Overview

This is a long-only Ichimoku cloud quant strategy. The strategy judges the trend direction through the Ichimoku indicator, combined with K-line patterns, moving averages and the Stochastic RSI indicator to filter signals and go long at better entry points when the trend goes up.

Strategy Principle

The main judgment criteria of the strategy are:

- Ichimoku lead line 1 crosses above lead line 2, indicating an upward trend

- K-line close price crosses above lead line 1, meeting the condition to follow the trend

- K-line is a green candle, the trend goes up

- When moving averages are enabled, fast MA crosses above slow MA

- When Stochastic RSI is enabled, %K line crosses above %D line

When all the above conditions are met at the same time, the strategy will open long positions. When the price drops below lead line 1, the strategy will close positions.

The strategy mainly uses the Ichimoku cloud to determine the main trend direction, combined with auxiliary indicators to filter signals and go long at better points when the trend goes up.

Advantages of the Strategy

- Use Ichimoku cloud to determine main trend, backtest shows high accuracy

- Combined with multiple auxiliary indicators to filter entry points, can significantly improve profit rate

- Long-only strategy, suitable for currencies judged to be in a bull market

- Large space for parameter optimization, can adjust indicator parameters for further optimization

Risks of the Strategy

- There is a probability of Ichimoku cloud judging the trend wrongly

- Stop loss point may be broken during sudden market changes, leading to enlarged losses

- Designed for bull markets, not suitable for currencies with hidden signs of trend reversal

- Improper parameter settings may lead to over-aggressive entries or over-conservative actions

Countermeasures:

- Combine more indicators to judge the trend, improve accuracy

- Set reasonable stop loss points to strictly control single loss

- Select suitable strategies according to market conditions of different currencies

- Carefully test and optimize parameters to make the strategy more stable

Directions for Strategy Optimization

- Optimize parameter settings of auxiliary indicators to further improve stability

- Add stop loss mechanisms such as trailing stop loss, exponential moving average stop loss, etc.

- Add position management like fixed position sizing, position averaging, etc.

- Make parameter adjustments and optimizations for specific currencies

Summary

This Ichimoku cloud quant strategy achieves a high win rate yet risk-controllable only-long strategy by judging trend directions. The advantages of the strategy are obvious and it shows outstanding performance in bull markets. The next step is to improve aspects like indicator optimization, stop loss mechanism, position management to make the strategy more comprehensive and stable.

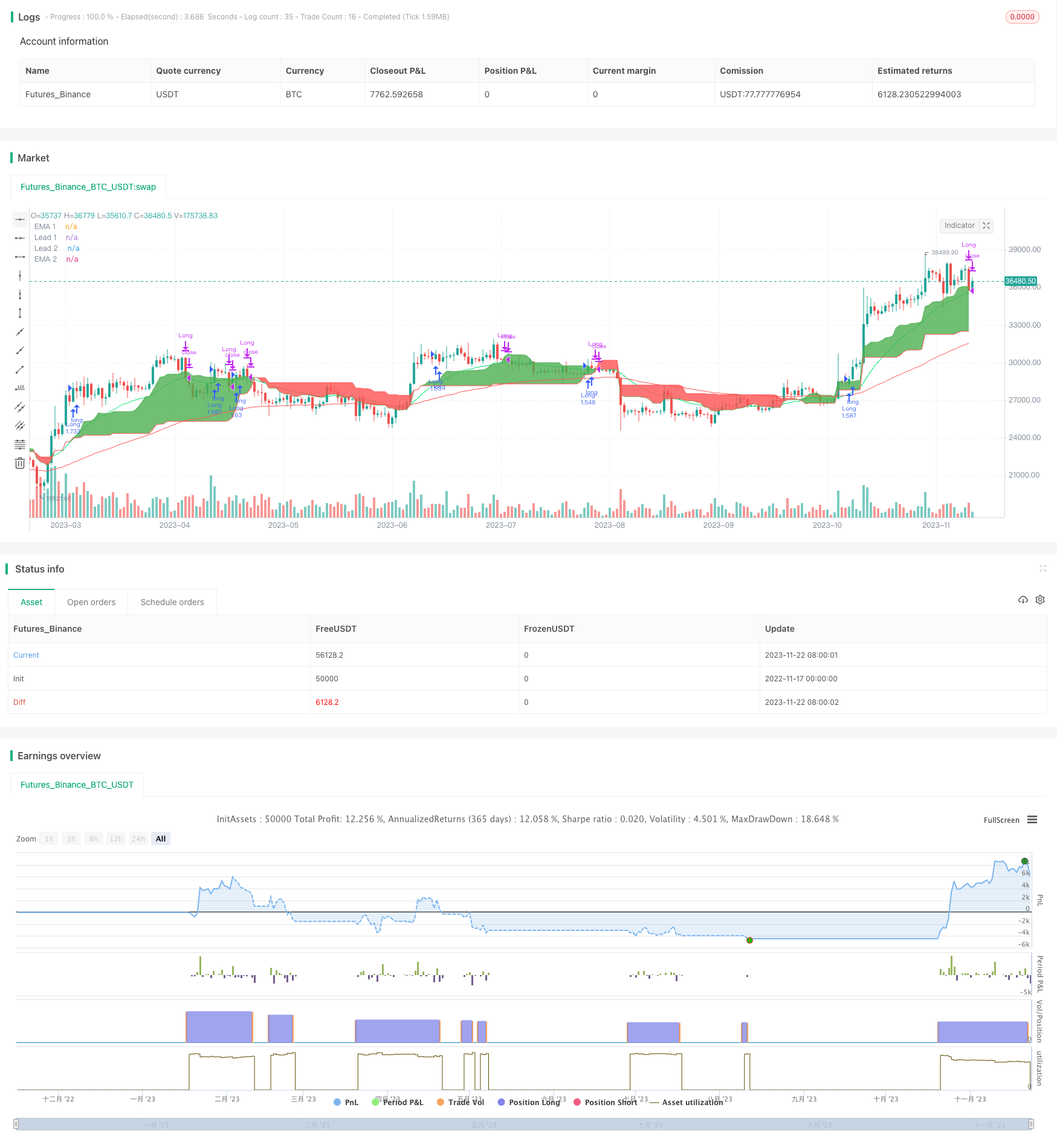

/*backtest

start: 2022-11-17 00:00:00

end: 2023-11-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Ichimoku only Long Strategy", shorttitle="Ichimoku only Long", overlay = true, pyramiding = 0, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, currency=currency.USD)

// Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2017,title="FromYear",minval=2017)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

//Enable RSI

enableema = input(true, title="Enable EMA?")

enablestochrsi = input(false, title="Enable Stochastik RSI?")

//EMA

emasrc = close,

len1 = input(24, minval=1, title="EMA 1")

len2 = input(90, minval=1, title="EMA 2")

ema1 = ema(emasrc, len1)

ema2 = ema(emasrc, len2)

col1 = color.lime

col2 = color.red

//EMA Plots

plot(ema1, title="EMA 1", linewidth=1, color=col1)

plot(ema2, title="EMA 2", linewidth=1, color=col2)

//STOCH RSI

smoothK = input(3, minval=1, title="RSI K Line")

smoothD = input(3, minval=1, title="RSI D Line")

lengthRSI = input(14, minval=1, title="RSI Length")

lengthStoch = input(14, minval=1, title="Stochastik Length")

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

//Ichimoku

conversionPeriods = input(9, minval=1, title="Ichi Conversion Line Length")

basePeriods = input(26, minval=1, title="Ichi Base Line Length")

laggingSpan2Periods = input(52, minval=1, title="Ichi Lagging Span 2 Length")

displacement = input(1, minval=0, title="Ichi Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

p1 = plot(leadLine1, offset = displacement - 1, color=color.green,

title="Lead 1")

p2 = plot(leadLine2, offset = displacement - 1, color=color.red,

title="Lead 2")

fill(p1, p2, color = leadLine1 > leadLine2 ? color.green : color.red)

//Long Condition

crossup = k[0] > d[0] and k[1] <= d[1]

ichigreenabovered = leadLine1 > leadLine2

ichimokulong = close > leadLine1

greencandle = close > open

redcandle = close < open

emacond = ema1 > ema2

longcondition = ichigreenabovered and ichimokulong and greencandle

//Exit Condition

ichimokuexit = close < leadLine1

exitcondition = ichimokuexit and redcandle

//Entrys

if (enablestochrsi == false) and (enableema == false) and (longcondition) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enablestochrsi == true) and (enableema == false) and (longcondition) and (crossup) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enableema == true) and (enablestochrsi == false) and (longcondition) and (emacond) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enableema == true) and (enablestochrsi == true) and (longcondition) and (emacond) and (crossup) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

//Exits

if (afterStartDate)

strategy.close(id = "Long", when = exitcondition)