Overview

The Reversal-Catcher strategy is a reversal trading strategy that utilizes volatility indicator Bollinger Bands and momentum indicator RSI. It sets the Bollinger Bands channel and RSI overbought/oversold lines as signals to find reversal opportunities when trend direction changes.

Strategy Logic

The strategy uses Bollinger Bands as the main technical indicator, combined with RSI and other momentum indicators to verify trading signals. The specific logic is:

- Judge the major trend direction to determine long or short stance. Use 50-day EMA and 21-day EMA golden cross/dead cross to determine trend.

- In a downtrend, when price breaks above the Bollinger Lower Band, and RSI just bounces back from oversold territory, forming a golden cross, it indicates the oversold area has already bottomed, giving a buy signal.

- In a uptrend, when price breaks below the Bollinger Upper Band, and RSI falls back from overbought area, forming a dead cross, it indicates the overbought area starts retracing, giving a sell signal.

- The above buy and sell signals must be triggered together to avoid false signals.

Advantage Analysis

The advantages of this strategy includes:

- Combining volatility and momentum indicators makes signals more reliable.

- Reversal trading has lower risk, suitable for short-term trading.

- Trading rules are programmable for automation trading.

- Combining with trend trading avoids disorder opening during market consolidation.

Risk Analysis

The risks of this strategy includes:

- Bollinger Bands breakout false signal risk, needs RSI filter.

- Failed reversal risk, needs timely stop loss.

- Reversal timing risk, may enter too early or miss best entry point.

To control the risks, we can set stop loss level to limit risk exposure, and optimize parameters like Bollinger Bands period or RSI figures to improve system performance.

Optimization Directions

The main optimization directions includes:

- Optimize Bollinger Bands parameters, adjust period length and standard deviation to find optimum setting.

- Optimize moving averages period to determine best period for trend judgment.

- Adjust RSI parameters to find out best overbought/oversold range.

- Add other indicators like KDJ, MACD to diversify entry signals.

- Introduce machine learning models to find optimized parameters.

Conclusion

The Reversal-Catcher strategy is an effective short-term trading strategy overall. By combining trend filtering and reversal signals, it can avoid false signals during market consolidation and avoid fighting against trend. Through continuous parameters and model optimization, better strategy performance can be achieved.

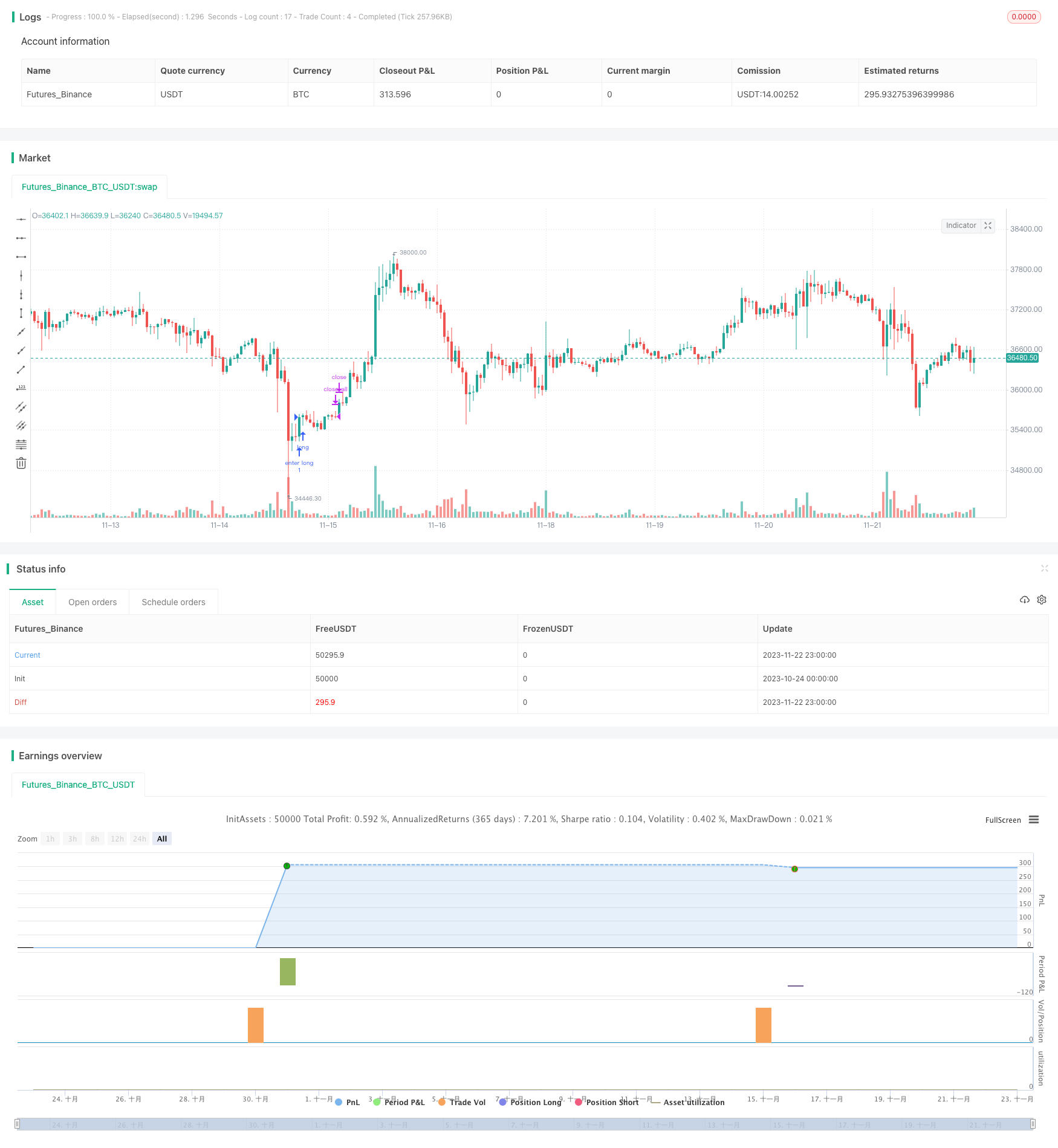

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This is an Open source work. Please do acknowledge in case you want to reuse whole or part of this code.

// Please see the documentation to know the details about this.

//@version=5

strategy('Strategy:Reversal-Catcher', shorttitle="Reversal-Catcher", overlay=true , currency=currency.NONE, initial_capital=100000)

// Inputs

src = input(close, title="Source (close, high, low, open etc.")

BBlength = input.int(defval=20, minval=1,title="Bollinger Period Length, default 20")

BBmult = input.float(defval=1.5, minval=1.0, maxval=4, step=0.1, title="Bollinger Bands Standard Deviation, default is 1.5")

fastMovingAvg = input.int(defval=21, minval=5,title="Fast Exponential Moving Average, default 21", group = "Trends")

slowMovingAvg = input.int(defval=50, minval=8,title="Slow Exponential Moving Average, default 50", group = "Trends")

rsiLenght = input.int(defval=14, title="RSI Lenght, default 14", group = "Momentum")

overbought = input.int(defval=70, title="Overbought limit (RSI), default 70", group = "Momentum")

oversold = input.int(defval=30, title="Oversold limit (RSI), default 30", group = "Momentum")

hide = input.bool(defval=true, title="Hide all plots and legends from the chart (default: true)")

// Trade related

tradeType = input.string(defval='Both', group="Trade settings", title="Trade Type", options=['Both', 'TrendFollowing', 'Reversal'], tooltip="Consider all types of trades? Or only Trend Following or only Reversal? (default: Both).")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=false, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked. (Default: off)", group="Trade settings")

// Utils

annotatePlots(txt, val, hide) =>

if (not hide)

var l1 = label.new(bar_index, val, txt, style=label.style_label_left, size = size.tiny, textcolor = color.white, tooltip = txt)

label.set_xy(l1, bar_index, val)

/////////////////////////////// Indicators /////////////////////

vwap = ta.vwap(src)

plot(hide ? na : vwap, color=color.purple, title="VWAP", style = plot.style_line)

annotatePlots('VWAP', vwap, hide)

// Bollinger Band of present time frame

[BBbasis, BBupper, BBlower] = ta.bb(src, BBlength, BBmult)

p1 = plot(hide ? na : BBupper, color=color.blue,title="Bollinger Bands Upper Line")

p2 = plot(hide ? na : BBlower, color=color.blue,title="Bollinger Bands Lower Line")

p3 = plot(hide ? na : BBbasis, color=color.maroon,title="Bollinger Bands Width", style=plot.style_circles, linewidth = 1)

annotatePlots('BB-Upper', BBupper, hide)

annotatePlots('BB-Lower', BBlower, hide)

annotatePlots('BB-Base(20-SMA)', BBbasis, hide)

// RSI

rsi = ta.rsi(src, rsiLenght)

// Trend following

ema50 = ta.ema(src, slowMovingAvg)

ema21 = ta.ema(src, fastMovingAvg)

annotatePlots('21-EMA', ema21, hide)

annotatePlots('50-EMA', ema50, hide)

// Trend conditions

upTrend = ema21 > ema50

downTrend = ema21 < ema50

// Condition to check Special Entry: HH_LL

// Long side:

hhLLong = barstate.isconfirmed and (low > low[1]) and (high > high[1]) and (close > high[1])

hhLLShort = barstate.isconfirmed and (low < low[1]) and (high < high[1]) and (close < low[1])

longCond = barstate.isconfirmed and (high[1] < BBlower[1]) and (close > BBlower) and (close < BBupper) and hhLLong and ta.crossover(rsi, oversold) and downTrend

shortCond = barstate.isconfirmed and (low[1] > BBupper[1]) and (close < BBupper) and (close > BBlower) and hhLLShort and ta.crossunder(rsi, overbought) and upTrend

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, 1, limit=na, stop=na, comment="Long[E]")

sl := low[1]

target := high >= BBbasis ? BBupper : BBbasis

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, 1, limit=na, stop=na, comment="Short[E]")

sl := high[1]

target := low <= BBbasis ? BBlower : BBbasis

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long[SL]" : "Long[T]")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short[SL]" : "Short[T]")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "EoD[Exit]", alert_message = "EoD Exit", immediately = true)