Basierend auf der Double-Counter-Momentum-Strategie

Überblick

Die Doppel-Return-Quantität-Strategie ermöglicht Trending-Handel durch die Kombination von Preis-Return-Signal und Volatilität-Return-Signal. Sie basiert hauptsächlich auf 123-Formen, die Preis-Return-Punkte beurteilen, während die Donchian-Kanal-Volatilität zur Filterung von Falschsignalen verwendet wird. Die Strategie ist für mittlere und lange Positionen geeignet.

Strategieprinzip

Der Kursumkehrteil verwendet die 123-Form. Diese Form bedeutet, dass sich die ersten beiden K-Linien umkehren (aufwärts oder nach unten) und die dritte K-Line erneut umkehren (aufwärts oder nach unten). Daher wird sie als 123-Form bezeichnet. Wenn sich die drei K-Linien umkehren, deutet dies normalerweise auf eine kurzfristige Tendenz hin.

Die Donchian-Channel-Wandelrate wird im Wende-Teil verwendet. Die Donchian-Channel-Wandelrate spiegelt hauptsächlich die Bandbreite der Preise wider. Wenn die Preisschwankungen größer sind, wird die Donchian-Channel-Breite erweitert; wenn die Preisschwankungen geringer sind, wird die Donchian-Channel-Breite verkleinert.

Insgesamt ist die Strategie durch eine doppelte Rückwärtsprüfung sowohl sicher, dass die Handelssignale zuverlässig sind, als auch Risiken zu kontrollieren, was eine relativ robuste Trendstrategie darstellt.

Strategische Vorteile

- Doppelte Filtermechanismen, um die Zuverlässigkeit von Handelssignalen zu gewährleisten und falsche Abbrüche zu vermeiden

- Risiken kontrollieren und die Wahrscheinlichkeit von Verlusten senken

- Es ist wichtig, dass Sie sich für die mittleren und langen Positionen eignen, um Marktgeräusche zu vermeiden und die Überschüsse zu nutzen.

- Optimierung von Parametern mit viel Platz für Optimierung

- Einzigartiger Stil und eine gute Kombination mit gängigen technischen Kennzahlen

Strategisches Risiko

- Abhängig von Parameteroptimierungen, bei denen falsche Parameter die Strategie beeinträchtigen

- Die Stop-Loss-Strategie muss weiter verbessert werden, und die Maximal-Rücknahme-Kontrollen müssen verbessert werden.

- Die Handelsfrequenz ist möglicherweise niedrig und nicht für den Handel mit Hochfrequenzalgorithmen geeignet.

- Die Auswahl der richtigen Sorten und Zeitspannen ist begrenzt.

- Optimierte Parameter können mit Hilfe von Machine Learning und anderen Methoden ermittelt werden.

Optimierungsrichtung

- Erhöhung der Adaptive Stop-Loss-Module, um die maximale Rücknahme erheblich zu reduzieren

- Die Einführung eines Volumenindikators, um den Einstieg bei einem hohen Volumenbruch zu sichern

- Optimierung der Parameter für optimale Stabilität

- Versuchen Sie mit verschiedenen Sorten und Zeitspannen, um die beste Umgebung zu finden

- Versuchen Sie es mit anderen Kennzahlen oder Strategien zu kombinieren, um eine Synergie von 1 + 1 > 2 zu erzielen

Zusammenfassen

Die Doppel-Return-Quantität-Strategie ermöglicht eine bessere Risikokontrolle durch die Doppel-Verifizierung von Preis-Return- und Volatilitäts-Return-Raten. Im Vergleich zu einem einzelnen Indikator filtert sie eine große Menge an Geräuschen und ist stabiler. Die Strategie kann die Signalqualität und Ertragsstabilität durch Optimierung von Parametern, Verlustmodule-Verstärkung und die Einführung von Quantitativen weiter verbessern.

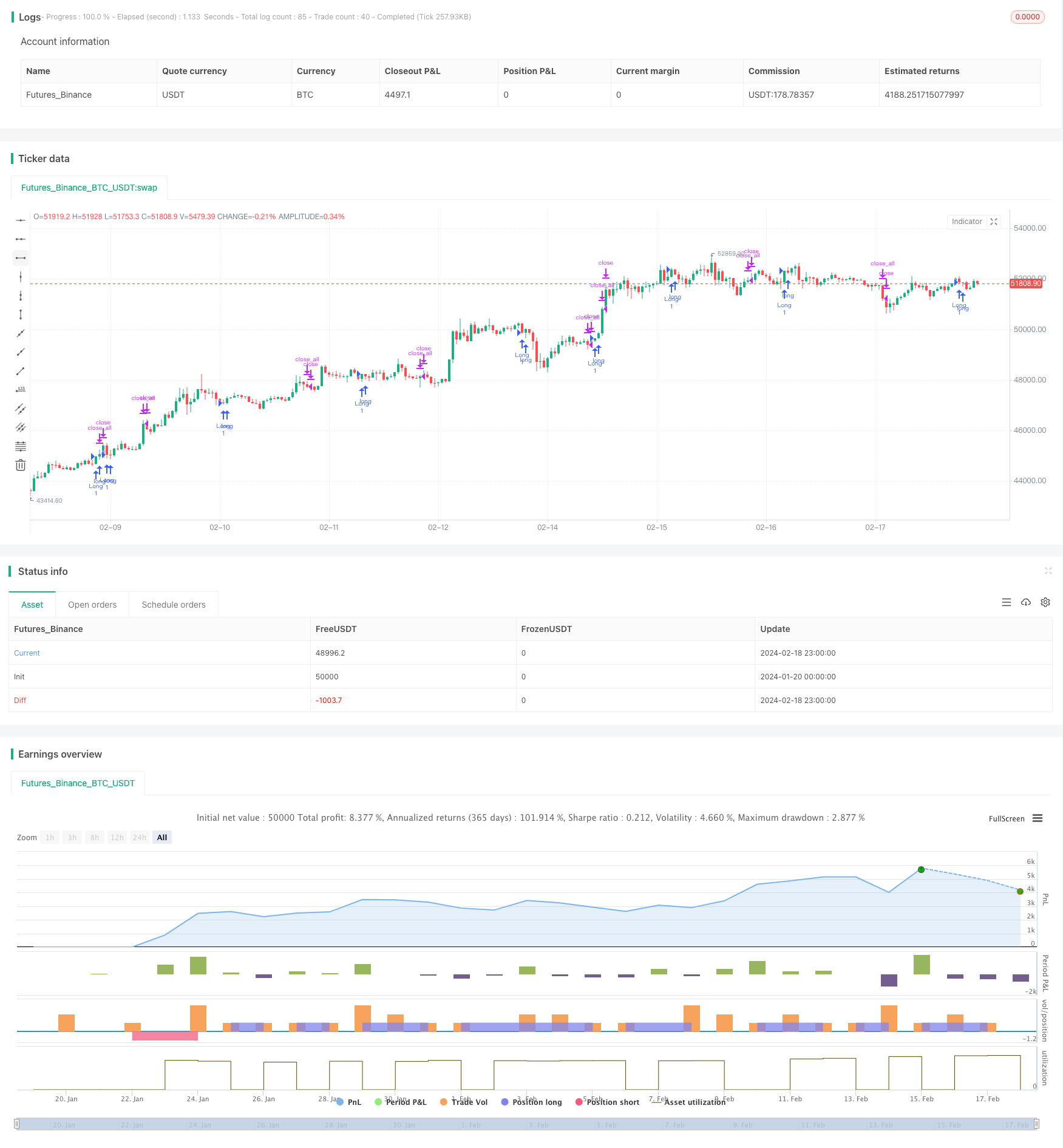

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 06/03/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Donchian Channel was developed by Richard Donchian and it could be compared

// to the Bollinger Bands. When it comes to volatility analysis, the Donchian Channel

// Width was created in the same way as the Bollinger Bandwidth technical indicator was.

//

// As was mentioned above the Donchian Channel Width is used in technical analysis to measure

// volatility. Volatility is one of the most important parameters in technical analysis.

// A price trend is not just about a price change. It is also about volume traded during this

// price change and volatility of a this price change. When a technical analyst focuses his/her

// attention solely on price analysis by ignoring volume and volatility, he/she only sees a part

// of a complete picture only. This could lead to a situation when a trader may miss something and

// lose money. Lets take a look at a simple example how volatility may help a trader:

//

// Most of the price based technical indicators are lagging indicators.

// When price moves on low volatility, it takes time for a price trend to change its direction and

// it could be ok to have some lag in an indicator.

// When price moves on high volatility, a price trend changes its direction faster and stronger.

// An indicator's lag acceptable under low volatility could be financially suicidal now - Buy/Sell signals could be generated when it is already too late.

//

// Another use of volatility - very popular one - it is to adapt a stop loss strategy to it:

// Smaller stop-loss recommended in low volatility periods. If it is not done, a stop-loss could

// be generated when it is too late.

// Bigger stop-loss recommended in high volatility periods. If it is not done, a stop-loss could

// be triggered too often and you may miss good trades.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

DCW(length, smoothe) =>

pos = 0.0

xUpper = highest(high, length)

xLower = lowest(low, length)

xDonchianWidth = xUpper - xLower

xSmoothed = sma(xDonchianWidth, smoothe)

pos := iff(xDonchianWidth > xSmoothed, -1,

iff(xDonchianWidth < xSmoothed, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Donchian Channel Width", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthDCW = input(20, minval=1)

SmootheSCW = input(22, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posDCW = DCW(LengthDCW, SmootheSCW)

pos = iff(posReversal123 == 1 and posDCW == 1 , 1,

iff(posReversal123 == -1 and posDCW == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )