Overview

The Connors Dual Moving Average RSI Reversal Trading Strategy combines the Relative Strength Index (RSI) and dual moving averages to identify high probability reversal trading opportunities. When the short-term and long-term trends reverse direction, this strategy judges that the market is about to turn and establishes a position.

Strategy Principle

This strategy utilizes both RSI and dual moving averages to determine market trends. First, it calculates a 2-period RSI to judge short-term trend reversals. Second, it calculates a 200-period moving average to determine the long-term trend direction. When the short-term RSI bounces back from the overbought/oversold area and moves against the long-term trend, it signals that the market is about to reverse and a trading position can be established.

Entry signals: Go long when RSI is below the oversold area (default 5) and short-term price is above long-term price; Go short when RSI is above the overbought area (default 95) and short-term price is below long-term price.

Exit signals: Exit when the 5-period short-term moving average gives a signal opposite to the entry direction; or stop loss (default 3% loss).

Advantage Analysis

This strategy combines multiple indicators to judge market structure and can improve the accuracy of trading. Specific advantages are:

- Use RSI to determine short-term reversal points and moving averages to filter the reliability of reversal signals

- Dual moving averages form a strong filtering to avoid delays

- The short-term moving average re-verifies the reversal signal to ensure high probability exits

- Good risk control with stop loss mechanism

Risk Analysis

There are some risks with this strategy:

- RSI indicators are more likely to give incorrect signals during violent market fluctuations

- Multi-indicator combo judgments make parameter optimization complex

- Reversals are not guaranteed to succeed, timely stop losses are needed

Optimization Directions

This strategy can be optimized in several aspects:

- Optimize RSI parameters to find the best reversal parameter combination

- Test different types of moving average parameters

- Optimize stop loss strategies to find the best stop loss points

- Add trend judgment indicators to avoid failed reversals

Conclusion

The Connors Dual Moving Average RSI Reversal Trading Strategy captures market reversals at high probability positions by filtering RSI reversal signals with dual moving averages. This strategy utilizes multiple indicators to improve stability. Next, through parameter optimization and risk control improvements, it has the potential to further expand the advantages of the strategy and achieve higher trading efficiency.

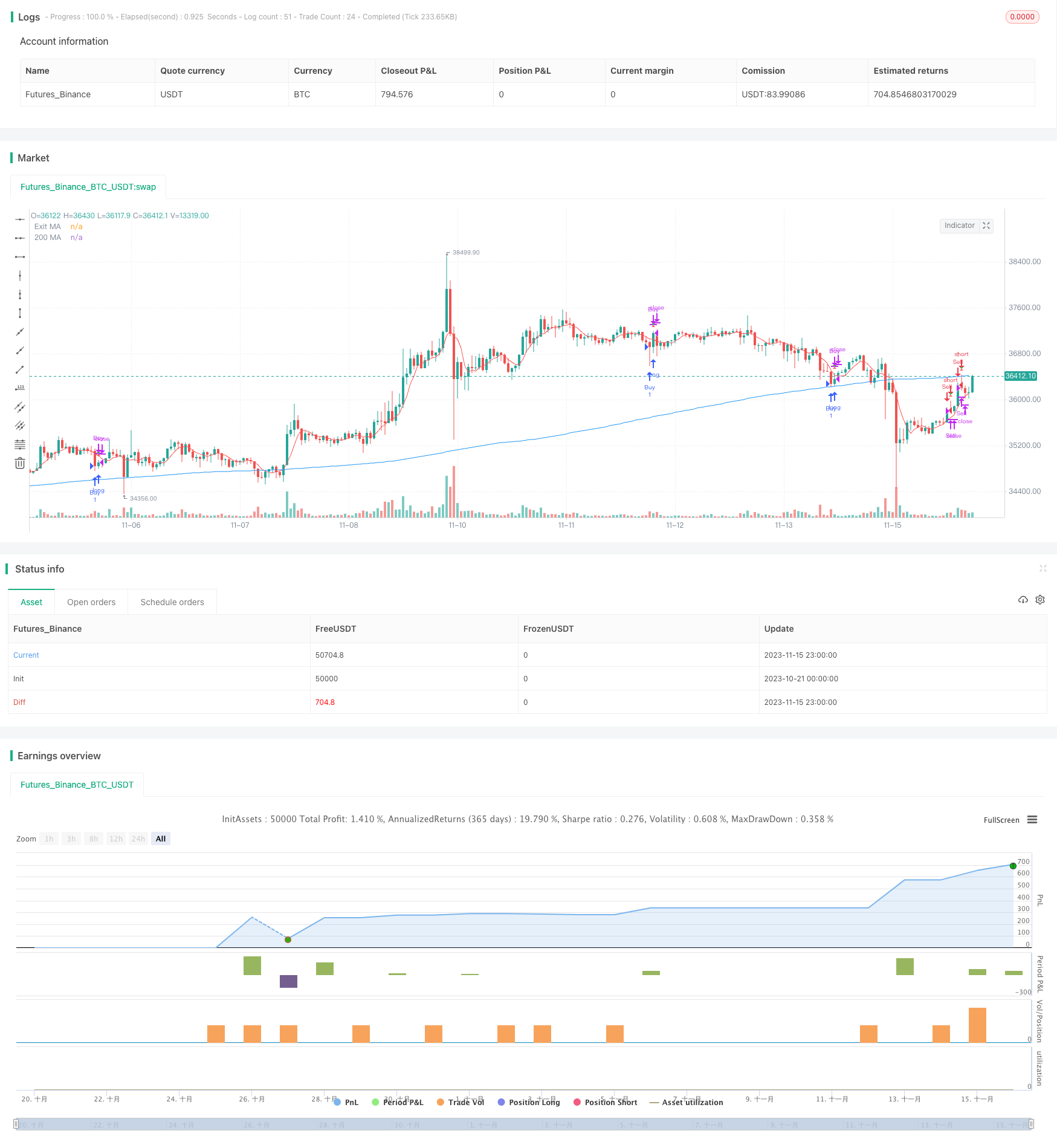

/*backtest

start: 2023-10-21 00:00:00

end: 2023-11-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Connors RSI-MA Strategy", overlay=true)

// Strategy parameters

rsiLength = input(2, title="RSI Length")

maLength = input(200, title="MA Length")

exitMaLength = input(5, title="Exit MA Length")

overboughtThreshold = input(95, title="Overbought Threshold")

oversoldThreshold = input(5, title="Oversold Threshold")

stopLossPercentage = input(3, title="Stop Loss Percentage")

// 2-period RSI

rsi2 = ta.rsi(close, rsiLength)

// 200-period MA

ma200 = ta.sma(close, maLength)

// 5-period MA for exit signals

ma5_exit = ta.sma(close, exitMaLength)

// Positive trend condition

positiveTrend = close > ma200

// Negative trend condition

negativeTrend = close < ma200

// Buy and sell conditions

buyCondition = rsi2 < oversoldThreshold and positiveTrend

sellCondition = rsi2 > overboughtThreshold and negativeTrend

// Exit conditions

exitLongCondition = close > ma5_exit

exitShortCondition = close < ma5_exit

// Stop Loss

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPercentage / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPercentage / 100)

// Strategy logic

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

if (exitLongCondition or close >= stopLossLevelLong)

strategy.close("Buy")

if (exitShortCondition or close <= stopLossLevelShort)

strategy.close("Sell")

// Plotting

plot(ma200, title="200 MA", color=color.blue)

plot(ma5_exit, title="Exit MA", color=color.red)

// Plot stop loss levels

plotshape(series=stopLossLevelLong, title="Long Stop Loss", color=color.green, style=shape.triangledown, size=size.small)

plotshape(series=stopLossLevelShort, title="Short Stop Loss", color=color.red, style=shape.triangleup, size=size.small)