Überblick

Die Multi-Cycle Dynamic Volatility Tracking Strategie ist ein Short-Line-Trading-System, das eine Kombination aus einem Fast/Slow Index Moving Average (EMA) Crossover und einem relativ starken Index (RSI) Filter verwendet. Die Strategie konzentriert sich auf die Suche nach Rückschlagsmöglichkeiten innerhalb eines dominanten kurzfristigen Trends und reduziert den Handelsrauschen durch mehrere Bestätigungsmechanismen.

Strategieprinzip

Die Strategie basiert auf einer mehrschichtigen Signalstapel-Architektur:

- Trends erkennenDie Richtung des Mikrotrends wird durch die Kreuzung des schnellen EMA mit dem langsamen EMA beurteilt. Wenn der schnelle EMA über dem langsamen EMA liegt, wird er als bullish identifiziert; umgekehrt als bearish.

- Das ist eine gute Idee.Es ist nur erlaubt, mehr zu machen, wenn der RSI unter dem Überkauf liegt. Es ist nur erlaubt, weniger zu machen, wenn der RSI über dem Überverkauf liegt.

- K-Linie-BestätigungsmechanismusDie Signalbedingungen erfordern eine Reihe von K-Leitung, um Marktlärm zu filtern.

- Eintritt ausgelöst: Marktaufträge werden ausgegeben, wenn die K-Zeile im Bestätigungsfenster erscheint.

- Erste SchadensbegrenzungDie ATR-basierte Volatilitätsanpassung und die dynamische Anpassung an das relative Handelsvolumen.

- Verfolgung der Stop-Loss-LogikDie Optimierung von Pivot-Points und ATR-basierten Stop-Loss-Systemen zur Erreichung von Profitlocking.

- RSI-Überwachung im hohen ZeitrahmenDas ist eine sehr wichtige Aufgabe für die Banken, die sich mit dem Markt befassen und sich damit beschäftigen.

- Klassifizierte GewinnzieleDas Ziel ist es, drei ATR-basierte Zielpositionen zu erstellen, um eine schrittweise Verlagerung zu ermöglichen.

- HandelsbeschränkungEs gibt eine begrenzte Anzahl von Transaktionen pro Trendphase, um zu verhindern, dass übertrieben wird.

Die Schlüsselinnovation der Strategie besteht darin, dass mehrere technische Indikatoren mit Indikatoren für das Marktverhalten (z. B. Handelsvolumen, Volatilität) in einem anpassungsfähigen Handelssystem kombiniert werden, das die Parameter automatisch an unterschiedliche Marktbedingungen anpasst.

Strategische Vorteile

- AnpassungsfähigkeitDie Strategie kann sich an unterschiedliche Marktschwankungen anpassen, ohne dass die Parameter häufig neu optimiert werden müssen.

- Mehrere Ebenen des RisikomanagementsDie Kombination von Initial Stop, Tracking Stop, Partial Profit und Multi-Cycle-RSI-Filterung bildet ein vollständiges Risikokontrollsystem.

- LärmfilterDie Bestätigung der K-Linie reduziert die Anzahl der Falschmeldungen und verbessert die Qualität der Transaktionen.

- BewegungsempfindungDie Risikogrenze wird automatisch bei geringer Liquidität eingeschränkt.

- Überwachung der TrendreifeEs wird empfohlen, die Anzahl der zulässigen Transaktionen automatisch zu reduzieren, um zu vermeiden, dass zu viele Transaktionen im späteren Trendstadium stattfinden.

- Flexible ProfitmechanismenDie drei-Level-Teilgewinn-Strategie erlaubt es, einen Teil des Gewinns zu sperren, wenn die Preisentwicklung günstig ist, und gleichzeitig Raum für einen Anstieg zu behalten.

- Überkreislauf-AnalyseDie RSI-Überwachung im hohen Zeitrahmen bietet einen breiteren Blick auf den Markthintergrund und verhindert, dass bei einer großen Trendwende auf Mikrosignale festgehalten wird.

- Einfachheit der AusführungMit der Integration von PineConnector können Strategien leicht automatisiert werden, was menschliche Interventionen und emotionale Auswirkungen reduziert.

Strategisches Risiko

- Rückzug RisikenTrotz vielschichtiger Risikokontrollen kann die Strategie unter extremen Marktbedingungen (z. B. Sprünge, Blitzkriege) mit einem höheren als erwarteten Rückzug konfrontiert sein. Die Reaktion ist eine angemessene Verringerung der Positionsgröße oder eine Erhöhung des ATR-Multiplikators.

- ParameterempfindlichkeitEs wird empfohlen, Schritt-für-Schritt-Tests zu verwenden, anstatt In-Sample-Optimierung.

- Hochfrequenz-TransaktionskostenAls Kurzlinien-Strategie kann die hohe Handelsfrequenz und die kumulierten Handelskosten (Differenz, Provisionen) erhebliche Auswirkungen auf die tatsächlichen Erträge haben. Die tatsächlichen Handelskosten sollten in der Rückmeldung berücksichtigt werden.

- Die Gefahr der VerzögerungDie Ausführungsverzögerung von PineConnector (ca. 100-300 ms) kann zu einer Erhöhung des Slippings in hochflüchtigen Märkten führen. Es wird nicht empfohlen, in Märkten mit extremer Volatilität oder geringer Liquidität zu arbeiten.

- Neugestaltung der DrehscheibeAuf einer hyperkurzen Graphik unterhalb der Minutenlinie können die Achsenpunkte während der K-Linienbildung in Echtzeit neu gezeichnet werden, was die Stop-Loss-Genauigkeit beeinträchtigt.

- Trends erkennen und hinterherlaufenTrends mit EMA-Kreuzungen sind von Natur aus nachlässig und können zu Beginn des Trends einen Teil des Trends übersehen.

- Risiken von übermäßiger HebelwirkungWenn Sie zu viele Positionsmultiplizierungen einrichten, kann dies dazu führen, dass das Risiko für einen einzelnen Handel zu hoch ist und das Konto schnell erschöpft wird.

Richtung der Strategieoptimierung

- Maschinelle LernoptimierungDie Einführung von Machine-Learning-Algorithmen zur dynamischen Anpassung der EMA- und RSI-Parameter an unterschiedliche Marktbedingungen. Dies löst das Problem, dass feste Parameter in verschiedenen Marktphasen nicht anpassungsfähig sind.

- Klassifizierung der MarktsituationErhöhung der Aggregation der Volatilitätsanalysen, Aufteilung der Märkte in Hoch-, Mittel- und Niedrig-Volatilitätszustände und Verwendung differenzierter Handelsparameter für die verschiedenen Zustände. Dies erhöht die Anpassungsfähigkeit der Strategie in wechselnden Märkten.

- Mehrindikator-KonsensDie Integration anderer Dynamik- und Trendindikatoren (z. B. MACD, Brinband, KDJ) in ein Kennzeichen-Konsenssystem, das nur dann signalisiert wird, wenn sich die meisten Indikatoren einigen. Dies hilft, falsche Signale zu reduzieren.

- Intelligentes ZeitfilterEs ist wichtig, dass Sie sich mit der Analyse von Marktzeiten und -schwankungen befassen, um ineffiziente Handelszeiten und bekannte hochvolatile Ereignisse (wie die Veröffentlichung wichtiger Wirtschaftsdaten) zu vermeiden.

- Prozentsatz der Erträge aus dem dynamischen TeilDer Prozentsatz und die Zielentfernung des Gewinns werden automatisch an die Marktfluktuation und die Trendstärke angepasst. Bei starken Trends werden mehr Positionen gehalten, während bei schwachen Trends wird aktiver profitiert.

- ZurückziehungEinführung eines Risikovergleichsmechanismus, der auf einem historischen Rückzugmodell basiert und automatisch die Handelsfrequenz reduziert oder die Stop-Loss-Distanz erhöht, wenn ein Vorzeichen eines ähnlichen historischen Rückzugs festgestellt wird.

- Hochfrequenz-Daten: Integration von Tick-Level-Daten zur Einstiegsoptimierung, zur Verringerung von Gleitpunkten und zur Verbesserung der Einstiegspreise, sofern die Bedingungen es zulassen.

- Analyse der MarktübergreifungDie Analyse der Verknüpfungen mit den relevanten Märkten und die Nutzung der Vor- und Rückstandsbeziehungen zwischen den Märkten zur Verbesserung der Signalqualität.

Zusammenfassen

Die Multi-Cycle Dynamic Rate Tracking Strategie ist ein Short-Line-Trading-System, das klassische technische Analyse-Tools mit modernen, quantitativen Risikomanagement-Methoden kombiniert. Es baut über eine mehrschichtige Signalstapel-Architektur, kombiniert mit EMA-Trenderkennung, RSI-Dynamik-Filterung, einer kontinuierlichen K-Line-Bestätigungsmechanik, ATR-Rate-Anpassung und Multi-Cycle-Analyse, einen umfassenden Rahmen für Handelsentscheidungen auf. Das herausragende Merkmal der Strategie ist die Fähigkeit des Adaptive-Systems, die Handelsparameter und Risikokontrollmaßnahmen automatisch an die Marktfluktuation, das Handelsvolumen und die Trendreife anzupassen.

Trotz einiger inhärenter Risiken, wie Parameter-Sensitivität, Hochfrequenz-Transaktionskosten und Verzögerungsrisiken, können diese Risiken durch vernünftiges Kapitalmanagement und kontinuierliche Optimierung wirksam kontrolliert werden. Die zukünftige Optimierungsrichtung konzentriert sich hauptsächlich auf die Optimierung von Machine Learning-Parametern, die Klassifizierung von Marktzuständen, Multi-Indicator-Konsensmechanismen und das dynamische Risikomanagement.

Die Strategie bietet einen strukturierten Rahmen für Händler, die eine Trendrückführung in einem kurzen Markt erwarten, um die Notwendigkeit der Erfassung von Handelschancen und Risikokontrolle auszugleichen. Wie bei allen Handelsstrategien sollte die praktische Anwendung jedoch zuerst auf einem Simulationskonto ausgiebig getestet und die Parameter entsprechend der individuellen Risikobereitschaft und der Größe des Kapitals angepasst werden.

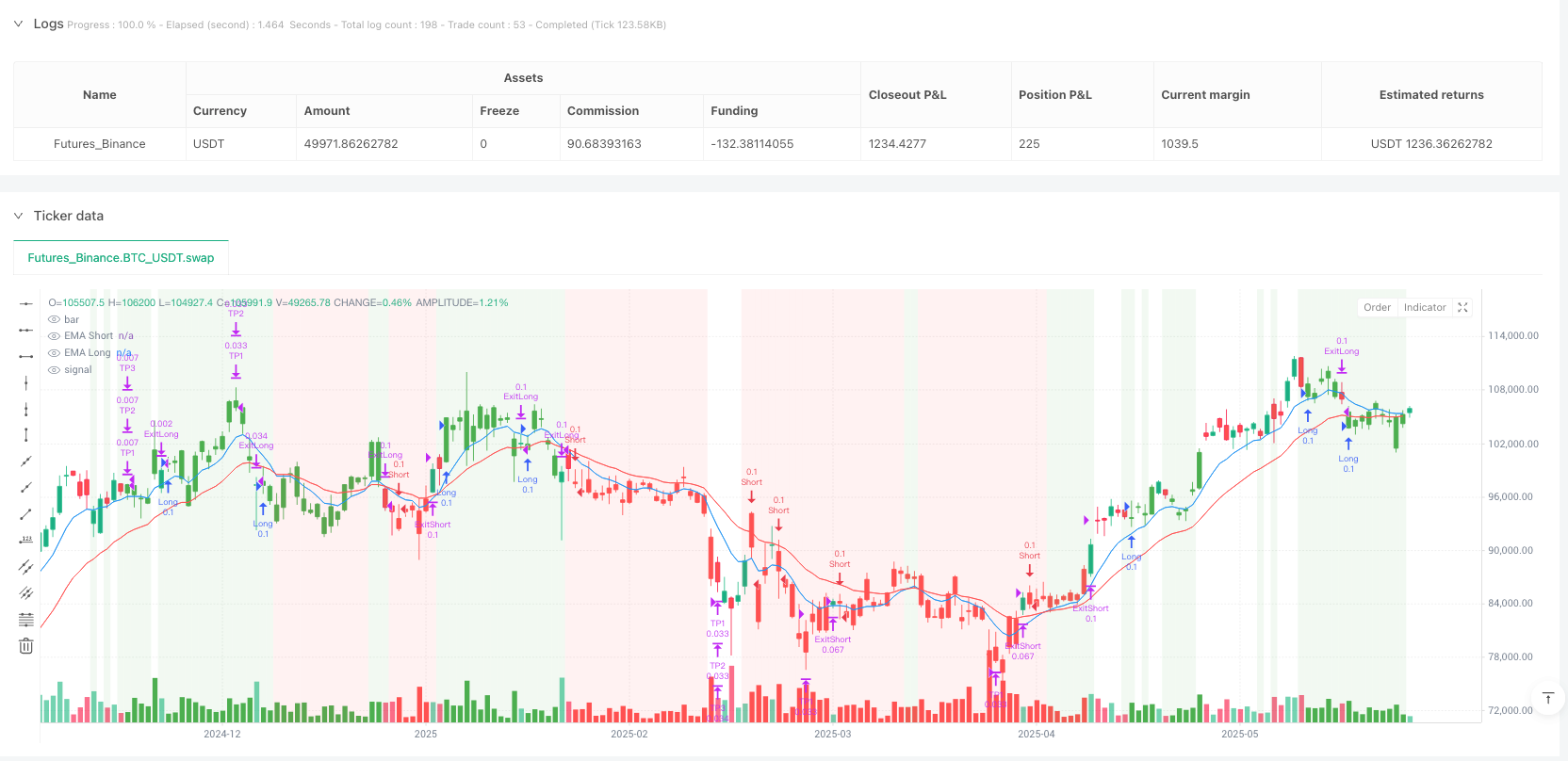

/*backtest

start: 2024-09-15 00:00:00

end: 2025-06-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.comment}}

// © AlgoSystems

strategy("Scalping Trend Power for MT5 - Updated", overlay=true, calc_on_every_tick=false)

//-------------------------------------------------------------------

// Function: confirm a condition for N consecutive bars

//-------------------------------------------------------------------

f_confirm(cond, bars) =>

_ok = true

for i = 0 to bars - 1

_ok := _ok and cond[i]

_ok

//-------------------------------------------------------------------

// Inputs: strategy parameters & PineConnector

//-------------------------------------------------------------------

lotSize = input.float(0.1, title="Lot Size")

lotMultiplier = input.float(1.0, title="Lot Multiplier", minval=0.1, step=0.1)

contractType = input.string("FX", title="Contract Type", options=["FX", "CFD", "Futures"])

// (kept for potential future use)

riskPercentage = input.float(1.0, title="Risk per Trade (%)")

riskRewardRatio = input.float(1.2, title="Risk/Reward Ratio", step=0.1)

trailingStopMultiplier = input.float(1.2, title="Trailing-Stop Multiplier", step=0.1)

emaShortLength = input.int(9, title="EMA Short Length")

emaLongLength = input.int(21, title="EMA Long Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

higherTF = input.timeframe("30", title="Higher Time-Frame for Exit")

higherRsiOverbought = input.int(70, title="Higher-TF RSI Overbought", minval=50)

higherRsiOversold = input.int(30, title="Higher-TF RSI Oversold", minval=10)

pivotLookback = input.int(5, title="Pivot Look-Back Period", minval=2, step=1)

volumeLookback = input.int(20, title="Volume Look-Back Period", minval=5, step=1)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1, step=0.1)

enablePartialExit = input.bool(true, title="Enable Partial Exit")

tp1ProfitMult = input.float(1.0, title="TP1 Profit Multiplier", step=0.1)

tp2ProfitMult = input.float(1.5, title="TP2 Profit Multiplier", step=0.1)

tp3ProfitMult = input.float(2.0, title="TP3 Profit Multiplier", step=0.1)

tp1ExitPercentage = input.float(33, title="TP1 Exit (%)", minval=1, maxval=100, step=1)

tp2ExitPercentage = input.float(33, title="TP2 Exit (%)", minval=1, maxval=100, step=1)

tp3ExitPercentage = input.float(34, title="TP3 Exit (%)", minval=1, maxval=100, step=1)

confirmBars = input.int(2, title="Confirmation Bars", minval=1, step=1)

baseLongTrades = 5

tradeDecreaseFactor = input.int(0, title="Trade Decrease Factor", minval=0)

maxLongTradesPerTrend = math.max(1, baseLongTrades - tradeDecreaseFactor)

activatePineConnector = input.bool(false, title="Activate PineConnector")

pineConnectorLicense = input.string("", title="PineConnector License Code")

//-------------------------------------------------------------------

// Indicator calculations

//-------------------------------------------------------------------

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

rsiValue = ta.rsi(close, rsiLength)

atrValue = ta.atr(atrLength)

// ATR-based TP & SL

dynamicTP = atrValue * riskRewardRatio

dynamicSL = atrValue * trailingStopMultiplier

rawLongSignal = emaShort > emaLong and rsiValue < rsiOverbought

rawShortSignal = emaShort < emaLong and rsiValue > rsiOversold

longSignal = f_confirm(rawLongSignal, confirmBars)

shortSignal = f_confirm(rawShortSignal, confirmBars)

//-------------------------------------------------------------------

// Dynamic ticker symbol (remove exchange prefix if any)

//-------------------------------------------------------------------

var string dynSymbol = na

if bar_index == 0

parts = str.split(syminfo.tickerid, ":")

dynSymbol := array.size(parts) > 1 ? array.get(parts, 1) : syminfo.tickerid

//-------------------------------------------------------------------

// PineConnector messages (no "lots=" or "contract=" – updated syntax)

// The value after risk= is interpreted as LOTS if EA’s VolumeType = "Lots".

//-------------------------------------------------------------------

prefix = activatePineConnector and (pineConnectorLicense != "") ? pineConnectorLicense + "," : ""

calculatedLot = lotSize * lotMultiplier // actual order volume

// ENTRY messages

riskValue = str.tostring(calculatedLot) // risk= interpreted as lots

txtBuy = prefix + "buy," + dynSymbol + ",risk=" + riskValue

txtSell = prefix + "sell," + dynSymbol + ",risk=" + riskValue

// CLOSE FULL messages

txtCloseLong = prefix + "closelong," + dynSymbol

txtCloseShort = prefix + "closeshort," + dynSymbol

// Helper to compute risk= for partial exits

f_partialRisk(pct) => str.tostring(calculatedLot * pct / 100)

// PARTIAL EXIT messages

msgTP1Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

msgTP1Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

//-------------------------------------------------------------------

// Higher-time-frame RSI request

//-------------------------------------------------------------------

higherRsi = request.security(syminfo.tickerid, higherTF, ta.rsi(close, rsiLength))

//-------------------------------------------------------------------

// State variables

//-------------------------------------------------------------------

var bool inLongTrade = false

var bool inShortTrade = false

var int longTradeCount = 0

var float trailingStopLevel = na

var bool tp1_exited = false

var bool tp2_exited = false

var bool tp3_exited = false

//-------------------------------------------------------------------

// Entry/Exit logic

//-------------------------------------------------------------------

if barstate.isconfirmed

avgVol = ta.sma(volume, volumeLookback)

volRatio = avgVol != 0 ? volume / avgVol : 1.0

adjSL = dynamicSL / (volRatio * volumeMultiplier)

pivotH = ta.pivothigh(high, pivotLookback, pivotLookback)

pivotL = ta.pivotlow(low, pivotLookback, pivotLookback)

// LONG entry

if longSignal and not inLongTrade and not inShortTrade and longTradeCount < maxLongTradesPerTrend

strategy.entry("Long", strategy.long, qty=calculatedLot, comment="Long Entry")

if activatePineConnector

alert(txtBuy, alert.freq_once_per_bar)

inLongTrade := true

inShortTrade := false

longTradeCount += 1

trailingStopLevel := low - adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// SHORT entry

if shortSignal and not inShortTrade and not inLongTrade

strategy.entry("Short", strategy.short, qty=calculatedLot, comment="Short Entry")

if activatePineConnector

alert(txtSell, alert.freq_once_per_bar)

inShortTrade := true

inLongTrade := false

trailingStopLevel := high + adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// Trailing-stop update

if inLongTrade

baseStop = close - adjSL

trailingStopLevel := (not na(pivotL) and pivotL > trailingStopLevel) ? pivotL : math.max(trailingStopLevel, baseStop)

if inShortTrade

baseStop = close + adjSL

trailingStopLevel := (not na(pivotH) and pivotH < trailingStopLevel) ? pivotH : math.min(trailingStopLevel, baseStop)

// Dynamic TPs & partial exits

if enablePartialExit and strategy.position_size != 0

avgPrice = strategy.position_avg_price

direction = strategy.position_size > 0 ? 1 : -1

tp1 = avgPrice + direction * dynamicTP * tp1ProfitMult

tp2 = avgPrice + direction * dynamicTP * tp2ProfitMult

tp3 = avgPrice + direction * dynamicTP * tp3ProfitMult

// TP1

if not tp1_exited and f_confirm(direction > 0 ? close >= tp1 : close <= tp1, confirmBars)

strategy.exit("TP1", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp1ExitPercentage, limit=tp1, comment=direction>0 ? msgTP1Long : msgTP1Short)

if activatePineConnector

alert(direction>0 ? msgTP1Long : msgTP1Short, alert.freq_once_per_bar)

tp1_exited := true

// TP2

if not tp2_exited and f_confirm(direction > 0 ? close >= tp2 : close <= tp2, confirmBars)

strategy.exit("TP2", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp2ExitPercentage, limit=tp2, comment=direction>0 ? msgTP2Long : msgTP2Short)

if activatePineConnector

alert(direction>0 ? msgTP2Long : msgTP2Short, alert.freq_once_per_bar)

tp2_exited := true

// TP3

if not tp3_exited and f_confirm(direction > 0 ? close >= tp3 : close <= tp3, confirmBars)

strategy.exit("TP3", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp3ExitPercentage, limit=tp3, comment=direction>0 ? msgTP3Long : msgTP3Short)

if activatePineConnector

alert(direction>0 ? msgTP3Long : msgTP3Short, alert.freq_once_per_bar)

tp3_exited := true

// FULL exit (trailing stop or opposite signals)

exitCondLong = inLongTrade and (close < trailingStopLevel or rsiValue > rsiOverbought or higherRsi > higherRsiOverbought)

exitCondShort = inShortTrade and (close > trailingStopLevel or rsiValue < rsiOversold or higherRsi < higherRsiOversold)

if exitCondLong and f_confirm(exitCondLong, confirmBars)

strategy.exit("ExitLong", from_entry="Long", stop=trailingStopLevel, comment=txtCloseLong)

if activatePineConnector

alert(txtCloseLong, alert.freq_once_per_bar)

inLongTrade := false

if exitCondShort and f_confirm(exitCondShort, confirmBars)

strategy.exit("ExitShort", from_entry="Short", stop=trailingStopLevel, comment=txtCloseShort)

if activatePineConnector

alert(txtCloseShort, alert.freq_once_per_bar)

inShortTrade := false

// Reset counter when the bullish trend ends

if not rawLongSignal

longTradeCount := 0

//-------------------------------------------------------------------

// Plot & styling

//-------------------------------------------------------------------

plot(emaShort, color=color.blue, linewidth=1, title="EMA Short")

plot(emaLong , color=color.red , linewidth=1, title="EMA Long")

barcolor(inLongTrade ? color.new(color.green,0) : inShortTrade ? color.new(color.red,0) : na)

bgcolor(rawLongSignal ? color.new(color.green,90) : rawShortSignal ? color.new(color.red,90) : na)

// Signal arrows disabled (user request):

// plotshape(longSignal , title="Long signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

// plotshape(shortSignal, title="Short signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//-------------------------------------------------------------------

// HOW TO USE with PineConnector (quick checklist):

// 1. Attach this script to the chart.

// 2. Click the “Alert” bell → Create Alert.

// 3. Condition: “Scalping Trend Power … (Any alert() call)” (or “Order fills only”).

// 4. Webhook URL: https://webhook.pineconnector.com

// 5. Leave the Message box empty – the script fills it.

// 6. On MT5, run the PineConnector EA on the same symbol (dynSymbol) and keep VolumeType = Lots.

// 7. Enter your License ID in the input and tick “Activate PineConnector”.

//-------------------------------------------------------------------