Überblick

Die Strategie ist ein umfassendes Handelssystem, das mehrere klassische technische Indikatoren kombiniert, darunter gleitender Durchschnitt (MA), Relative-Stärke-Index (RSI), Moving Average Convergence Divergence (MACD) und Bollinger Bands (BB). Das System nutzt die koordinierte Zusammenarbeit dieser Indikatoren, um genauere Kauf- und Verkaufssignale auf dem Markt zu finden und so die Erfolgsquote von Transaktionen zu verbessern.

Strategieprinzip

Die Strategie verwendet einen mehrschichtigen Signalüberprüfungsmechanismus, der hauptsächlich die folgenden Aspekte umfasst:

- Bestimmen Sie die zugrunde liegende Trendrichtung anhand der Kreuzungspunkte der kurzfristigen (9-Tage) und langfristigen (21-Tage) gleitenden Durchschnitte.

- Verwenden Sie RSI (14 Tage), um überkaufte und überverkaufte Bereiche zu identifizieren, und legen Sie 70 und 30 als Schlüsselniveaus fest

- Verwenden Sie MACD (12, 26, 9), um die Stärke des Trends und mögliche Wendepunkte zu bestätigen

- Verwenden Sie Bollinger-Bänder (20 Tage, 2 Standardabweichungen), um den Bereich der Preisschwankungen und mögliche Umkehrpunkte zu bestimmen

Das System generiert Handelssignale unter folgenden Bedingungen:

- Wichtiges Kaufsignal: Kurzfristiger MA kreuzt den langfristigen MA

- Wichtiges Verkaufssignal: Kurzfristiger MA unterschreitet langfristigen MA

- Zusätzliche Kaufsignale: RSI liegt unter 30, MACD-Histogramm ist positiv und der Preis berührt das untere Bollinger-Band

- Zusätzliche Verkaufssignale: RSI liegt über 70 und das MACD-Histogramm ist negativ und der Preis berührt das obere Bollinger-Band

Strategische Vorteile

- Mehrdimensionale Analyse: Durch die Integration mehrerer technischer Indikatoren wird eine umfassendere Marktanalyseperspektive bereitgestellt

- Signalbestätigungsmechanismus: Die Kombination von Haupt- und Hilfssignalen kann die Auswirkung falscher Signale verringern

- Perfekte Risikokontrolle: Nutzen Sie die Kombination aus Bollinger Bands und RSI, um das Risiko von Einstiegspunkten zu kontrollieren

- Trendverfolgungsfähigkeit: Durch die Zusammenarbeit von MA und MACD können wir nicht nur den Haupttrend erfassen, sondern auch den Wendepunkt des Trends identifizieren

- Starker Visualisierungseffekt: Das System bietet eine klare grafische Benutzeroberfläche mit Hintergrundfarbaufforderungen und Formmarkierungen

Strategisches Risiko

- Signalhysterese: Der gleitende Durchschnitt selbst weist eine Hysterese auf, was zu einem suboptimalen Einstiegspunkt führen kann.

- Risiko eines volatilen Marktes: In einem seitwärts gerichteten und volatilen Markt können häufig falsche Signale auftreten

- Widersprüchliche Indikatoren: Mehrere Indikatoren können zu bestimmten Zeiten widersprüchliche Signale erzeugen

- Parametersensitivität: Die Wirkung der Strategie ist empfindlich gegenüber der Parametereinstellung und erfordert eine ausreichende Parameteroptimierung.

Richtung der Strategieoptimierung

- Dynamische Parameteranpassung: Die Parameter jedes Indikators können automatisch entsprechend der Marktvolatilität angepasst werden.

- Klassifizierung des Marktumfelds: Fügen Sie einen Erkennungsmechanismus für unterschiedliche Marktumfelder hinzu und verwenden Sie unterschiedliche Signalkombinationen unter unterschiedlichen Marktbedingungen.

- Verbesserter Stop-Loss-Mechanismus: Fügen Sie flexiblere Stop-Loss-Systeme hinzu, wie z. B. Trailing Stop Loss oder ATR-basierter Stop Loss

- Optimierung des Positionsmanagements: Passen Sie die Positionsgröße dynamisch an die Signalstärke und Marktvolatilität an.

- Zeitrahmenkoordination: Erwägen Sie die Hinzufügung mehrerer Zeitrahmenanalysen, um die Signalzuverlässigkeit zu verbessern

Zusammenfassen

Dies ist ein gut konzipiertes mehrdimensionales Handelsstrategiesystem, das Handelssignale durch die Synergie mehrerer technischer Indikatoren liefert. Die Hauptvorteile der Strategie liegen in ihrem umfassenden Analyserahmen und ihrem strengen Signalbestätigungsmechanismus, allerdings müssen auch Aspekte wie Parameteroptimierung und Anpassungsfähigkeit an das Marktumfeld berücksichtigt werden. Durch die empfohlenen Optimierungsrichtungen ist bei dieser Strategie noch viel Luft nach oben.

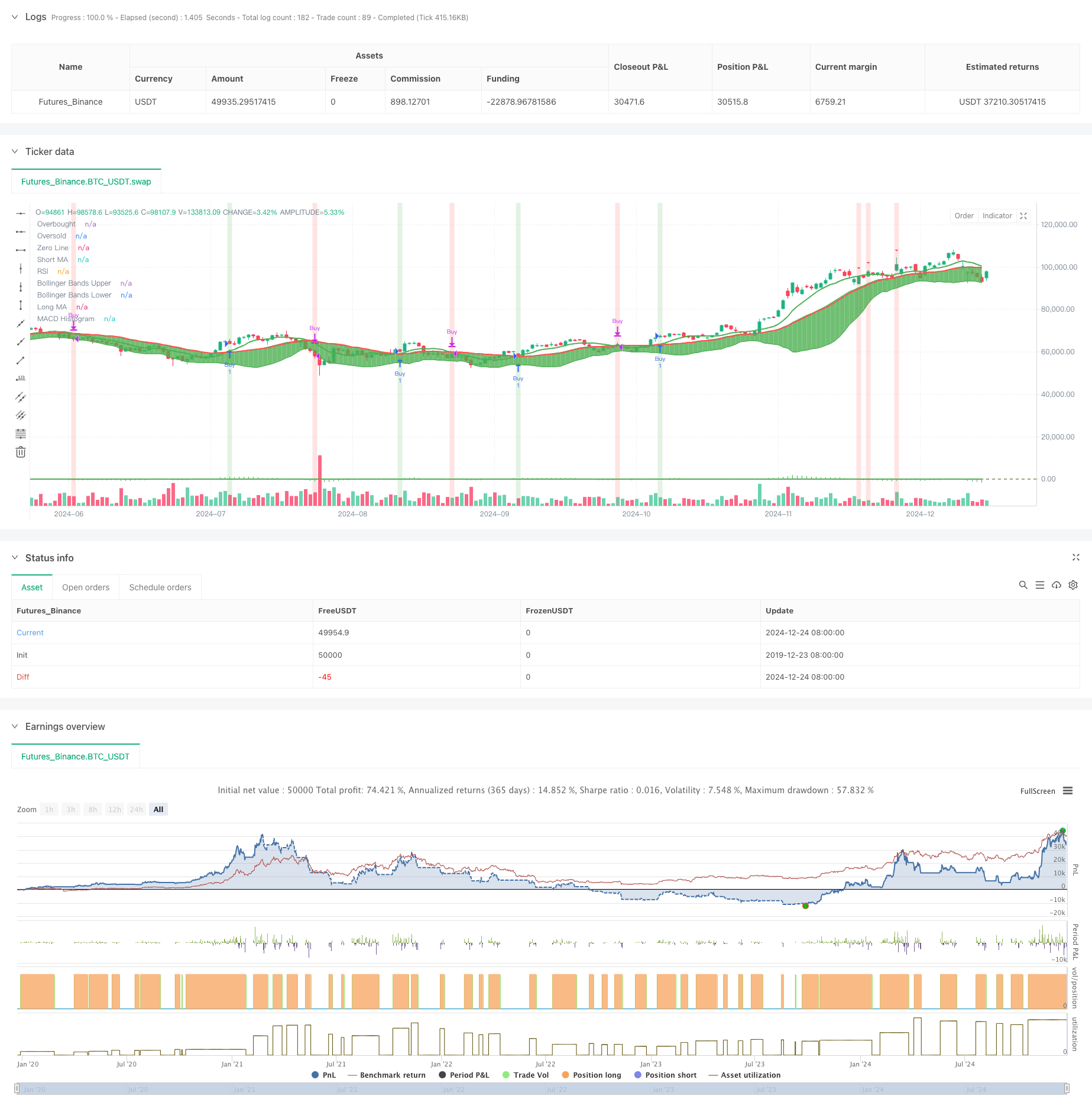

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")