2

konzentrieren Sie sich auf

365

Anhänger

Überblick

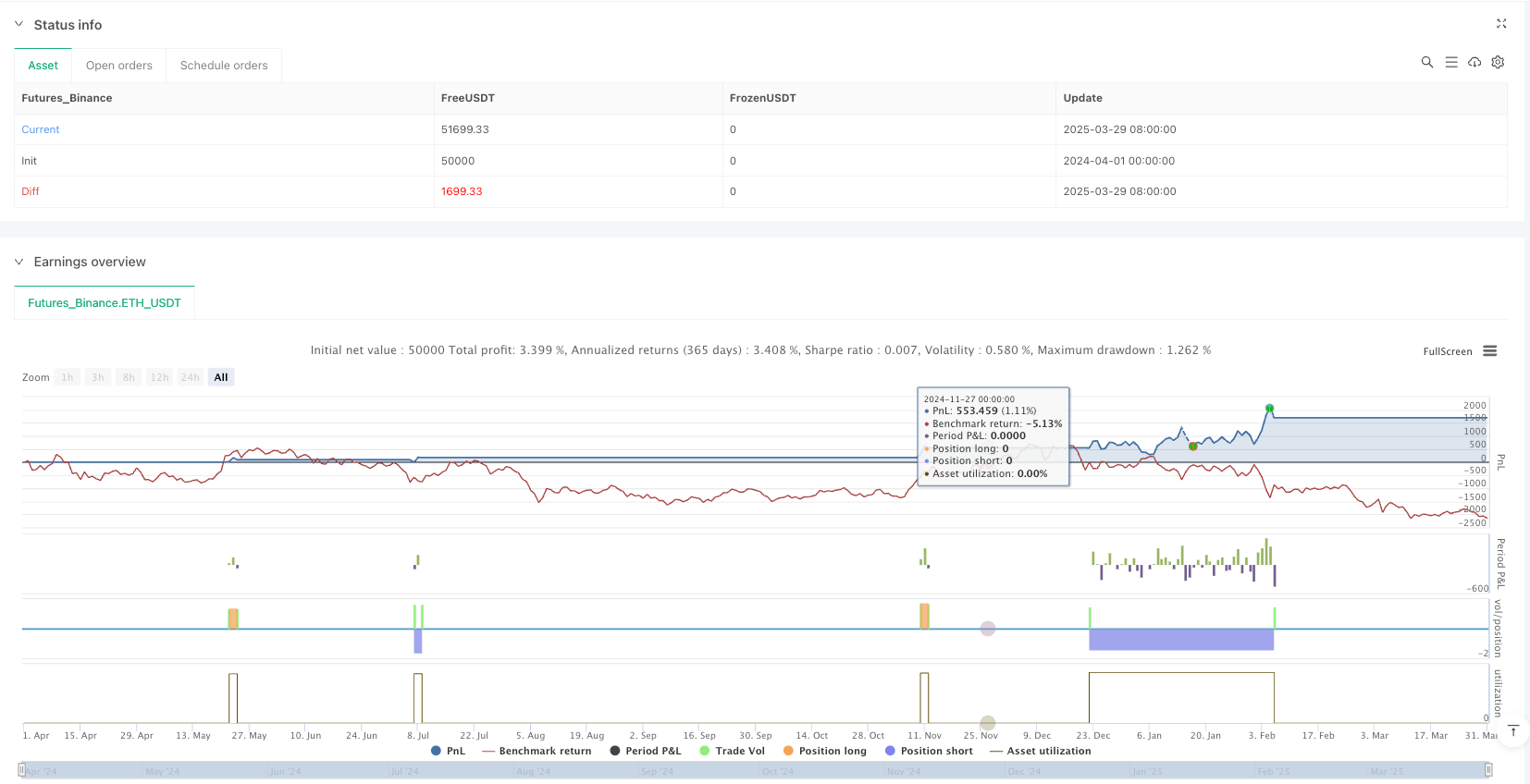

Dieser Artikel beschreibt eine kombinierte Trading-Strategie, die Bollinger Bands und Supertrends kombiniert. Die Strategie integriert mehrere technische Analyse-Tools, um genauere Marktein- und Ausstiegssignale zu liefern und gleichzeitig das Trading-Risiko zu reduzieren.

Strategieprinzip

Der Kern der Strategie besteht aus zwei Hauptkomponenten: Bollinger Bands und SuperTrend-Indikatoren.

- Die Berechnungen von Brin:

- Benchmark mit konfigurierbaren Moving Averages (MA)

- Aufwärts- und Abwärts-Orbitalerzeugung nach Standarddifferenz-Multiplikatoren

- Unterstützt mehrere Arten von Moving Averages: einfache Moving Averages (SMA), Index Moving Averages (EMA), glatte Moving Averages (SMMA), gewichtete Moving Averages (WMA) und VWMA

- Der Blog “SuperTrend” ist ein Teil von “SuperTrend”:

- Berechnung eines Stop-Losses anhand der durchschnittlichen realen Bandbreite (ATR)

- Dynamik und Markttrends

- Erstellen von Kauf- und Verkaufssignalen auf Basis von Trendänderungen

Strategische Vorteile

- Mehrindikator-Palette: Signalgenauigkeit durch Kombination von Brin-Band und Supertrend

- Flexible Konfiguration: Anpassbare Moving Average-Typen, Parameter und Berechnungsmethoden

- Dynamische Stop-Losses: Die ATR-basierte Stop-Loss-Mechanik ermöglicht eine effektive Risikokontrolle.

- Visuelle Erweiterung: Bereitstellung von Trendstatusfüllung und Signal-Tags

- Risikomanagement: Einschränkungen für die prozentuale Positionsverwaltung und Pyramidenhandel

Strategisches Risiko

- Parameter-Sensitivität: Parameter können unter verschiedenen Marktbedingungen häufig angepasst werden müssen

- Die Grenzen der Rückmeldung: Die historische Datenleistung ist nicht repräsentativ für die zukünftige Marktleistung

- Risiken von Multiple-Switching: Häufige Positionswechsel können die Kosten erhöhen

- Nachlässigkeit der Indikatoren: Es gibt eine gewisse Signalverzögerung bei technischen Indikatoren

Richtung der Strategieoptimierung

- Einführung von dynamischen Optimierungsparametern für Machine Learning-Algorithmen

- Zusätzliche Filterbedingungen, wie z.B. die Bestätigung der Abgabe

- Entwicklung eines Multi-Time-Framework-Verifizierungsmechanismus

- Optimierung des Risikomanagement-Moduls und Einführung einer feineren Positionskontrollstrategie

Zusammenfassen

Es ist eine Handelsstrategie, die mehrere dynamische Indikatoren kombiniert und durch die Kombination von Brin-Bändern und Supertrends ein relativ umfassendes Handelssignalsystem bietet. Der Kern der Strategie liegt in der Balance zwischen Signalgenauigkeit und Risikomanagement, die jedoch fortlaufend optimiert und an unterschiedliche Marktumstände angepasst werden muss.

Strategiequellcode

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Combined BB & New SuperTrend Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0)

//============================

// Bollinger Bands Parameters

//============================

lengthBB = input.int(20, minval=1, title="BB Length")

maType = input.string("SMA", "BB Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

srcBB = input(close, title="BB Source")

multBB = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev Multiplier")

offsetBB = input.int(0, title="BB Offset", minval=-500, maxval=500)

// Moving average function based on chosen type

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Bollinger Bands calculations

basis = ma(srcBB, lengthBB, maType)

dev = multBB * ta.stdev(srcBB, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Plot Bollinger Bands

plot(basis, title="BB Basis", color=color.blue, offset=offsetBB)

p1 = plot(upperBB, title="BB Upper", color=color.red, offset=offsetBB)

p2 = plot(lowerBB, title="BB Lower", color=color.green, offset=offsetBB)

fill(p1, p2, title="BB Fill", color=color.new(color.blue, 90))

//============================

// New SuperTrend Parameters & Calculations

// (Based on the new script you provided)

//============================

st_length = input.int(title="ATR Period", defval=22)

st_mult = input.float(title="ATR Multiplier", step=0.1, defval=3)

st_src = input.source(title="SuperTrend Source", defval=hl2)

st_wicks = input.bool(title="Take Wicks into Account?", defval=true)

st_showLabels = input.bool(title="Show Buy/Sell Labels?", defval=true)

st_highlightState = input.bool(title="Highlight State?", defval=true)

// Calculate ATR component for SuperTrend

st_atr = st_mult * ta.atr(st_length)

// Price selection based on wicks option

st_highPrice = st_wicks ? high : close

st_lowPrice = st_wicks ? low : close

st_doji4price = (open == close and open == low and open == high)

// Calculate SuperTrend stop levels

st_longStop = st_src - st_atr

st_longStopPrev = nz(st_longStop[1], st_longStop)

if st_longStop > 0

if st_doji4price

st_longStop := st_longStopPrev

else

st_longStop := (st_lowPrice[1] > st_longStopPrev ? math.max(st_longStop, st_longStopPrev) : st_longStop)

else

st_longStop := st_longStopPrev

st_shortStop = st_src + st_atr

st_shortStopPrev = nz(st_shortStop[1], st_shortStop)

if st_shortStop > 0

if st_doji4price

st_shortStop := st_shortStopPrev

else

st_shortStop := (st_highPrice[1] < st_shortStopPrev ? math.min(st_shortStop, st_shortStopPrev) : st_shortStop)

else

st_shortStop := st_shortStopPrev

// Determine trend direction: 1 for bullish, -1 for bearish

var int st_dir = 1

st_dir := st_dir == -1 and st_highPrice > st_shortStopPrev ? 1 : st_dir == 1 and st_lowPrice < st_longStopPrev ? -1 : st_dir

// Define colors for SuperTrend

st_longColor = color.green

st_shortColor = color.red

// Plot SuperTrend stops

st_longStopPlot = plot(st_dir == 1 ? st_longStop : na, title="Long Stop", style=plot.style_line, linewidth=2, color=st_longColor)

st_shortStopPlot = plot(st_dir == -1 ? st_shortStop : na, title="Short Stop", style=plot.style_line, linewidth=2, color=st_shortColor)

// Generate SuperTrend signals based on direction change

st_buySignal = st_dir == 1 and st_dir[1] == -1

st_sellSignal = st_dir == -1 and st_dir[1] == 1

// Optionally plot labels for buy/sell signals

if st_buySignal and st_showLabels

label.new(bar_index, st_longStop, "Buy", style=label.style_label_up, color=st_longColor, textcolor=color.white, size=size.tiny)

if st_sellSignal and st_showLabels

label.new(bar_index, st_shortStop, "Sell", style=label.style_label_down, color=st_shortColor, textcolor=color.white, size=size.tiny)

// Fill the state area (optional visual enhancement)

st_midPricePlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=1, display=display.none)

st_longFillColor = st_highlightState ? (st_dir == 1 ? st_longColor : na) : na

st_shortFillColor = st_highlightState ? (st_dir == -1 ? st_shortColor : na) : na

fill(st_midPricePlot, st_longStopPlot, title="Long State Filling", color=st_longFillColor)

fill(st_midPricePlot, st_shortStopPlot, title="Short State Filling", color=st_shortFillColor)

//============================

// Trading Logic

//============================

// When a bullish reversal occurs, close any short position before entering long.

if st_buySignal

strategy.close("Short")

strategy.entry("Long", strategy.long)

// When a bearish reversal occurs, close any long position before entering short.

if st_sellSignal

strategy.close("Long")

strategy.entry("Short", strategy.short)

// Exit conditions using Bollinger Bands:

// - For a long position: exit if price reaches (or exceeds) the upper Bollinger Band.

// - For a short position: exit if price reaches (or falls below) the lower Bollinger Band.

if strategy.position_size > 0 and close >= upperBB

strategy.close("Long", comment="Exit Long via BB Upper")

if strategy.position_size < 0 and close <= lowerBB

strategy.close("Short", comment="Exit Short via BB Lower")