Überblick

Die Strategie ist ein umfassendes technisch-analytisches Handelssystem, das die klassische Graphit-Form-Erkennung mit der Trendanalyse kombiniert. Das System stützt sich hauptsächlich auf die Erkennung mehrerer klassischer Graphit-Formen, darunter mehr als zehn verschiedene Graphit-Formen, und kombiniert kurz- und langfristige Moving Averages, um Markttrends zu bestätigen und so ein Kauf- und Verkaufsignal zu erzeugen. Die Strategie ist für verschiedene Zeiträume geeignet und kann sowohl für kurz- als auch für mittelfristige Positionen verwendet werden.

Strategieprinzip

Die Strategie nutzt mehrschichtige Signalbestätigungsmechanismen:

- Verwendung eines 6-Perioden-Indikator-Moving Averages (EMA) als kurzfristiger Trendindikator

- Langfristige Trends anhand von 50- und 200-Perioden-SMAs

- Es gibt mehrere Arten von Graphiken:

- Kreuzsternfamilie (Gewöhnliche Kreuzstern, Grabmalkreuz, Kruszkreuz)

- Die Form des Fangs (Fangs, Aufhänger, Rücken Fangs, Stern)

- Die Form verschlingt

- Gestalt der Geburtslinie

- Aufgang/Sonnenuntergang

- Die Form der Trimmel/Trimmel

- Die Kombination von Trend und Form erzeugt Handelssignale

Strategische Vorteile

- Mehrdimensionale Signalbestätigung: Erhöhung der Zuverlässigkeit von Handelssignalen durch die doppelte Bestätigung von Moving Averages und Pivot-Graph-Formaten

- Anpassungsfähigkeit: Anpassung an unterschiedliche Marktumgebungen, um sowohl Trends als auch Umkehrmöglichkeiten zu erfassen

- Gute Risikokontrollen: Falschmeldungen durch strenge Bedingungen für die Formerkennung reduzieren

- Die Logik ist klar: Jedes Handelssignal hat klare Einstiegsbedingungen.

- Erweiterbarkeit: Das Strategie-Framework erlaubt es, neue Formenerkennungsmodule nach Bedarf hinzuzufügen.

Strategisches Risiko

- Verzögerung bei der Formerkennung: Die Formbestätigung durch die Karte benötigt mehrere K-Linien und kann den besten Einstiegsmoment verpassen.

- Signalüberschneidung: Mehrere Formen können zu Signalkonflikten führen

- Marktgeräusche: Zu viele falsche Signale in der unruhigen Stadt

- Parameter-Sensitivität: Die Wahl der Moving Average-Periode hat einen großen Einfluss auf die Strategie-Performance

- Komplexität der Berechnung: Echtzeitberechnung in mehreren Formen kann die Effizienz der Ausführung beeinträchtigen

Richtung der Strategieoptimierung

- Signalgewichtssystem:

- Anpassbare Gewichte für verschiedene Formen

- Gewichte, die der Dynamik des Marktumfelds angepasst werden

- Identifizierung des Marktumfelds:

- Hinzufügen von Volatilitätsindikatoren zur Identifizierung von Marktzuständen

- Anpassung der Strategieparameter an unterschiedliche Marktbedingungen

- Stop Loss Optimierung:

- Dynamische Verlustbewältigung basierend auf Formmerkmalen

- Hinzufügen von Tracking-Stopp-Mechanismen

- Das ist ein Signal-Filter:

- Mechanismus zur Bestätigung des Transaktionsvolumens hinzufügen

- Trendstärkefilter hinzufügen

- Optimierung der Rechenleistung:

- Vereinfachte Formenerkennungsalgorithmen

- Optimierung der Datenstruktur

Zusammenfassen

Die Strategie baut ein vollständiges Handelssystem auf, indem sie mehrere technische Analyse-Tools integriert. Die Kernvorteile der Strategie liegen in einer mehrdimensionalen Signalbestätigungsmechanik, aber gleichzeitig besteht die Gefahr von Signalverzögerungen und Überfusion. Durch die Hinzufügung von Marktelementerkennungs- und Dynamikparameteranpassungsmechanismen wird die Strategie eine bessere Leistung erwarten.

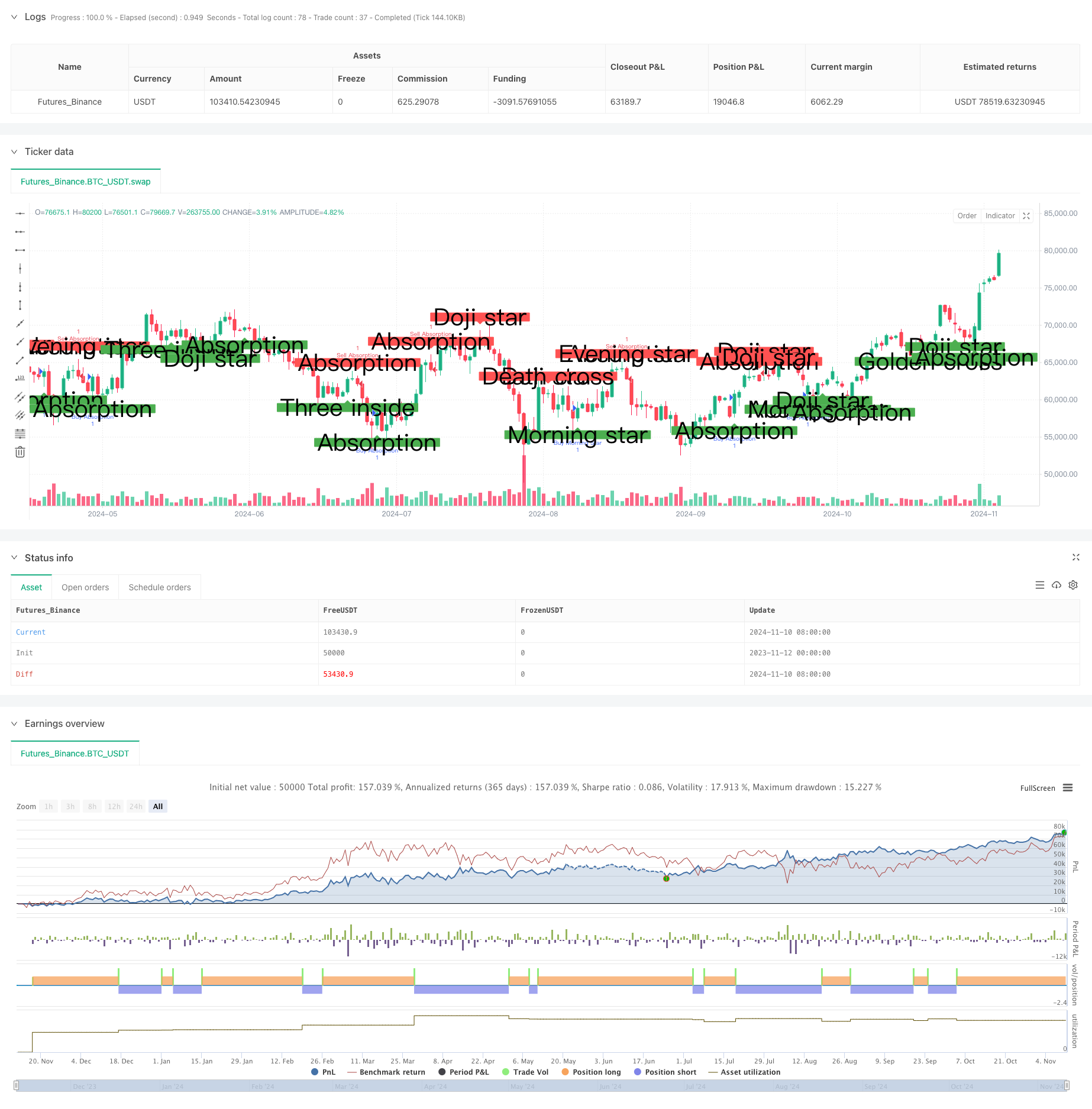

/*backtest

start: 2023-11-12 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("hazed candles", shorttitle="hazed candles", overlay=true)

// Inputs

ema_input = input.int(6, title="EMA value to detect trend")

show_doji = input.bool(true, title="Doji star")

show_doji_grave = input.bool(true, title="Doji grave")

show_doji_dragonfly = input.bool(true, title="Doji dragonfly")

show_hammer = input.bool(true, title="Hammer")

show_hanginman = input.bool(true, title="Hanging man")

show_rhammer = input.bool(true, title="Reversed hammer")

show_falling_star = input.bool(true, title="Falling star")

show_absorption = input.bool(true, title="Absorptions")

show_tweezers = input.bool(true, title="Tweezers")

show_triple_inside = input.bool(true, title="Triple inside")

show_three_soldiers = input.bool(true, title="Three soldiers")

show_three_crows = input.bool(true, title="Three crows")

show_morning_evening_stars = input.bool(true, title="Morning / evening stars")

show_golden_death_cross = input.bool(true, title="Golden / Death cross")

// EMA calculation

prev_p_1 = ta.ema(close, ema_input)

// Variables

lowhigh_long_prop = 10

body_prop_size = 9

bar_size_h = high - close

bar_size_l = math.max(open, close) - math.min(close, open)

body_size_h = high - low

low_body_prop = close - low

high_body_prop = high - close

low_half_eq = (low_body_prop > body_size_h / 2.5 and low_body_prop < body_size_h / 1.65)

high_half_eq = (high_body_prop > body_size_h / 2.5 and high_body_prop < body_size_h / 1.65)

open_close_eq = (bar_size_l < body_size_h / body_prop_size)

///////////////// Doji star ///////////////

doji_star_up = show_doji and close <= prev_p_1 and open_close_eq and high_body_prop and low_half_eq

doji_star_down = show_doji and close > prev_p_1 and open_close_eq and high_body_prop and low_half_eq

plotshape(doji_star_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji star")

plotshape(doji_star_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji star")

// Strategy entries for Doji star

if (doji_star_up)

strategy.entry("Buy Doji Star", strategy.long)

if (doji_star_down)

strategy.entry("Sell Doji Star", strategy.short)

///////////////// Doji grave ///////////////

long_high_body = (high_body_prop > bar_size_l * lowhigh_long_prop)

open_low_eq = ((close - low) < body_size_h / body_prop_size)

doji_grave = show_doji_grave and close > prev_p_1 and open_close_eq and open_low_eq and long_high_body

plotshape(doji_grave, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji grave")

// Strategy entries for Doji grave

if (doji_grave)

strategy.entry("Sell Doji Grave", strategy.short)

///////////////// Doji dragonfly ///////////////

long_low_body = (low_body_prop > bar_size_l * lowhigh_long_prop)

open_high_eq = ((high - close) < body_size_h / body_prop_size)

doji_dragonfly = show_doji_dragonfly and close <= prev_p_1 and open_close_eq and open_high_eq and long_low_body

plotshape(doji_dragonfly, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji dragonfly")

// Strategy entries for Doji dragonfly

if (doji_dragonfly)

strategy.entry("Buy Doji Dragonfly", strategy.long)

///////////////// Hammer ///////////////

bottom_low = close - bar_size_h * 15

bottom_high = close - bar_size_h * 1.5

top_low = open + bar_size_l * 1.5

top_high = open + bar_size_l * 15

h_down = show_hammer and prev_p_1 > close and open == high and low > bottom_low and low < bottom_high

plotshape(h_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Hammer")

// Strategy entries for Hammer

if (h_down)

strategy.entry("Buy Hammer", strategy.long)

///////////////// Hanging man ///////////////

hm_down = show_hanginman and prev_p_1 < close and open == high and low > bottom_low and low < bottom_high

plotshape(hm_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Hanging man")

// Strategy entries for Hanging man

if (hm_down)

strategy.entry("Sell Hanging Man", strategy.short)

///////////////// Reversed hammer ///////////////

rh_down = show_rhammer and prev_p_1 > open and low == close and high > top_low and high < top_high

plotshape(rh_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Reversed hammer")

// Strategy entries for Reversed hammer

if (rh_down)

strategy.entry("Buy Reversed Hammer", strategy.long)

///////////////// Fallling star ///////////////

fs_down = show_falling_star and prev_p_1 < close and low == close and high > top_low and high < top_high

plotshape(fs_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Falling star")

// Strategy entries for Falling star

if (fs_down)

strategy.entry("Sell Falling Star", strategy.short)

///////////////// Absorption ///////////////

open_1 = open[1]

close_1 = close[1]

high_1 = high[1]

low_1 = low[1]

open_2 = open[2]

close_2 = close[2]

high_2 = high[2]

low_2 = low[2]

open_3 = open[3]

close_3 = close[3]

high_3 = high[3]

low_3 = low[3]

bar_1 = math.max(open_1, close_1) - math.min(open_1, close_1)

bar_2 = math.max(open_2, close_2) - math.min(open_2, close_2)

bar_3 = math.max(open_3, close_3) - math.min(open_3, close_3)

bar_h = math.max(open, close) - math.min(open, close)

bar_size_min = bar_1 * 1.2

bar_size_f = (bar_h > bar_size_min)

absorption_up = show_absorption and bar_size_f and open_1 > close_1 and open_1 != open and open_3 > open_2 and open_2 > open_1 and open_1 > open and close > open

absorption_down = show_absorption and bar_size_f and open_1 < close_1 and open_1 != open and open_3 < open_2 and open_2 < open_1 and open_1 < open and close < open

plotshape(absorption_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Absorption")

plotshape(absorption_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Absorption")

// Strategy entries for Absorption

if (absorption_up)

strategy.entry("Buy Absorption", strategy.long)

if (absorption_down)

strategy.entry("Sell Absorption", strategy.short)

///////////////// Tweezer ///////////////

match_lows = (low_1 == low or (low_2 == low and open_2 == open_1))

sprici_up = show_tweezers and prev_p_1 > open and match_lows and open_3 > open_2 and open_2 > open_1 and open_1 > open and low != open and close_1 != low_1

plotshape(sprici_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Tweezer")

match_highs = (high_1 == high or (high_2 == high and open_2 == open_1))

sprici_down = show_tweezers and prev_p_1 <= open and match_highs and open_3 < open_2 and open_2 < open_1 and open_1 < open and high != open and close_1 != high_1

plotshape(sprici_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Tweezer")

// Strategy entries for Tweezer

if (sprici_up)

strategy.entry("Buy Tweezer", strategy.long)

if (sprici_down)

strategy.entry("Sell Tweezer", strategy.short)

///////////////// Triple inside up/down ///////////////

open_close_min = math.min(close, open)

open_close_max = math.max(close, open)

bar = open_close_max - open_close_min

open_close_min_1 = math.min(close[1], open[1])

open_close_max_1 = math.max(close[1], open[1])

open_close_min_2 = math.min(close[2], open[2])

open_close_max_2 = math.max(close[2], open[2])

body_top_1 = math.max(close[1], open[1])

body_low_1 = math.min(close[1], open[1])

triple_inside_up = show_triple_inside and open_close_min_2 == open_close_min_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close > open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three inside")

triple_inside_down = show_triple_inside and open_close_max_2 == open_close_max_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close < open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three inside")

// Strategy entries for Triple inside

if (triple_inside_up)

strategy.entry("Buy Triple Inside", strategy.long)

if (triple_inside_down)

strategy.entry("Sell Triple Inside", strategy.short)

///////////////// Triple soldiers / crows ///////////////

triple_solders = show_three_soldiers and prev_p_1 > open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close > close_1 and close_1 > close_2 and open_2 < close_2 and open_1 < close_1

plotshape(triple_solders, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three soldiers")

triple_crows = show_three_crows and prev_p_1 < open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close < close_1 and close_1 < close_2 and open_2 > close_2 and open_1 > close_1

plotshape(triple_crows, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three crows")

// Strategy entries for Three soldiers and Three crows

if (triple_solders)

strategy.entry("Buy Three Soldiers", strategy.long)

if (triple_crows)

strategy.entry("Sell Three Crows", strategy.short)

///////////////// Golden death cross ///////////////

ma_50 = ta.sma(close, 50)

ma_200 = ta.sma(close, 200)

ma_50_200_cross = ta.crossover(ma_50, ma_200) or ta.crossunder(ma_50, ma_200)

golden_cross_up = show_golden_death_cross and ma_50_200_cross and ma_50 > ma_200

plotshape(golden_cross_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Golden cross")

death_cross_down = show_golden_death_cross and ma_50_200_cross and ma_50 < ma_200

plotshape(death_cross_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Death cross")

// Strategy entries for Golden cross and Death cross

if (golden_cross_up)

strategy.entry("Buy Golden Cross", strategy.long)

if (death_cross_down)

strategy.entry("Sell Death Cross", strategy.short)

///////////////// Morning evening stars ///////////////

morning_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_min_2 > open_close_min_1 and open_close_min > open_close_min_1 and prev_p_1 > close_2 and prev_p_1 > close_1 and close > close_1 and close_3 > close_2 and close_2 > close_1 and close > body_top_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(morning_star, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Morning star")

evening_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_max_2 < open_close_max_1 and open_close_max < open_close_max_1 and prev_p_1 < close_2 and prev_p_1 < close_1 and close < close_1 and close_3 < close_2 and close_2 < close_1 and close < body_low_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(evening_star, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Evening star")

// Strategy entries for Morning star and Evening star

if (morning_star)

strategy.entry("Buy Morning Star", strategy.long)

if (evening_star)

strategy.entry("Sell Evening Star", strategy.short)