Overview

This is a trend-following strategy based on breakout and volatility stop. The strategy identifies trend direction by price breakout of dynamic stop loss line. It enters trade when price penetrates the stop loss line and uses the stop loss line to track trends and lock in profits. The strategy aims to capture mid-long term trends while controlling risk with dynamic stops.

Strategy Logic

The strategy utilizes Volatility Stop indicator to determine trend direction and track stop loss. Volatility Stop calculates a dynamic stop loss line based on price fluctuation range. The specific steps are:

- Calculate ATR (Average True Range) of price

- Get stop loss line by multiplying ATR with a stop loss coefficient

- When price goes up, record highest price, stop loss line is highest price minus ATR * coefficient

- When price goes down, record lowest price, stop loss line is lowest price plus ATR * coefficient

The stop loss line fluctuates up and down with price, forming a dynamic channel.

When price penetrates the stop loss line, it signals a trend reversal. The strategy will open position:

- When price breaks above stop loss line, go long

- When price breaks below stop loss line, go short

After opening position, the strategy tracks stop loss with the line:

- For long, stop loss is highest price minus ATR * coefficient

- For short, stop loss is lowest price plus ATR * coefficient

When price hits the stop loss line again, the position will be closed.

This way, the strategy can follow trends in a timely manner while controlling risk with stops.

Advantage Analysis

The strategy has the following advantages:

- Can capture trend reversals in a timely manner and follow the trend

- Uses dynamic stop loss to adjust stop position based on market volatility

- Stop loss updates with trend to lock in maximum profits

- Rides the trend to achieve significant profit

- Effectively controls risk and avoids huge losses

Risk Analysis

There are also some risks to consider:

- Stop loss may be triggered frequently during ranging markets

- Need to set proper stop loss coefficient, too small may be too sensitive

- Trading fees may eat up profits with frequent trading

- May miss some profits at early stage of trends

- Risk when stop loss is too far from price

Solutions:

- Optimize stop loss coefficient through backtest to find best parameter

- Use longer time frames to lower trade frequency

- Add filter to avoid over-trading

- Allow some flexibility in stop distance but not too large

Optimization Directions

The strategy can be further optimized in the following aspects:

- Optimize stop loss coefficient to find best parameter combination

- Add filters to avoid whipsaws in ranging market

- Combine multiple timeframes for signal verification

- Optimize position sizing, gradually increase size

- Consider dynamic adjustment of time frame

- Combine with stock fundamentals to catch main trends

Summary

Overall this momentum breakout strategy with volatility stop is a very practical trend following system. It can capture trend reversal opportunities and follow the trend while controlling risk effectively with dynamic stops. With proper parameter tuning, it can achieve good return during trending markets. But some issues need to be addressed like over-sensitive stops, high trading frequency etc. Further optimizations can turn it into an efficient and robust quant trading strategy.

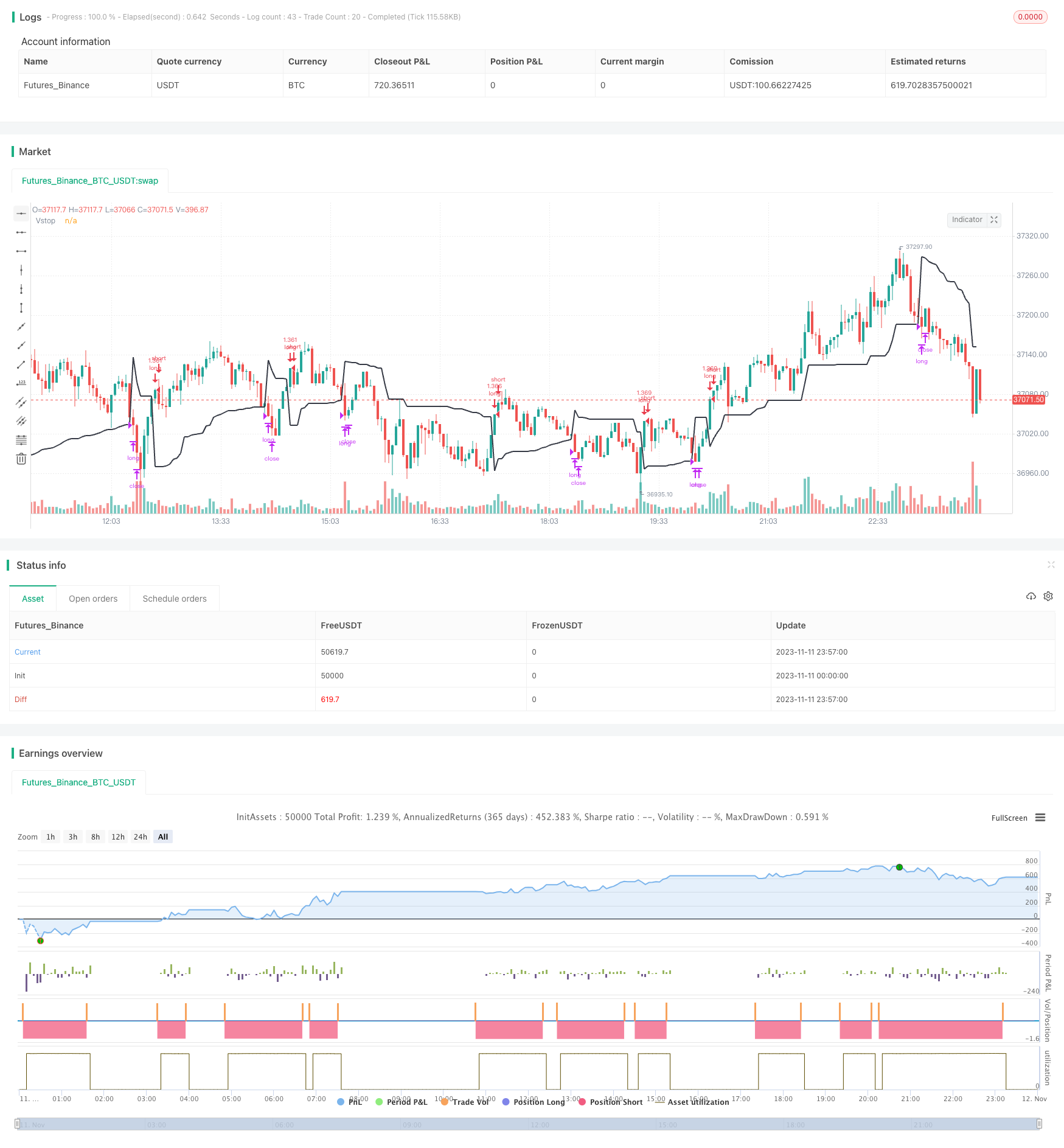

/*backtest

start: 2023-11-11 00:00:00

end: 2023-11-12 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Volatility Stop Strategy',title='Volatility Stop Strategy (by Coinrule)', overlay=true, initial_capital = 100, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.1)

// Works better on 3h, 1h, 2h, 4h

// Best time frame 2H

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

length = input(20, "Length", minval = 2)

src = input(close, "Source")

factor = input(3.0, "vStop Multiplier", minval = 0.25, step = 0.25)

volStop(src, atrlen, atrfactor) =>

var max = src

var min = src

var uptrend = true

var stop = 0.0

atrM = nz(atr(atrlen) * atrfactor, tr)

max := max(max, src)

min := min(min, src)

stop := nz(uptrend ? max(stop, max - atrM) : min(stop, min + atrM), src)

uptrend := src - stop >= 0.0

if uptrend != nz(uptrend[1], true)

max := src

min := src

stop := uptrend ? max - atrM : min + atrM

[stop, uptrend]

[vStop, uptrend] = volStop(src, length, factor)

//Entry

strategy.entry(id="long", long = true, when = crossover(close, vStop) and window())

//Exit

strategy.close("long", when = crossunder(close, vStop))

plot(vStop,"Vstop", color.black, linewidth=2)