Überblick

Die Strategie kombiniert mehrere technische Indikatoren wie den relativ starken und schwachen Index (RSI), die Moving Average Convergence Spread (MACD), die Bollinger Bands (Bollinger Bands) und die Handelsmenge, um die besten Handelszeiten zu bestimmen. Die Strategie identifiziert Trends und Schwankungen durch die Analyse von Preis- und Handelsmenge-Daten und erzeugt Handelssignale mithilfe von Dynamik- und Schwankungsindikatoren.

Strategieprinzip

- Berechnen Sie den RSI, MACD, Brin-Band und die Transaktionsmenge.

- Kurz- und langfristige Moving Averages werden verwendet, um Trends zu identifizieren.

- Identifizieren Sie die Höhen und Tiefen der Mobilitätszonen.

- Das ist ein Signal zum Kauf:

- Kaufen Sie, wenn der RSI unter 30 liegt und der Schlusskurs unterhalb des Bollinger Bands und oberhalb der Liquiditätszone liegt.

- Kaufen Sie, wenn die MACD-Spalte größer als 0 ist, der Aufwärtstrend feststeht, der Schlusskurs über dem Höchstpunkt der ersten 10 K-Linien liegt und sich über dem Tiefpunkt der Liquiditätszone befindet.

- Kaufen Sie, wenn der Umsatz explodiert, der Schlusskurs über dem Bollinger Band liegt und sich oberhalb der Tiefpunkte der Liquiditätszone befindet.

- Das sind die wichtigsten Themen, die wir diskutieren.

- Verkaufen Sie, wenn der RSI über 70 liegt, der Schlusskurs über dem Bollinger Band liegt und sich unter dem Höchststand der Liquiditätszone befindet.

- Verkauft wird, wenn die MACD-Spalte kleiner als 0 ist, ein Abwärtstrend etabliert ist, der Schlusskurs unter dem Tiefpunkt der ersten 10 K-Linien liegt und sich unter dem Hochpunkt der Liquiditätszone befindet.

- Verkauft wird, wenn der Umsatz explodiert, der Schlusskurs unterhalb der Bollinger Band-Abwärtsbahn liegt und sich unterhalb des Höchstwerts der Liquiditätszone befindet.

- Vermeidung von Wiederholungen bei der Ausführung von Transaktionen auf Basis von Kauf- und Verkaufssignalen.

Strategische Vorteile

- Multi-Indicator-Palette: Die Strategie berücksichtigt mehrere Aspekte wie Preis, Transaktionsvolumen, Trends und Schwankungen, um zuverlässigere Handelssignale zu liefern.

- Trendbestätigung: Durch den Vergleich von kurz- und langfristigen gleitenden Durchschnitten kann die Strategie die aktuelle Trendrichtung effektiv erkennen.

- Volatilität: Die Einführung von Brin-Bändern und Transaktionsvolumen-Indikatoren ermöglicht es der Strategie, Preisschwankungen und Veränderungen der Marktstimmung zu erfassen.

- Liquiditätszonen: Durch die Identifizierung von Liquiditätszonen kann die Strategie die Erfolgsrate erhöhen, indem sie in der Nähe von wichtigen Unterstützungs- und Widerstandspunkten handelt.

- Übertriebsvorbeugung: Die Strategie enthält Mechanismen, um Wiederholungen zu verhindern und unnötige Transaktionskosten zu vermeiden.

Strategisches Risiko

- Optimierungsrisiken für Parameter: Die Performance einer Strategie hängt von der Auswahl mehrerer Parameter ab, und eine unsachgemäße Einstellung der Parameter kann zu einem Ausfall der Strategie führen.

- Marktrisiko: Strategien werden auf Basis historischer Daten optimiert und können sich in Zukunft nicht gut auf Marktveränderungen auswirken.

- Black Swan: Strategie, die nicht in der Lage ist, auf außergewöhnliche Schwankungen unter extremen Marktbedingungen zu reagieren.

- Schlupfpunkte und Transaktionskosten: Schlupfpunkte und Transaktionskosten in den tatsächlichen Transaktionen können die Gesamtperformance der Strategie beeinflussen.

Richtung der Strategieoptimierung

- Dynamische Parameteroptimierung: Strategieparameter werden dynamisch an die Marktlage angepasst, um sie an die verschiedenen Marktphasen anzupassen.

- Risikomanagement: Einführung von Stop-Loss- und Stop-Stop-Mechanismen, um die Risikothek für einzelne Geschäfte zu kontrollieren.

- Multi-Markt-Tests: Die Anwendung von Strategien in verschiedenen Finanzmärkten zur Bewertung ihrer Allgemeingültigkeit und Stabilität.

- Optimierung durch maschinelles Lernen: Die Nutzung von maschinellen Lernalgorithmen zur Optimierung von Strategien und zur Anpassung an Marktveränderungen.

Zusammenfassen

Die Strategie kombiniert mehrere technische Indikatoren wie RSI, MACD, Bollinger Bands und Transaktionsvolumen, um ein vollständiges Handelssystem zu bilden. Die Strategie berücksichtigt mehrere Aspekte wie Preis, Trend, Volatilität und Marktgefühl und führt das Konzept der Liquiditätszonen ein, um die Handelssignale zu optimieren. Obwohl die Strategie einige Vorteile hat, stehen sie weiterhin vor Herausforderungen wie Parameteroptimierung und Marktrisiken.

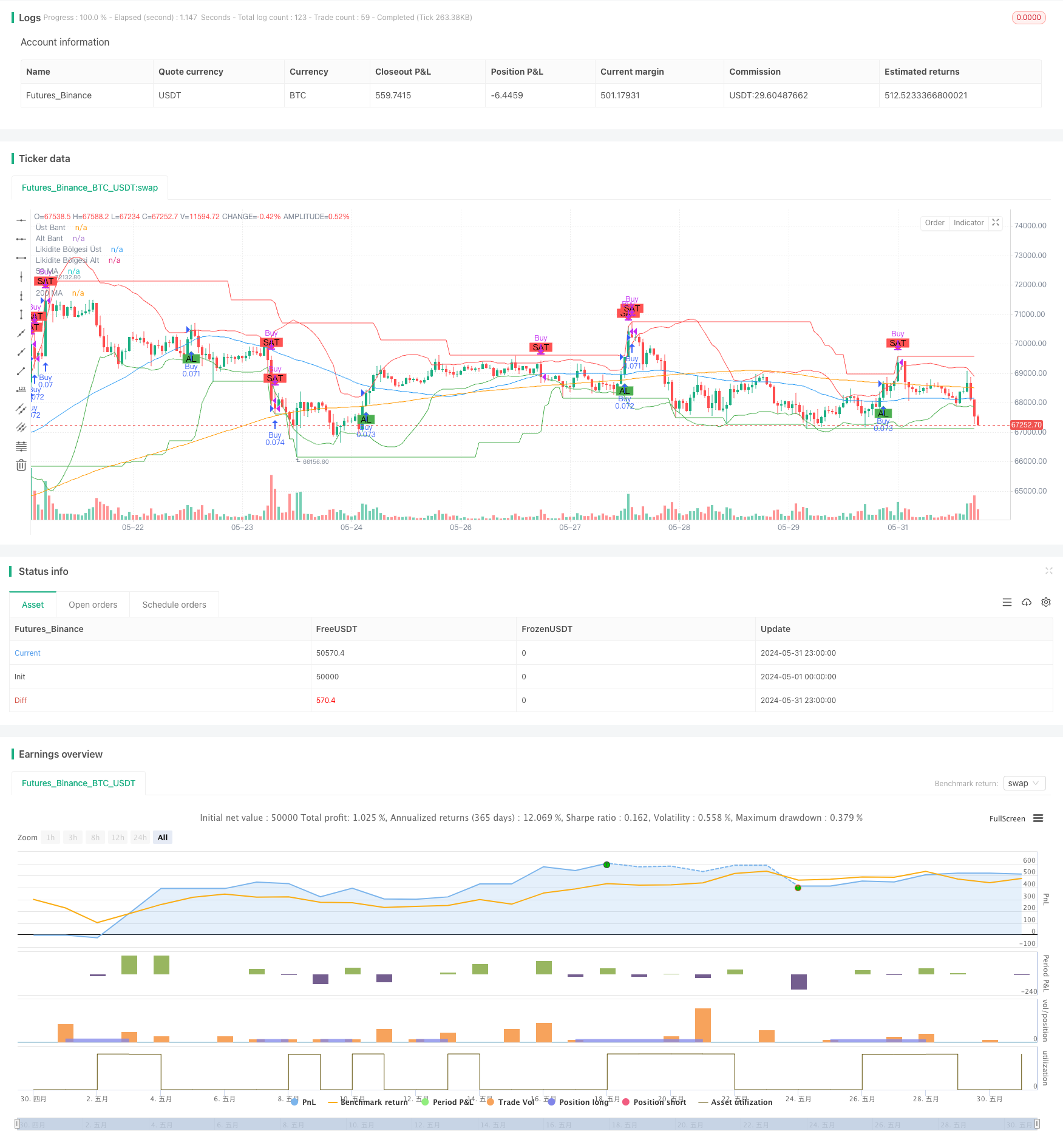

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimize Edilmiş Kapsamlı Ticaret Stratejisi - Likidite Bölgeleri ile 30 Dakika", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Optimize edilebilir parametreler

rsiPeriod = input.int(14, minval=5, maxval=30, title="RSI Periyodu")

macdShortPeriod = input.int(12, minval=5, maxval=30, title="MACD Kısa Periyodu")

macdLongPeriod = input.int(26, minval=20, maxval=50, title="MACD Uzun Periyodu")

macdSignalPeriod = input.int(9, minval=5, maxval=20, title="MACD Sinyal Periyodu")

smaPeriod = input.int(20, minval=10, maxval=50, title="SMA Periyodu")

bollingerMultiplier = input.float(2.0, minval=1.0, maxval=3.0, title="Bollinger Bantları Çarpanı")

volumeSpikeMultiplier = input.float(1.5, minval=1.0, maxval=3.0, title="Hacim Artış Çarpanı")

shortTermMAPeriod = input.int(50, minval=20, maxval=100, title="Kısa Dönem MA Periyodu")

longTermMAPeriod = input.int(200, minval=100, maxval=300, title="Uzun Dönem MA Periyodu")

liquidityZonePeriod = input.int(50, minval=10, maxval=100, title="Likidite Bölgesi Periyodu")

// İndikatörleri Tanımla

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

macdHist = macdLine - signalLine

basis = ta.sma(close, smaPeriod)

dev = bollingerMultiplier * ta.stdev(close, smaPeriod)

upperBand = basis + dev

lowerBand = basis - dev

volumeSpike = volume > ta.sma(volume, 20) * volumeSpikeMultiplier

// Hareketli Ortalamaları Kullanarak Trend Takibi

shortTermMA = ta.sma(close, shortTermMAPeriod)

longTermMA = ta.sma(close, longTermMAPeriod)

trendUp = shortTermMA > longTermMA

trendDown = shortTermMA < longTermMA

// Likidite Bölgelerini Belirleme

liquidityZoneHigh = ta.highest(high, liquidityZonePeriod)

liquidityZoneLow = ta.lowest(low, liquidityZonePeriod)

// Likidite Bölgelerini Çiz

plot(liquidityZoneHigh, color=color.red, title="Likidite Bölgesi Üst")

plot(liquidityZoneLow, color=color.green, title="Likidite Bölgesi Alt")

// Sinyal Durumlarını Saklamak İçin Değişkenler

var bool inPosition = false

var bool isBuy = false

// Al ve Sat Sinyali Bayrakları

var bool buyFlag = false

var bool sellFlag = false

// Bayrakları Sıfırla

buyFlag := false

sellFlag := false

// Al ve Sat Sinyallerini Tanımla

var bool buySignal = false

var bool sellSignal = false

if (barstate.isconfirmed)

buySignal := ((rsi < 30 and close < lowerBand and close > liquidityZoneLow) or

(macdHist > 0 and trendUp and close > ta.highest(high, 10)[1] and close > liquidityZoneLow) or

(volumeSpike and close > upperBand and close > liquidityZoneLow))

sellSignal := ((rsi > 70 and close > upperBand and close < liquidityZoneHigh) or

(macdHist < 0 and trendDown and close < ta.lowest(low, 10)[1] and close < liquidityZoneHigh) or

(volumeSpike and close < lowerBand and close < liquidityZoneHigh))

// Aynı Sinyali Tekrarlamamak İçin Kontroller

if (buySignal and (not inPosition or not isBuy))

inPosition := true

isBuy := true

buyFlag := true

sellFlag := false

strategy.entry("Buy", strategy.long)

if (sellSignal and inPosition and isBuy)

inPosition := false

isBuy := false

sellFlag := true

buyFlag := false

strategy.close("Buy")

// Sinyalleri Grafiğe Çiz

plotshape(series=buyFlag, location=location.belowbar, color=color.green, style=shape.labelup, text="AL")

plotshape(series=sellFlag, location=location.abovebar, color=color.red, style=shape.labeldown, text="SAT")

// Hareketli Ortalamaları ve Bollinger Bantlarını Çiz

plot(shortTermMA, color=color.blue, title="50 MA")

plot(longTermMA, color=color.orange, title="200 MA")

plot(upperBand, color=color.red, title="Üst Bant")

plot(lowerBand, color=color.green, title="Alt Bant")