Überblick

Die Strategie ist ein quantifiziertes Handelssystem, das Volatilitätsbrechungen, Trendverfolgung und Dynamikbestätigung kombiniert. Es identifiziert Handelschancen durch die Berechnung von dynamischen Breakout-Niveaus auf der Grundlage von ATR und kombiniert EMA-Trendfilter und RSI-Dynamikindikatoren. Die Strategie verwendet strenge Risikokontrollmaßnahmen, einschließlich einer festen Prozentsatz-Risikomanagement- und dynamischen Stop-Loss-Einstellung.

Strategieprinzip

Die Strategie besteht aus drei Kernkomponenten:

- Die Berechnung des Volatilitätsbruchs: Die Berechnung des Volatilitätsbruchs erfolgt anhand der Höchst- und Tiefstpreise der Rücklaufphase in Kombination mit der Berechnung des ATR-Multiplikators.

- Trendfilter: Die Richtung des aktuellen Trends wird anhand der kurzfristigen EMA beurteilt. Es werden nur überschüssige Aufträge über EMA und leere Aufträge unter EMA eröffnet.

- Dynamikbestätigung: Die RSI-Anzeige wird verwendet, um die Dynamik des Marktes zu bestätigen. Mehrköpfige Eintritte erfordern einen RSI von mehr als 50 und leere Eintritte erfordern einen RSI von weniger als 50.

Strategische Vorteile

- Dynamische Anpassungsfähigkeit: Durchschnittsniveaus werden automatisch an die Marktfluktuation angepasst, so dass die Strategie sich an unterschiedliche Marktbedingungen anpassen kann.

- Mehrfachfilterung: Kombination von Trends und Dynamometer, um falsche Signale zu reduzieren.

- Strenge Risikokontrolle: Positionsmanagement mit festen Risikoprozentsätzen und dynamischer Stop-Loss-Schutz.

- Stärkere Anpassbarkeit: Schlüsselparameter wie ATR-Zyklen, Durchbruch-Multiplikatoren und EMA-Zyklen können je nach Bedarf angepasst werden.

Strategisches Risiko

- Rückstandsrisiko: Die Verwendung von Indikatoren wie beispielsweise Moving Averages kann zu einem Rückstand am Einstiegspunkt führen.

- Schwankungsrisiko: Häufige falsche Durchbruchsignale können in schwankenden Märkten auftreten.

- Parameter-Sensitivität: Die Strategie-Performance ist sehr sensibel für Parameter-Einstellungen und muss ausreichend getestet werden. Lösung:

- Empfehlung zur Rückmessung und Optimierung unter verschiedenen Marktbedingungen

- Das Modul zur Identifizierung der Marktumgebung kann hinzugefügt werden

- Ein konservativeres Finanzmanagement empfohlen

Richtung der Strategieoptimierung

- Anpassung an die Marktumgebung: Hinzufügen von Schwankungsraten-Bereichsurteilen, die unterschiedliche Parameter-Einstellungen für verschiedene Schwankungsumgebungen verwenden.

- Optimierung des Signals: Die Einbeziehung von Transaktionsmengenbestätigung kann in Erwägung gezogen werden, um die Zuverlässigkeit des Durchbruchssignals zu verbessern.

- Stop-Loss-Optimierung: Erzielung einer dynamisch angepassten Gewinn- und Verlustquote, die sich an die Marktschwankungen anpasst.

- Zeitfilter: Erhöhen Sie die Zeitfenster für den Handel, um zu vermeiden, dass Sie zu ungünstigen Zeiten handeln.

Zusammenfassen

Es handelt sich um eine strukturierte, logisch eindeutige und quantifizierte Handelsstrategie. Durch die Kombination von Volatilitätsbrechern, Trendverfolgung und Dynamikbestätigung werden bedeutende Preisschwankungen erfasst, während Risiken kontrolliert werden. Die Strategie ist stark anpassbar und kann weiter optimiert werden, um sich an verschiedene Handelsarten und Marktumgebungen anzupassen.

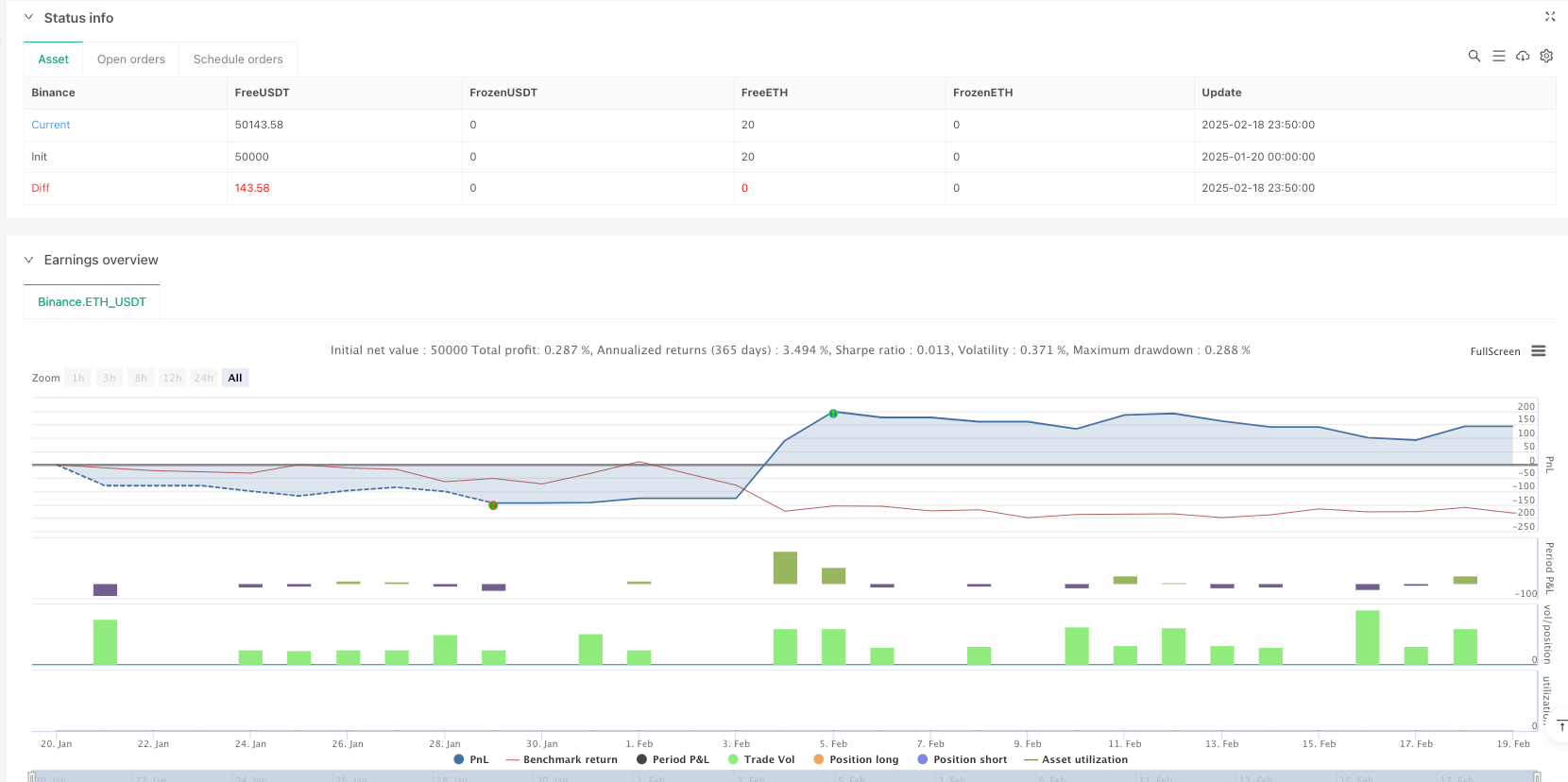

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

// Volatility Momentum Breakout Strategy

//

// Description:

// This strategy is designed to capture significant price moves by combining a volatility breakout method

// with a momentum filter. Volatility is measured by the Average True Range (ATR), which is used to set dynamic

// breakout levels. A short‑term Exponential Moving Average (EMA) is applied as a trend filter, and the Relative

// Strength Index (RSI) is used to help avoid entries when the market is overextended.

//

// Signal Logic:

// • Long Entry: When the current close is above the highest high of the previous N bars (excluding the current bar)

// plus a multiple of ATR, provided that the price is above the short‑term EMA and the RSI is above 50.

// • Short Entry: When the current close is below the lowest low of the previous N bars (excluding the current bar)

// minus a multiple of ATR, provided that the price is below the short‑term EMA and the RSI is below 50.

//

// Risk Management:

// • Trades are sized to risk 2% of account equity.

// • A stop loss is placed at a fixed ATR multiple away from the entry price.

// • A take profit target is set to achieve a 1:2 risk‑reward ratio.

//

// Backtesting Parameters:

// • Initial Capital: $10,000

// • Commission: 0.1% per trade

// • Slippage: 1 tick per bar

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and provided solely for educational

// purposes. Always backtest and paper trade before any live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Volatility Momentum Breakout Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=5, commission_type=strategy.commission.percent, commission_value=0.1, slippage=1)

// ─── INPUTS ─────────────────────────────────────────────────────────────

atrPeriod = input.int(14, "ATR Period", minval=1)

atrMultiplier = input.float(1.5, "ATR Multiplier for Breakout", step=0.1)

lookback = input.int(20, "Breakout Lookback Period", minval=1)

emaPeriod = input.int(50, "EMA Period", minval=1)

rsiPeriod = input.int(14, "RSI Period", minval=1)

rsiLongThresh = input.float(50, "RSI Long Threshold", step=0.1)

rsiShortThresh = input.float(50, "RSI Short Threshold", step=0.1)

// Risk management inputs:

riskPercent = input.float(2.0, "Risk Percent per Trade (%)", step=0.1) * 0.01 // 2% risk per trade

riskReward = input.float(2.0, "Risk-Reward Ratio", step=0.1) // Target profit is 2x risk

atrStopMult = input.float(1.0, "ATR Multiplier for Stop Loss", step=0.1) // Stop loss distance in ATRs

// ─── INDICATOR CALCULATIONS ───────────────────────────────────────────────

atrVal = ta.atr(atrPeriod)

emaVal = ta.ema(close, emaPeriod)

rsiVal = ta.rsi(close, rsiPeriod)

// Calculate breakout levels using the highest high and lowest low of the previous N bars,

// excluding the current bar (to avoid look-ahead bias).

highestHigh = ta.highest(high[1], lookback)

lowestLow = ta.lowest(low[1], lookback)

// Define breakout thresholds.

longBreakoutLevel = highestHigh + atrMultiplier * atrVal

shortBreakoutLevel = lowestLow - atrMultiplier * atrVal

// ─── SIGNAL LOGIC ─────────────────────────────────────────────────────────

// Long Entry: Price closes above the long breakout level,

// the close is above the EMA, and RSI > 50.

longCondition = (close > longBreakoutLevel) and (close > emaVal) and (rsiVal > rsiLongThresh)

// Short Entry: Price closes below the short breakout level,

// the close is below the EMA, and RSI < 50.

shortCondition = (close < shortBreakoutLevel) and (close < emaVal) and (rsiVal < rsiShortThresh)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// ─── RISK MANAGEMENT ──────────────────────────────────────────────────────

// For each new trade, use the entry price as the basis for stop loss and target calculations.

// We assume the entry price equals the close on the bar where the trade is triggered.

var float longEntryPrice = na

var float shortEntryPrice = na

// Record entry prices when a trade is opened.

if (strategy.position_size > 0 and na(longEntryPrice))

longEntryPrice := strategy.position_avg_price

if (strategy.position_size < 0 and na(shortEntryPrice))

shortEntryPrice := strategy.position_avg_price

// Calculate stop loss and take profit levels based on ATR.

longStop = longEntryPrice - atrStopMult * atrVal

longTarget = longEntryPrice + (longEntryPrice - longStop) * riskReward

shortStop = shortEntryPrice + atrStopMult * atrVal

shortTarget= shortEntryPrice - (shortStop - shortEntryPrice) * riskReward

// Issue exit orders if a position is open.

if (strategy.position_size > 0 and not na(longEntryPrice))

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTarget)

if (strategy.position_size < 0 and not na(shortEntryPrice))

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTarget)

// Reset recorded entry prices when the position is closed.

if (strategy.position_size == 0)

longEntryPrice := na

shortEntryPrice := na

// ─── CHART VISUAL AIDS ─────────────────────────────────────────────────────

// Plot the breakout levels and EMA.

plot(longBreakoutLevel, color=color.new(color.green, 0), title="Long Breakout Level", style=plot.style_linebr)

plot(shortBreakoutLevel, color=color.new(color.red, 0), title="Short Breakout Level", style=plot.style_linebr)

plot(emaVal, color=color.blue, title="EMA")

// Optionally, shade the background: green when price is above the EMA (bullish) and red when below.

bgcolor(close > emaVal ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")