Überblick

Dies ist eine Trend-Tracking-Trading-Strategie, die den UT Bot mit einem 50-Zyklus-Index-Moving Average (EMA) kombiniert. Die Strategie handelt hauptsächlich in 1-Minuten-Zeitspannen und verwendet 5-Minuten-Zeitspannen als Richtungsfilter. Die Strategie verwendet den ATR-Indikator, um die Stop-Loss-Position dynamisch zu berechnen, und setzt ein doppeltes Stop-Goal, um den Gewinn zu optimieren.

Strategieprinzip

Die Kernlogik der Strategie basiert auf den folgenden Schlüsselkomponenten:

- Mit dem UT Bot berechnen Sie die Widerstandswerte für die dynamische Unterstützung

- 50 Perioden EMAs mit 5-Minuten-Perioden zur Bestimmung der Gesamttrendrichtung

- In Kombination mit einem 21-Zyklus-EMA und einem UT-Bot-Signal wird ein spezifischer Einstiegspunkt festgelegt.

- Dynamische Tracking-Stopp-Verluste durch ATR-Multiplier

- Setzen Sie zwei Stop-Loss-Ziele von 0,5% und 1%, um jeweils 50% der Positionen zu platzieren

Wenn der Preis die von der UT Bot berechnete Unterstützung/Widerstandslage durchbricht und die 21-Zyklus-EMA mit der UT Bot kreuzt, wird ein Handelssignal ausgelöst, wenn der Preis sich in der richtigen Richtung der 5-minütigen 50-Zyklus-EMA befindet.

Strategische Vorteile

- Mehrfache Zeiträume verbunden mit höherer Zuverlässigkeit der Transaktionen

- Dynamische ATR-Stopps können an Marktschwankungen angepasst werden

- Doppel-Stop-Ziel: Gewinn und Gewinnquote im Gleichgewicht

- Mit Hilfe der Heikin Ashi-Filterkarte kann ein Teil des falschen Durchbruchs gefiltert werden.

- Unterstützt flexible Handelsprozesse (einfach zu viel, einfach zu wenig oder in beide Richtungen)

Strategisches Risiko

- Kurzfristige Transaktionen können mit höheren Spreads und Gebühren verbunden sein.

- Häufige Falschsignale in der Querkorrektur

- Die Einschränkung von mehreren Bedingungen kann dazu führen, dass potenzielle Handelschancen verpasst werden.

- Die Einstellungen für die ATR-Parameter müssen für verschiedene Märkte optimiert werden

Richtung der Strategieoptimierung

- Umsatzindikatoren können als zusätzliche Bestätigung hinzugefügt werden

- Erwägen Sie die Einführung von mehr Market Sentiment Indicators

- Entwicklung von Adaptionsparametern für unterschiedliche Marktschwankungen

- Filter für zusätzliche Transaktionszeiten

- Entwicklung eines intelligenten Lagerverwaltungssystems

Zusammenfassen

Die Strategie baut durch die Kombination von mehreren technischen Indikatoren und Zeiträumen ein vollständiges Handelssystem auf. Es enthält nicht nur klare Ein- und Ausstiegsbedingungen, sondern bietet auch eine solide Risikomanagement-Mechanismus. Obwohl in der praktischen Anwendung noch Parameter-Optimierung nach den spezifischen Marktsituationen erforderlich ist, ist das gesamte Framework sehr praktisch und erweiterbar.

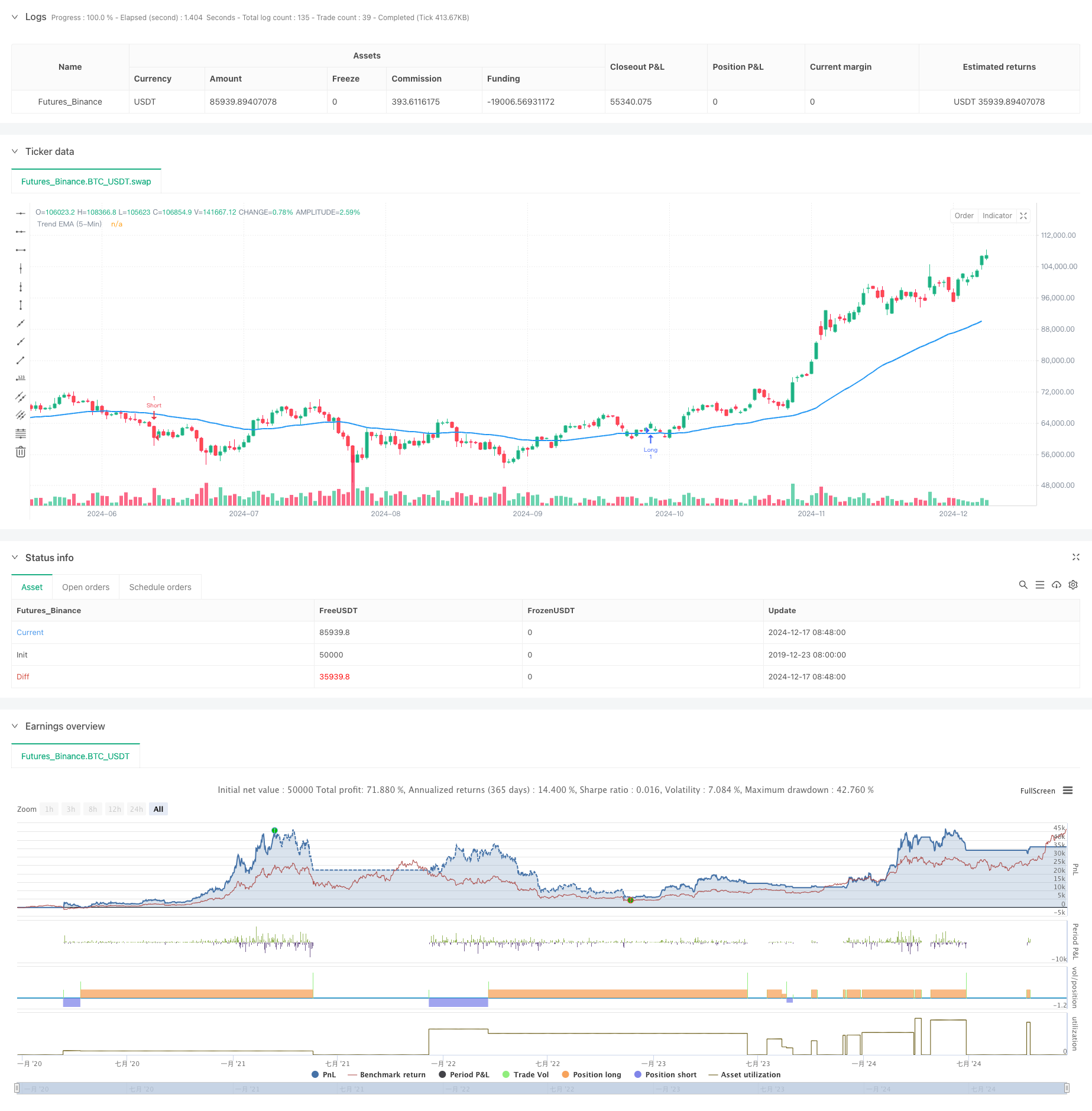

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Created by Nasser mahmoodsani' all rights reserved

// E-mail : [email protected]

strategy("UT Bot Strategy with T/P and S/L and Trend EMA", overlay=true)

// Inputs

along = input(1, title='Key Value (Sensitivity - Long)', group="LONG")

clong = input(10, title='ATR Period (Long)', group="LONG")

h = input(true, title='Signals from Heikin Ashi Candles')

ashort = input(7, title='Key Value (Sensitivity - Short)', group="SHORT")

cshort = input(2, title='ATR Period (Short)', group="SHORT")

tradeType = input.string("Both", title="Trade Type", options=["Buy Only", "Sell Only", "Both"])

tp1_percent = input.float(0.5, title="TP1 Percentage", step=0.1, group="TP Settings") // TP1 % input

tp2_percent = input.float(1.0, title="TP2 Percentage", step=0.1, group="TP Settings") // TP2 % input

sl_percent = input.float(1.0, title="Stop Loss Percentage", step=0.1, group="TP Settings") // SL % input

sl_in_percent = input(true, title="Use Stop Loss in Percentage", group="TP Settings")

tp1_qty = input.float(0.5, title="Take Profit 1 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

tp2_qty = input.float(0.5, title="Take Profit 2 Quantity (as % of position size)", minval=0.0, maxval=1.0, step=0.1)

// Check that total quantities for TPs do not exceed 100%

if tp1_qty + tp2_qty > 1

runtime.error("The sum of Take Profit quantities must not exceed 100%.")

// Calculate 50 EMA from 5-Minute Timeframe

trendEmaPeriod = 50

trendEma_5min = request.security(syminfo.tickerid, "5", ta.ema(close, trendEmaPeriod))

plot(trendEma_5min, title="Trend EMA (5-Min)", color=color.blue, linewidth=2)

// Calculations

xATRlong = ta.atr(clong)

xATRshort = ta.atr(cshort)

nLosslong = along * xATRlong

nLossshort = ashort * xATRshort

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close) : close

// LONG

var float xATRTrailingStoplong = na

var float stopLossLong = na

var float takeProfit1 = na

var float takeProfit2 = na

iff_1long = src > nz(xATRTrailingStoplong[1], 0) ? src - nLosslong : src + nLosslong

iff_2long = src < nz(xATRTrailingStoplong[1], 0) and src[1] < nz(xATRTrailingStoplong[1], 0) ? math.min(nz(xATRTrailingStoplong[1]), src + nLosslong) : iff_1long

xATRTrailingStoplong := src > nz(xATRTrailingStoplong[1], 0) and src[1] > nz(xATRTrailingStoplong[1], 0) ? math.max(nz(xATRTrailingStoplong[1]), src - nLosslong) : iff_2long

buy = src > xATRTrailingStoplong and ta.crossover(ta.ema(src, 21), xATRTrailingStoplong) and close > trendEma_5min

if buy and (tradeType == "Buy Only" or tradeType == "Both")

takeProfit1 := close * (1 + tp1_percent / 100)

takeProfit2 := close * (1 + tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossLong := close * (1 - sl_percent / 100)

else

stopLossLong := close - nLosslong

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit 1", from_entry="Long", limit=takeProfit1, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2", from_entry="Long", limit=takeProfit2, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossLong, qty=strategy.position_size)

// // Create Position Projectile for Long

// var line tpLineLong1 = na

// var line tpLineLong2 = na

// var line slLineLong = na

// var label entryLabelLong = na

// // Update projectile on entry

// line.delete(tpLineLong1)

// line.delete(tpLineLong2)

// line.delete(slLineLong)

// label.delete(entryLabelLong)

// tpLineLong1 := line.new(x1=bar_index, y1=takeProfit1, x2=bar_index + 1, y2=takeProfit1, color=color.green, width=2, style=line.style_solid)

// tpLineLong2 := line.new(x1=bar_index, y1=takeProfit2, x2=bar_index + 1, y2=takeProfit2, color=color.green, width=2, style=line.style_dashed)

// slLineLong := line.new(x1=bar_index, y1=stopLossLong, x2=bar_index + 1, y2=stopLossLong, color=color.red, width=2, style=line.style_solid)

// SHORT

var float xATRTrailingStopshort = na

var float stopLossShort = na

var float takeProfit1Short = na

var float takeProfit2Short = na

iff_1short = src > nz(xATRTrailingStopshort[1], 0) ? src - nLossshort : src + nLossshort

iff_2short = src < nz(xATRTrailingStopshort[1], 0) and src[1] < nz(xATRTrailingStopshort[1], 0) ? math.min(nz(xATRTrailingStopshort[1]), src + nLossshort) : iff_1short

xATRTrailingStopshort := src > nz(xATRTrailingStopshort[1], 0) and src[1] > nz(xATRTrailingStopshort[1], 0) ? math.max(nz(xATRTrailingStopshort[1]), src - nLossshort) : iff_2short

sell = src < xATRTrailingStopshort and ta.crossover(xATRTrailingStopshort, ta.ema(src, 21)) and close < trendEma_5min

if sell and (tradeType == "Sell Only" or tradeType == "Both")

takeProfit1Short := close * (1 - tp1_percent / 100)

takeProfit2Short := close * (1 - tp2_percent / 100)

// Calculate stop loss based on percentage or ATR

if sl_in_percent

stopLossShort := close * (1 + sl_percent / 100)

else

stopLossShort := close + nLossshort

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit 1 Short", from_entry="Short", limit=takeProfit1Short, qty=strategy.position_size * tp1_qty)

strategy.exit("Take Profit 2 Short", from_entry="Short", limit=takeProfit2Short, qty=strategy.position_size * tp2_qty)

strategy.exit("Stop Loss Short", from_entry="Short", stop=stopLossShort, qty=strategy.position_size)

// Create Position Projectile for Short

// var line tpLineShort1 = na

// var line tpLineShort2 = na

// var line slLineShort = na

// var label entryLabelShort = na

// // Update projectile on entry

// line.delete(tpLineShort1)

// line.delete(tpLineShort2)

// line.delete(slLineShort)

// label.delete(entryLabelShort)

// tpLineShort1 := line.new(x1=bar_index, y1=takeProfit1Short, x2=bar_index + 1, y2=takeProfit1Short, color=color.green, width=2, style=line.style_solid)

// tpLineShort2 := line.new(x1=bar_index, y1=takeProfit2Short, x2=bar_index + 1, y2=takeProfit2Short, color=color.green, width=2, style=line.style_dashed)

// slLineShort := line.new(x1=bar_index, y1=stopLossShort, x2=bar_index + 1, y2=stopLossShort, color=color.red, width=2, style=line.style_solid)

// Updating Stop Loss after hitting Take Profit 1

if buy and close >= takeProfit1

strategy.exit("Adjusted Stop Loss", from_entry="Long", stop=close)

// Updating Stop Loss after hitting Take Profit 1 for Short

if sell and close <= takeProfit1Short

strategy.exit("Adjusted Stop Loss Short", from_entry="Short", stop=close)