Überblick

Es ist eine Trendverfolgungsstrategie, die auf mehreren technischen Indikatoren und Risikomanagement basiert. Die Strategie verwendet mehrere technische Indikatoren wie beispielsweise Moving Averages, Relativ Strong Indicators (RSI) und Moving Indicators (DMI) zur Identifizierung von Markttrends und zur Sicherung der Kapitalsicherheit durch Risikokontrollen wie Dynamische Stop Losses, Positionsmanagement und monatliche Maximalrücknahmelimits. Der Kern der Strategie liegt in der Bestätigung der Effektivität von Trends durch mehrdimensionale technische Indikatoren, während die Risikogrenzen streng kontrolliert werden.

Strategieprinzip

Die Strategie nutzt mehrschichtige Mechanismen zur Trendbestätigung:

- Die Richtung des Trends wird anhand des 8/21/50-Periodenindex des Moving Averages (EMA) ermittelt

- Die mittlere Linie des Preiskanals als Trendfilter

- Bewegung im Bereich 35-65 in Kombination mit dem RSI-Meanline ((5-Zyklus) zur Filterung falscher Durchbrüche

- Bestätigung der Trendstärke durch den DMI-Indikator ((14-Zyklus)

- Die Dauerhaftigkeit des Trends wird anhand von Dynamikindikatoren ((8 Zyklen) und Transaktionsvolumenverstärkung überprüft

- Das ATR-basierte dynamische Stop-Loss zur Risikokontrolle

- Positionsmanagement mit einem festen Risikomodell mit einem Risikomargin von 5% des Anfangskapitals pro Transaktion

- Setzen Sie eine maximale monatliche Auszahlung von 10% ein, um übermäßige Verluste zu vermeiden

Strategische Vorteile

- Mehrfache technische Kennzahlen, die sich durch eine Cross-Verifizierung verbessern

- Dynamische Stop-Loss-Mechanismen zur effektiven Steuerung des Einzelhandelsrisikos

- Positionsmanagement mit festen Risiken macht die Verwendung von Geldern sinnvoller

- Maximale monatliche Auszahlungsbeschränkungen bieten systematische Risikobeschutzmaßnahmen

- Die Kombination von Umsatzindikatoren erhöht die Zuverlässigkeit der Trendbestätigung

- Ein 2:1 Gewinn-Verlust-Verhältnis erhöht die langfristige Profitabilität

Strategisches Risiko

- Die Verwendung mehrerer Indikatoren kann zu Signalverzögerungen führen

- Häufige Falschsignale können in einem wackligen Markt entstehen

- Das Fixed-Risk-Modell ist möglicherweise nicht flexibel genug, wenn die Schwankungen stark sind.

- Monatliche Abhebungsbeschränkungen könnten wichtige Handelschancen verpassen

- Der Trend könnte sich umkehren und einen größeren Rückschlag erleiden.

Richtung der Strategieoptimierung

- Einführung von Anpassungsparametern für verschiedene Marktumgebungen

- Entwicklung flexiblerer Positionsmanagement-Systeme, die Veränderungen der Marktfluktuation berücksichtigen

- Quantifizierung von Trendstärken und Optimierung der Eintrittszeit

- Eine intelligentere, monatliche Risikobegrenzung

- Hinzufügen eines Moduls zur Identifizierung von Marktbedingungen, um Strategieparameter unter verschiedenen Marktbedingungen anzupassen

Zusammenfassen

Die Strategie baut durch die integrierte Anwendung von mehrdimensionalen technischen Indikatoren ein relativ vollständiges Trend-Tracking-Handelssystem auf. Der Vorteil der Strategie liegt in ihrem umfassenden Risikomanagement-Framework, das dynamische Stop-Loss, Position-Management und Rücknahme-Kontrollen umfasst. Obwohl ein gewisses Rückstandsrisiko besteht, wird die Strategie durch Optimierung und Verbesserung eine stabile Leistung in verschiedenen Marktumgebungen aufweisen.

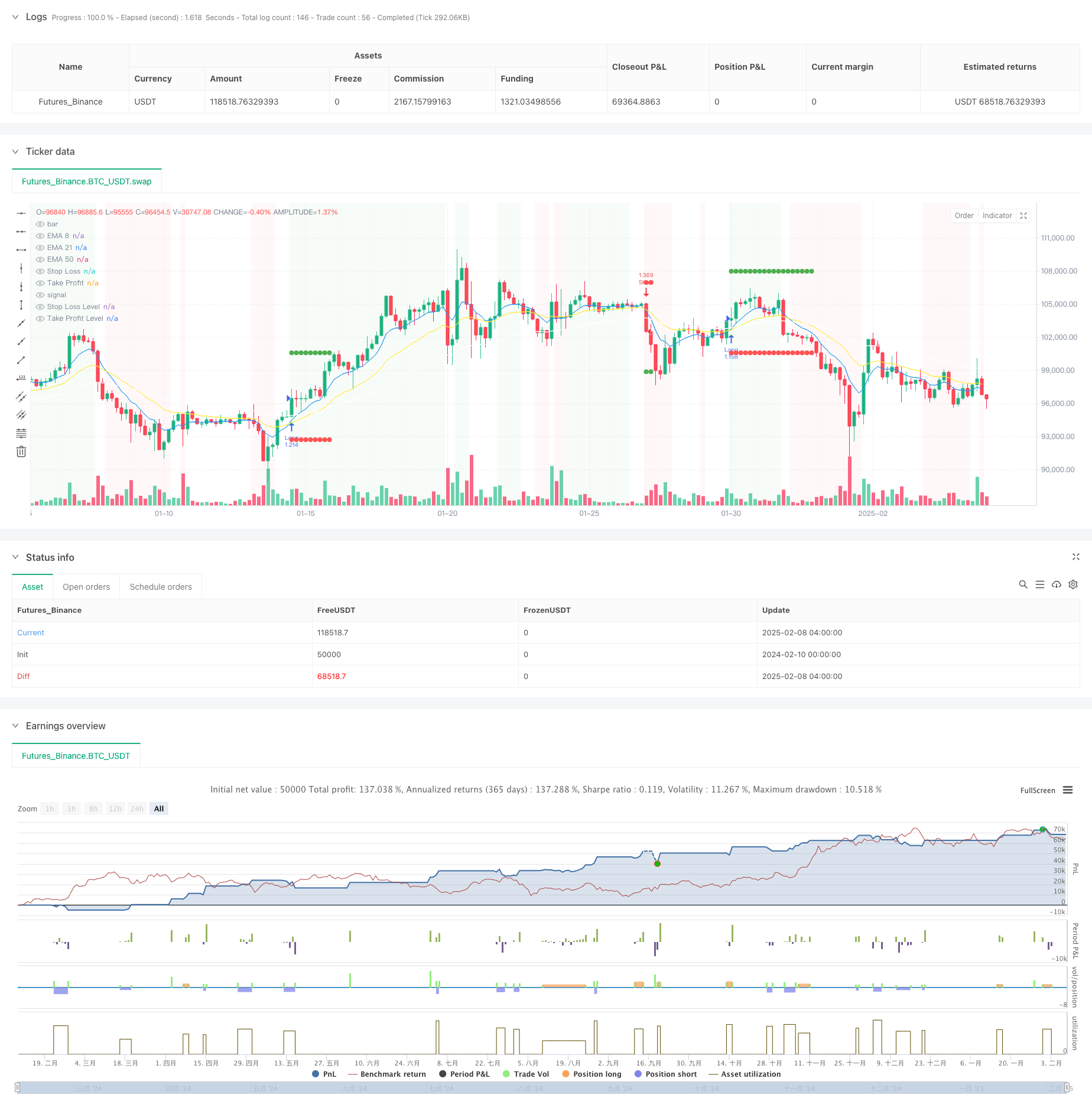

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Win-Rate Crypto Strategy with Drawdown Limit", overlay=true, initial_capital=10000, default_qty_type=strategy.fixed, process_orders_on_close=true)

// Moving Averages

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

ema50 = ta.ema(close, 50)

// RSI settings

rsi = ta.rsi(close, 14)

rsi_ma = ta.sma(rsi, 5)

// Momentum and Volume

mom = ta.mom(close, 8)

vol_ma = ta.sma(volume, 15)

high_vol = volume > vol_ma * 1

// Trend Strength

[diplus, diminus, _] = ta.dmi(14, 14)

strong_trend = diplus > 20 or diminus > 20

// Price channels

highest_15 = ta.highest(high, 15)

lowest_15 = ta.lowest(low, 15)

mid_channel = (highest_15 + lowest_15) / 2

// Trend Conditions

uptrend = ema8 > ema21 and close > mid_channel

downtrend = ema8 < ema21 and close < mid_channel

// Entry Conditions

longCondition = uptrend and ta.crossover(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom > 0 and high_vol and diplus > diminus

shortCondition = downtrend and ta.crossunder(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom < 0 and high_vol and diminus > diplus

// Dynamic Stop Loss based on ATR

atr = ta.atr(14)

stopSize = atr * 1.3

// Calculate position size based on fixed risk

riskAmount = strategy.initial_capital * 0.05

getLongPosSize(riskAmount, stopSize) => riskAmount / stopSize

getShortPosSize(riskAmount, stopSize) => riskAmount / stopSize

// Monthly drawdown tracking

var float peakEquity = na

var int currentMonth = na

var float monthlyDrawdown = na

maxDrawdownPercent = 10

// Variables for SL and TP

var float stopLoss = na

var float takeProfit = na

var bool inTrade = false

var string tradeType = na

// Reset monthly metrics

monthNow = month(time)

if na(currentMonth) or currentMonth != monthNow

currentMonth := monthNow

peakEquity := strategy.equity

monthlyDrawdown := 0.0

// Update drawdown metrics

peakEquity := math.max(peakEquity, strategy.equity)

monthlyDrawdown := math.max(monthlyDrawdown, (peakEquity - strategy.equity) / peakEquity * 100)

// Trading condition

canTrade = monthlyDrawdown < maxDrawdownPercent

// Entry and Exit Logic

if strategy.position_size == 0

inTrade := false

if longCondition and canTrade

stopLoss := low - stopSize

takeProfit := close + (stopSize * 2)

posSize = getLongPosSize(riskAmount, stopSize)

strategy.entry("Long", strategy.long, qty=posSize)

strategy.exit("Long Exit", "Long", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "long"

if shortCondition and canTrade

stopLoss := high + stopSize

takeProfit := close - (stopSize * 2)

posSize = getShortPosSize(riskAmount, stopSize)

strategy.entry("Short", strategy.short, qty=posSize)

strategy.exit("Short Exit", "Short", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "short"

// Plot variables

plotSL = inTrade ? stopLoss : na

plotTP = inTrade ? takeProfit : na

// EMA Plots

plot(ema8, "EMA 8", color=color.blue, linewidth=1)

plot(ema21, "EMA 21", color=color.yellow, linewidth=1)

plot(ema50, "EMA 50", color=color.white, linewidth=1)

// SL and TP Plots

plot(plotSL, "Stop Loss", color=color.red, style=plot.style_linebr, linewidth=1)

plot(plotTP, "Take Profit", color=color.green, style=plot.style_linebr, linewidth=1)

// Signal Plots

plotshape(longCondition and canTrade, "Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition and canTrade, "Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// SL/TP Markers with correct y parameter syntax

plot(inTrade ? stopLoss : na, "Stop Loss Level", style=plot.style_circles, color=color.red, linewidth=2)

plot(inTrade ? takeProfit : na, "Take Profit Level", style=plot.style_circles, color=color.green, linewidth=2)

// Background Color

noTradingMonth = monthlyDrawdown >= maxDrawdownPercent

bgcolor(noTradingMonth ? color.new(color.gray, 80) : uptrend ? color.new(color.green, 95) : downtrend ? color.new(color.red, 95) : na)

// Drawdown Label

var label drawdownLabel = na

label.delete(drawdownLabel)

drawdownLabel := label.new(bar_index, high, "Monthly Drawdown: " + str.tostring(monthlyDrawdown, "#.##") + "%\n" + (noTradingMonth ? "NO TRADING" : "TRADING ALLOWED"), style=label.style_label_down, color=noTradingMonth ? color.red : color.green, textcolor=color.white, size=size.small)