Überblick

Die Strategie ist ein mehrschichtiges Handelssystem, das auf Dynamik und Trendverfolgung basiert. Es identifiziert mehrere Chancen mit hoher Wahrscheinlichkeit durch die Kombination des Williams-Schock-Indikators, des Williams-Split-Indikators, des Magic Shock-Indikators (AO) und des Index Moving Averages (EMA). Die Strategie verwendet einen Kapital-Schichtbetrieb, der nach und nach erhöht, wenn sich der Trend verstärkt, und maximal fünf Positionen gleichzeitig hält, wobei jeder Position 10% des Kapitals verwendet.

Strategieprinzip

Die Strategie verwendet mehrere Filtermechanismen, um die Genauigkeit der Handelsrichtung zu gewährleisten. Zuerst wird eine langfristige Trendentscheidung über die EMA vorgenommen, um nur nach Mehrheitsmöglichkeiten zu suchen, wenn der Preis über der EMA liegt. Zweitens wird ein kurzfristiger Trend durch eine Kombination aus dem Williams-Schwanz-Indikator und dem Spalt-Indikator beurteilt, um einen Aufwärtstrend zu bestätigen, wenn ein oberer Spalt-Bruch über der Shark-Zahnlinie erfolgt.

Strategische Vorteile

- Mehrschicht-Filtermechanismen wirksam zur Verringerung der Falschsignalstörung

- Die Wissenschaft des Geldmanagements, mit schrittweisen Anlagerungen

- Die Trend-Following-Funktion ermöglicht es, große Trends zu erfassen.

- Keine festen Stop-Losses, sondern die Dynamik der technischen Indikatoren, um den Trend zu beenden

- Die Systeme sind gut konfigurierbar und lassen sich leicht an unterschiedliche Marktbedingungen anpassen

- Die Rückmeldung zeigt gute Gewinnfaktoren und durchschnittliche Erträge.

Strategisches Risiko

- In einem schwankenden Markt könnte es zu einer Folge von Falschsignalen kommen

- Bei einer Trendumkehr kann es zu einer größeren Korrektur kommen.

- Mehrere Filterbedingungen könnten zu verpassten Handelschancen führen

- In Bezug auf die Vermögensverwaltung kann eine fortgesetzte Verlagerung zu einem Risiko bei starken Schwankungen führen.

- Die Wahl der EMA-Parameter wirkt sich stärker auf die Strategie aus

Um diese Risiken zu verringern, wird empfohlen:

- Optimierung der Parameter in unterschiedlichen Marktumgebungen

- Erwägen Sie die Erhöhung der Fluktuationsrate Filter

- Einführung strengerer Aufschlagbedingungen

- Setzen Sie eine maximale Rücknahme-Grenze

Richtung der Strategieoptimierung

- Einführung von Fluktuationsfiltern für ATR-Indikatoren

- Fügen Sie eine Handelsvolumenanalyse hinzu, um die Signalzuverlässigkeit zu verbessern

- Entwicklung von Anpassungsmechanismen für dynamische Parameter

- Improvisation von Stop-Off-Mechanismen, um bei einer Abschwächung rechtzeitig zu profitieren

- Hinzufügung von Modulen zur Erkennung von Marktzuständen, die unterschiedliche Parameter für verschiedene Marktumgebungen verwenden

Zusammenfassen

Es handelt sich hierbei um eine ausgeklügelte Trend-Tracking-Strategie, die durch die Kombination mehrerer technischer Kennzahlen eine gute Ertragsleistung erzielt, während die Sicherheit gewährleistet ist. Die Innovationen der Strategie liegen in den mehrschichtigen Trend-Bekennungsmechanismen und der schrittweisen Methode der Geldverwaltung. Obwohl es einige Optimierungsmöglichkeiten gibt, ist es insgesamt ein lohnendes Handelssystem, das es sich lohnt, zu versuchen.

/*backtest

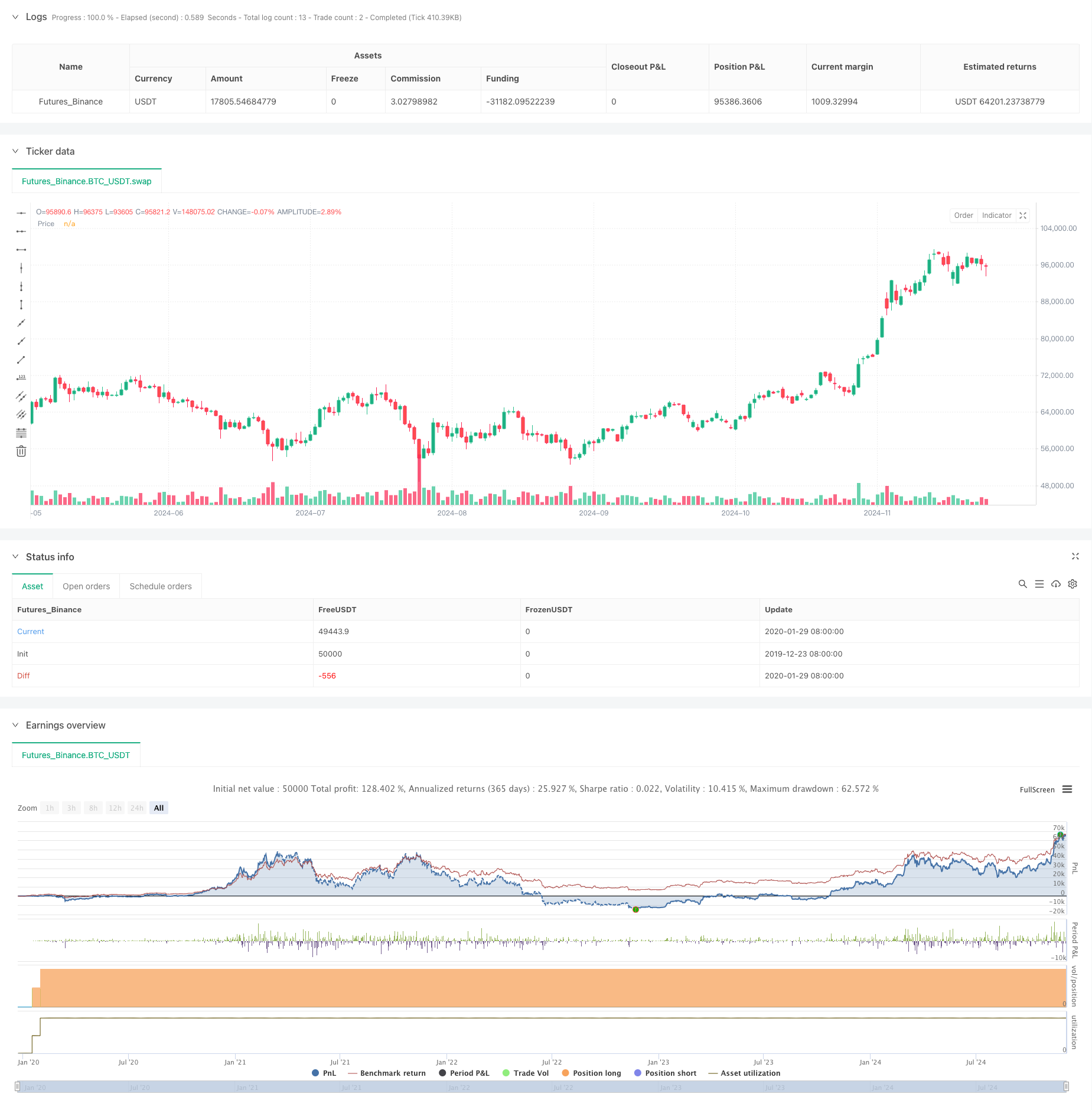

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>