Langfristige Umkehrstrategie basierend auf doppelten gleitenden Durchschnitten

Überblick

Die Strategie nutzt hauptsächlich Gold- und Todeskreuzungen, die sich am 14. und 28. Tag im einfachen gleitenden Mittelwert bilden, um den Umkipp-Operation durchzuführen. Wenn der schnelle Mittelwert den langsamen Mittelwert von unten durchbricht, kann eine Mehrkopfposition errichtet werden, die darauf hinweist, dass der Umkipp beginnt.

Aufgrund der einfachen Moving Averages, die für die Beurteilung von Markttrendänderungen verwendet werden, habe ich diese Strategie als “Langstrecken-Umkehr-Strategie” bezeichnet, die auf zwei Gleichlinien basiert.

Strategieprinzip

Die Kernlogik der Strategie besteht darin, die Marktentwicklung anhand von einfachen Moving Averages für zwei verschiedene Termine am 14. und 28. Tag zu bestimmen. Die Regeln lauten:

Die schnelle Linie ist als einfacher gleitender Durchschnitt von 14 Tagen und die langsame Linie als einfacher gleitender Durchschnitt von 28 Tagen definiert.

Wenn die schnelle Linie die langsame Linie von unten durchbricht, gibt es mehrere Einstiege.

Wenn die schnelle Linie von oben nach unten fällt und die langsame Linie überschreitet, gibt man ein Signal für die Luft, um eine Luftfahrt zu starten.

Wenn die schnelle Linie nach dem Über-/Low-Line wieder unter die langsame Linie fällt, ist dies ein Flach-Signal.

Die Strategie kombiniert Stop-Loss, Stop-Stop und Tracking-Stop mit Risikomanagement. Für die Übernahme und die Deckung werden der Long-Loss-Preis, der Long-Stop-Preis, der Short-Stop-Preis und der Long-Stop-Preis definiert. Diese Parameter werden in Prozentform eingestellt, um die Strategie flexibler zu machen.

Analyse der Stärken

- Die Strategie und die Prinzipien, die die wichtigsten Markttrends mit Hilfe von Binärwährungen beurteilen, sind einfach und klar, leicht zu verstehen und zu überprüfen.

- Die schnellen und langsamen Durchschnittskurven sind mit einer Periodensetzung von 14 und 28 Tagen eingestellt, um kurzfristige und mittelfristige Trendwechsel zu repräsentieren, die eine bessere Chance auf eine Umkehrung bieten.

- Die Kombination von Stop-Stops, Stop-Loss-Stops und Tracking-Stops zur Risikokontrolle ermöglicht es, Gewinne zu sichern und Verluste zu vermeiden.

- Sie können gleichzeitig mehrere Arbeitsplätze für unterschiedliche Marktumgebungen nutzen.

Risiko und Verbesserung

- Die doppelte Gleichgewichtskreuzung hat eine gewisse Verzögerung und kann die beste Einstiegsmomente verpassen.

- Bei langen und kurzen Durchschnittskreuzungen kann es zu Fehlsignalen kommen. Es sollte vermieden werden, eine zu kurze Durchschnittsphase einzurichten.

- Eine zu kleine Einstellung des Stopp-Abstands kann die Wahrscheinlichkeit erhöhen, dass der Stopp getroffen wird. Der Stopp-Abstand sollte entsprechend der verschiedenen Sorten vernünftigerweise eingestellt werden.

- Es können mehr Indikatoren eingeführt werden, um die Kombination zu verbessern und die Stabilität der Strategie zu verbessern. Zum Beispiel die Aufnahme von Brin-Band-Bestimmungstrends oder die Einführung von MACD-Prüfungen zur Eintrittszeit.

Optimierungsrichtung

- Verschiedene Kombinationen von Mittellinien-Parametern werden getestet, um die Mittellinien-Perioden zu finden, die am besten zu den Eigenschaften der Sorte passen.

- Versuchen Sie, verschiedene Stop-Distance-Einstellungen zu testen, um die optimale Stop-Position zu finden.

- Tests mit anderen Indikatoren werden optimiert, um die optimale Kombination von Parametern zu finden, um Fehlsignale zu reduzieren.

- Die Regeln zur Positionsverwaltung wurden optimiert, um die Gewinne zu steigern.

Zusammenfassen

Die Strategie insgesamt ist eine sehr klassische Strategie, die auf der Tendenzumkehr basiert. Sie hat die Vorteile, dass sie einfach und leicht zu erlernen ist; es gibt auch einige Richtungen, die nachträglich optimiert werden können. Insgesamt ist die Strategie sowohl in der Theorie als auch in der Operation eher ausgereift und ist eine gute Einstiegsstrategie für quantitative Handel.

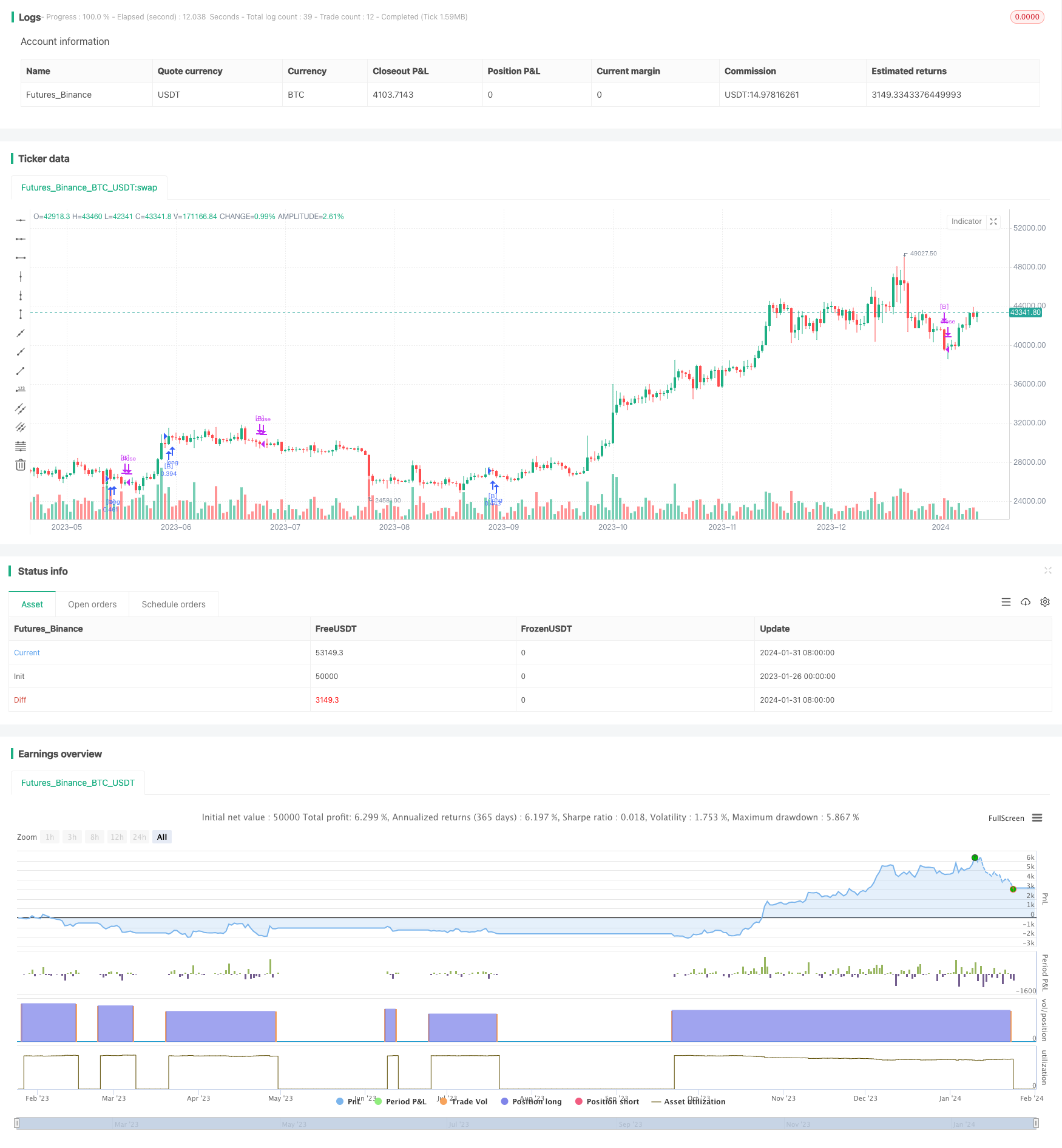

/*backtest

start: 2023-01-26 00:00:00

end: 2024-02-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ruckard

//@version=4

// Current version: v20201031 ( A061 )

// Tradingview Public description - BEGIN

//

// This strategy serves as a beginner's guide to connect TradingView signals to Zignaly Crypto Trading Platform.

//

// It was originally tested at BTCUSDT pair and 1D timeframe.

// The strategy is a slightly modified copy of default TradingView strategy that appears when you create a blank new strategy.

// It decides to go long when 14-period SMA crosses over 28-period SMA and goes short when 14-period SMA crosses under 28-period SMA.

//

// Before using this documentation it's recommended that you:

// [LIST]

// [*] Use default TradingView strategy script or another script and setup its associated alert manually. Just make the alert pop-up in the screen.

// [*] Create a 'Copy-Trader provider' (or Signal Provider) in Zignaly and send signals to it either thanks to your browser or with some basic programming.

// [/LIST]

// [B]SETTINGS[/B]

// [B]__ SETTINGS - Capital[/B]

// [LIST]

// [*] (CAPITAL) Capital quote invested per order in USDT units {100.0}. This setting is only used when '(ZIG) Provider type' is set to 'Signal Provider'.

// [*] (CAPITAL) Capital percentage invested per order (%) {25.0}. This setting is only used when '(ZIG) Provider type' is set to 'Copy Trader Provider'.

// [/LIST]

// [B]__ SETTINGS - Misc[/B]

// [LIST]

// [*] (ZIG) Enable Alert message {True}: Whether to enable alert message or not.

// [*] (DEBUG) Enable debug on order comments {True}: Whether to show alerts on order comments or not.

// [*] Number of decimal digits for Prices {2}.

// [*] (DECIMAL) Maximum number of decimal for contracts {3}.

// [/LIST]

// [B]__ SETTINGS - Zignaly[/B]

// [LIST]

// [*] (ZIG) Integration type {TradingView only}: [b]Hybrid[/b]: Both TradingView and Zignaly handle take profit, trailing stops and stop losses. Useful if you are scared about TradingView not firing an alert. It might arise problems if TradingView and Zignaly get out of sync. [b]TradingView only[/b]: TradingView sends entry and exit orders to Zignaly so that Zignaly only buys or sells. Zignaly won't handle stop loss or other settings on its own.

// [*] (ZIG) Zignaly Alert Type {WebHook}: 'Email' or 'WebHook'.

// [*] (ZIG) Provider type {Copy Trader Provider}: 'Copy Trader Provider' or 'Signal Provider'. 'Copy Trader Provider' sends a percentage to manage. 'Signal Provider' sends a quote to manage.

// [*] (ZIG) Exchange: 'Binance' or 'Kucoin'.

// [*] (ZIG) Exchange Type {Spot}: 'Spot' or 'Futures'.

// [*] (ZIG) Leverage {1}. Set it to '1' when '(ZIG) Exchange Type' is set to 'Spot'.

// [/LIST]

// [B]__ SETTINGS - Strategy[/B]

// [LIST]

// [*] (STRAT) Strategy Type: 'Long and Short', 'Long Only' or 'Short Only'.

// [*] (STOPTAKE) Take Profit? {false}: Whether to enable Take Profit.

// [*] (STOPTAKE) Stop Loss? {True}: Whether to enable Stop Loss.

// [*] (TRAILING) Enable Trailing Take Profit (%) {True}: Whether to enable Trailing Take Profit.

// [*] (STOPTAKE) Take Profit % {3.0}: Take profit percentage. This setting is only used when '(STOPTAKE) Take Profit?' setting is set to true.

// [*] (STOPTAKE) Stop Loss % {2.0}: Stop loss percentage. This setting is only used when '(STOPTAKE) Stop Loss?' setting is set to true.

// [*] (TRAILING) Trailing Take Profit Trigger (%) {2.5}: Trailing Stop Trigger Percentage. This setting is only used when '(TRAILING) Enable Trailing Take Profit (%)' setting is set to true.

// [*] (TRAILING) Trailing Take Profit as a percentage of Trailing Take Profit Trigger (%) {25.0}: Trailing Stop Distance Percentage. This setting is only used when '(TRAILING) Enable Trailing Take Profit (%)' setting is set to true.

// [*] (RECENT) Number of minutes to wait to open a new order after the previous one has been opened {6}.

// [/LIST]

// [B]DEFAULT SETTINGS[/B]

// By default this strategy has been setup with these beginner settings:

// [LIST]

// [*] '(ZIG) Integration type' : TradingView only

// [*] '(ZIG) Provider type' : 'Copy Trader Provider'

// [*] '(ZIG) Exchange' : 'Binance'

// [*] '(ZIG) Exchange Type' : 'Spot'

// [*] '(STRAT) Strategy Type' : 'Long Only'

// [*] '(ZIG) Leverage' : '1' (Or no leverage)

// [/LIST]

// but you can change those settings if needed.

// [B]FIRST STEP[/B]

// [LIST]

// [*] For both future or spot markets you should make sure to change '(ZIG) Zignaly Alert Type' to match either WebHook or Email. If you have a non paid account in TradingView as in October 2020 you would have to use Email which it's free to use.

// [/LIST]

// [B]RECOMMENDED SETTINGS[/B]

// [B]__ RECOMMENDED SETTINGS - Spot markets[/B]

// [LIST]

// [*] '(ZIG) Exchange Type' setting should be set to 'Spot'

// [*] '(STRAT) Strategy Type' setting should be set to 'Long Only'

// [*] '(ZIG) Leverage' setting should be set to '1'

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Future markets[/B]

// [LIST]

// [*] '(ZIG) Exchange Type' setting should be set to 'Futures'

// [*] '(STRAT) Strategy Type' setting should be set to 'Long and Short'

// [*] '(ZIG) Leverage' setting might be changed if desired.

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Signal Providers[/B]

// [LIST]

// [*] '(ZIG) Provider type' setting should be set to 'Signal Provider'

// [*] '(CAPITAL) Capital quote invested per order in USDT units' setting might be changed if desired.

// [/LIST]

// [B]__ RECOMMENDED SETTINGS - Copy Trader Providers[/B]

// [LIST]

// [*] '(ZIG) Provider type' setting should be set to 'Copy Trader Provider'

// [*] '(CAPITAL) Capital percentage invested per order (%)' setting might be changed if desired.

// [*] Strategy Properties setting: 'Initial Capital' might be changed if desired.

// [/LIST]

// [B]INTEGRATION TYPE EXPLANATION[/B]

// [LIST]

// [*] 'Hybrid': Both TradingView and Zignaly handle take profit, trailing stops and stop losses. Useful if you are scared about TradingView not firing an alert. It might arise problems if TradingView and Zignaly get out of sync.

// [*] 'TradingView only': TradingView sends entry and exit orders to Zignaly so that Zignaly only buys or sells. Zignaly won't handle stop loss or other settings on its own.

// [/LIST]

// [B]HOW TO USE THIS STRATEGY[/B]

// [LIST]

// [*] Beginner: Copy and paste the strategy and change it to your needs. Turn off '(DEBUG) Enable debug on order comments' setting.

// [*] Medium: Reuse functions and inputs from this strategy into your own as if it was a library.

// [*] Advanced: Check Strategy Tester. List of trades. Copy and paste the different suggested 'alert_message' variable contents to your script and change them to your needs.

// [*] Expert: You needed a way to pass data from TradingView script to the alert. Now you know it's the 'alert_message' variable. You can find several examples in the source code using the variable. You also have seen 'ALERTS SETUP' explanation below. An additional quick look at 'Strategy Tester', 'List of Trades' and you are ready to go.

// [/LIST]

// [B] ALERTS SETUP[/B]

// This is the important piece of information that allows you to connect TradingView to Zignaly in a semi-automatic manner.

// [B] __ ALERTS SETUP - WebHook[/B]

// [LIST]

// [*] Webhook URL: https : // zignaly . com / api / signals.php?key=MYSECRETKEY

// [*] Message: { {{strategy.order.alert_message}} , "key" : "MYSECRETKEY" }

// [/LIST]

// [B] __ ALERTS SETUP - Email[/B]

// [LIST]

// [*] Setup a new Hotmail account

// [*] Add it as an 'SMS email' in TradingView Profile settings page.

// [*] Confirm your own the email address

// [*] Create a rule in your Hotmail account that 'Redirects' (not forwards) emails to 'signals @ zignaly . email' when (1): 'Subject' includes 'Alert', (2): 'Email body' contains string 'MYZIGNALYREDIRECTTRIGGER' and (3): 'From' contains 'noreply @ tradingview . com'.

// [*] In 'More Actions' check: Send Email-to-SMS

// [*] Message: ||{{strategy.order.alert_message}}||key=MYSECRETKEY||

// MYZIGNALYREDIRECTTRIGGER

// [/LIST]

// '(DEBUG) Enable debug on order comments' is turned on by default so that you can see in the Strategy Tester. List of Trades. The different orders alert_message that would have been sent to your alert. You might want to turn it off it some many letters in the screen is problem.

// [B]STRATEGY ADVICE[/B]

// [LIST]

// [*] If you turn on 'Take Profit' then turn off 'Trailing Take Profit'.

// [/LIST]

//

// [B]ZIGNALY SIDE ADVICE[/B]

// [LIST]

// [*] If you are a 'Signal Provider' make sure that 'Allow reusing the same signalId if there isn't any open position using it?' setting in the profile tab is set to true.

// [*] You can find your 'MYSECRETKEY' in your 'Copy Trader/Signal' provider Edit tab at 'Signal URL'.

// [/LIST]

//

// [B]ADDITIONAL ZIGNALY DOCUMENTATION[/B]

// This beginner's guide is quite basic and meant to be an introduction. Please read additional documentation to learn what you actually can do with Zignaly.

// [LIST]

// [*] docs . zignaly . com / signals / how-to -- How to send signals to Zignaly

// [*] 3 Ways to send signals to Zignaly

// [*] SIGNALS

// [/LIST]

//

// [B]FINAL REMARKS[/B]

// [LIST]

// [*] This strategy tries to match the Pine Script Coding Conventions as best as possible.

// [*] You can check my 'Ruckard TradingLatino' strategy for a more complex strategy that it's also integrated with Zignaly. Unfortunatley it does not use Pine Script Coding Conventions as much.

// [/LIST]

// Tradingview Public description - END

strategy("Zignaly Tutorial A061", shorttitle="A061ZigTuto", overlay=true, max_bars_back=5000, calc_on_order_fills=false, calc_on_every_tick=false, pyramiding=0, initial_capital=1000, slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// INPUTS - BEGIN

// Strategy - Inputs

i_enableZignalyAlert = input(true, "(ZIG) Enable Alert message {True}")

_ZIGHYBRIDINTEGRATION_ = "Hybrid" , _ZIGTVONLYINTEGRATION_ = "TradingView only"

i_zignalyIntegrationType = input(_ZIGTVONLYINTEGRATION_, "(ZIG) Integration type", options=[_ZIGTVONLYINTEGRATION_, _ZIGHYBRIDINTEGRATION_])

_ZIGSIGNALPROVIDER_ = "Signal Provider" , _ZIGCOPYTRADERPROVIDER_ = "Copy Trader Provider"

i_zignalyProviderType = input(_ZIGCOPYTRADERPROVIDER_, "(ZIG) Provider type", options=[_ZIGSIGNALPROVIDER_, _ZIGCOPYTRADERPROVIDER_])

L_S = "Long and Short" , _L_ = "Long Only" , _S_ = "Short Only"

i_strategyType = input(_L_, "(STRAT) Strategy Type", options=[L_S, _L_, _S_])

// Order comments based debug

i_enableOrderCommentDebug = input(true, title="(DEBUG) Enable debug on order comments {True}", type=input.bool)

i_enableTakeProfit = input(false, "(STOPTAKE) Take Profit? {false}")

i_enableStopLoss = input(true, "(STOPTAKE) Stop Loss? {True}")

i_enableTrailingTakeProfit = input(true, title="(TRAILING) Enable Trailing Take Profit (%) {True}", type=input.bool)

i_TakeProfit = input(1.1, title="(STOPTAKE) Take Profit % {3.0}") / 100

i_StopLoss = input(2.0, title="(STOPTAKE) Stop Loss % {2.0}", minval=0.01 ) / 100

// Trailing Take Profit - Inputs

i_trailingTakeProfitPercentageTrigger = input(1.2, "(TRAILING) Trailing Take Profit Trigger (%) {2.5}",minval=0,step=0.01,type=input.float) * 0.01

i_trailingTakeProfitPercentageOffset = input(25.0, "(TRAILING) Trailing Take Profit as a percentage of Trailing Take Profit Trigger (%) {25.0}",minval=0,step=0.01,type=input.float) * 0.01

// Zignaly - Email (zignalye)

_ZIGNALYE_="Email", _ZIGNALYW_="WebHook"

i_zignalyAlertType = input(_ZIGNALYW_, "(ZIG) Zignaly Alert Type {WebHook}", options=[_ZIGNALYW_, _ZIGNALYE_])

_ZIGEXBINANCE_ = "Binance" , _ZIGEXKUCOIN_ = "Kucoin"

i_zignalyExchange = input(_ZIGEXBINANCE_, "(ZIG) Exchange", options=[_ZIGEXBINANCE_, _ZIGEXKUCOIN_])

_ZIGEXTYPESPOT_ = "spot" , _ZIGEXFUTURES_ = "futures"

i_zignalyExchangeType = input(_ZIGEXTYPESPOT_, "(ZIG) Exchange Type {Spot}", options=[_ZIGEXTYPESPOT_, _ZIGEXFUTURES_])

i_zignalyLeverage = input(1, "(ZIG) Leverage {1}",minval=1,step=1,maxval=125,type=input.integer)

var i_zignalyLeverage_str = tostring(i_zignalyLeverage) // It needs to run only once

i_priceDecimalDigits = input(2, "Number of decimal digits for Prices {2}", minval=0, maxval=10, step=1)

// Decimal - Inputs

i_contractMaximumDecimalNumber = input(3, title="(DECIMAL) Maximum number of decimal for contracts {3}",minval=0)

i_tooRecentMinutesNumber = input(6, "(RECENT) Number of minutes to wait to open a new order after the previous one has been opened {6}", minval=1, maxval=100, step=1)

i_CapitalQuote = input(100.0, title="(CAPITAL) Capital quote invested per order in USDT units {100.0}")

i_CapitalPercentage = input(25.0, title="(CAPITAL) Capital percentage invested per order (%) {25.0}",minval=0,step=0.01,type=input.float) * 0.01

// INPUTS - END

// Strategy - INIT - BEGIN

// Dynamic Trailing Take Profit - Variables

var int buyOrderOpenBarIndex = na

var int sellOrderOpenBarIndex = na

var float buyStopLoss = na

var float sellStopLoss = na

var float newBuyStopLoss = na

var float newSellStopLoss = na

// Handle to avoid two long and short orders being too next to each other

var bool _oldInsideABuyOrder = false

var bool oldInsideASellOrder = false

var bool insideABuyOrder = false

var bool insideASellOrder = false

_oldInsideABuyOrder := insideABuyOrder

oldInsideASellOrder := insideASellOrder

var int lastOrderOpenBarTime = na

// Handle recalculate after Stop Loss / Take Profit order

if (strategy.position_size == 0.0)

insideABuyOrder := false

insideASellOrder := false

else

lastOrderOpenBarTime := time_close

// Zignaly

exchangeTickerID = syminfo.basecurrency + syminfo.currency

var string zignalySeparator = ","

var string zignalyQuote = "\""

var string zignalyEquals = "="

if ( i_zignalyAlertType == _ZIGNALYE_)

zignalySeparator := "||"

zignalyQuote := ""

zignalyEquals := "="

else

zignalySeparator := ","

zignalyQuote := "\""

zignalyEquals := ":"

zignalyCommonAlertMessage = zignalyQuote + "exchange" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyExchange + zignalyQuote + zignalySeparator + zignalyQuote + "exchangeAccountType" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyExchangeType + zignalyQuote + zignalySeparator + zignalyQuote + "pair" + zignalyQuote + zignalyEquals + zignalyQuote + "" + exchangeTickerID + zignalyQuote + zignalySeparator + zignalyQuote + "leverage" + zignalyQuote + zignalyEquals + zignalyQuote + i_zignalyLeverage_str + zignalyQuote

var string tmpOrderComment = na

var string tmpOrderAlertMessage = na

var int i_tooRecentMinutesNumber_ms = i_tooRecentMinutesNumber * 60 * 1000 // Convert minutes into milliseconds only once

// Strategy - INIT - END

// FUNCTIONS - BEGIN

// Decimals - Functions

f_getContractMultiplier(_contractMaximumDecimalNumber) =>

_contractMultiplier = 1

if (_contractMaximumDecimalNumber == 0)

_contractMultiplier // Return 1

else

for _counter = 1 to _contractMaximumDecimalNumber

_contractMultiplier:= _contractMultiplier * 10

_contractMultiplier

f_priceDecimalDigitsZeroString () =>

// Dependencies: i_priceDecimalDigits (initialized in inputs).

_zeroString = ""

if not (i_priceDecimalDigits == 0)

for _digit = 1 to i_priceDecimalDigits

_zeroString := _zeroString + "0"

_zeroString

// Zignalye - Functions - BEGIN

f_getZignalyLongAlertMessage(_entryQuantityContractsUSDT, _currentCapital) =>

// Dependencies: i_enableStopLoss (initialized in inputs).

// Dependencies: i_enableTakeProfit (initialized in inputs).

// Dependencies: i_TakeProfit (initialized in inputs).

// Dependencies: i_enableTrailingTakeProfit (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageOffset (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageTrigger (initialized in inputs).

// Dependencies: i_zignalyIntegrationType (initialized in inputs).

// Function Dependencies: f_priceDecimalDigitsZeroString()

var string _zignaleStopLossCombo = ""

var string _zignaleTakeProfitCombo = ""

var string _zignaleTrailingTakeProfitCombo = ""

_zignalyLongCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "entry" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "long" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "LONG-" + exchangeTickerID + zignalyQuote

float _floatEntryQuantityContractsUSDT = _entryQuantityContractsUSDT

_entryQuantityContractsUSDTStr = tostring(_entryQuantityContractsUSDT, "0." + f_priceDecimalDigitsZeroString())

float _floatCurrentCapital = _currentCapital

float _entryQuantityContractsPercent = (_floatEntryQuantityContractsUSDT / _floatCurrentCapital) * 100.00

_entryQuantityContractsPercentStr = tostring(_entryQuantityContractsPercent, "0." + f_priceDecimalDigitsZeroString())

// This is actually not needed because with pyramiding=0 it's impossible that an order is scaled (and thus modified)

float _constantBuyStopLoss = na

if (_oldInsideABuyOrder and insideABuyOrder)

_constantBuyStopLoss := buyStopLoss

else

_constantBuyStopLoss := newBuyStopLoss

if (i_enableStopLoss and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleStopLossCombo := zignalySeparator + zignalyQuote + "stopLossPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((nz(_constantBuyStopLoss) * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleStopLossCombo := ""

if (i_enableTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTakeProfitCombo := zignalySeparator + zignalyQuote + "takeProfitPercentage1" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_TakeProfit * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTakeProfitCombo := ""

if (i_enableTrailingTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTrailingTakeProfitCombo := zignalySeparator + zignalyQuote + "trailingStopDistancePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_trailingTakeProfitPercentageOffset * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote + zignalySeparator + zignalyQuote + "trailingStopTriggerPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_trailingTakeProfitPercentageTrigger * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTrailingTakeProfitCombo := ""

var string _message = ""

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsPercentStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

else // _ZIGSIGNALPROVIDER_

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizeQuote" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsUSDTStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

_message

f_getZignalyLongCloseAlertMessage() =>

// Dependencies: zignalyQuote

// Dependencies: zignalyEquals

// Dependencies: zignalySeparator

// Dependencies: zignalyCommonAlertMessage

_zignalyLongCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "exit" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "long" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "LONG-" + exchangeTickerID + zignalyQuote

var string _message = ""

_message := zignalyCommonAlertMessage + zignalySeparator + _zignalyLongCloseCommonAlertMessage

_message

f_getZignalyShortAlertMessage(_entryQuantityContractsUSDT, _currentCapital) =>

// Dependencies: i_enableStopLoss (initialized in inputs).

// Dependencies: i_enableTakeProfit (initialized in inputs).

// Dependencies: i_TakeProfit (initialized in inputs).

// Dependencies: i_enableTrailingTakeProfit (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageOffset (initialized in inputs).

// Dependencies: i_trailingTakeProfitPercentageTrigger (initialized in inputs).

// Dependencies: i_zignalyIntegrationType (initialized in inputs).

// Function Dependencies: f_priceDecimalDigitsZeroString()

var string _zignaleStopLossCombo = ""

var string _zignaleTakeProfitCombo = ""

var string _zignaleTrailingTakeProfitCombo = ""

_zignalyLongCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "entry" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "short" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "SHORT-" + exchangeTickerID + zignalyQuote

float _floatEntryQuantityContractsUSDT = _entryQuantityContractsUSDT

_entryQuantityContractsUSDTStr = tostring(_entryQuantityContractsUSDT, "0." + f_priceDecimalDigitsZeroString())

float _floatCurrentCapital = _currentCapital

float _entryQuantityContractsPercent = (_floatEntryQuantityContractsUSDT / _floatCurrentCapital) * 100.00

_entryQuantityContractsPercentStr = tostring(_entryQuantityContractsPercent, "0." + f_priceDecimalDigitsZeroString())

// This is actually not needed because with pyramiding=0 it's impossible that an order is scaled (and thus modified)

float _constantSellStopLoss = na

if (oldInsideASellOrder and insideASellOrder)

_constantSellStopLoss := sellStopLoss

else

_constantSellStopLoss := newSellStopLoss

if (i_enableStopLoss and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleStopLossCombo := zignalySeparator + zignalyQuote + "stopLossPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((nz(_constantSellStopLoss) * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleStopLossCombo := ""

if (i_enableTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTakeProfitCombo := zignalySeparator + zignalyQuote + "takeProfitPercentage1" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_TakeProfit * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTakeProfitCombo := ""

if (i_enableTrailingTakeProfit and (i_zignalyIntegrationType == _ZIGHYBRIDINTEGRATION_))

_zignaleTrailingTakeProfitCombo := zignalySeparator + zignalyQuote + "trailingStopDistancePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + tostring((i_trailingTakeProfitPercentageOffset * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote + zignalySeparator + zignalyQuote + "trailingStopTriggerPercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "-" + tostring((i_trailingTakeProfitPercentageTrigger * 100), "0." + f_priceDecimalDigitsZeroString()) + zignalyQuote

else

_zignaleTrailingTakeProfitCombo := ""

var string _message = ""

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCloseCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizePercentage" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsPercentStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

else // _ZIGSIGNALPROVIDER_

_message :=

zignalyCommonAlertMessage +

zignalySeparator +

_zignalyLongCloseCommonAlertMessage +

zignalySeparator +

zignalyQuote + "positionSizeQuote" + zignalyQuote + zignalyEquals + zignalyQuote + "" + _entryQuantityContractsUSDTStr + zignalyQuote +

_zignaleStopLossCombo +

_zignaleTakeProfitCombo +

_zignaleTrailingTakeProfitCombo

_message

f_getZignalyShortCloseAlertMessage() =>

// Dependencies: zignalyQuote

// Dependencies: zignalyEquals

// Dependencies: zignalySeparator

// Dependencies: zignalyCommonAlertMessage

zignalyShortCloseCommonAlertMessage = zignalyQuote + "type" + zignalyQuote + zignalyEquals + zignalyQuote + "exit" + zignalyQuote + zignalySeparator + zignalyQuote + "side" + zignalyQuote + zignalyEquals + zignalyQuote + "short" + zignalyQuote + zignalySeparator + zignalyQuote + "orderType" + zignalyQuote + zignalyEquals + zignalyQuote + "market" + zignalyQuote + zignalySeparator + zignalyQuote + "signalId" + zignalyQuote + zignalyEquals + zignalyQuote + "SHORT-" + exchangeTickerID + zignalyQuote

var string _message = ""

_message := zignalyCommonAlertMessage + zignalySeparator + zignalyShortCloseCommonAlertMessage

_message

// Zignalye - Functions - END

// Order comment - Functions - BEGIN

f_getOrderComment(_typeOrder, _side, _alertMessage) =>

// Dependencies: i_enableOrderCommentDebug (initialized in inputs).

// TODO: Add descriptive comments

// _typeOrder="entry" or _typeOrder="close"

// _side: true means long ; false means short ; We can use strategy.long or strategy.short as true and false aliases

// _alertMessage

var string _orderComment = ""

if (i_enableOrderCommentDebug)

_orderComment := _alertMessage

else

// TODO: Use human explanations instead of default order comment value (na)

_orderComment := na

_orderComment

// Order comment - Functions - END

// Too recent orders functions

f_getTooRecentOrderNotOpenAdvice () =>

// Dependencies: i_tooRecentMinutesNumber_ms

// Dependencies: lastOrderOpenBarTime

// Condition 1: The order was open

// Condition 2: The order was long or short

// Condition 3: Time since order was last open is smaller than minimum between orders

// Returns boolean

bool _isTooRecent = ((time_close) <= (lastOrderOpenBarTime + i_tooRecentMinutesNumber_ms))

bool _tooRecentOrderBuyNotOpenAdvice = na

if (na(lastOrderOpenBarTime))

_tooRecentOrderBuyNotOpenAdvice := false

else

_tooRecentOrderBuyNotOpenAdvice := _isTooRecent

_tooRecentOrderBuyNotOpenAdvice

// FUNCTIONS - END

// Strategy Body - BEGIN

// Simple Logic to go LONG/LONG or go SHORT/SHORT - BEGIN

// longCondition = crossover(sma(close, 14), sma(close, 28))

// shortCondition = crossunder(sma(close, 14), sma(close, 28))

longCondition = sma(close, 14) >= sma(close, 28)

shortCondition = sma(close, 14) < sma(close, 28)

// Simple Logic to go LONG/LONG or go SHORT/SHORT - END

// Position price calculation - BEGIN

float positionPrice = na

if (insideASellOrder or insideABuyOrder)

positionPrice := strategy.position_avg_price

else

positionPrice := close

// Position price calculation - END

tooRecentOrderNotOpenAdvice = f_getTooRecentOrderNotOpenAdvice ()

newBuyStopLoss := i_StopLoss

newSellStopLoss := i_StopLoss

// Decide if we are going to LONG/Go LONG - BEGIN

PRE_LONG = false

PRE_LONG := longCondition and (not tooRecentOrderNotOpenAdvice)

// LONG = PRE_LONG[1] and PRE_LONG // Wait for confirmation

LONG = PRE_LONG // Do not wait for confirmation

// Decide if we are going to LONG/Go LONG - END

// Decide if we are going to SHORT/Go SHORT - BEGIN

PRE_SHORT = false

PRE_SHORT := shortCondition and (not tooRecentOrderNotOpenAdvice)

// SHORT = PRE_SHORT[1] and PRE_SHORT // Wait for confirmation

SHORT = PRE_SHORT // Do not wait for confirmation

// Decide if we are going to SHORT/Go SHORT - END

// Decide if a LONG/LONG entry should be closed - BEGIN

LONG_CLOSE = true

LONG_CLOSE := not (longCondition)

// Let's make sure LONG does not trigger if LONG_CLOSE would tell us to close the LONG

if LONG_CLOSE

LONG := false

// Decide if a LONG/LONG entry should be closed - END

// Decide if a SHORT/SHORT entry should be closed - BEGIN

SHORT_CLOSE = true

SHORT_CLOSE := not (shortCondition)

// Let's make sure SHORT does not trigger if SHORT_CLOSE would tell us to close the SHORT

if SHORT_CLOSE

SHORT := false

// Decide if a SHORT/SHORT entry should be closed - END

// How much to LONG/GO LONG/SHORT/GO SHORT - BEGIN

// Custom take profit and stop loss

LongTakeProfit = positionPrice * (1 + i_TakeProfit)

ShortTakeProfit = positionPrice * (1 - i_TakeProfit)

float LongStopLoss = na

float ShortStopLoss = na

LongStopLoss := positionPrice * (1 - buyStopLoss)

ShortStopLoss := positionPrice * (1 + sellStopLoss)

strategy.initial_capital = 50000

float entryQuantity = na

float currentCapital = strategy.initial_capital + strategy.netprofit

if (i_zignalyProviderType == _ZIGCOPYTRADERPROVIDER_)

entryQuantity := i_CapitalPercentage * currentCapital

else // _ZIGSIGNALPROVIDER_

entryQuantity := i_CapitalQuote

float entryQuantityContractsReducer = 0.99

contractMultiplier = f_getContractMultiplier(i_contractMaximumDecimalNumber)

// We assume the current price is current bar close

entryQuantityContracts = (floor(((entryQuantity / close) * entryQuantityContractsReducer) * contractMultiplier) / contractMultiplier)

entryQuantityContractsUSDT = entryQuantityContracts * (close)

// How much to LONG/GO LONG/SHORT/GO SHORT - END

// GO LONG only logic - BEGIN

var float tmpPositionBeforeOpeningOrder = na

if (i_strategyType == _L_)

if LONG

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyLongAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.long, tmpOrderAlertMessage)

strategy.entry("[B]", strategy.long, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

buyOrderOpenBarIndex := bar_index + 1

if (not insideABuyOrder)

buyStopLoss := newBuyStopLoss

insideABuyOrder := true

0 // Workaround for making every if branch to return the same type of value

else if LONG_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.close("[B]", alert_message=i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

insideABuyOrder := false

0 // Workaround for making every if branch to return the same type of value

// GO LONG only logic - END

// GO SHORT only logic - BEGIN

if (i_strategyType == _S_)

if SHORT

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyShortAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.short, tmpOrderAlertMessage)

strategy.entry("[S]", strategy.short, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

sellOrderOpenBarIndex := bar_index + 1

if (not insideASellOrder)

sellStopLoss := newSellStopLoss

insideASellOrder := true

0 // Workaround for making every if branch to return the same type of value

else if SHORT_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.close("[S]", alert_message=i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

insideASellOrder := false

0 // Workaround for making every if branch to return the same type of value

// GO SHORT only logic - END

// GO LONG and SHORT logic - BEGIN

if (i_strategyType == L_S)

// Asumption: Above we have:

// if LONG_CLOSE

// LONG := false

// if SHORT_CLOSE

// SHORT := false

// LONG and SHORT cannot be true at the same time

// Anyways we will take it into account

if (LONG == true) and (SHORT == true)

LONG := true

SHORT := false

SHORT_CLOSE := true

if LONG

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyLongAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.long, tmpOrderAlertMessage)

strategy.entry("[B]", strategy.long, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

buyOrderOpenBarIndex := bar_index + 1

if (not insideABuyOrder)

buyStopLoss := newBuyStopLoss

insideABuyOrder := true

if LONG_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.close("[B]", alert_message=i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

insideABuyOrder := false

if SHORT

tmpPositionBeforeOpeningOrder := strategy.position_avg_price

tmpOrderAlertMessage := f_getZignalyShortAlertMessage(entryQuantityContractsUSDT, currentCapital)

tmpOrderComment := f_getOrderComment("entry", strategy.short, tmpOrderAlertMessage)

strategy.entry("[S]", strategy.short, qty=entryQuantityContracts, alert_message=i_enableZignalyAlert ? tmpOrderAlertMessage : na, comment=tmpOrderComment)

if (na(tmpPositionBeforeOpeningOrder)) // bar_index should only be saved when there is no order opened

sellOrderOpenBarIndex := bar_index + 1

if (not insideASellOrder)

sellStopLoss := newSellStopLoss

insideASellOrder := true

if SHORT_CLOSE

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.close("[S]", alert_message=i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

insideASellOrder := false

// GO LONG and SHORT logic - END

// Handle STOP LOSS (and similar) order exits - BEGIN

// Quick Paste - BEGIN

float longTrailingTakeProfitPrice = na

float longTrailingTakeProfitPoints = na

float longTrailingTakeProfitOffset = na

float shortTrailingTakeProfitPrice = na

float shortTrailingTakeProfitPoints = na

float shortTrailingTakeProfitOffset = na

// Calculate trailing_take_profit_offset based on tick units

longTmpTtpBaseValue = positionPrice * (1 + i_trailingTakeProfitPercentageTrigger)

longTmpTtpTop_value = longTmpTtpBaseValue * (1 + i_trailingTakeProfitPercentageOffset)

longTrailingTakeProfitOffsetFloat = longTmpTtpTop_value - longTmpTtpBaseValue

float longTrailingTakeProfitOffsetTick = floor (longTrailingTakeProfitOffsetFloat / syminfo.mintick)

shortTmpTtpBaseValue = positionPrice * (1 - i_trailingTakeProfitPercentageTrigger)

shortTmpTtpBottomValue = shortTmpTtpBaseValue * (1 - i_trailingTakeProfitPercentageOffset)

shortTrailingTakeProfitOffsetFloat = shortTmpTtpBaseValue - shortTmpTtpBottomValue

float shortTrailingTakeProfitOffsetTick = floor (shortTrailingTakeProfitOffsetFloat / syminfo.mintick)

if i_enableTrailingTakeProfit

longTrailingTakeProfitPrice := positionPrice * (1 + i_trailingTakeProfitPercentageTrigger)

longTrailingTakeProfitOffset := longTrailingTakeProfitOffsetTick

shortTrailingTakeProfitPrice := positionPrice * (1 - i_trailingTakeProfitPercentageTrigger)

shortTrailingTakeProfitOffset := shortTrailingTakeProfitOffsetTick

else

longTrailingTakeProfitPrice := na

longTrailingTakeProfitOffset := na

shortTrailingTakeProfitPrice := na

shortTrailingTakeProfitOffset := na

// Quick Paste - END

// This might trigger additional close orders than needed in zignaly

// Better close an existing order twice than regreting zignaly not having closed it.

tmpOrderComment := f_getOrderComment("close", strategy.long, f_getZignalyLongCloseAlertMessage())

strategy.exit("[SL/TP]", "[B]", stop= i_enableStopLoss ? LongStopLoss : na, limit= i_enableTakeProfit ? LongTakeProfit : na, trail_price= i_enableTrailingTakeProfit ? longTrailingTakeProfitPrice : na, trail_offset = i_enableTrailingTakeProfit ? longTrailingTakeProfitOffset : na, alert_message= i_enableZignalyAlert ? f_getZignalyLongCloseAlertMessage() : na, comment=tmpOrderComment)

tmpOrderComment := f_getOrderComment("close", strategy.short, f_getZignalyShortCloseAlertMessage())

strategy.exit("[SL/TP]", "[S]", stop= i_enableStopLoss ? ShortStopLoss : na, limit= i_enableTakeProfit ? ShortTakeProfit : na, trail_price= i_enableTrailingTakeProfit ? shortTrailingTakeProfitPrice : na, trail_offset = i_enableTrailingTakeProfit ? shortTrailingTakeProfitOffset : na, alert_message= i_enableZignalyAlert ? f_getZignalyShortCloseAlertMessage() : na, comment=tmpOrderComment)

// Handle STOP LOSS (and similar) order exits - END

// Strategy Body - END