Überblick

Die Strategie ist ein hoch entwickeltes Handelssystem, das auf einer Pivot-Analyse basiert, um potenzielle Trendwende durch Identifizierung von wichtigen Wendepunkten in einem Markt vorherzusagen. Die Strategie verwendet eine innovative “Pivot of the Pivot” -Methode, die in Kombination mit dem Volatilitätsindikator ATR zur Positionsverwaltung verwendet wird, um ein vollständiges Handelssystem zu bilden. Die Strategie ist für mehrere Märkte geeignet und kann entsprechend den Merkmalen der verschiedenen Märkte optimiert werden.

Strategieprinzip

Der Kern der Strategie ist die Identifizierung von Chancen für eine Marktumkehr durch eine zwei-Stufen-Pivot-Analyse. Die erste Ebene Pivot-Punkte sind die grundlegenden Höhen und Tiefen, und die zweite Ebene Pivot-Punkte sind die bedeutenden Wendepunkte, die in der ersten Ebene Pivot-Punkte ausgewählt werden.

Strategische Vorteile

- Anpassungsfähigkeit: Die Strategie kann sich an unterschiedliche Marktumgebungen anpassen, indem sie die Parameter an unterschiedliche Schwankungsraten anpasst.

- Perfekte Risikomanagement: ATR wird für dynamische Stop-Loss-Einstellungen verwendet, um Schutzmaßnahmen automatisch an die Marktvolatilität anzupassen.

- Multi-Level-Bestätigung: Die Gefahr von falschen Durchbrüchen wird durch die Analyse von zwei Ebenen verringert.

- Flexible Positionsverwaltung: Die Positionsgröße wird je nach Kontogröße und Marktdynamik angepasst.

- Klare Eintrittsregeln: Es gibt eine klare Signalerkennungsmechanismus, um subjektive Urteile zu reduzieren.

Strategisches Risiko

- Rutschrisiko: Es besteht die Gefahr eines Rutschrisikos in einem stark bewegten Markt.

- Falsche Durchbruchrisiken: Bei Marktschwankungen können falsche Signale erzeugt werden.

- Risiken von übermäßiger Hebelwirkung: Missbräuchliche Hebelwirkung kann zu schweren Verlusten führen.

- Risiko der Parameteroptimierung: Überoptimierung kann zu einer Überpassung führen.

Richtung der Strategieoptimierung

- Signalfilter: Trendfilter können hinzugefügt werden, um nur in Richtung des Haupttrends zu handeln.

- Dynamische Parameter: Anpassung der Kernpunkte automatisch an die Marktlage.

- Mehrfache Zeitspanne: Mehrfache Zeitspanne zur Bestätigung zur Verbesserung der Genauigkeit.

- Intelligente Stop-Loss: Entwickeln Sie intelligentere Stop-Loss-Strategien, wie zum Beispiel die Verfolgung von Stop-Losses.

- Risikokontrolle: Hinzufügen weiterer Risikokontrollmaßnahmen, wie z. B. eine Korrelationsanalyse.

Zusammenfassen

Dies ist eine gut entwickelte Trend-Umkehr-Handelsstrategie, die durch eine doppelte Pivot-Analyse und ATR-Volatilitätsmanagement ein robustes Handelssystem aufbaut. Die Strategie hat den Vorteil, dass sie anpassungsfähig und risikomanagementfähig ist, aber die Händler müssen die Parameter sorgfältig nutzen und kontinuierlich optimieren. Durch die empfohlene Optimierungsrichtung gibt es noch Raum für Verbesserung.

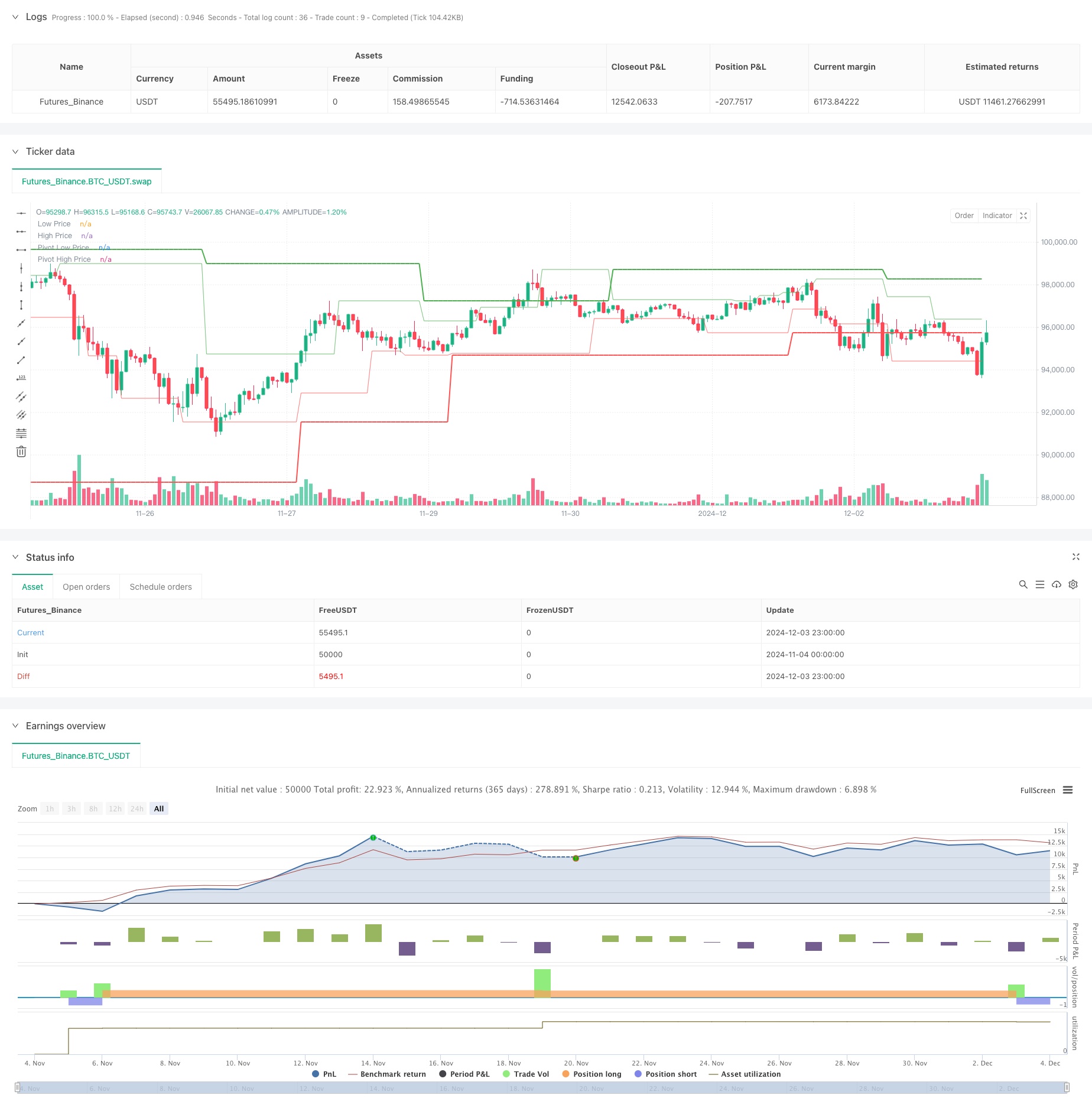

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot of Pivot Reversal Strategy [MAD]", shorttitle="PoP Reversal Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs with Tooltips

leftBars = input.int(4, minval=1, title='PP Left Bars', tooltip='Number of bars to the left of the pivot point. Increasing this value makes the pivot more significant.')

rightBars = input.int(2, minval=1, title='PP Right Bars', tooltip='Number of bars to the right of the pivot point. Increasing this value delays the pivot detection but may reduce false signals.')

atr_length = input.int(14, minval=1, title='ATR Length', tooltip='Length for ATR calculation. ATR is used to assess market volatility.')

atr_mult = input.float(0.1, minval=0.0, step=0.1, title='ATR Multiplier', tooltip='Multiplier applied to ATR for pivot significance. Higher values require greater price movement for pivots.')

allowLongs = input.bool(true, title='Allow Long Positions', tooltip='Enable or disable long positions.')

allowShorts = input.bool(true, title='Allow Short Positions', tooltip='Enable or disable short positions.')

margin_amount = input.float(1.0, minval=1.0, maxval=100.0, step=1.0, title='Margin Amount (Leverage)', tooltip='Set the leverage multiplier (e.g., 3x, 5x, 10x). Note: Adjust leverage in strategy properties for accurate results.')

risk_reward_enabled = input.bool(false, title='Enable Risk/Reward Ratio', tooltip='Enable or disable the use of a fixed risk/reward ratio for trades.')

risk_reward_ratio = input.float(1.0, minval=0.1, step=0.1, title='Risk/Reward Ratio', tooltip='Set the desired risk/reward ratio (e.g., 1.0 for 1:1).')

risk_percent = input.float(1.0, minval=0.1, step=0.1, title='Risk Percentage per Trade (%)', tooltip='Percentage of entry price to risk per trade.')

trail_stop_enabled = input.bool(false, title='Enable Trailing Stop Loss', tooltip='Enable or disable the trailing stop loss.')

trail_percent = input.float(0.5, minval=0.0, step=0.1, title='Trailing Stop Loss (%)', tooltip='Percentage for trailing stop loss.')

start_year = input.int(2018, title='Start Year', tooltip='Backtest start year.')

start_month = input.int(1, title='Start Month', tooltip='Backtest start month.')

start_day = input.int(1, title='Start Day', tooltip='Backtest start day.')

end_year = input.int(2100, title='End Year', tooltip='Backtest end year.')

end_month = input.int(1, title='End Month', tooltip='Backtest end month.')

end_day = input.int(1, title='End Day', tooltip='Backtest end day.')

date_start = timestamp(start_year, start_month, start_day, 00, 00)

date_end = timestamp(end_year, end_month, end_day, 00, 00)

time_cond = time >= date_start and time <= date_end

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if high[right] < high[right + i] + atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if high[right] < high[i] + atr * atr_mult

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if low[right] > low[right + i] - atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if low[right] > low[i] - atr * atr_mult

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig(leftBars, rightBars)

swh_cond = not na(swh)

var float hprice = 0.0

hprice := swh_cond ? swh : nz(hprice[1])

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

var float lprice = 0.0

lprice := swl_cond ? swl : nz(lprice[1])

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

var float ph1 = 0.0

var float ph2 = 0.0

var float ph3 = 0.0

var float pl1 = 0.0

var float pl2 = 0.0

var float pl3 = 0.0

var float pphprice = 0.0

var float pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

// Entry and Exit Logic

if time_cond

// Calculate order quantity based on margin amount

float order_qty = na

if margin_amount > 0

order_qty := (strategy.equity * margin_amount) / close

// Long Position

if allowLongs and le and not na(pphprice) and pphprice != 0

float entry_price_long = pphprice + syminfo.mintick

strategy.entry("PivRevLE", strategy.long, qty=order_qty, comment="PivRevLE", stop=entry_price_long)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_long = na

float trail_points_long = na

if risk_reward_enabled

float risk_amount = entry_price_long * (risk_percent / 100)

stop_loss_price := entry_price_long - risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_long + profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_long := (trail_percent / 100.0) * entry_price_long

trail_points_long := trail_offset_long / syminfo.pointvalue

strategy.exit("PivRevLE Exit", from_entry="PivRevLE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_long, trail_offset=trail_points_long)

// Short Position

if allowShorts and se and not na(pplprice) and pplprice != 0

float entry_price_short = pplprice - syminfo.mintick

strategy.entry("PivRevSE", strategy.short, qty=order_qty, comment="PivRevSE", stop=entry_price_short)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_short = na

float trail_points_short = na

if risk_reward_enabled

float risk_amount = entry_price_short * (risk_percent / 100)

stop_loss_price := entry_price_short + risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_short - profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_short := (trail_percent / 100.0) * entry_price_short

trail_points_short := trail_offset_short / syminfo.pointvalue

strategy.exit("PivRevSE Exit", from_entry="PivRevSE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_short, trail_offset=trail_points_short)

// Plotting

plot(lprice, color=color.new(color.red, 55), title='Low Price')

plot(hprice, color=color.new(color.green, 55), title='High Price')

plot(pplprice, color=color.new(color.red, 0), linewidth=2, title='Pivot Low Price')

plot(pphprice, color=color.new(color.green, 0), linewidth=2, title='Pivot High Price')