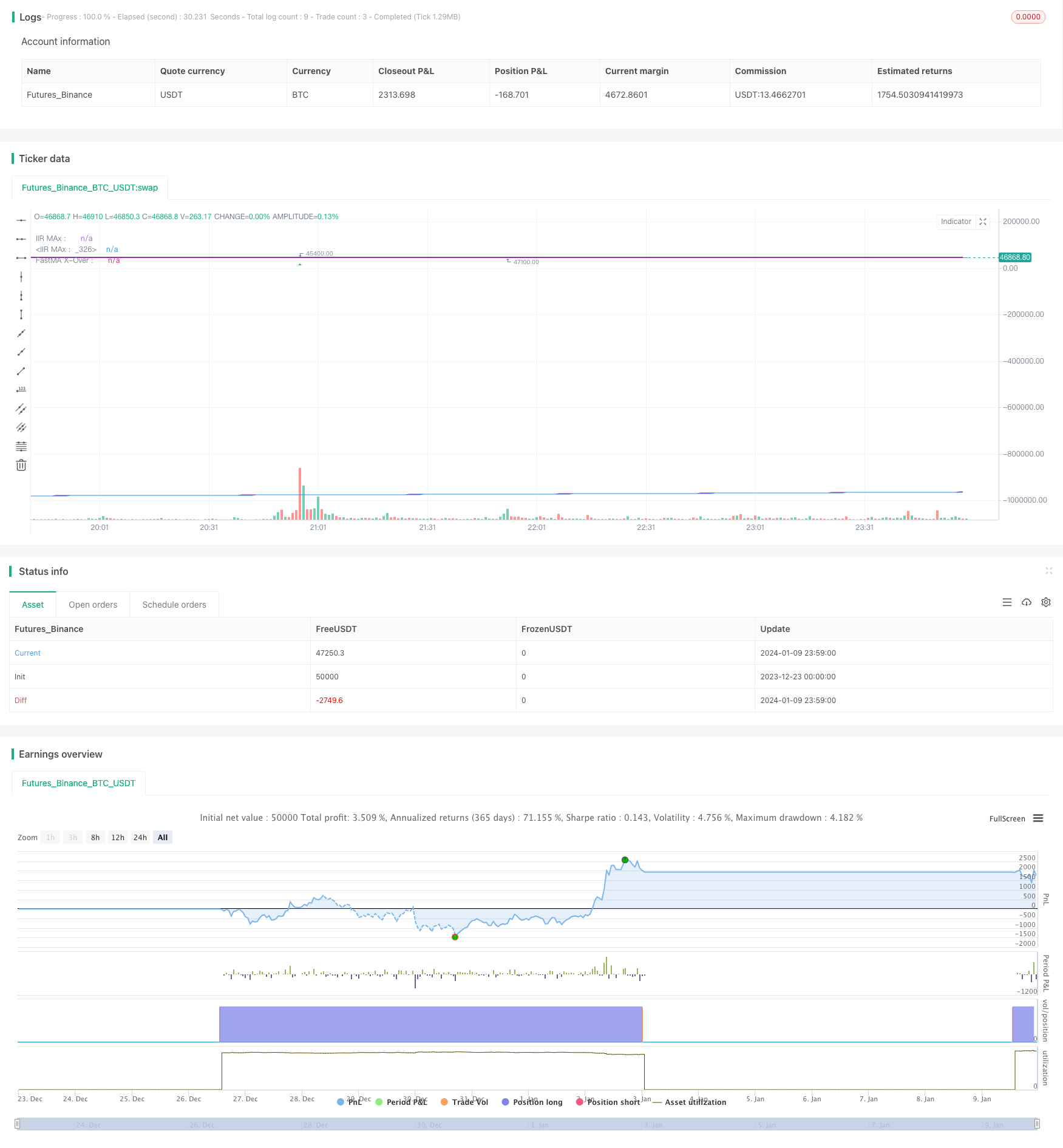

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-10 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//The plotchar UP/DOWN Arrows is the crossover of the fastest MA and fastest IIR MAs

//

//The dots at the bottom are the two simple averages crossing over

//

//The count over/under the candles is the count of bars that the SMAs on their

//respective resolution are fanning out.

//

//The colored background indicates a squeeze, lime=kinda tight : green=very tight squeeze. based on the 3 IIRs

//

//To answer my own question in a forum, looking at the code, i couldn't figure out how to get it from another timeframe

//and run the same calculations with the same results. My answer in the end was to scale the chosen MA length

//in the corresponding CurrentPeriod/ChosenMAPeriod proportion. This results in the same line in the same place when browsing through the

//different time resolutions. Somebody might find this invaluable

//

//The counts are for MA's fanning out, or going parabolic. Theres IIRs, Almas, one done of the other. A lot.

//The arrows above and below bars are from standard RSI numbers for OB/OS

//

//The IIRs changes color depending on their slope, which can be referenced easily with a variable.

//

//The backgrond on a bar-by-bar basis is colored when 2 sets of moving averages are in a squeeze, aka

//when price is consolidating.

//

//This aims to help the trader combine conditions and entry criteria of the trade and explore these options visually.

//They detail things from all time-frames on the current one. I prefer it because of the fractal nature of price-action, both large and small,

//either yesterday or last year. For best results, go long in short-term trades when the long-term trend is also up.

//and other profitable insights. This is also a great example of an automation algorith.

//

//The pretty ribbon is my script called 'Trading With Colors'. Use them together for fanciest results. 55/233 is my Fib Cross (golden/death) Compare it to the classic 50/200 if

//you get bored. I believe it simply works better, at least for Crypto.

//

//Evidently, I am a day-trader. But this yields higher profits on larger time-frames anyways, so do play around with it. Find what works for you.

//Thanks and credit for code snippets goes to:

//matryskowal

//ChrisMoody, probably twice

//Alex Orekhov (everget)

//author=LucF and midtownsk8rguy, for PineCoders

//If you use code from this, real quick search for perhaps the original and give them a shoutout too. I may have missed something

//Author: Sean Duffy

//@version=4

strategy(title = "Combination Parabolic MA/IIR/ALMA Strategy",

shorttitle = "MA-QuickE",

overlay = true )

// calc_on_order_fills = true,

// calc_on_every_tick = true,

// Input Variables

showFIBMAs = input(false, type=input.bool, title="═══════════════ Show Fibby MAs ═══════════════")

maRes = input(960, type=input.integer, title="MA-Cross Resolution")

mal1 = input(8, type=input.integer, title="MA#1 Length")

mal2 = input(13, type=input.integer, title="MA#2 Length")

mal3 = input(34, type=input.integer, title="MA#3 Length")

loosePercentClose = input(1.1, type=input.float, title="SMA LooseSqueeze Percent")

showIIRs = input(false, type=input.bool, title="═══════════════════ Show IIRs ═══════════════════")

iirRes = input(60, type=input.integer, title="IIR Resolution")

percentClose = input(title="IIR Squeeze PercentClose", type=input.float, defval=.8)

iirlength1 = input(title="IIR Length 1", type=input.integer, defval=34)

iirlength2 = input(title="IIR Length 2", type=input.integer, defval=144)//input(title="ATR Period", type=input.integer, defval=1)

iirlength3 = input(title="IIR Length 3", type=input.integer, defval=720)//input(title="ATR Period", type=input.integer, defval=1)

showIIR1 = input(true, type=input.bool, title="Show IIR1")

showIIR2 = input(true, type=input.bool, title="Show IIR2")

showIIR3 = input(true, type=input.bool, title="Show IIR3")

showCounts = input(true, type=input.bool, title="═════════════ Show Parabolic MA Counts ════════════")

showSignals = input(true, type=input.bool, title="══════════════ Show Buy/Sell Signals ══════════════")

showBackground = input(true, type=input.bool, title="══════════════ Show Background Colors ══════════════")

//runStrategy = input(true, type=input.bool, title="══════════════ Run Strategy ══════════════")

debug = input(false, type=input.bool, title="══════════════ Show Debug ══════════════")

barLookbackPeriod = input(title="══ Bar Lookback Period ══", type=input.integer, defval=5)

percentageLookbackPeriod = input(title="══ Percentage Lookback Period ══", type=input.integer, defval=1)

bullcolor = color.green

bearcolor = color.red

color bgcolor = na

var bool slope1Green = na

var bool slope2Green = na

var bool slope3Green = na

var bool buySignal = na

var bool sellSignal = na

var bool bigbuySignal = na

var bool bigsellSignal = na

bool smbuySignal = false

bool smsellSignal = false

var bool insqueeze = na

var bool intightsqueeze = na

var bool infastsqueeze = na

var bool awaitingEntryIn = false

// My counting variables

var int count1 = 0

var float madist1 = 0

var int count2 = 0

var float madist2 = 0

var int sinceSmSignal = 0

var entryPrice = 0.0

var entryBarIndex = 0

var stopLossPrice = 0.0

// var updatedEntryPrice = 0.0

// var alertOpenPosition = false

// var alertClosePosition = false

// var label stopLossPriceLabel = na

// var line stopLossPriceLine = na

positionType = "LONG" // Strategy type, and the only current option

hasOpenPosition = strategy.opentrades != 0

hasNoOpenPosition = strategy.opentrades == 0

strategyClose() =>

if (hasOpenPosition)

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if (hasNoOpenPosition)

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

checkEntry() =>

buysignal = false

if (hasNoOpenPosition)

strategyOpen()

buysignal := true

// if (slope1Green and (trend1Green or trend2Green) and awaitingEntryIn and hasNoOpenPosition)

// strategyOpen()

// buysignal := true

buysignal

checkExit() =>

sellsignal = false

// if (trend1Green == false and trend2Green == false) // to later have quicker exit strategy

// sellsignal := true

// strategyClose()

if (hasOpenPosition)

sellsignal := true

strategyClose()

sellsignal

multiplier(_adjRes, _adjLength) => // returns adjusted length

multiplier = _adjRes/timeframe.multiplier

round(_adjLength*multiplier)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

ma1 = sma(close, multiplier(maRes, mal1))

ma2 = sma(close, multiplier(maRes, mal2))

ma3 = sma(close, multiplier(maRes, mal3))

madist1 := abs(ma1 - ma2)

madist2 := abs(ma1 - ma3) // check if MA's are fanning/going parabolic

if (ma1 >= ma2 and ma2 >= ma3 and madist1[0] > madist1[1]) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count1 := count1 + 1

else

count1 := 0

if (ma1 <= ma2 and ma2 <= ma3 and madist1[0] > madist1[1]) //<= madist2 and dataB <= dataC) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count2 := count2 + 1

else

count2 := 0

crossoverAB = crossover(ma1, ma2)

crossunderAB = crossunder(ma1, ma2)

plot(showFIBMAs ? ma1 : na, linewidth=3)

plot(showFIBMAs ? ma2 : na)

plot(showFIBMAs ? ma3 : na)

// Fast Squeese Check WORK IN PROGRESS

//

float singlePercent = close / 100

if max(madist1, madist2) <= singlePercent*loosePercentClose

bgcolor := color.yellow

infastsqueeze := true

else

infastsqueeze := false

// IIR MOVING AVERAGE

f(a) => a[0] // fixes mutable error

iirma(iirlength, iirsrc) =>

cf = 2*tan(2*3.14159*(1/iirlength)/2)

a0 = 8 + 8*cf + 4*pow(cf,2) + pow(cf,3)

a1 = -24 - 8*cf + 4*pow(cf,2) + 3*pow(cf,3)

a2 = 24 - 8*cf - 4*pow(cf,2) + 3*pow(cf,3)

a3 = -8 + 8*cf - 4*pow(cf,2) + pow(cf,3)

//----

c = pow(cf,3)/a0

d0 = -a1/a0

d1 = -a2/a0

d2 = -a3/a0

//----

out = 0.

out := nz(c*(iirsrc + iirsrc[3]) + 3*c*(iirsrc[1] + iirsrc[2]) + d0*out[1] + d1*out[2] + d2*out[3],iirsrc)

f(out)

iirma1 = iirma(multiplier(iirRes, iirlength1), close)

iirma2 = iirma(multiplier(iirRes, iirlength2), close)

iirma3 = iirma(multiplier(iirRes, iirlength3), close)

// adjusts length for current resolution now, length is lengthened/shortened accordingly, upholding exact placement of lines

// iirmaD1 = security(syminfo.tickerid, tostring(iirRes), iirma1, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD2 = security(syminfo.tickerid, tostring(iirRes), iirma2, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD3 = security(syminfo.tickerid, tostring(iirRes), iirma3, barmerge.gaps_on, barmerge.lookahead_on)

slope1color = slope1Green ? color.lime : color.blue

slope2color = slope2Green ? color.lime : color.blue

slope3color = slope3Green ? color.lime : color.blue

plot(showIIR1 and showIIRs ? iirma1 : na, title="IIR1", color=slope1color, linewidth=2, transp=30)

plot(showIIR2 and showIIRs ? iirma2 : na, title="IIR2", color=slope2color, linewidth=3, transp=30)

plot(showIIR3 and showIIRs ? iirma3 : na, title="IIR3", color=slope3color, linewidth=4, transp=30)

// checks slope of IIRs to create a boolean variable and and color it differently

if (iirma1[0] >= iirma1[1])

slope1Green := true

else

slope1Green := false

if (iirma2[0] >= iirma2[1])

slope2Green := true

else

slope2Green := false

if (iirma3[0] >= iirma3[1])

slope3Green := true

else

slope3Green := false

// calculate space between IIRs and then if the price jumps above both

//float singlePercent = close / 100 // = a single percent

var float distIIR1 = na

var float distIIR2 = na

distIIR1 := abs(iirma1 - iirma2)

distIIR2 := abs(iirma1 - iirma3)

if (distIIR1[0] < percentClose*singlePercent and close[0] >= iirma1[0])

if close[0] >= iirma2[0] and close[0] >= iirma3[0]

bgcolor := color.green

insqueeze := true

intightsqueeze := true

else

bgcolor := color.lime

insqueeze := true

intightsqueeze := false

else

insqueeze := false

intightsqueeze := false

// if (true)//sinceSmSignal > 0) // cutting down on fastest MAs noise

// sinceSmSignal := sinceSmSignal + 1

// if (crossoverAB)

// //checkEntry()

// //smbuySignal := true

// sinceSmSignal := 0

// if (crossunderAB) // and all NOT greennot (slope1Green and slope2Green and slope3Green)

// //checkExit()

// //smsellSignal := true

// sinceSmSignal := 0

// else

// sinceSmSignal := sinceSmSignal + 1

f_draw_infopanel(_x, _y, _line, _text, _color)=>

_rep_text = ""

for _l = 0 to _line

_rep_text := _rep_text + "\n"

_rep_text := _rep_text + _text

var label _la = na

label.delete(_la)

_la := label.new(

x=_x, y=_y,

text=_rep_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.black, style=label.style_labelup, textcolor=_color, size=size.normal)

posx = timenow + round(change(time)*60)

posy = highest(50)

// CONSTRUCTION ZONE

// TODO: program way to eliminate noise and false signals

// MAYBEDO: program it to differentiate between a moving average bump and a cross

// I think the best way would be to calculate the tangent line... OR

// Take the slope of both going back a couple bars and if it's close enough, its a bounce off

// and an excellent entry signal

// program in quickest exit, 2 bars next to eachother both closing under, as to avoid a single wick from

// prompting to close the trade

// Some other time, have it move SMA up or down depending on whether trending up or down. Then use those MA crosses

//THIS CHECKS THE SLOPE FROM CURRENT PRICE TO BACK 10 BARS

checkSlope(_series) => (_series[0]/_series[10])*100 // it now returns it as a percentage

doNewX = input(true, type=input.bool, title="══════════ Show misc MA Cross Strategy ══════════")

iirX = input(555, title="IIRx Length: ", type=input.integer)

iirXperiod = input(30, title="IIRx Period/TF: ", type=input.integer)

iirX2 = input(13, title="IIRx2 Length: ", type=input.integer)

iirX2period = input(5, title="IIRx2 Period/TF: ", type=input.integer) //15

almaXperiod = input(defval=15, title="Alma of IIR1 Period: ", type=input.integer)

almaXalpha = input(title="Alma Alpha Value: ", defval=.7, maxval=.95, type=input.float) // dont forget to try .99

almaXsigma = input(title="Alma Sigma Value: ", defval=500, type=input.float)

iirmaOTF = iirma(multiplier(iirXperiod, iirX), close)

iirma2OTF = iirma(multiplier(iirX2period, iirX2), close)

smaOTF = alma(iirmaOTF, almaXperiod, almaXalpha, almaXsigma) // maybe dont touch, its precise // I took the ALMA of the IIRMA, and i hope thats not cheating ;)

// I could have removed this. the multiplier function adjusts the length to fit the current timeframe while displaying the same

// smaXOTF = security(syminfo.tickerid, smaXperiod, smaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaXOTF = security(syminfo.tickerid, iirXperiod, iirmaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaX2OTF = security(syminfo.tickerid, iirX2period, iirma2OTF, barmerge.gaps_on, barmerge.lookahead_on)

plot(doNewX ? smaOTF : na, title="FastMA X-Over : ", color=color.blue, linewidth=1, transp=40)

plot(doNewX ? iirmaOTF : na, title="IIR MAx : ", color=color.purple, linewidth=1, transp=30)

plot(doNewX ? iirma2OTF : na, title="IIR MAx : ", color=color.purple, linewidth=2, transp=20)

iirma2Up = checkSlope(iirma2OTF) > 0 // just another slope up/down variable.

//calculate spaces between averages

distiiralma = abs(iirmaOTF - smaOTF)

crossoverFast = crossover(iirmaOTF, smaOTF) // and (iirmaOTF[1] <= smaOTF[1])

crossunderFast = crossunder(iirmaOTF, smaOTF) // and (iirmaOTF[1] >= smaOTF[1])

if (crossoverFast and iirma2Up == true and infastsqueeze == false and intightsqueeze == false) // and (count1 != 0))// or close[0] < (lowest(barLookbackPeriod) + singlePercent*3))) // must be at most a few percent up from a recent low. Avoid buying highs :P

buySignal := true

strategyOpen()

// if (slope1Green and slope2Green and slope3Green and infastsqueeze == false)

// checkEntry()

if (crossunderFast)

sellSignal := true

checkExit()

// I feel like I didn't cite the OG author for this panel correctly. I hope I did, but there are extentions of his/her work in multiple places.

// I could have gotten it confused.

if (debug)

f_draw_infopanel(posx, posy, 18, "distiiralma from IIR: " + tostring(distiiralma), color.lime)

//f_draw_infopanel(posx, posy, 16, "distiirs: " + tostring(distiirX1), color.lime)

f_draw_infopanel(posx, posy, 14, "Value of iirmaOTF: " + tostring(iirmaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slope X: " + tostring(abs(100 - checkSlope(iirmaOTF))), color.lime)

f_draw_infopanel(posx, posy, 12, "value of smaOTF: " + tostring(smaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slopeAlma: " + tostring(abs(100 - checkSlope(smaOTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

// I kept this separate because it discludes the calculations. Its hard to hold a train of thought while fishing for the right section

bgcolor(showBackground ? bgcolor : na)

plotshape(showSignals ? buySignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.blue, transp=60)

plotshape(showSignals ? sellSignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.red, transp=60)

plotchar(showSignals and smbuySignal, title="smBuy", location=location.belowbar, char='↑', size=size.tiny, color=color.green, transp=0)

plotchar(showSignals and smsellSignal, title="smSell", location=location.abovebar, char='↓', size=size.tiny, color=color.orange, transp=0)

// can not display a variable. Can only match the count to a corresponding plotchar

// to display a non-constant variable, use the debug box, which was so kindly offered up by our community.

plotchar(showCounts and count1==1, title='', char='1', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==2, title='', char='2', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==3, title='', char='3', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==4, title='', char='4', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==5, title='', char='5', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==6, title='', char='6', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==7, title='', char='7', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==8, title='', char='8', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==9, title='', char='9', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1>=10, title='', char='$', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count2==1, title='', char='1', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==2, title='', char='2', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==3, title='', char='3', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==4, title='', char='4', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==5, title='', char='5', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==6, title='', char='6', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==7, title='', char='7', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==8, title='', char='8', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==9, title='', char='9', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2>=10, title='', char='$', location=location.abovebar, color=#e91e63, transp=0)

showRSIind = input(true, type=input.bool, title="═══════════════════ Show RSI Arrows ═══════════════════")

// Get user input

rsiSource = input(title="RSI Source", type=input.source, defval=close)

rsiLength = input(title="RSI Length", type=input.integer, defval=14)

rsiOverbought = input(title="RSI Overbought Level", type=input.integer, defval=80)

rsiOversold = input(title="RSI Oversold Level", type=input.integer, defval=20)

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

isRsiOB = rsiValue >= rsiOverbought

isRsiOS = rsiValue <= rsiOversold

// Plot signals to chart

plotshape(isRsiOB, title="Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown)

plotshape(isRsiOS, title="Oversold", location=location.belowbar, color=color.green, transp=0, style=shape.triangleup)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false