Überblick

Die Strategie ist ein Trend-Tracking-Trading-System, basierend auf einer über die Periode durchgeführten Analyse, das EMA-Meanlines auf Umlauf- und Tageslinien-Ebenen sowie RSI-Indikatoren kombiniert, um Markttrends und -dynamik zu identifizieren. Die Strategie ermittelt Handelschancen durch Trendkonsistenz über mehrere Zeitrahmen und verwendet ATR-basierte dynamische Stop-Losses, um Risiken zu verwalten. Das System verwendet ein Fondsmanagement-Modell, bei dem 100% der Konten für jeden Handel verwendet werden und eine Transaktionsgebühr von 0,1% berücksichtigt wird.

Strategieprinzip

Die Kernlogik der Strategie basiert auf den folgenden Schlüsselelementen:

- Die Verwendung von EMAs auf der Kreislinie als Haupttrendfilter, in Verbindung mit der Beziehung zwischen dem Tagesabschlusspreis und den Kreislinien-EMA, um den Marktzustand zu bestimmen

- Trendbewertete Schwellenwerte, die durch ATR-Dynamik angepasst werden, um die Anpassungsfähigkeit der Strategie zu erhöhen

- Integration der RSI-Dynamik als zusätzliche Handelsfilterbedingungen

- Die Verwendung eines Stop-Loss-Tracking-Systems basierend auf 7-Tage-Limit und ATR

- Wenn ein Warnsignal für eine übermäßige Erhöhung auftritt, wird die Strategie ausgesetzt, um das Risiko zu vermeiden

Strategische Vorteile

- Mehrfache Zeitrahmen-Analysen bieten eine umfassendere Sicht auf den Markt, um falsche Durchbrüche effektiv zu filtern

- Dynamische Stop-Loss-Mechanismen bieten flexible Risikokontrollen, die sich an die Marktvolatilität anpassen

- Der RSI-Dynamikfilter hilft bei der Bestätigung der Trendstärke und verbessert die Einstiegsqualität

- Das System beinhaltet eine Vorwarnmechanik für Überdosierung, um das Risiko eines Rückzugs zu vermeiden.

- Die Parameter der Strategie sind flexibel und lassen sich leicht an unterschiedliche Marktbedingungen anpassen

Strategisches Risiko

- Häufige Ein- und Ausgänge in den OTC-Märkten können zu erhöhten Transaktionskosten führen

- Ein hohes Rücknahmerisiko bei einem 100%igen Handel

- Technische Indikatoren, auf die man angewiesen ist, können zu unvorhergesehenen Marktereignissen nicht reagieren.

- Die Analyse mehrerer Zeitrahmen kann auf unterschiedlichen Ebenen widersprüchliche Signale hervorrufen.

- Tracking-Stopps können bei starken Schwankungen zu früh ausgelöst werden

Richtung der Strategieoptimierung

- Einführung von Volatilitätsfiltern, um die Häufigkeit von Transaktionen während der niedrigen Volatilität zu verringern

- Hinzufügung eines Positionsmanagementsystems, um die Positionsquote an die Marktentwicklung anzupassen

- Integration von Fundamentaldaten, um zusätzliche Marktumstände zu beurteilen

- Optimierung der Verfolgung von Stop-Loss-Parametern, um sie besser an unterschiedliche Marktphasen anzupassen

- Umtrendsanalysen, um die Genauigkeit der Trendbeurteilung zu verbessern

Zusammenfassen

Dies ist eine strukturierte, logisch klare Trend-Tracking-Strategie. Die Strategie kann die wichtigsten Trends besser erfassen, indem sie mehrere Zeitrahmen analysiert und die dynamischen Indikatoren gefiltert werden. Obwohl es einige inhärente Risiken gibt, gibt es viel Raum für Verbesserung durch Optimierung der Parameter und Hinzufügen zusätzlicher Indikatoren.

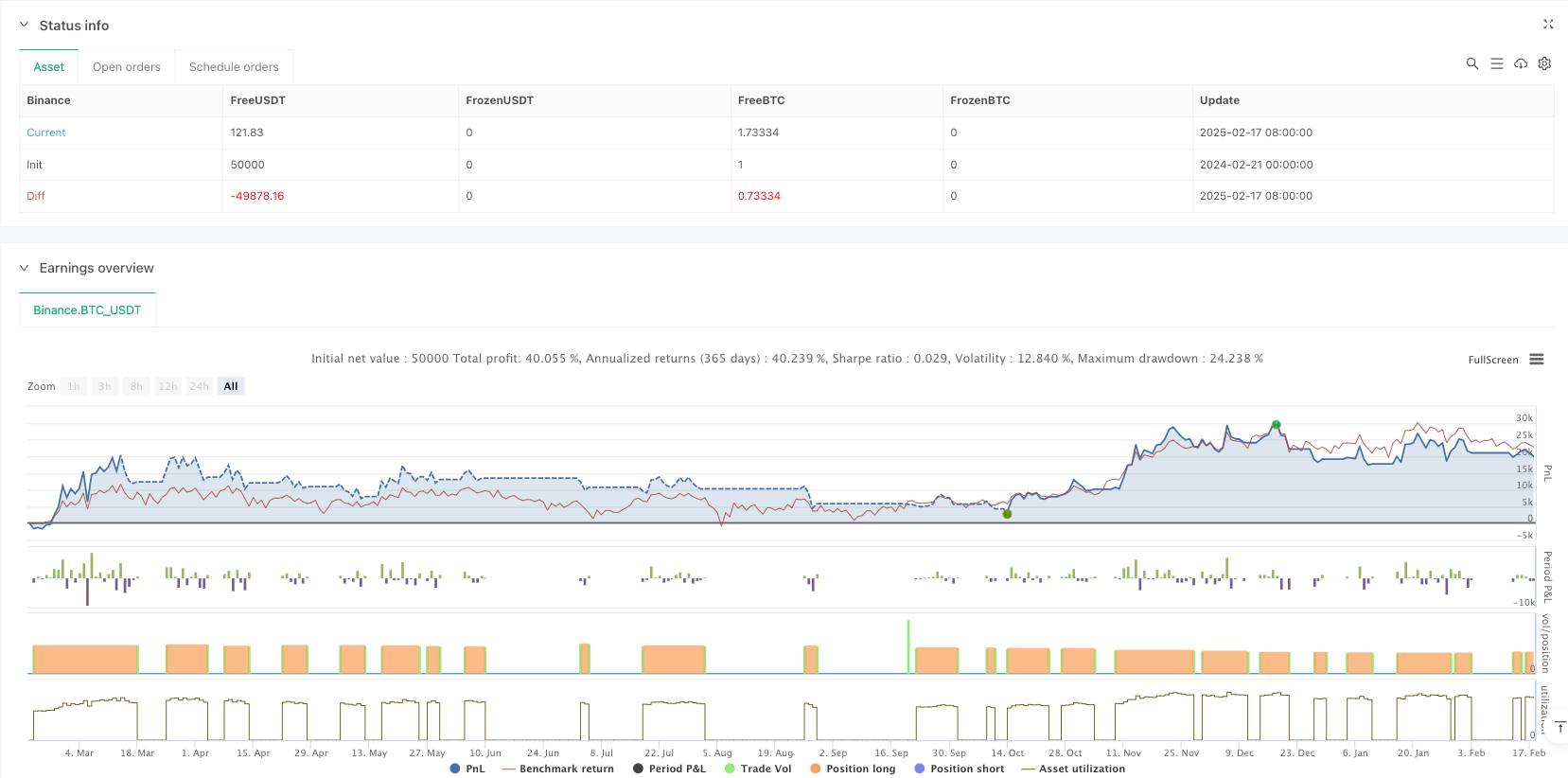

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// @version=6

strategy("Bitcoin Regime Filter Strategy", // Strategy name

overlay=true, // The strategy will be drawn directly on the price chart

initial_capital=10000, // Initial capital of 10000 USD

currency=currency.USDT, // Defines the currency used, USDT

default_qty_type=strategy.percent_of_equity, // Position size will be calculated as a percentage of equity

default_qty_value=100, // The strategy uses 100% of available capital for each trade

commission_type=strategy.commission.percent, // The strategy uses commission as a percentage

commission_value=0.1) // Transaction fee is 0.1%

// User input

res = input.timeframe(title = "Timeframe", defval = "W") // Higher timeframe for reference

len = input.int(title = "EMA Length", defval = 20) // EMA length input

marketTF = input.timeframe(title = "Market Timeframe", defval = "D") // Current analysis timeframe (D)

useRSI = input.bool(title = "Use RSI Momentum Filter", defval = false) // Option to use RSI filter

rsiMom = input.int(title = "RSI Momentum Threshold", defval = 70) // RSI momentum threshold (default 70)

// Custom function to output data

f_sec(_market, _res, _exp) => request.security(_market, _res, _exp[barstate.isrealtime ? 1 : 0])[barstate.isrealtime ? 0: 1]

// The f_sec function has three input parameters: _market, _res, _exp

// request.security = a Pine Script function to fetch market data, accessing OHLC data

// _exp[barstate.isrealtime ? 1 : 0] checks if the current bar is real-time, and retrieves the previous bar (1) or the current bar (0)

// [barstate.isrealtime ? 0 : 1] returns the value of request.security, with a real-time check on the bar

// Define time filter

dateFilter(int st, int et) => time >= st and time <= et

// The dateFilter function has two input parameters: st (start time) and et (end time)

// It checks if the current bar's time is between st and et

// Fetch EMA value

ema = ta.ema(close, len) // Calculate EMA with close prices and input length

htfEmaValue = f_sec(syminfo.tickerid, res, ema) // EMA value for high time frame, using f_sec function

// Fetch ATR value

atrValue = ta.atr(5)

// Check if price is above or below EMA

marketPrice = f_sec(syminfo.tickerid, marketTF, close)

regimeFilter = marketPrice > (htfEmaValue + (atrValue * 0.25)) // Compare current price with EMA in higher timeframe (with ATR dependency)

// Calculate RSI value

rsiValue = ta.rsi(close, 7)

// Bullish momentum filter

bullish = regimeFilter and (rsiValue > rsiMom or not useRSI)

// Set caution alert

caution = bullish and (ta.highest(high, 7) - low) > (atrValue * 1.5)

// Set momentum background color

bgCol = color.red

if bullish[1]

bgCol := color.green

if caution[1]

bgCol := color.orange

// Plot background color

plotshape(1, color = bgCol, style = shape.square, location = location.bottom, size = size.auto, title = "Momentum Strength")

plot(htfEmaValue, color = close > htfEmaValue ? color.green : color.red, linewidth = 2)

// Initialize trailing stop variable

var float trailStop = na

// Entry logic

if bullish and strategy.position_size == 0 and not caution

strategy.entry(id = "Buy", direction = strategy.long)

trailStop := na

// Trailing stop logic

temp_trailStop = ta.highest(low, 7) - (caution[1] ? atrValue * 0.2 : atrValue)

if strategy.position_size > 0

if temp_trailStop > trailStop or na(trailStop)

trailStop := temp_trailStop

// Exit logic

if (close < trailStop or close < htfEmaValue)

strategy.close("Buy", comment = "Sell")

// Plot stop loss line

plot(strategy.position_size[1] > 0 ? trailStop : na, style = plot.style_linebr, color = color.red, title = "Stoploss")