RSI-Strategie mit dynamischer Divergenz und quantitativer Analyse

RSI ATR SL/TP risk management DIVERGENCE Pivot

Überblick

Die RSI-Doppel-Achs-Abweichungs-Quantifizierung ist eine hochwertige Handelsstrategie, die potenzielle Umkehrmöglichkeiten identifiziert, indem sie die regulären bullish-bullish-Abweichungen zwischen dem Preisverhalten und dem relativ starken Index ((RSI)) erkennt. Die Strategie verwendet eine automatisierte Pivot-Detection-Algorithmus, die zwei verschiedene Stop-Loss-Management-Methoden kombiniert, um automatisch Positionen zu erstellen, wenn ein Abweichungssignal bestätigt wird. Die Kernstrategie besteht darin, die Abweichung zwischen dem Preis und dem RSI-Indikator durch präzise mathematische Berechnungen zu bestätigen.

Strategieprinzip

- RSI-Berechnungsmodule: Berechnung des RSI-Wertes mit Hilfe der Wilder-Gleichmethode für 14 Zyklen, mit dem Schlusskurs als Standard-Eingabequelle.

- Kernpunkte:

- Lokale Höhen und Tiefen des RSI-Indikators mit einem Schiebefenster, das jeweils 5 Perioden lang und 5 Perioden lang eingestellt werden kann

- Sicherung des Abstands von 5 bis 60 K-Linien zwischen den Achsenpunkten durch die Funktion ta.barssince (modifizierbarer Bereich)

- Die Logik der Bestätigung:

- Der RSI-Wert hat sich in den letzten drei Monaten deutlich erhöht.

- Rückwärts: Preisinnovationen hoch, RSI bildet niedrigere Höhen

- System für die Ausführung von Transaktionen:

- Doppelmodus-Stoppmechanismus: basierend auf den letzten 20 Zyklen (verstellbar) Schwingungspunkten oder ATR-Schwingungsbreiten

- Dynamische Stop-Loss-Berechnung: Risiko-Rendite-Verhältnis, multipliziert mit dem Risikobetrag und der vorgegebenen Rendite (standard 2: 1)

- Visualisierungssystem: Markieren Sie alle effektiven Abweichsignale auf der Grafik und zeigen Sie in Echtzeit die Stop-Loss (rot) und Stop-Stop-Line (grün) der aktuellen Position.

Analyse der Stärken

- Multi-Dimensionalisierungsmechanismen: Die Anforderung, dass der Preis und der RSI eine bestimmte Form gleichzeitig erfüllen müssen, und die Zeitintervalle innerhalb der voreingestellten Grenzen, reduzieren die Wahrscheinlichkeit von Falschsignalen erheblich.

- Selbständiges Risikomanagement:

- Das Swinging-Point-Modell eignet sich für Trendmärkte und kann die Bandbreite effektiv erfassen.

- ATR-Modell für die Schaukelmarkt, automatische Anpassung der Stop-Loss-Grenze an die Schwankungen

- Die Parameter sind hoch konfigurierbar: Alle wichtigen Parameter (RSI-Zyklus, Pivot-Range, Risiko-Rendite, etc.) können an die Merkmale des Marktes angepasst werden.

- Wissenschaftliche Geldverwaltung: Die Standardposition von 10% wird verwendet, um die übermäßige Risikobereitschaft eines einzelnen Handels zu verhindern.

- Echtzeit visuelle Rückmeldung: Intuitive Unterstützung bei der Entscheidungsfindung durch Diagrammarbeitungen und dynamische Stop/Stop-Linien.

Risikoanalyse

- Rückstandsrisiko: Der RSI als Rückstandsindikator kann in einer heftigen einseitigen Situation ein Verzögerungssignal erzeugen. Minderung: Kombination mit einem Trendfilter oder Verkürzung des RSI-Zyklus.

- Schwankungsrisiko: Es kann zu einer Folge von Falschsignalen kommen, wenn keine eindeutige Trendentwicklung vorliegt. Abwehr: Aktivieren Sie den ATR-Modus und erhöhen Sie die Maximalzahl oder fügen Sie einen Fluktuationsfilter hinzu.

- Risiko von Parameterüberschneidung: Eine bestimmte Parameterkombination kann in historischen Daten gut abschneiden, aber in der Realität nicht funktionieren. Minderungsschema: Multi-Zyklus-Multivariate-Stresstests.

- Extreme Marktrisiken: Leerlauf-Lücken können zu Stop-Loss-Effekten führen. Minderung: Vermeiden Sie den Handel vor oder nach einem großen wirtschaftlichen Ereignis oder nutzen Sie die Optionssicherung.

- Zeitrahmenabhängigkeit: Unterschiedliche Zeitspannen führen zu sehr unterschiedlichen Leistungen. Mitigationsschema: Optimierung mit voller Rückverfolgung innerhalb des Zielzeitrahmens.

Optimierungsrichtung

- Komplex-Verifizierung: Hinzufügen von MACD oder Transaktionsmengen als zweite Bestätigung, um die Signalqualität zu verbessern.

- Dynamische Parameter-Anpassung: Automatische Anpassung der RSI-Zyklen und ATR-Multiplikatoren an die Marktschwankungen.

- Optimierung durch maschinelles Lernen: Optimierung von Schlüsselparameterkombinationen mit genetischen Algorithmen.

- Mehrzeit-Analyse: Trends für höhere Zeiträume filtern.

- Positionsdynamik: Anpassung der Positionsgröße an die Volatilität, um das Risiko auszugleichen.

- Ereignisfilter: Integration von Wirtschaftskalenderdaten, um Transaktionen vor und nach der Veröffentlichung wichtiger Daten zu vermeiden.

Zusammenfassen

Die RSI-Doppel-Achse-Abweichungs-Quantifizierungsstrategie bietet eine strukturierte Umkehrungsmethode für den Handel durch systematische Abweichungs-Identifizierung und strenge Risikomanagement. Ihr Kernwert liegt in der Umwandlung traditioneller technischer Analyse-Konzepte in quantifizierbare Handelsregeln und der Anpassung an verschiedene Marktumgebungen durch ein Dual-Modell-Stopp-Loss-Mechanismus.

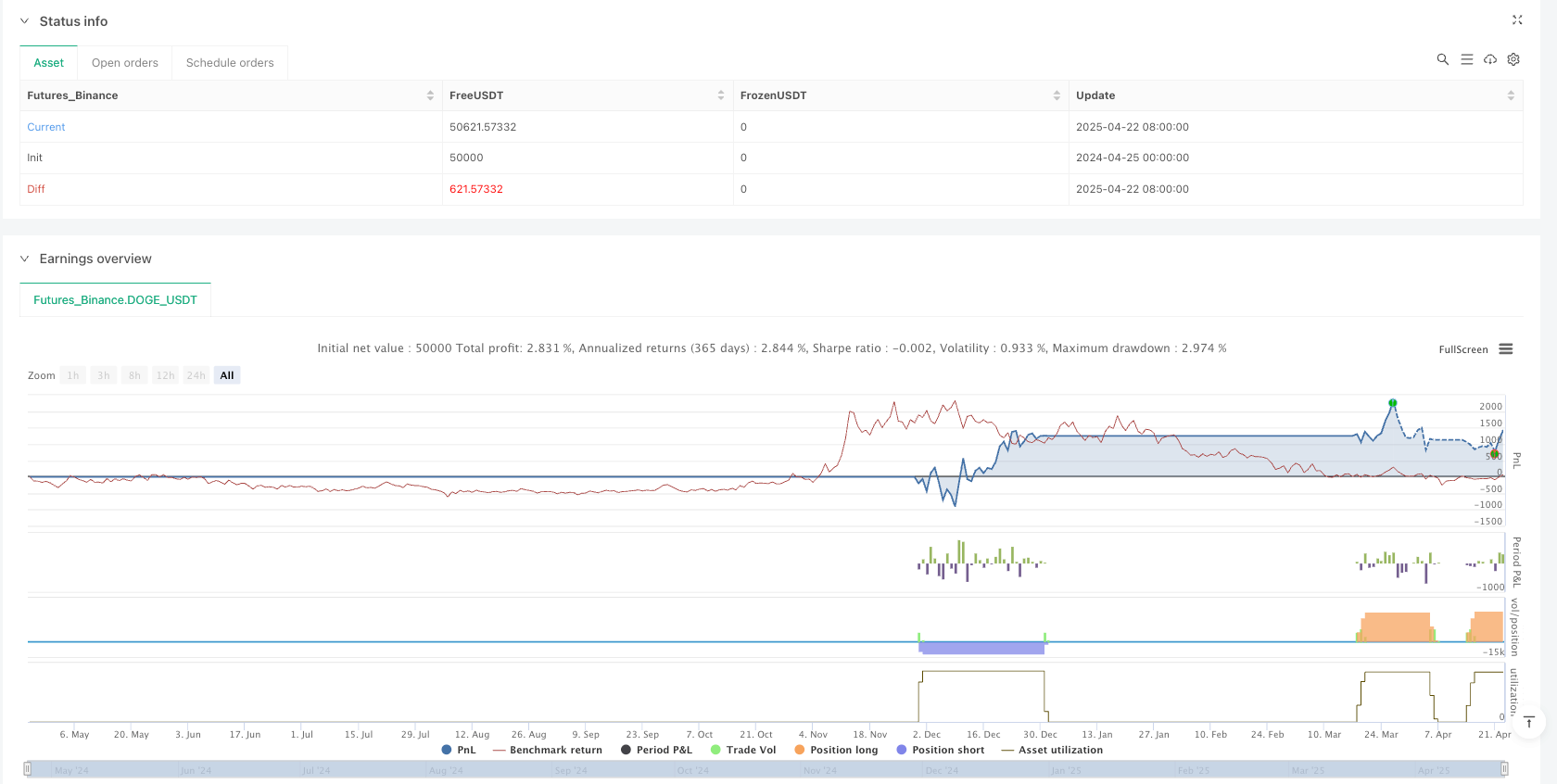

/*backtest

start: 2024-04-25 00:00:00

end: 2025-04-23 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("RSI Divergence Strategy - AliferCrypto", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === RSI Settings ===

rsiLength = input.int(14, minval=1, title="RSI Length", group="RSI Settings", tooltip="Number of periods for RSI calculation")

rsiSource = input.source(close, title="RSI Source", group="RSI Settings", tooltip="Price source used for RSI calculation")

// === Divergence Settings ===

lookLeft = input.int(5, minval=1, title="Pivot Lookback Left", group="Divergence Settings", tooltip="Bars to the left for pivot detection")

lookRight = input.int(5, minval=1, title="Pivot Lookback Right", group="Divergence Settings", tooltip="Bars to the right for pivot detection")

rangeLower = input.int(5, minval=1, title="Min Bars Between Pivots", group="Divergence Settings", tooltip="Minimum bars between pivots to validate divergence")

rangeUpper = input.int(60, minval=1, title="Max Bars Between Pivots", group="Divergence Settings", tooltip="Maximum bars between pivots to validate divergence")

// === SL/TP Method ===

method = input.string("Swing", title="SL/TP Method", options=["Swing", "ATR"], group="SL/TP Settings", tooltip="Choose between swing-based or ATR-based stop and target")

// === Swing Settings ===

swingLook = input.int(20, minval=1, title="Swing Lookback (bars)", group="Swing Settings", tooltip="Bars to look back for swing high/low")

swingMarginPct = input.float(1.0, minval=0.0, title="Swing Margin (%)", group="Swing Settings", tooltip="Margin around swing levels as percentage of price")

rrSwing = input.float(2.0, title="R/R Ratio (Swing)", group="Swing Settings", tooltip="Risk/reward ratio when using swing-based method")

// === ATR Settings ===

atrLen = input.int(14, minval=1, title="ATR Length", group="ATR Settings", tooltip="Number of periods for ATR calculation")

atrMult = input.float(1.5, minval=0.1, title="ATR SL Multiplier", group="ATR Settings", tooltip="Multiplier for ATR-based stop loss calculation")

rrAtr = input.float(2.0, title="R/R Ratio (ATR)", group="ATR Settings", tooltip="Risk/reward ratio when using ATR-based method")

// === RSI Calculation ===

_d = ta.change(rsiSource)

up = ta.rma(math.max(_d, 0), rsiLength)

down = ta.rma(-math.min(_d, 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// === Divergence Detection ===

defPl = not na(ta.pivotlow(rsi, lookLeft, lookRight))

defPh = not na(ta.pivothigh(rsi, lookLeft, lookRight))

rsiAtRR = rsi[lookRight]

barsPl = ta.barssince(defPl)

barsPl1 = barsPl[1]

inRangePL = barsPl1 >= rangeLower and barsPl1 <= rangeUpper

barsPh = ta.barssince(defPh)

barsPh1 = barsPh[1]

inRangePH = barsPh1 >= rangeLower and barsPh1 <= rangeUpper

prevPlRsi = ta.valuewhen(defPl, rsiAtRR, 1)

prevPhRsi = ta.valuewhen(defPh, rsiAtRR, 1)

prevPlPrice = ta.valuewhen(defPl, low[lookRight], 1)

prevPhPrice = ta.valuewhen(defPh, high[lookRight], 1)

bullCond = defPl and low[lookRight] < prevPlPrice and rsiAtRR > prevPlRsi and inRangePL

bearCond = defPh and high[lookRight] > prevPhPrice and rsiAtRR < prevPhRsi and inRangePH

plotshape(bullCond, title="Bullish Divergence", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(bearCond, title="Bearish Divergence", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

// === Entries ===

if bullCond

strategy.entry("Long", strategy.long)

if bearCond

strategy.entry("Short", strategy.short)

// === Pre-calculate SL/TP components ===

swingLow = ta.lowest(low, swingLook)

swingHigh = ta.highest(high, swingLook)

atrValue = ta.atr(atrLen)

// === SL/TP Calculation & Exits ===

var float slPrice = na

var float tpPrice = na

var float rr = na

// Long exits

if strategy.position_size > 0

entryPrice = strategy.position_avg_price

if method == "Swing"

slPrice := swingLow * (1 - swingMarginPct / 100)

rr := rrSwing

else

slPrice := entryPrice - atrValue * atrMult

rr := rrAtr

risk = entryPrice - slPrice

tpPrice := entryPrice + risk * rr

strategy.exit("Exit Long", from_entry="Long", stop=slPrice, limit=tpPrice)

// Short exits

if strategy.position_size < 0

entryPrice = strategy.position_avg_price

if method == "Swing"

slPrice := swingHigh * (1 + swingMarginPct / 100)

rr := rrSwing

else

slPrice := entryPrice + atrValue * atrMult

rr := rrAtr

risk = slPrice - entryPrice

tpPrice := entryPrice - risk * rr

strategy.exit("Exit Short", from_entry="Short", stop=slPrice, limit=tpPrice)

// === Plot SL/TP Levels ===

plot(strategy.position_size != 0 ? slPrice : na, title="Stop Loss", style=plot.style_linebr, color=color.red)

plot(strategy.position_size != 0 ? tpPrice : na, title="Take Profit", style=plot.style_linebr, color=color.green)

// === Alerts ===

alertcondition(bullCond, title="Bull RSI Divergence", message="Bullish RSI divergence detected")

alertcondition(bearCond, title="Bear RSI Divergence", message="Bearish RSI divergence detected")