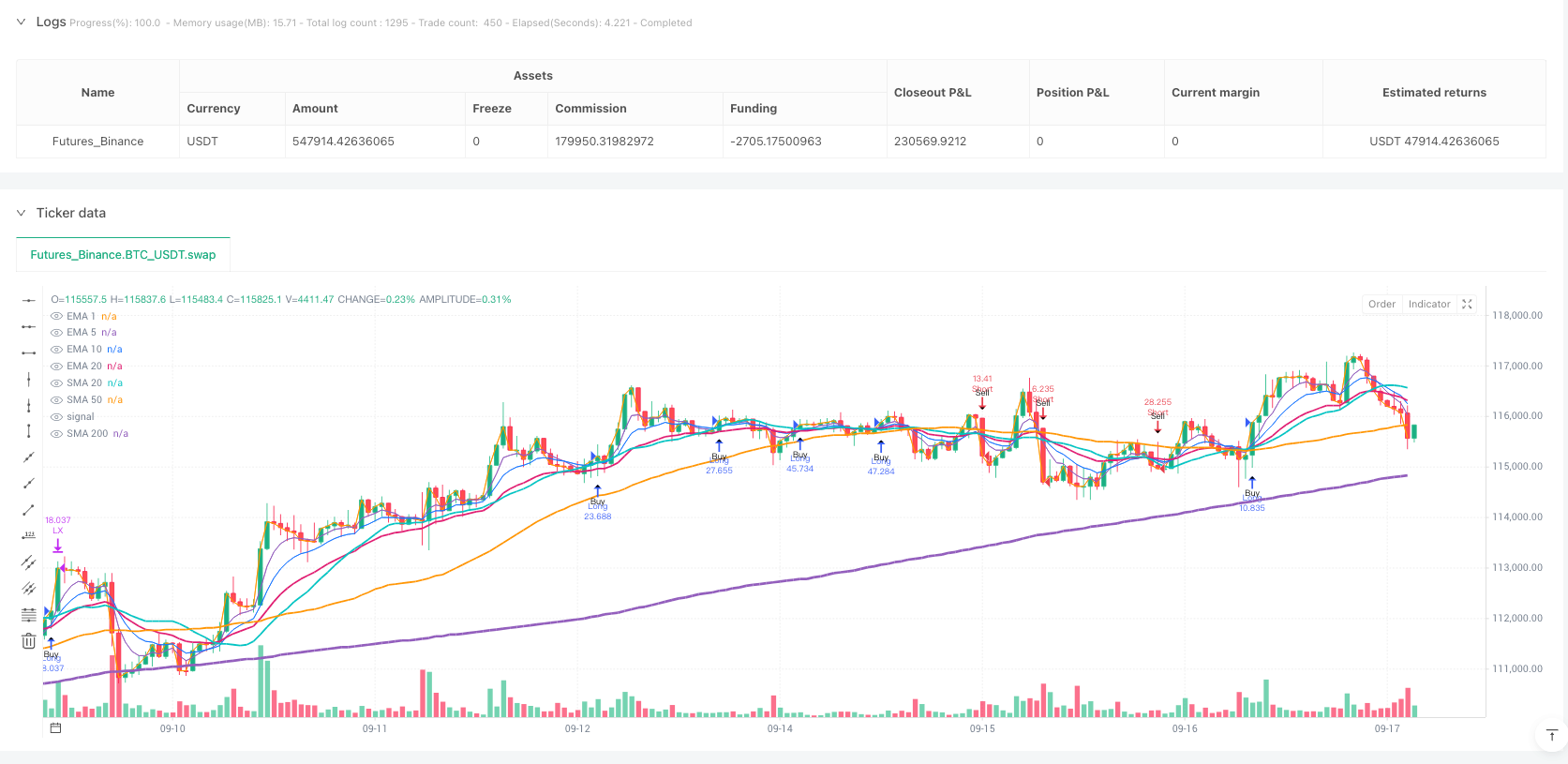

Kernpunkte der Strategie

Die Strategie ist wie ein superintelligenter “Trenddetektiv”: Mit den 4 EMA-Linien (Zyklen 1, 5, 10 und 20) wird eine perfekte “Leiterform” gebildet, um die Richtung des Trends zu erkennen. Wenn EMA1> EMA5> EMA10> EMA20 ist, ist es wie eine grüne Ampel, die dir sagt: “Rush!”; das Gegenteil ist “Stop Stop!”.

Mehrfachfilter gegen Stempel

Die Strategie ist nicht der “Signal-Auf-Flüchtling”, sondern setzt drei “Sicherheits-Türen” ein: SMA20, SMA50 und SMA200 Filter. Wie ein Flugzeug mit drei Sicherheitsprüfungen, wird die Strategie nur dann gehandelt, wenn der Preis auf der richtigen Seite des Moving Averages steht.

Dynamische Risikomanagement-Instrumente

Das Beste an dieser Strategie ist ihre Vier-in-Eins-Schadensersatz-System:

- EMA20-Stopp: Wie ein Bodyguard, der dem Preis folgt

- ATR-Multiplikator-Stopp: Anpassung an die schwankende Marktlage

- Der Prozentsatz des Stop-Losses: Einfach, grob und für Anfänger geeignet

- Swing-Stop-Verlust: Suche nach wichtigen Unterstützungswiderstandspunkten

Das Positionsmanagement verwendet das Prozentsatz-Risiko-Modell, bei dem nur 1% des Kontos riskiert wird, ohne dass es zu Verlusten führt.

Das ist eine intelligente Transaktionssteuerung.

Die Strategie bietet auch eine sehr behutsame “Kühlungsphase” - Funktion, die wie die Fähigkeit des Spiels abkühlt. Nach dem Ausgleich der Position müssen Sie einige K-Linien warten, um die Position erneut zu eröffnen, um einen emotionalen und häufigen Handel zu vermeiden.

/*backtest

start: 2024-09-19 00:00:00

end: 2025-09-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy("Hilega Milega v6 - Pure EMA/SMA (Nitesh Kumar) + Full Backtest",

overlay=true, initial_capital=100000,

commission_type=strategy.commission.percent, commission_value=0.05,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=false,

max_labels_count=200, max_boxes_count=0)

// ============================

// Backtest Controls

// ============================

string G_BT = "Backtest"

bool useDateRange = input.bool(false, "Use Date Range (OFF = all history)", group=G_BT)

int bt_from = input(timestamp("2022-01-01T00:00:00"), "From", group=G_BT)

int bt_to = input(timestamp("2099-12-31T23:59:59"), "To", group=G_BT)

string sess = input("0000-2359:1234567", "Session (Exchange Time)", group=G_BT)

bool mon = input.bool(true, "Mon", group=G_BT)

bool tue = input.bool(true, "Tue", group=G_BT)

bool wed = input.bool(true, "Wed", group=G_BT)

bool thu = input.bool(true, "Thu", group=G_BT)

bool fri = input.bool(true, "Fri", group=G_BT)

bool sat = input.bool(true, "Sat", group=G_BT)

bool sun = input.bool(true, "Sun", group=G_BT)

int cooldownBars = input.int(3, "Cooldown bars after flat", 0, 500, group=G_BT)

int timeExitBars = input.int(0, "Time-based exit (0 = off)", 0, 5000, group=G_BT)

bool allowLongs = input.bool(true, "Allow Longs", group=G_BT)

bool allowShorts = input.bool(true, "Allow Shorts", group=G_BT)

// ============================

// Hilega Milega Inputs

// ============================

string G_HM = "Hilega Milega Filters (Side Rules)"

bool needSMA20 = input.bool(true, "Long above SMA20 / Short below SMA20", group=G_HM)

bool needSMA50 = input.bool(true, "Long above SMA50 / Short below SMA50", group=G_HM)

bool needSMA200 = input.bool(false, "Long above SMA200 / Short below SMA200", group=G_HM)

bool useSlope200= input.bool(false, "200 SMA slope filter (up for long / down for short)", group=G_HM)

int slopeLook = input.int(5, "Slope lookback (bars)", 1, 200, group=G_HM)

// ============================

// Risk / Targets

// ============================

string G_RM = "Risk / Targets"

string stopMode = input.string("EMA20", "Stop Type", options=["EMA20","ATR","Percent","Swing"], group=G_RM)

int atrLen = input.int(14, "ATR Length (for ATR/Swing calc)", 1, 200, group=G_RM)

float atrMult = input.float(2.0, "ATR Stop Mult (if Stop=ATR)", 0.1, 10, group=G_RM)

float pctSL = input.float(1.5, "Percent Stop % (if Stop=Percent)", 0.1, 50, group=G_RM)

int swingLen = input.int(10, "Swing lookback (if Stop=Swing)", 1, 200, group=G_RM)

float rrTarget = input.float(1.5, "Take Profit at R (x Risk)", 0.5, 20, group=G_RM)

bool riskPctMode = input.bool(true, "Position size by Risk % of equity", group=G_RM)

float riskPct = input.float(1.0, "Risk %", 0.05, 20, group=G_RM)

float fixedQty = input.float(1, "Fixed Qty (if Risk% OFF)", 0.0001, 1e9, group=G_RM)

// ============================

// Guards

// ============================

bool inDate = not useDateRange or (time >= bt_from and time <= bt_to)

bool inSess = not na(time(timeframe.period, sess))

bool inDOW = (dayofweek == dayofweek.monday and mon) or

(dayofweek == dayofweek.tuesday and tue) or

(dayofweek == dayofweek.wednesday and wed) or

(dayofweek == dayofweek.thursday and thu) or

(dayofweek == dayofweek.friday and fri) or

(dayofweek == dayofweek.saturday and sat) or

(dayofweek == dayofweek.sunday and sun)

bool canCalc = inDate and inSess and inDOW

// ============================

// Indicators (Pure HM stack)

// ============================

float ema1 = ta.ema(close, 1)

float ema5 = ta.ema(close, 5)

float ema10 = ta.ema(close, 10)

float ema20 = ta.ema(close, 20)

float sma20 = ta.sma(close, 20)

float sma50 = ta.sma(close, 50)

float sma200 = ta.sma(close, 200)

float atrVal = ta.atr(atrLen)

// Visuals

plot(ema1, "EMA 1", linewidth=1)

plot(ema5, "EMA 5", linewidth=1)

plot(ema10, "EMA 10", linewidth=1)

plot(ema20, "EMA 20", linewidth=2)

plot(sma20, "SMA 20", linewidth=2)

plot(sma50, "SMA 50", linewidth=2)

plot(sma200,"SMA 200",linewidth=3)

// ============================

// Hilega Milega Conditions

// ============================

bool emaBull = ema1 > ema5 and ema5 > ema10 and ema10 > ema20

bool emaBear = ema1 < ema5 and ema5 < ema10 and ema10 < ema20

bool sideLong = (not needSMA20 or close > sma20) and (not needSMA50 or close > sma50) and (not needSMA200 or close > sma200)

bool sideShort = (not needSMA20 or close < sma20) and (not needSMA50 or close < sma50) and (not needSMA200 or close < sma200)

bool slopeUp = not useSlope200 or sma200 > sma200[slopeLook]

bool slopeDown = not useSlope200 or sma200 < sma200[slopeLook]

// Entry triggers (classic HM: EMA5/EMA10 cross)

bool trigLong = ta.crossover(ema5, ema10)

bool trigShort = ta.crossunder(ema5, ema10)

bool setupLong = emaBull and sideLong and slopeUp

bool setupShort = emaBear and sideShort and slopeDown

// ============================

// Cooldown & Signals

// ============================

var int barsSinceFlat = 1000000000

barsSinceFlat += 1

bool posChanged = strategy.position_size != nz(strategy.position_size[1], 0)

bool flatNow = posChanged and strategy.position_size == 0

if flatNow

barsSinceFlat := 0

bool coolOK = barsSinceFlat >= cooldownBars

bool longSignal = canCalc and allowLongs and setupLong and trigLong and coolOK

bool shortSignal = canCalc and allowShorts and setupShort and trigShort and coolOK

plotshape(longSignal, title="BUY", style=shape.triangleup, size=size.tiny, location=location.belowbar, text="Buy")

plotshape(shortSignal, title="SELL", style=shape.triangledown, size=size.tiny, location=location.abovebar, text="Sell")

// ============================

// Position Sizing & Orders

// ============================

var float entrySLlong = na

var float entrySLshort = na

// Compute dynamic stops with simple if/else

float slLongByMode = na

if stopMode == "EMA20"

slLongByMode := ema20

else if stopMode == "ATR"

slLongByMode := close - atrMult * atrVal

else if stopMode == "Percent"

slLongByMode := close * (1 - pctSL/100.0)

else

slLongByMode := ta.lowest(low, swingLen)

float slShortByMode = na

if stopMode == "EMA20"

slShortByMode := ema20

else if stopMode == "ATR"

slShortByMode := close + atrMult * atrVal

else if stopMode == "Percent"

slShortByMode := close * (1 + pctSL/100.0)

else

slShortByMode := ta.highest(high, swingLen)

// Entries

if longSignal and strategy.position_size <= 0

float riskPerUnit = math.max(close - slLongByMode, syminfo.mintick)

float qty = riskPctMode ? (strategy.equity * (riskPct/100.0) / riskPerUnit) : fixedQty

entrySLlong := slLongByMode

strategy.entry("Long", strategy.long, qty=qty)

if shortSignal and strategy.position_size >= 0

float riskPerUnitS = math.max(slShortByMode - close, syminfo.mintick)

float qtyS = riskPctMode ? (strategy.equity * (riskPct/100.0) / riskPerUnitS) : fixedQty

entrySLshort := slShortByMode

strategy.entry("Short", strategy.short, qty=qtyS)

// Track entry bar index for time-based exits (no valuewhen)

var int entryBarL = na

var int entryBarS = na

if posChanged

if strategy.position_size > 0 and strategy.position_size[1] == 0

entryBarL := bar_index

entryBarS := na

if strategy.position_size < 0 and strategy.position_size[1] == 0

entryBarS := bar_index

entryBarL := na

// Exits (stop + RR limit) and optional time exit

if strategy.position_size > 0

float ep = strategy.position_avg_price

float rBase = math.max(ep - nz(entrySLlong, ep - atrVal), syminfo.mintick)

float tp = ep + rrTarget * rBase

float st = nz(entrySLlong, ep - atrVal)

strategy.exit("LX", from_entry="Long", stop=st, limit=tp)

if timeExitBars > 0 and not na(entryBarL) and (bar_index - entryBarL >= timeExitBars)

strategy.close("Long", comment="TimeExitL")

if strategy.position_size < 0

float epS = strategy.position_avg_price

float rBaseS= math.max(nz(entrySLshort, epS + atrVal) - epS, syminfo.mintick)

float tpS = epS - rrTarget * rBaseS

float stS = nz(entrySLshort, epS + atrVal)

strategy.exit("SX", from_entry="Short", stop=stS, limit=tpS)

if timeExitBars > 0 and not na(entryBarS) and (bar_index - entryBarS >= timeExitBars)

strategy.close("Short", comment="TimeExitS")

// Reset snapshots when flat

if strategy.position_size == 0

entrySLlong := na

entrySLshort := na

// ============================

// Alerts

// ============================

alertcondition(longSignal, title="HM Long", message="Hilega Milega LONG: EMA1>5>10>20; 5 crossed above 10; side filters OK")

alertcondition(shortSignal, title="HM Short", message="Hilega Milega SHORT: EMA1<5<10<20; 5 crossed below 10; side filters OK")