Überblick

Dies ist eine Adaptive Trading-Strategie, basierend auf RSI und CCI Dual-Technik-Indikatoren. Die Strategie baut ein vollständiges Handelssystem auf, indem sie die Kreuzung der RSI und CCI-Indikatoren in verschiedenen Zeiträumen überwacht und die EMA-Gleichgewichtstrends kombiniert. Die Strategie weist eine starke Adaptivität und Signalstabilität auf und kann die Überkauf- und Überverkaufsmöglichkeiten des Marktes effektiv erfassen.

Strategieprinzip

Die Kernlogik der Strategie umfasst folgende Aspekte:

- Zeitzyklus-Adaptivität: Die Parameter-Einstellungen für RSI und CCI werden dynamisch angepasst, je nach unterschiedlichen Zeitzyklen (von 1 Minute bis 4 Stunden).

- Doppelindikator-Bestätigung: Die Kombination von RSI (relativ starker Indikator) und CCI (kursiver Indikator) wird verwendet, um Handelssignale zu filtern. Ein Handelssignal wird erzeugt, wenn RSI und CCI gleichzeitig bestimmte Bedingungen erfüllen.

- Signal-Kontinuitätsprüfung: Sie gewährleistet die Stabilität des Signals, indem Sie die Mindestdauer (“stayTimeFrames”) festlegen.

- Dynamischer Stop-Loss: Der Stop-Loss-Punkt, der dynamisch auf den RSI- und CCI-Levels zum Zeitpunkt des Einstiegs eingestellt wird.

- Trendbestätigung: 200-Perioden-EMA als Trendreferenz verwendet.

Strategische Vorteile

- Anpassungsfähigkeit: Die Strategie kann die Parameter automatisch an unterschiedliche Zeiträume anpassen, was eine bessere Anpassungsfähigkeit bedeutet.

- Hohe Signalzuverlässigkeit: Die Signalzuverlässigkeit wurde durch die Kreuzbestätigung der doppelten technischen Indikatoren deutlich erhöht.

- Risikokontrolle: Dynamische Stop-Loss-Mechanismen zur effektiven Risikokontrolle.

- Die Betriebsregeln sind eindeutig: Ein- und Ausfahrtbedingungen sind klar, um die praktische Bedienung zu ermöglichen.

- Erweiterbarkeit: Die Strategie ist flexibel und neue Filterbedingungen können hinzugefügt werden, wenn nötig.

Strategisches Risiko

- Parameter-Sensitivität: Die optimalen Parameter können in verschiedenen Marktumgebungen unterschiedlich sein.

- Die Gefahr von Schwankungen am Horizont: Falsche Signale können während der Marktschwankungen erzeugt werden.

- Der Schlupfpunkt: Hochfrequenz-Trading kann Schlupfpunkte aufweisen.

- Signalverzögerung: Mehrfachbestätigung kann zu einer geringfügigen Verzögerung der Einfahrtszeit führen.

- Abhängigkeit von der Marktumgebung: In einem starken Trendmarkt kann es besser sein als in einem wackligen Markt.

Richtung der Strategieoptimierung

- Anpassung der Parameter: Anpassung der Optimierungsmechanismen der Parameter kann eingeführt werden, um die Parameter dynamisch an die Marktlage anzupassen.

- Marktumfelderkennung: Hinzufügen eines Moduls zur Marktumfelderkennung, um verschiedene Handelsstrategien in verschiedenen Marktzuständen zu verwenden.

- Schwankungsrate-Anpassung: Einführung von Schwankungsrate-Indikatoren und Anpassung der Stop-Loss-Parameter an die Größe der Schwankungsrate.

- Signalfilter: Mehr technische Kennzahlen und Formerkennung zum Filtern falscher Signale.

- Risikomanagement: Verbesserung des Fondsmanagementprogramms, Erhöhung der Haltedauer und der Kontrolle der Positionen.

Zusammenfassen

Durch die Kombination der Vorteile der RSI- und CCI-Indikatoren baut die Strategie ein robustes Handelssystem auf. Die anpassungsfähigen Eigenschaften der Strategie und die ausgefeilten Risikokontrollmechanismen machen sie praktisch gut. Durch kontinuierliche Optimierung und Verbesserung wird die Strategie voraussichtlich besser im realen Handel abschneiden.

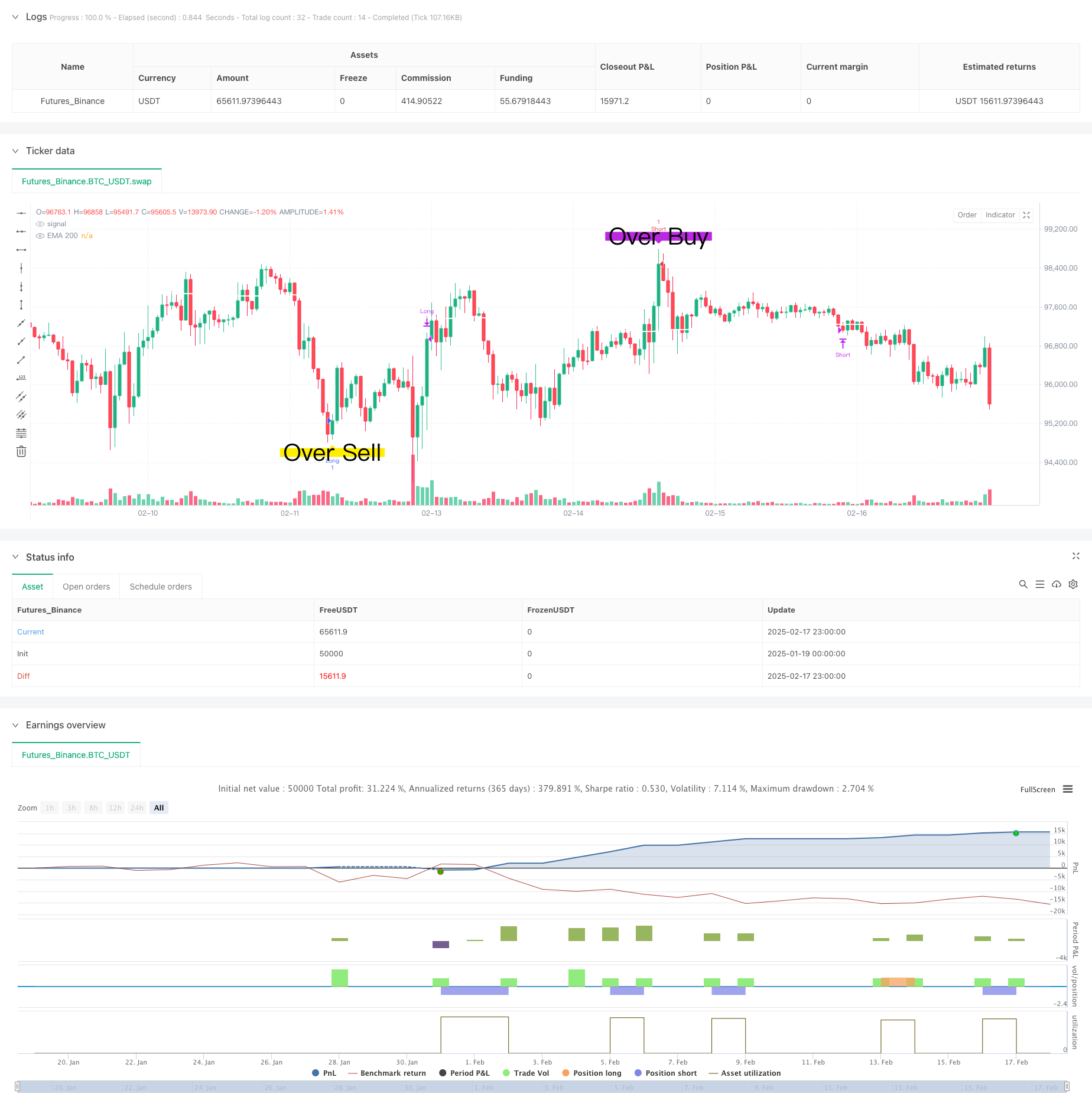

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI & CCI Strategy with Alerts", overlay=true)

// Detect current chart timeframe

tf = timeframe.period

// Define settings for different timeframes

rsiLength = tf == "1" ? 30 : tf == "5" ? 30 : tf == "15" ? 30 : tf == "30" ? 30 : 30 // Default

cciLength = tf == "1" ? 15 : tf == "5" ? 20 : tf == "15" ? 20 : tf == "30" ? 20 : 20 // Default

cciBuyThreshold = tf == "1" ? -100 : tf == "5" ? -100 : tf == "15" ? -100 : tf == "30" ? -100 : -100

cciSellThreshold = tf == "1" ? 100 : tf == "5" ? 100 : tf == "15" ? 100 : tf == "30" ? 100 : 100 // Default

stayTimeFrames = tf == "1" ? 1 : tf == "5" ? 1 : tf == "15" ? 1 : tf == "30" ? 1 : tf == "240" ? 1 : 2 // Default

stayTimeFramesOver =tf == "1" ? 1 : tf == "5" ? 2 : tf == "15" ? 2 : tf == "30" ? 3 : 2 // Default

// Calculate RSI & CCI

rsi = ta.rsi(close, rsiLength)

rsiOver = ta.rsi(close, 14)

cci = ta.cci(close, cciLength)

// EMA 50

ema200 = ta.ema(close, 200)

plot(ema200, color=color.rgb(255, 255, 255), linewidth=2, title="EMA 200")

// CCI candle threshold tracking

var int cciEntryTimeLong = na

var int cciEntryTimeShort = na

// Store entry time when CCI enters the zone

if (cci < cciBuyThreshold)

if na(cciEntryTimeLong)

cciEntryTimeLong := bar_index

else

cciEntryTimeLong := na

if (cci > cciSellThreshold)

if na(cciEntryTimeShort)

cciEntryTimeShort := bar_index

else

cciEntryTimeShort := na

// Confirming CCI has stayed in the threshold for required bars

cciStayedBelowNeg100 = not na(cciEntryTimeLong) and (bar_index - cciEntryTimeLong >= stayTimeFrames) and rsi >= 53

cciStayedAbove100 = not na(cciEntryTimeShort) and (bar_index - cciEntryTimeShort >= stayTimeFrames) and rsi <= 47

// CCI & RSI candle threshold tracking for Buy Over and Sell Over signals

var int buyOverEntryTime = na

var int sellOverEntryTime = na

// Track entry time when RSI and CCI conditions are met

if (rsiOver <= 31 and cci <= -120)

if na(buyOverEntryTime)

buyOverEntryTime := bar_index

else

buyOverEntryTime := na

if (rsiOver >= 69 and cci >= 120)

if na(sellOverEntryTime)

sellOverEntryTime := bar_index

else

sellOverEntryTime := na

// Confirm that conditions are met for the required stayTimeFrames

buyOverCondition = not na(buyOverEntryTime) and (bar_index - buyOverEntryTime >= stayTimeFramesOver)

sellOverCondition = not na(sellOverEntryTime) and (bar_index - sellOverEntryTime <= stayTimeFramesOver)

//Buy and sell for over bought or sell

conditionOverBuy = buyOverCondition

conditionOverSell = sellOverCondition

// Buy and sell conditions

buyCondition = cciStayedBelowNeg100

sellCondition = cciStayedAbove100

// // Track open positions

var bool isLongOpen = false

var bool isShortOpen = false

// // Strategy logic for backtesting

// if (buyCondition and not isLongOpen)

// strategy.entry("Long", strategy.long)

// isLongOpen := true

// isShortOpen := false

// if (sellCondition and not isShortOpen)

// strategy.entry("Short", strategy.short)

// isShortOpen := true

// isLongOpen := false

// // Close positions based on EMA 50

// if (isLongOpen and exitLongCondition)

// strategy.close("Long")

// isLongOpen := false

// if (isShortOpen and exitShortCondition)

// strategy.close("Short")

// isShortOpen := false

// Track RSI at position entry

var float entryRSILong = na

var float entryRSIShort = na

// Track CCI at position entry

var float entryCCILong = na

var float entryCCIShort = na

if (buyOverCondition and not isLongOpen)

strategy.entry("Long", strategy.long)

entryRSILong := rsi // Store RSI at entry

entryCCILong := cci

isLongOpen := true

isShortOpen := false

if (sellOverCondition and not isShortOpen)

strategy.entry("Short", strategy.short)

entryRSIShort := rsi // Store RSI at entry

entryCCIShort := cci // Stpre CCI at entry

isShortOpen := true

isLongOpen := false

exitLongRSICondition = isLongOpen and not na(entryRSILong) and rsi >= (entryRSILong + 12) or rsi <= (entryRSILong -8)

exitShortRSICondition = isShortOpen and not na(entryRSIShort) and rsi <= (entryRSIShort - 12) or rsi >= (entryRSIShort +8)

exitLongCCICondition = isLongOpen and not na(entryCCILong) and cci <= (entryCCILong -100)

exitShortCCICondition = isShortOpen and not na(entryCCIShort) and cci >= (entryCCIShort +100)

// Close positions based on EMA 50 or RSI change

if (isLongOpen and (exitLongRSICondition) or (exitLongCCICondition))

strategy.close("Long")

isLongOpen := false

entryRSILong := na

entryCCILong := na

isLongOpen := false

if (isShortOpen and (exitShortRSICondition) or (exitShortCCICondition))

strategy.close("Short")

isShortOpen := false

entryRSIShort := na

entryCCIShort := na

isShortOpen := false

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.large, title="Buy Signal", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.large, title="Sell Signal", text="SELL")

//Plot buy and sell OverBought

plotshape(conditionOverBuy, style=shape.labelup, location=location.belowbar, color=color.rgb(255, 238, 0), size=size.large, title="OverBuy Signal", text="Over Sell")

plotshape(conditionOverSell, style=shape.labeldown, location=location.abovebar, color=color.rgb(186, 40, 223), size=size.large, title="OverSell Signal", text="Over Buy")

// Alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell Signal Triggered")