Trend River Pullback-Strategie

EMA RSI ATR CHANDELIER

Was ist ein “Trend River”? Das ist eine tolle Metapher!

Die Strategie stellt sich die fünf EMA-Gleichlinien als einen “Fluss” vor. Wie bei einem echten Fluss gibt es einen Flussboden und eine Flussfläche, so ist der Bereich, der zwischen den fünf Gleichlinien entsteht, unser “Trend-Fluss”.

Es ist so einfach wie die Richtung des Flusses zu sehen - wohin der Fluss fließt, wohin fließen wir

Kernstrategie: Die Fische sollen zurück schwimmen, um ihre Netze zu legen

Wo ist der klügste Teil dieser Strategie? Es geht nicht darum, die Preise zu erhöhen, wenn sie hoch sind, sondern es geht darum, geduldig zu warten, bis sie sich “umkehren”!

Wie funktioniert das?

- Mehrköpfige Signale: Aufwärtstrend + RSI≥60 + Preisrückführung auf 40% tiefe Fluss + erneuter Durchbruch der schnellen EMA

- Hohes Signal: Abwärtstrend + RSI≤40 + Preis rückt auf 40% Höhe des Flusses zurück + erneuter Bruch der schnellen EMA

Es ist wie bei einem Hai, der nicht aufhört zu schwimmen, wenn er auf dem höchsten Sprung ist, sondern wartet, bis er wieder in das bekannte Wasser zurückschwimmt!

Risikomanagement: Mit nur 1% des Kapitals riskieren

Das Beste an dieser Strategie ist die automatische Berechnung der Positionsgröße:

- Das Risiko für jede Transaktion wird auf 1% des Kapitals begrenzt

- Setzen Sie den Stop-Loss mit dem ATR-Indikator ((2x ATR))

- Das Verhältnis von Gewinn und Verlust wurde auf 2:1 gesetzt.

- Und Chandler verfolgt die Stop Loss-Schutz-Gewinne.

Es ist wie ein Sicherheitsgurt im Auto - nicht um einen Unfall zu verhindern, sondern um sicher zu fahren und Spaß am Fahren zu haben!

Warum ist diese Strategie von Bedeutung?

Die drei Schmerzpunkte der Händler wurden gelöst:

- Nach dem Tod“Wir haben keine Zeit, um zu spielen, wir haben keine Zeit, um zu spielen”.

- Ich weiß nicht, wie viel.Das ist eine sehr gute Idee, aber es ist nicht einfach.

- Ich weiß nicht, wann ich laufen soll.Das ist eine sehr interessante Frage, die sich in den letzten Jahren in vielen Ländern der Welt gestellt hat.

Diese Strategie eignet sich besonders für Trader, die “stark gewinnen” wollen. Sie ist nicht auf der Suche nach Übernachtungs-Reichtum, aber sie hilft Ihnen, im Trend zu bleiben und zu gewinnen! Denken Sie daran, dass es nicht darum geht, am schnellsten zu schwimmen, sondern am bestmöglichen zu schwimmen.

||

🌊 What is “Trend River”? This Analogy is Brilliant!

You know what? This strategy imagines 5 EMA lines as a “river”! Just like a real river has riverbed and surface, when 5 EMAs align properly, the area between them forms our “trend river”. Key point! When the river direction is clear (bullish: fast line above, bearish: fast line below), that’s when our money-making opportunities arrive!

It’s as simple as watching water flow direction - wherever the river flows, that’s where we profit! 💰

🎯 Core Strategy: Wait for Fish to Return Before Casting the Net

What’s the smartest part of this strategy? It doesn’t chase prices during rallies, but patiently waits for “pullbacks”!

How does it work exactly?

- Long signal: Uptrend + RSI≥60 + Price pulls back to 40% river depth + Re-breaks above fast EMA

- Short signal: Downtrend + RSI≤40 + Price bounces to 40% river height + Re-breaks below fast EMA

It’s like fishing - you don’t cast when fish jump highest, but wait for them to return to familiar waters! 🎣

💡 Risk Management: Only Risk 1% Capital Each Time

Here’s the pitfall guide! The most thoughtful part of this strategy is automatic position sizing:

- Each trade risks only 1% of capital

- Uses ATR indicator for stop loss (2x ATR)

- Risk-reward ratio set at 2:1 (earn 2 to risk 1)

- Plus Chandelier trailing stop to protect profits

It’s like wearing a seatbelt while driving - not because you expect an accident, but to enjoy the ride with peace of mind! 🚗

🚀 Why is This Strategy Worth Attention?

Solves three major trader pain points:

- FOMO trading: Wait for pullbacks instead of buying tops

- Position sizing confusion: Auto-calculates position size with controlled risk

- Exit uncertainty: Has stop loss, take profit, and trailing stop

This strategy is perfect for traders who want “steady wins”. It doesn’t promise overnight riches, but helps you profit steadily in trends! Remember: In the river of trading, the most important thing isn’t swimming fastest, but swimming most steadily 🏊♀️

[/trans]

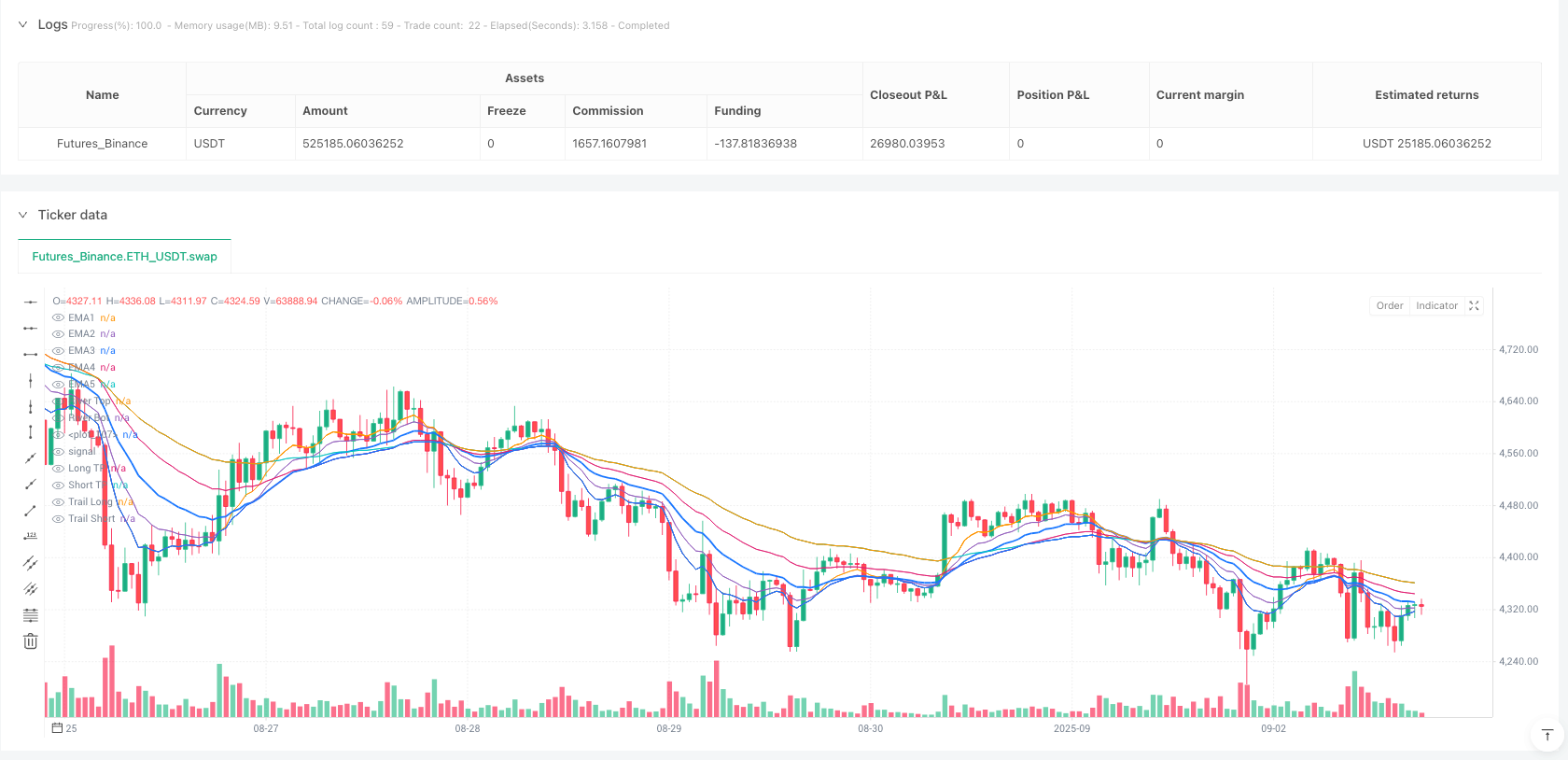

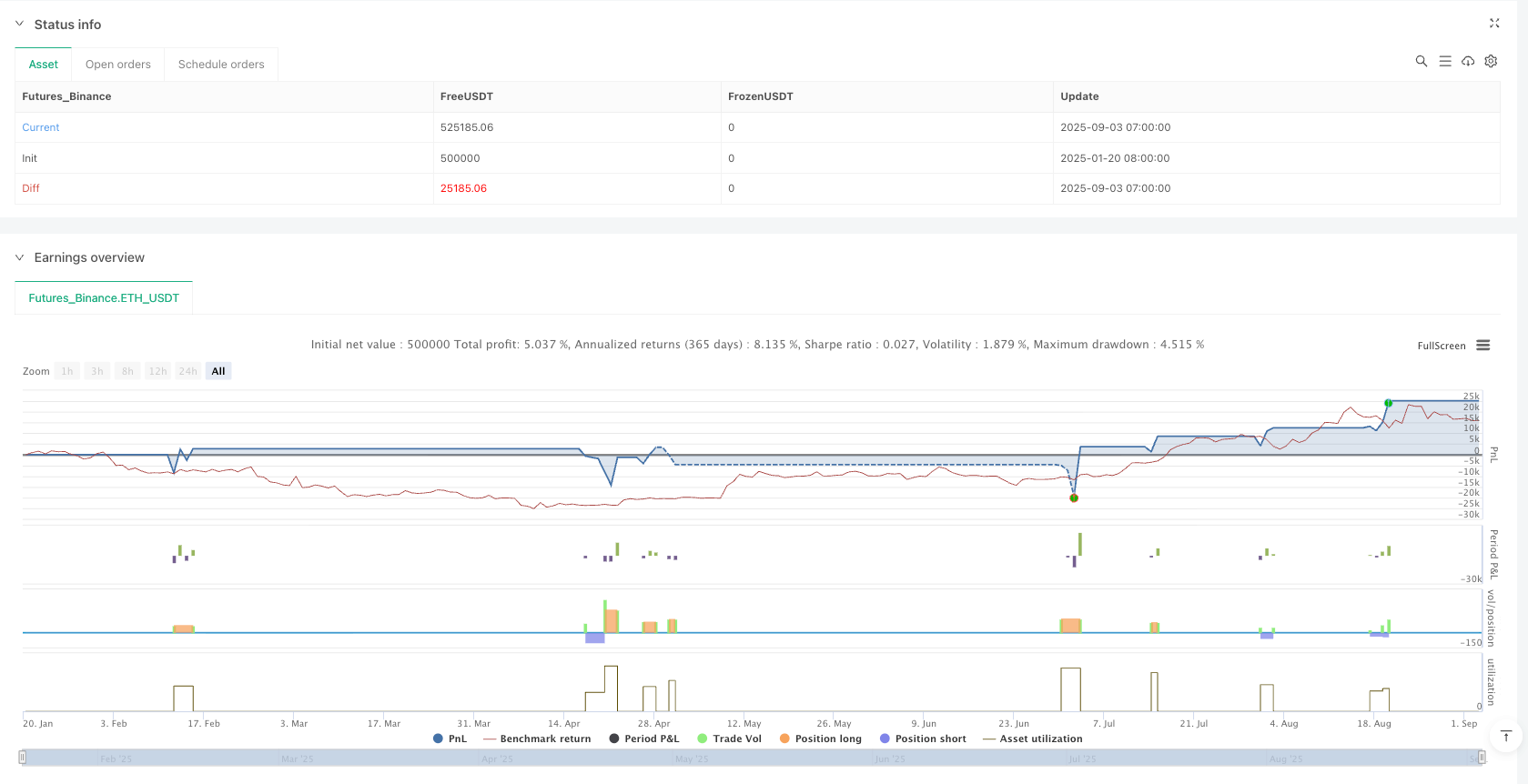

/*backtest

start: 2025-01-20 08:00:00

end: 2025-09-03 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Trend River Pullback Strategy v1",

overlay=true, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.02,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=true, margin_long=1, margin_short=1)

// ===== Inputs

// EMA river

emaFastLen = input.int(8, "EMA1 (fast)")

ema2Len = input.int(13, "EMA2")

emaMidLen = input.int(21, "EMA3 (middle)")

ema4Len = input.int(34, "EMA4")

emaSlowLen = input.int(55, "EMA5 (slow)")

// Pullback and momentum

rsiLen = input.int(14, "RSI length")

rsiOB = input.int(60, "RSI trend threshold (long)")

rsiOS = input.int(40, "RSI trend threshold (short)")

pullbackPct = input.float(40.0, "Pullback depth % of river width", minval=0, maxval=100)

// Risk management

riskPct = input.float(1.0, "Risk per trade % of capital", step=0.1, minval=0.1)

atrLen = input.int(14, "ATR length (stop/trailing)")

atrMultSL = input.float(2.0, "ATR multiplier for stop", step=0.1)

tpRR = input.float(2.0, "Take profit R-multiple", step=0.1)

// Trailing stop

useTrail = input.bool(true, "Enable trailing stop (Chandelier)")

trailMult = input.float(3.0, "ATR multiplier for trailing", step=0.1)

// ===== Calculations

ema1 = ta.ema(close, emaFastLen)

ema2 = ta.ema(close, ema2Len)

ema3 = ta.ema(close, emaMidLen)

ema4 = ta.ema(close, ema4Len)

ema5 = ta.ema(close, emaSlowLen)

// River: top/bottom as envelope of averages

riverTop = math.max(math.max(ema1, ema2), math.max(ema3, math.max(ema4, ema5)))

riverBot = math.min(math.min(ema1, ema2), math.min(ema3, math.min(ema4, ema5)))

riverMid = (riverTop + riverBot) / 2.0

riverWidth = riverTop - riverBot

// Trend conditions: EMA alignment

bullAligned = ema1 > ema2 and ema2 > ema3 and ema3 > ema4 and ema4 > ema5

bearAligned = ema1 < ema2 and ema2 < ema3 and ema3 < ema4 and ema4 < ema5

// Momentum

rsi = ta.rsi(close, rsiLen)

// Pullback into river

pullbackLevelBull = riverTop - riverWidth * (pullbackPct/100.0)

pullbackLevelBear = riverBot + riverWidth * (pullbackPct/100.0)

pullbackOkBull = bullAligned and rsi >= rsiOB and low <= pullbackLevelBull

pullbackOkBear = bearAligned and rsi <= rsiOS and high >= pullbackLevelBear

// Entry trigger: return to momentum (fast EMA crossover)

longTrig = pullbackOkBull and ta.crossover(close, ema1)

shortTrig = pullbackOkBear and ta.crossunder(close, ema1)

// ATR for stops

atr = ta.atr(atrLen)

// ===== Position sizing by risk

capital = strategy.equity

riskMoney = capital * (riskPct/100.0)

// Preliminary stop levels

longSL = close - atrMultSL * atr

shortSL = close + atrMultSL * atr

// Tick value and size

tickValue = syminfo.pointvalue

// Avoid division by zero

slDistLong = math.max(close - longSL, syminfo.mintick)

slDistShort = math.max(shortSL - close, syminfo.mintick)

// Number of contracts/lots

qtyLong = riskMoney / (slDistLong * tickValue)

qtyShort = riskMoney / (slDistShort * tickValue)

// Limit: not less than 0

qtyLong := math.max(qtyLong, 0)

qtyShort := math.max(qtyShort, 0)

// ===== Entries

if longTrig and strategy.position_size <= 0

strategy.entry("Long", strategy.long, qty=qtyLong)

if shortTrig and strategy.position_size >= 0

strategy.entry("Short", strategy.short, qty=qtyShort)

// ===== Exits: fixed TP by R and stop

// Store entry price

var float entryPrice = na

if strategy.position_size != 0 and na(entryPrice)

entryPrice := strategy.position_avg_price

if strategy.position_size == 0

entryPrice := na

// Targets

longTP = na(entryPrice) ? na : entryPrice + tpRR * (entryPrice - longSL)

shortTP = na(entryPrice) ? na : entryPrice - tpRR * (shortSL - entryPrice)

// Trailing: Chandelier

trailLong = close - trailMult * atr

trailShort = close + trailMult * atr

// Final exit levels

useTrailLong = useTrail and strategy.position_size > 0

useTrailShort = useTrail and strategy.position_size < 0

// For long

if strategy.position_size > 0

stopL = math.max(longSL, na)

tStop = useTrailLong ? trailLong : longSL

strategy.exit("L-Exit", from_entry="Long", stop=tStop, limit=longTP)

// For short

if strategy.position_size < 0

stopS = math.min(shortSL, na)

tStopS = useTrailShort ? trailShort : shortSL

strategy.exit("S-Exit", from_entry="Short", stop=tStopS, limit=shortTP)

// ===== Visuals

plot(ema1, "EMA1", display=display.all, linewidth=1)

plot(ema2, "EMA2", display=display.all, linewidth=1)

plot(ema3, "EMA3", display=display.all, linewidth=2)

plot(ema4, "EMA4", display=display.all, linewidth=1)

plot(ema5, "EMA5", display=display.all, linewidth=1)

plot(riverTop, "River Top", style=plot.style_linebr, linewidth=1)

plot(riverBot, "River Bot", style=plot.style_linebr, linewidth=1)

fill(plot1=plot(riverTop, display=display.none), plot2=plot(riverBot, display=display.none), title="River Fill", transp=80)

plot(longTP, "Long TP", style=plot.style_linebr)

plot(shortTP, "Short TP", style=plot.style_linebr)

plot(useTrailLong ? trailLong : na, "Trail Long", style=plot.style_linebr)

plot(useTrailShort ? trailShort : na, "Trail Short", style=plot.style_linebr)

// Signal markers

plotshape(longTrig, title="Long Trigger", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="L")

plotshape(shortTrig, title="Short Trigger", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="S")

// ===== Alerts

alertcondition(longTrig, title="Long Signal", message="Long signal: trend aligned + pullback + momentum")

alertcondition(shortTrig, title="Short Signal", message="Short signal: trend aligned + pullback + momentum")