Overview

The Bollinger Bands Breakout Strategy is a short-term trend following strategy optimized for crypto trading. It utilizes the well-established Bollinger Bands indicator as the core signal generator and is capable of taking both long and short positions. With comprehensive risk management mechanisms, it is a robust automated trading system suitable for trending markets.

The strategy features a high level of configurability, including the Bollinger Bands parameters, various filters, take profit/stop loss settings and maximum intraday loss threshold. This adaptability empowers the strategy to achieve reliable performance across various market regimes.

How It Works

The strategy centres around the Bollinger Bands indicator, which calculates a middle band, an upper band and a lower band that serve as proxies for price averages and volatility limits. The crossing of price over the upper or lower bands generates entry signals – long when price breaks above upper band, short when below lower band.

In addition, multiple filters are implemented to avoid false signals:

Trend Filter: long above moving average, short below moving average

Volatility Filter: only trade when volatility expands

Direction Filter: configurable for long-only, short-only or both directions

Rate of Change Filter: sufficient price movement from previous close required

Date Filter: for backtesting timeframe specification

Exits are handled through take profit, stop loss and trailing stop mechanisms to lock in gains and limit losses. Maximum intraday loss threshold provides another layer of daily drawdown protection.

Advantages

The main advantages of this strategy include:

Reliable Bollinger Bands indicator as core signal

Customizable filters prevent unwanted trades

Comprehensive stop loss/take profit design

Max intraday loss guards against extreme drawdown

Thrives in trending markets with profit potential

Risks

Despite the advantages, some risks remain:

Whipsaws around Bollinger Bands may lead to losses

Too rigid filters reduce trades in range-bound markets

Gaps can stop out positions preemptively

Extreme moves cannot be fully avoided

Mitigations include adjusting filters, manual intervention and tweaked stops.

Enhancement Opportunities

Possible optimizations for this strategy:

Search for optimal parameter combinations

Introduce machine learning for adaptive optimization

Research better stop loss methods e.g. volatility stops

Incorporate sentiment to guide discretionary actions

Utilize correlated instruments for statistical arbitrage

Conclusion

The Bollinger Bands Breakout Strategy is a time-tested system for short-term trend trading. By combining the merits of Bollinger Bands signal and prudent filters, it generates quality entries for trends while avoiding false signals. Comprehensive risk management mechanisms also contain drawdowns effectively. With continuous improvements, this strategy has the potential to become a formidable automated trading system.

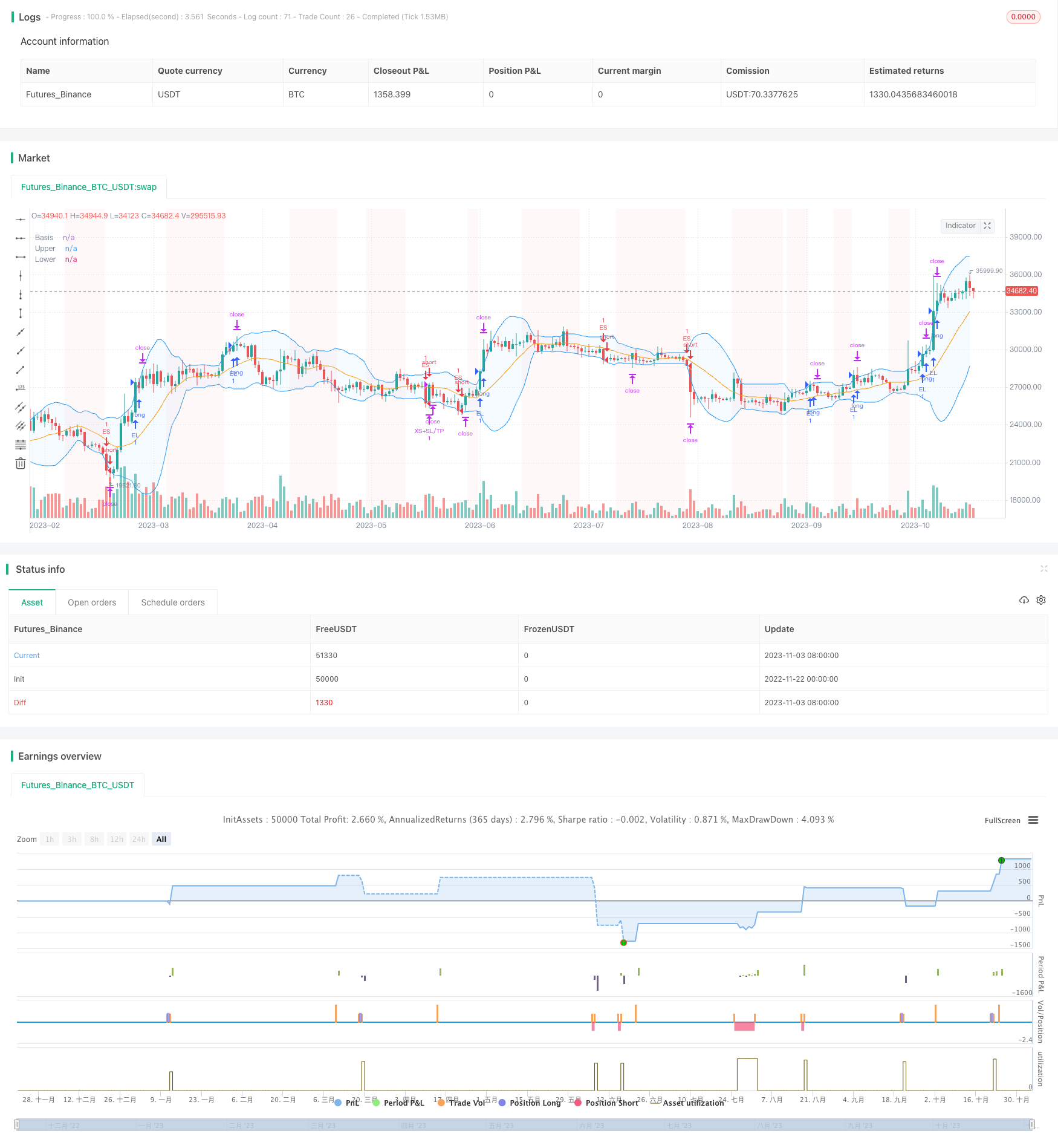

/*backtest

start: 2022-11-22 00:00:00

end: 2023-11-04 05:20:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands - Breakout Strategy",overlay=true

)

// Define the length of the Bollinger Bands

bbLengthInput = input.int (15,title="Length", group="Bollinger Bands", inline="BB")

bbDevInput = input.float (2.0,title="StdDev", group="Bollinger Bands", inline="BB")

// Define the settings for the Trend Filter

trendFilterInput = input.bool(false, title="Above/Below", group = "Trend Filter", inline="Trend")

trendFilterPeriodInput = input(223,title="", group = "Trend Filter", inline="Trend")

trendFilterType = input.string (title="", defval="EMA",options=["EMA","SMA","RMA", "WMA"], group = "Trend Filter", inline="Trend")

volatilityFilterInput = input.bool(true,title="StdDev", group = "Volatility Filter", inline="Vol")

volatilityFilterStDevLength = input(15,title="",group = "Volatility Filter", inline="Vol")

volatilityStDevMaLength = input(15,title=">MA",group = "Volatility Filter", inline="Vol")

// ROC Filter

// f_security function by LucF for PineCoders available here: https://www.tradingview.com/script/cyPWY96u-How-to-avoid-repainting-when-using-security-PineCoders-FAQ/

f_security(_sym, _res, _src, _rep) => request.security(_sym, _res, _src[not _rep and barstate.isrealtime ? 1 : 0])[_rep or barstate.isrealtime ? 0 : 1]

high_daily = f_security(syminfo.tickerid, "D", high, false)

roc_enable = input.bool(false, "", group="ROC Filter from CloseD", inline="roc")

roc_threshold = input.float(1, "Treshold", step=0.5, group="ROC Filter from CloseD", inline="roc")

closed = f_security(syminfo.tickerid,"1D",close, false)

roc_filter= roc_enable ? (close-closed)/closed*100 > roc_threshold : true

// Trade Direction Filter

// tradeDirectionInput = input.string("Auto",options=["Auto", "Long&Short","Long Only", "Short Only"], title="Trade", group="Direction Filter", tooltip="Auto: if a PERP is detected (in the symbol description), trade long and short\n Otherwise as per user-input")

// tradeDirection = switch tradeDirectionInput

// "Auto" => str.contains(str.lower(syminfo.description), "perp") or str.contains(str.lower(syminfo.description), ".p") ? strategy.direction.all : strategy.direction.long

// "Long&Short" => strategy.direction.all

// "Long Only" => strategy.direction.long

// "Short Only" => strategy.direction.short

// => strategy.direction.all

// strategy.risk.allow_entry_in(tradeDirection)

// Calculate and plot the Bollinger Bands

[bbMiddle, bbUpper, bbLower] = ta.bb (close, bbLengthInput, bbDevInput)

plot(bbMiddle, "Basis", color=color.orange)

bbUpperPlot = plot(bbUpper, "Upper", color=color.blue)

bbLowerrPlot = plot(bbLower, "Lower", color=color.blue)

fill(bbUpperPlot, bbLowerrPlot, title = "Background", color=color.new(color.blue, 95))

// Calculate and view Trend Filter

float tradeConditionMa = switch trendFilterType

"EMA" => ta.ema(close, trendFilterPeriodInput)

"SMA" => ta.sma(close, trendFilterPeriodInput)

"RMA" => ta.rma(close, trendFilterPeriodInput)

"WMA" => ta.wma(close, trendFilterPeriodInput)

// Default used when the three first cases do not match.

=> ta.wma(close, trendFilterPeriodInput)

trendConditionLong = trendFilterInput ? close > tradeConditionMa : true

trendConditionShort = trendFilterInput ? close < tradeConditionMa : true

plot(trendFilterInput ? tradeConditionMa : na, color=color.yellow)

// Calculate and view Volatility Filter

stdDevClose = ta.stdev(close,volatilityFilterStDevLength)

volatilityCondition = volatilityFilterInput ? stdDevClose > ta.sma(stdDevClose,volatilityStDevMaLength) : true

bbLowerCrossUnder = ta.crossunder(close, bbLower)

bbUpperCrossOver = ta.crossover(close, bbUpper)

bgcolor(volatilityCondition ? na : color.new(color.red, 95))

// Date Filter

start = input(timestamp("2017-01-01"), "Start", group="Date Filter")

finish = input(timestamp("2050-01-01"), "End", group="Date Filter")

date_filter = true

// Entry and Exit Conditions

entryLongCondition = bbUpperCrossOver and trendConditionLong and volatilityCondition and date_filter and roc_filter

entryShortCondition = bbLowerCrossUnder and trendConditionShort and volatilityCondition and date_filter and roc_filter

exitLongCondition = bbLowerCrossUnder

exitShortCondition = bbUpperCrossOver

// Orders

if entryLongCondition

strategy.entry("EL", strategy.long)

if entryShortCondition

strategy.entry("ES", strategy.short)

if exitLongCondition

strategy.close("EL")

if exitShortCondition

strategy.close("ES")

// Long SL/TP/TS

xl_ts_percent = input.float(2,step=0.5, title= "TS", group="Exit Long", inline="LTS", tooltip="Trailing Treshold %")

xl_to_percent = input.float(0.5, step=0.5, title= "TO", group="Exit Long", inline="LTS", tooltip="Trailing Offset %")

xl_ts_tick = xl_ts_percent * close/syminfo.mintick/100

xl_to_tick = xl_to_percent * close/syminfo.mintick/100

xl_sl_percent = input.float (2, step=0.5, title="SL",group="Exit Long", inline="LSLTP")

xl_tp_percent = input.float(9, step=0.5, title="TP",group="Exit Long", inline="LSLTP")

xl_sl_price = strategy.position_avg_price * (1-xl_sl_percent/100)

xl_tp_price = strategy.position_avg_price * (1+xl_tp_percent/100)

strategy.exit("XL+SL/TP", "EL", stop=xl_sl_price, limit=xl_tp_price, trail_points=xl_ts_tick, trail_offset=xl_to_tick,comment_loss= "XL-SL", comment_profit = "XL-TP",comment_trailing = "XL-TS")

// Short SL/TP/TS

xs_ts_percent = input.float(2,step=0.5, title= "TS",group="Exit Short", inline ="STS", tooltip="Trailing Treshold %")

xs_to_percent = input.float(0.5, step=0.5, title= "TO",group="Exit Short", inline ="STS", tooltip="Trailing Offset %")

xs_ts_tick = xs_ts_percent * close/syminfo.mintick/100

xs_to_tick = xs_to_percent * close/syminfo.mintick/100

xs_sl_percent = input.float (2, step=0.5, title="SL",group="Exit Short", inline="ESSLTP", tooltip="Stop Loss %")

xs_tp_percent = input.float(9, step=0.5, title="TP",group="Exit Short", inline="ESSLTP", tooltip="Take Profit %")

xs_sl_price = strategy.position_avg_price * (1+xs_sl_percent/100)

xs_tp_price = strategy.position_avg_price * (1-xs_tp_percent/100)

strategy.exit("XS+SL/TP", "ES", stop=xs_sl_price, limit=xs_tp_price, trail_points=xs_ts_tick, trail_offset=xs_to_tick,comment_loss= "XS-SL", comment_profit = "XS-TP",comment_trailing = "XS-TS")

max_intraday_loss = input.int(10, title="Max Intraday Loss (Percent)", group="Risk Management")

//strategy.risk.max_intraday_loss(max_intraday_loss, strategy.percent_of_equity)

// Monthly Returns table, modified from QuantNomad. Please put calc_on_every_tick = true to plot it.

monthly_table(int results_prec, bool results_dark) =>

new_month = month(time) != month(time[1])

new_year = year(time) != year(time[1])

eq = strategy.equity

bar_pnl = eq / eq[1] - 1

cur_month_pnl = 0.0

cur_year_pnl = 0.0

// Current Monthly P&L

cur_month_pnl := new_month ? 0.0 :

(1 + cur_month_pnl[1]) * (1 + bar_pnl) - 1

// Current Yearly P&L

cur_year_pnl := new_year ? 0.0 :

(1 + cur_year_pnl[1]) * (1 + bar_pnl) - 1

// Arrays to store Yearly and Monthly P&Ls

var month_pnl = array.new_float(0)

var month_time = array.new_int(0)

var year_pnl = array.new_float(0)

var year_time = array.new_int(0)

last_computed = false

if (not na(cur_month_pnl[1]) and (new_month or barstate.islast))

if (last_computed[1])

array.pop(month_pnl)

array.pop(month_time)

array.push(month_pnl , cur_month_pnl[1])

array.push(month_time, time[1])

if (not na(cur_year_pnl[1]) and (new_year or barstate.islast))

if (last_computed[1])

array.pop(year_pnl)

array.pop(year_time)

array.push(year_pnl , cur_year_pnl[1])

array.push(year_time, time[1])

last_computed := barstate.islast ? true : nz(last_computed[1])

// Monthly P&L Table

var monthly_table = table(na)

cell_hr_bg_color = results_dark ? #0F0F0F : #F5F5F5

cell_hr_text_color = results_dark ? #D3D3D3 : #555555

cell_border_color = results_dark ? #000000 : #FFFFFF

// ell_hr_bg_color = results_dark ? #0F0F0F : #F5F5F5

// cell_hr_text_color = results_dark ? #D3D3D3 : #555555

// cell_border_color = results_dark ? #000000 : #FFFFFF

if (barstate.islast)

monthly_table := table.new(position.bottom_right, columns = 14, rows = array.size(year_pnl) + 1, bgcolor=cell_hr_bg_color,border_width=1,border_color=cell_border_color)

table.cell(monthly_table, 0, 0, syminfo.tickerid + " " + timeframe.period, text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 1, 0, "Jan", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 2, 0, "Feb", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 3, 0, "Mar", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 4, 0, "Apr", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 5, 0, "May", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 6, 0, "Jun", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 7, 0, "Jul", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 8, 0, "Aug", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 9, 0, "Sep", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 10, 0, "Oct", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 11, 0, "Nov", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 12, 0, "Dec", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

table.cell(monthly_table, 13, 0, "Year", text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

for yi = 0 to array.size(year_pnl) - 1

table.cell(monthly_table, 0, yi + 1, str.tostring(year(array.get(year_time, yi))), text_color=cell_hr_text_color, bgcolor=cell_hr_bg_color)

y_color = array.get(year_pnl, yi) > 0 ? color.lime : array.get(year_pnl, yi) < 0 ? color.red : color.gray

table.cell(monthly_table, 13, yi + 1, str.tostring(math.round(array.get(year_pnl, yi) * 100, results_prec)), bgcolor = y_color)

for mi = 0 to array.size(month_time) - 1

m_row = year(array.get(month_time, mi)) - year(array.get(year_time, 0)) + 1

m_col = month(array.get(month_time, mi))

m_color = array.get(month_pnl, mi) > 0 ? color.lime : array.get(month_pnl, mi) < 0 ? color.red : color.gray

table.cell(monthly_table, m_col, m_row, str.tostring(math.round(array.get(month_pnl, mi) * 100, results_prec)), bgcolor = m_color)

results_prec = input(2, title = "Precision", group="Results Table")

results_dark = input.bool(defval=true, title="Dark Mode", group="Results Table")

monthly_table(results_prec, results_dark)