Überblick

Die Strategie verwendet eine Kombination aus Brin-Bands und Triple Overtrend-Indikatoren. Die Brin-Bands dienen zur Identifizierung von extremen Preisschwankungen, während die Triple Overtrends eine mehrfache Bestätigung der Trendrichtung durch verschiedene Parameter-Einstellungen bieten. Der Handel erfolgt nur, wenn alle Signale übereinstimmen, um das Risiko von falschen Signalen zu verringern.

Strategieprinzip

Die Kernlogik der Strategie umfasst die folgenden Schlüsselelemente:

- Die Brin-Band mit 20 Zyklen und einer Standarddifferenz von 2.0 wird verwendet, um Preisschwankungen zu beurteilen.

- Setzen Sie drei Supertrendlinien mit Perioden von 10 und Parametern von 3,0, 4,0 und 5,0

- Mehrfache Einstiegsbedingungen: Der Preis durchbricht die Brin-Band und die drei Übertrendlinien zeigen einen Aufwärtstrend

- Bottom-up-Einstiegsbedingungen: Der Preis fällt unterhalb der Bollinger Band und die drei Supertrendlinien zeigen einen Abwärtstrend.

- Wenn eine beliebige Übertrendlinie ihre Richtung ändert, wird die aktuelle Position platziert.

- Die mittlere Preislinie als Füllreferenz zur visuellen Erweiterung

Strategische Vorteile

- Multiple-Confirmation-Mechanismus: False Signals werden durch eine Kombination aus Brin-Band und Triple-Supertrend stark reduziert

- Trendspeicherung: Die progressive Parameter-Einstellung des Hypertrend-Indikators ermöglicht eine effektive Erfassung von Trends auf verschiedenen Ebenen

- Gute Risikokontrolle: Schnelle Platzierung und kontrollierte Rücknahme bei Anzeichen einer Trendwende

- Anpassbarkeit der Parameter: Die Parameter der einzelnen Indikatoren können anhand der Merkmale des Marktes optimiert werden

- Hohe Automatisierungsstufe: klare Strategie-Logik und einfache systematische Umsetzung

Strategisches Risiko

- Schwankungsrisiko: False Durchbruchsignale können häufig in schwankenden Märkten auftreten

- Schlupfpunkteffekte: In Zeiten starker Schwankungen können größere Schlupfpunkte verloren gehen

- Verspätungsrisiko: Mehrfachbestätigung kann zu verspäteten Anmeldungen führen

- Parametersensitivität: Unterschiedliche Parameterkombinationen können zu großen Unterschieden in der Strategieleistung führen

- Marktumfeld-Abhängigkeit: Strategien, die in trendigen Märkten besser abschneiden

Richtung der Strategieoptimierung

- Einführung von Umsatzindikatoren: Effektivität von Preisbrüchen durch Umsatzbestätigung

- Optimierte Stop-Mechanismen: mobile Stop-Mechanismen oder ATR-basierte Dynamische Stop-Mechanismen können hinzugefügt werden

- Erhöhung der Zeitfilterung: Verbot von Transaktionen in bestimmten Zeitabschnitten, um unwirksame Schwankungen zu vermeiden

- Hinzufügen von Volatilitätsfiltern: Positionsanpassung oder Aussetzung des Handels während übermäßiger Volatilität

- Anpassungsmechanismus für die Entwicklung von Parametern: Anpassung der Parameter an die dynamischen Marktbedingungen

Zusammenfassen

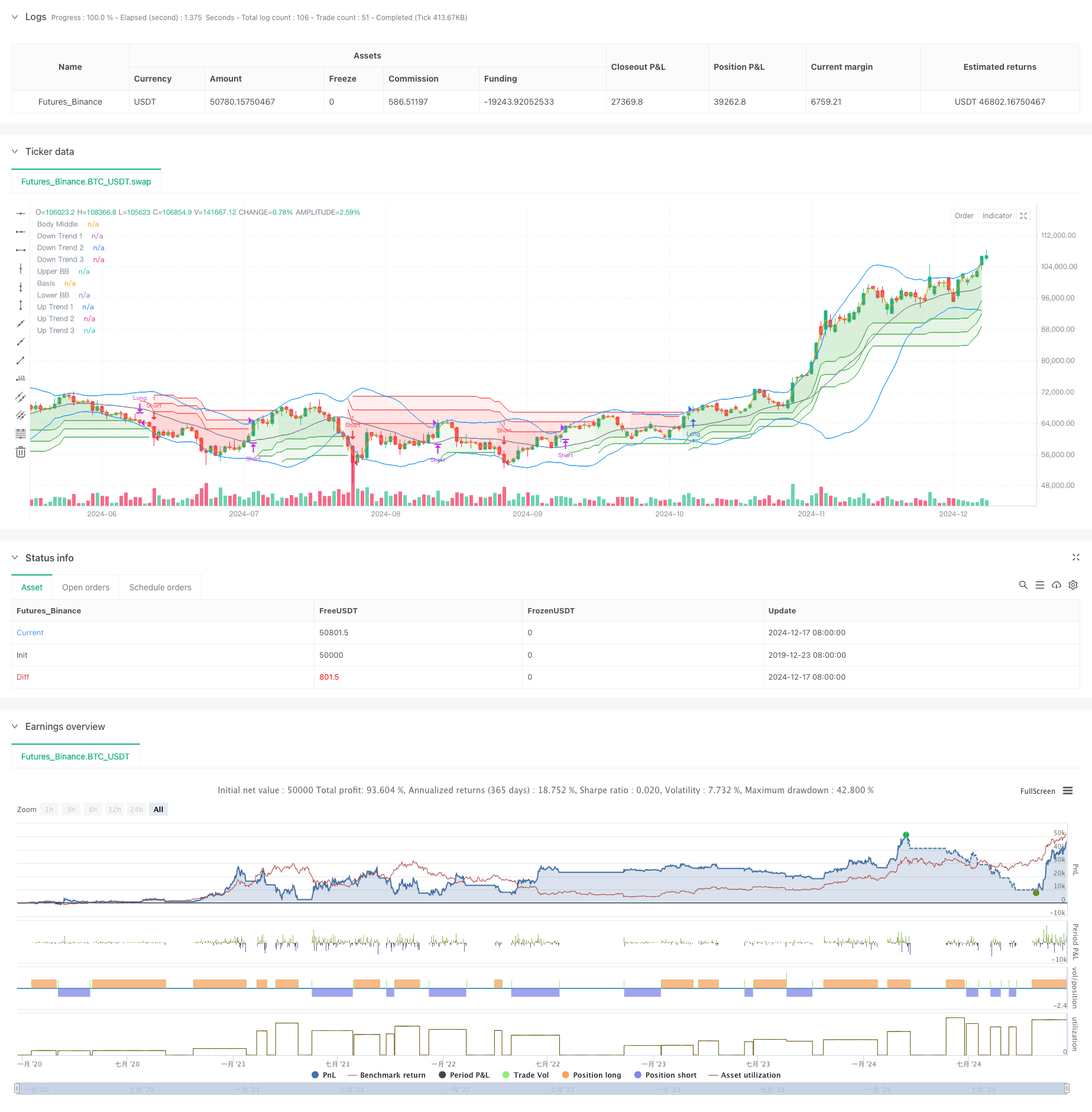

Dies ist eine Trend-Tracking-Strategie, die Brin-Bands und Triple Overtrends kombiniert, um die Zuverlässigkeit des Handels durch die Bestätigung mehrerer technischer Indikatoren zu verbessern. Die Strategie hat eine starke Trendfangfähigkeit und Risikokontrolle, muss aber auch auf die Auswirkungen des Marktumfelds auf die Strategie-Performance achten. Durch kontinuierliche Optimierung und Verbesserung wird die Strategie unter verschiedenen Marktbedingungen stabil bleiben.

//@version=5

strategy("Demo GPT - Bollinger + Triple Supertrend Combo", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// -------------------------------

// User Input for Date Range

// -------------------------------

startDate = input(title="Start Date", defval=timestamp("2018-01-01 00:00:00"))

endDate = input(title="End Date", defval=timestamp("2069-12-31 23:59:59"))

// -------------------------------

// Bollinger Band Inputs

// -------------------------------

lengthBB = input.int(20, "Bollinger Length")

multBB = input.float(2.0, "Bollinger Multiplier")

// -------------------------------

// Supertrend Inputs for 3 lines

// -------------------------------

// Line 1

atrPeriod1 = input.int(10, "ATR Length (Line 1)", minval = 1)

factor1 = input.float(3.0, "Factor (Line 1)", minval = 0.01, step = 0.01)

// Line 2

atrPeriod2 = input.int(10, "ATR Length (Line 2)", minval = 1)

factor2 = input.float(4.0, "Factor (Line 2)", minval = 0.01, step = 0.01)

// Line 3

atrPeriod3 = input.int(10, "ATR Length (Line 3)", minval = 1)

factor3 = input.float(5.0, "Factor (Line 3)", minval = 0.01, step = 0.01)

// -------------------------------

// Bollinger Band Calculation

// -------------------------------

basis = ta.sma(close, lengthBB)

dev = multBB * ta.stdev(close, lengthBB)

upperBand = basis + dev

lowerBand = basis - dev

// Plot Bollinger Bands

plot(upperBand, "Upper BB", color=color.new(color.blue, 0))

plot(basis, "Basis", color=color.new(color.gray, 0))

plot(lowerBand, "Lower BB", color=color.new(color.blue, 0))

// -------------------------------

// Supertrend Calculation Line 1

// -------------------------------

[supertrendLine1, direction1] = ta.supertrend(factor1, atrPeriod1)

supertrendLine1 := barstate.isfirst ? na : supertrendLine1

upTrend1 = plot(direction1 < 0 ? supertrendLine1 : na, "Up Trend 1", color = color.green, style = plot.style_linebr)

downTrend1 = plot(direction1 < 0 ? na : supertrendLine1, "Down Trend 1", color = color.red, style = plot.style_linebr)

// -------------------------------

// Supertrend Calculation Line 2

// -------------------------------

[supertrendLine2, direction2] = ta.supertrend(factor2, atrPeriod2)

supertrendLine2 := barstate.isfirst ? na : supertrendLine2

upTrend2 = plot(direction2 < 0 ? supertrendLine2 : na, "Up Trend 2", color = color.new(color.green, 0), style = plot.style_linebr)

downTrend2 = plot(direction2 < 0 ? na : supertrendLine2, "Down Trend 2", color = color.new(color.red, 0), style = plot.style_linebr)

// -------------------------------

// Supertrend Calculation Line 3

// -------------------------------

[supertrendLine3, direction3] = ta.supertrend(factor3, atrPeriod3)

supertrendLine3 := barstate.isfirst ? na : supertrendLine3

upTrend3 = plot(direction3 < 0 ? supertrendLine3 : na, "Up Trend 3", color = color.new(color.green, 0), style = plot.style_linebr)

downTrend3 = plot(direction3 < 0 ? na : supertrendLine3, "Down Trend 3", color = color.new(color.red, 0), style = plot.style_linebr)

// -------------------------------

// Middle line for fill (used as a reference line)

// -------------------------------

bodyMiddle = plot(barstate.isfirst ? na : (open + close) / 2, "Body Middle", display = display.none)

// Fill areas for each supertrend line

fill(bodyMiddle, upTrend1, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend1, color.new(color.red, 90), fillgaps = false)

fill(bodyMiddle, upTrend2, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend2, color.new(color.red, 90), fillgaps = false)

fill(bodyMiddle, upTrend3, color.new(color.green, 90), fillgaps = false)

fill(bodyMiddle, downTrend3, color.new(color.red, 90), fillgaps = false)

// Alerts for the first line only (as an example)

alertcondition(direction1[1] > direction1, title='Downtrend to Uptrend (Line 1)', message='Supertrend Line 1 switched from Downtrend to Uptrend')

alertcondition(direction1[1] < direction1, title='Uptrend to Downtrend (Line 1)', message='Supertrend Line 1 switched from Uptrend to Downtrend')

alertcondition(direction1[1] != direction1, title='Trend Change (Line 1)', message='Supertrend Line 1 switched trend')

// -------------------------------

// Strategy Logic

// -------------------------------

inDateRange = true

// Long Conditions

longEntryCondition = inDateRange and close > upperBand and direction1 < 0 and direction2 < 0 and direction3 < 0

longExitCondition = direction1 > 0 or direction2 > 0 or direction3 > 0

// Short Conditions

shortEntryCondition = inDateRange and close < lowerBand and direction1 > 0 and direction2 > 0 and direction3 > 0

shortExitCondition = direction1 < 0 or direction2 < 0 or direction3 < 0

// Execute Long Trades

if longEntryCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if strategy.position_size > 0 and longExitCondition

strategy.close("Long")

// Execute Short Trades

if shortEntryCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

if strategy.position_size < 0 and shortExitCondition

strategy.close("Short")