Überblick

Die Strategie ist ein intelligentes Handelssystem, das mehrere technische Kennzahlen kombiniert, um Marktchancen durch eine umfassende Analyse der Fair Value Gap (FVG), Trendsignale und Preisverhaltens zu identifizieren. Das System verwendet eine Dual-Strategie-Mechanismus, kombiniert mit Trend-Tracking und Bandbreiten-Trading-Eigenschaften, um die Handelsleistung durch dynamische Positionsmanagement und mehrdimensionale Ausstiegsmechanismen zu optimieren. Die Strategie legt besonderen Wert auf Risikokontrolle, um die Signalqualität durch Volatilitätsfilterung und Bestätigung von Transaktionen zu verbessern.

Strategieprinzip

Die Kernlogik der Strategie basiert auf folgenden Dimensionen:

- FVG-Lückenerkennung - Suche nach potenziellen Handelsmöglichkeiten durch Berechnung der Größe der Preissprunglücke

- Trendbestätigungssystem - die Bestätigung von Markttrends in Kombination mit dem 200-Tage-Durchschnittswert, dem SuperTrend-Indikator und dem MACD

- Intelligente Kapitalbestätigung - mit RSI-Überkauf, Überverkauf, Transaktionsanomalien und Preisverhaltensmustern als Triggerbedingungen für Transaktionen

- Dynamisches Positionsmanagement - Positionsgröße wird anhand der ATR-Schwankungen angepasst, um die Einheitlichkeit der Risikoplätze zu gewährleisten

- Mehrstufige Ausstiegsmechanismen - Verwalten von Ausstiegsgeschäften in Kombination mit Tracking-Stopps und Zielstopps

Strategische Vorteile

- Anpassungsfähigkeit - Strategien können die Parameter und Positionen automatisch an die Marktfluktuation anpassen

- Perfekte Risikokontrolle - Risiken durch mehrere Filter und strenge Positionsverwaltung

- Signalqualität ist zuverlässig - die Genauigkeit von Handelssignalen wird durch die Bestätigung von mehrdimensionalen Kennzahlen verbessert

- Flexible Handelsmethoden - Möglichkeiten, Trends und Schwankungen gleichzeitig zu erfassen

- Die Wissenschaft des Geldmanagements - Prozentsatzrisikomanagement, um die Rationalität der Verwendung von Geldern zu gewährleisten

Strategisches Risiko

- Parameter-Sensitivität - Einstellungen mit mehreren Parametern können die Strategie-Performance beeinflussen und müssen kontinuierlich optimiert werden

- Marktumgebungsabhängigkeit - Unter bestimmten Marktbedingungen können falsche Durchbruchsignale auftreten

- Schlupfwirkung - in weniger flüssigen Märkten können größere Schlupfwellen auftreten

- Komplexität der Berechnung - die Berechnung mehrerer Indikatoren kann zu Signalverzögerungen führen

- Hohe Finanzierungsbedürfnisse - eine umfassende Umsetzung der Strategie erfordert einen hohen Anfangskapitalbedarf

Richtung der Strategieoptimierung

- Gewichtsoptimierung der Kennzahlen - Einführung von maschinellen Lernmethoden, um die Gewichte der einzelnen Kennzahlen dynamisch anzupassen

- Erhöhung der Marktadaptivität - Anpassungsmechanismen zur Erhöhung der Marktvolatilität

- Verbesserte Signalfilterung - Einführung weiterer Mikrostrukturindikatoren

- Optimierung der Abwicklungsmechanismen - Erhöhung der Intelligenz der Auftragsspaltung und Reduzierung der Stoßkosten

- Risikokontroll-Aufwertung - Erweiterung der dynamischen Risikobudgetmanagement-Systeme

Zusammenfassen

Die Strategie baut ein vollständiges Handelssystem auf, indem sie mehrere technische Indikatoren und Handelstechniken kombiniert. Ihr Vorteil besteht darin, sich an Marktveränderungen anzupassen, während sie eine strenge Risikokontrolle beibehält. Obwohl es einen gewissen Optimierungsraum gibt, ist es insgesamt eine vernünftige quantitative Handelsstrategie.

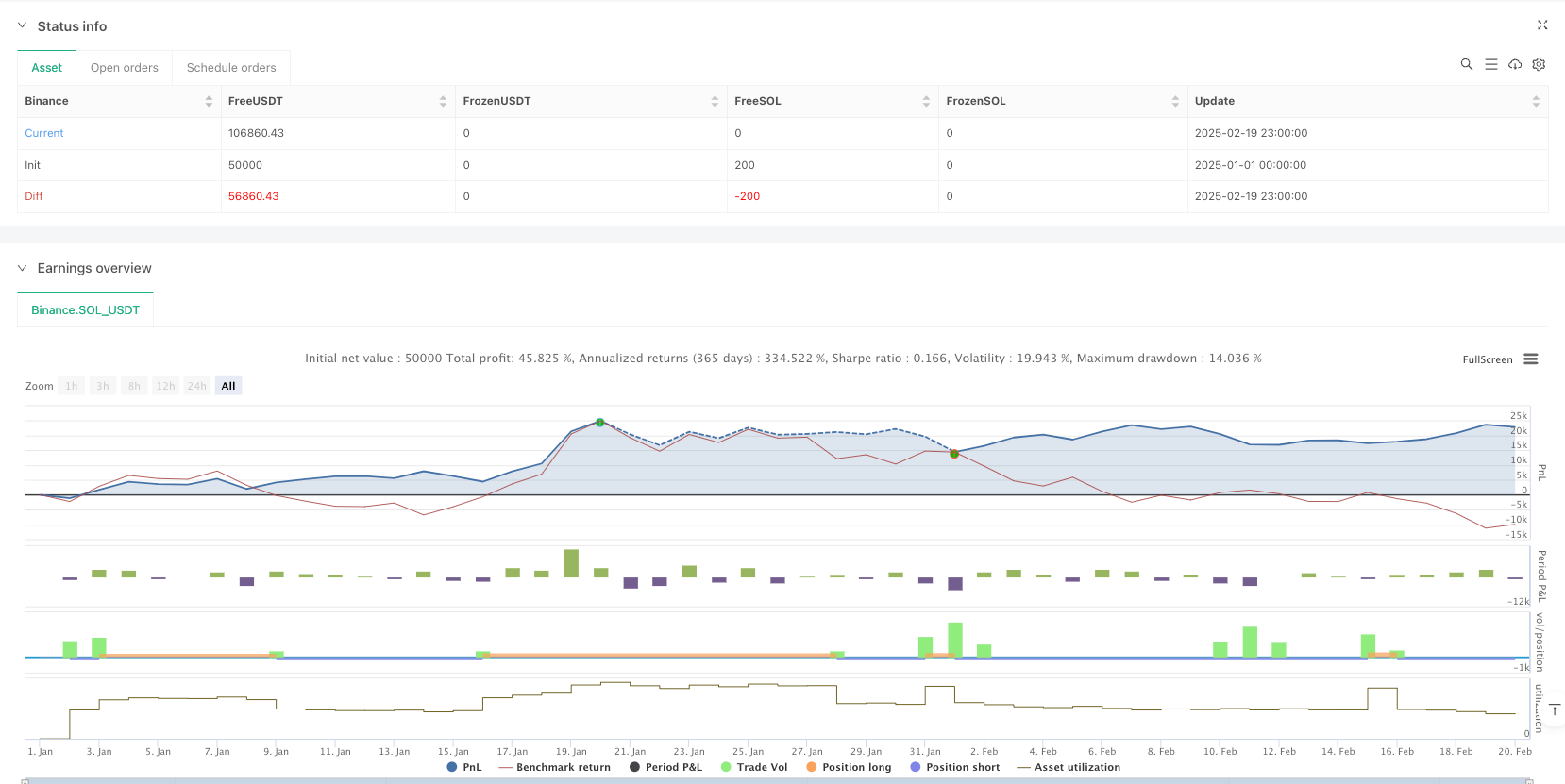

/*backtest

start: 2025-01-01 00:00:00

end: 2025-02-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Adaptive Trend Signals", overlay=true, margin_long=100, margin_short=100, pyramiding=1, initial_capital=50000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.075)

// 1. Enhanced Inputs with Debugging Options

fvgSize = input.float(0.25, "FVG Size (%)", minval=0.1, step=0.05)

atrPeriod = input.int(14, "ATR Period") // Increased for better stability

rsiPeriod = input.int(7, "RSI Period")

useSuperTrend = input.bool(true, "Use SuperTrend Filter")

useTrendFilter = input.bool(false, "Use 200 EMA Trend Filter") // Disabled by default

volatilityThreshold = input.float(1.0, "Volatility Threshold (ATR%)", step=0.1) // Increased threshold

useVolume = input.bool(true, "Use Volume Confirmation")

riskPercentage = input.float(2.0, "Risk %", minval=0.1, maxval=5)

// 2. Advanced Market Filters with Trend Change Detection

var int marketTrend = 0

var bool trendChanged = false

ema200 = ta.ema(close, 200)

prevMarketTrend = marketTrend

marketTrend := close > ema200 ? 1 : close < ema200 ? -1 : 0

trendChanged := marketTrend != prevMarketTrend

// 3. Enhanced FVG Detection with Adjusted Volume Requirements

bullishFVG = (low[1] > high[2] and (low[1] - high[2])/high[2]*100 >= fvgSize) or

(low > high[1] and (low - high[1])/high[1]*100 >= fvgSize)

bearishFVG = (high[1] < low[2] and (low[2] - high[1])/low[2]*100 >= fvgSize) or

(high < low[1] and (low[1] - high)/low[1]*100 >= fvgSize)

// 4. Smart Money Confirmation System with Signal Debugging

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, 5, 13, 5)

[supertrendLine, supertrendDir] = ta.supertrend(3, 10)

// Script 2 Indicators

[macdLine2, signalLine2, _] = ta.macd(close, 4, 11, 3)

[supertrendLine2, supertrendDir2] = ta.supertrend(3, 7)

vWAP = ta.vwap(close)

ema21 = ta.ema(close, 21)

// 5. Price Action Filters from Script 2

breakoutLong = close > ta.highest(high, 5) and (useVolume ? volume > ta.sma(volume, 10)*1.8 : true)

breakdownShort = close < ta.lowest(low, 5) and (useVolume ? volume > ta.sma(volume, 10)*1.8 : true)

bullishRejection = low < vWAP and close > (high + low)/2 and close > open

bearishRejection = high > vWAP and close < (high + low)/2 and close < open

// 6. Combined Entry Conditions

longBaseCond = (bullishFVG and rsi < 35 and macdLine > signalLine) or

(bullishFVG and rsi < 38 and supertrendDir2 == 1) or

(breakoutLong and macdLine2 > signalLine2) or

(bullishRejection and close > ema21)

shortBaseCond = (bearishFVG and rsi > 65 and macdLine < signalLine) or

(bearishFVG and rsi > 62 and supertrendDir2 == -1) or

(breakdownShort and macdLine2 < signalLine2) or

(bearishRejection and close < ema21)

longSignal = longBaseCond and (not useSuperTrend or supertrendDir == 1) and (not useTrendFilter or marketTrend == 1)

shortSignal = shortBaseCond and (not useSuperTrend or supertrendDir == -1) and (not useTrendFilter or marketTrend == -1)

// 7. Position Sizing with Minimum Quantity

var float longEntryPrice = na

var float shortEntryPrice = na

atr = ta.atr(atrPeriod)

positionSizeScript1 = math.max(strategy.equity * riskPercentage / 100 / (atr * 1.5), 1)

positionSizeScript2 = strategy.equity * riskPercentage / 100 / (atr * 2)

// 8. Dynamic Exit System with Dual Strategies

var float trailPrice = na

if longSignal or trendChanged and marketTrend == 1

trailPrice := close

if shortSignal or trendChanged and marketTrend == -1

trailPrice := close

trailOffset = atr * 0.75

// Script 1 Exit Logic

if strategy.position_size > 0

trailPrice := math.max(trailPrice, close)

strategy.exit("Long Exit", "Long", stop=trailPrice - trailOffset, trail_offset=trailOffset)

if strategy.position_size < 0

trailPrice := math.min(trailPrice, close)

strategy.exit("Short Exit", "Short", stop=trailPrice + trailOffset, trail_offset=trailOffset)

// Script 2 Exit Logic

longStop = close - atr * 1.2

shortStop = close + atr * 1.2

strategy.exit("Long Exit 2", "Long", stop=longStop, limit=na(longEntryPrice) ? na : longEntryPrice + (atr * 4), trail_points=not na(longEntryPrice) and close > longEntryPrice + atr ? atr * 3 : na, trail_offset=atr * 0.8)

strategy.exit("Short Exit 2", "Short", stop=shortStop, limit=na(shortEntryPrice) ? na : shortEntryPrice - (atr * 4), trail_points=not na(shortEntryPrice) and close < shortEntryPrice - atr ? atr * 3 : na, trail_offset=atr * 0.8)

// 9. Trend Change Signals and Visuals

// plot(supertrendLine, "SuperTrend", color=color.new(#2962FF, 0))

// plot(supertrendLine2, "SuperTrend 2", color=color.new(#FF00FF, 0))

// plot(ema200, "200 EMA", color=color.new(#FF6D00, 0))

// plot(ema21, "21 EMA", color=color.new(#00FFFF, 0))

bgcolor(marketTrend == 1 ? color.new(color.green, 90) :

marketTrend == -1 ? color.new(color.red, 90) : na)

plotshape(trendChanged and marketTrend == 1, "Bullish Trend", shape.labelup,

location.belowbar, color=color.green, text="▲ Trend Up")

plotshape(trendChanged and marketTrend == -1, "Bearish Trend", shape.labeldown,

location.abovebar, color=color.red, text="▼ Trend Down")

// 10. Signal Visualization for Both Strategies

// plotshape(longSignal, "Long Entry", shape.triangleup, location.belowbar,

// color=color.new(#00FF00, 0), size=size.small)

// plotshape(shortSignal, "Short Entry", shape.triangledown, location.abovebar,

// color=color.new(#FF0000, 0), size=size.small)

// plotshape(breakoutLong, "Breakout Long", shape.flag, location.belowbar,

// color=color.new(#00FF00, 50), size=size.small)

// plotshape(breakdownShort, "Breakdown Short", shape.flag, location.abovebar,

// color=color.new(#FF0000, 50), size=size.small)

// 11. Order Execution with Dual Entry Systems

if trendChanged and marketTrend == 1

strategy.entry("Long Trend", strategy.long, qty=positionSizeScript1)

longEntryPrice := close

if trendChanged and marketTrend == -1

strategy.entry("Short Trend", strategy.short, qty=positionSizeScript1)

shortEntryPrice := close

if longSignal and strategy.position_size == 0

strategy.entry("Long Signal", strategy.long, qty=positionSizeScript2)

longEntryPrice := close

if shortSignal and strategy.position_size == 0

strategy.entry("Short Signal", strategy.short, qty=positionSizeScript2)

shortEntryPrice := close