Overview

This strategy uses the CK channel to determine price trends and sets dynamic stop loss lines to make reverse operations when price reversal occurs. It belongs to short-term trading strategies.

Strategy Principle

The strategy uses the CK channel to determine price trends and support/resistance. It calculates the upper and lower channel lines. When the price breaks through the channel lines, trading signals are generated. In addition, the strategy also tracks the movement of the channel lines and takes reverse positions when the channel lines reverse, which belongs to reversal trading strategies.

Specifically, the strategy calculates the upper and lower channel lines based on the highest and lowest prices. If the upper channel line starts to fall and the lower channel line starts to rise, it is determined as a price reversal to go short. On the contrary, if the lower channel line starts to fall and the upper channel line starts to rise, it is determined as a price reversal to go long.

Advantages of the Strategy

- Use double channels to determine price reversal points for accurate reverse operations

- Adopt dynamic stop loss to control risks and realize timely stop loss

- The strategy logic is simple and clear, easy to understand and implement

Risks of the Strategy

- When market prices fluctuate violently, the stop loss line may be broken, leading to greater losses

- More frequent trading can increase transaction costs

- Need to choose appropriate parameters to control the stop loss line, avoid too loose or too tight

Optimization of the Strategy

- Optimize stop loss line parameters to make it more reasonable and effective

- Incorporate trend indicators to judge the reliability of reversal signals, avoid reverse operations during the trend

- Increase automatic trading and automatic stop loss modules to reduce transaction costs

Summary

The overall idea of the strategy is clear and easy to understand. It uses double channels to determine price reversals and take reverse operations. And it sets dynamic stop loss to control risks. It belongs to typical short-term trading strategies. The strategy effect can be further optimized, mainly by adjusting the stop loss parameters and assisting other technical indicators to determine entry and exit timing.

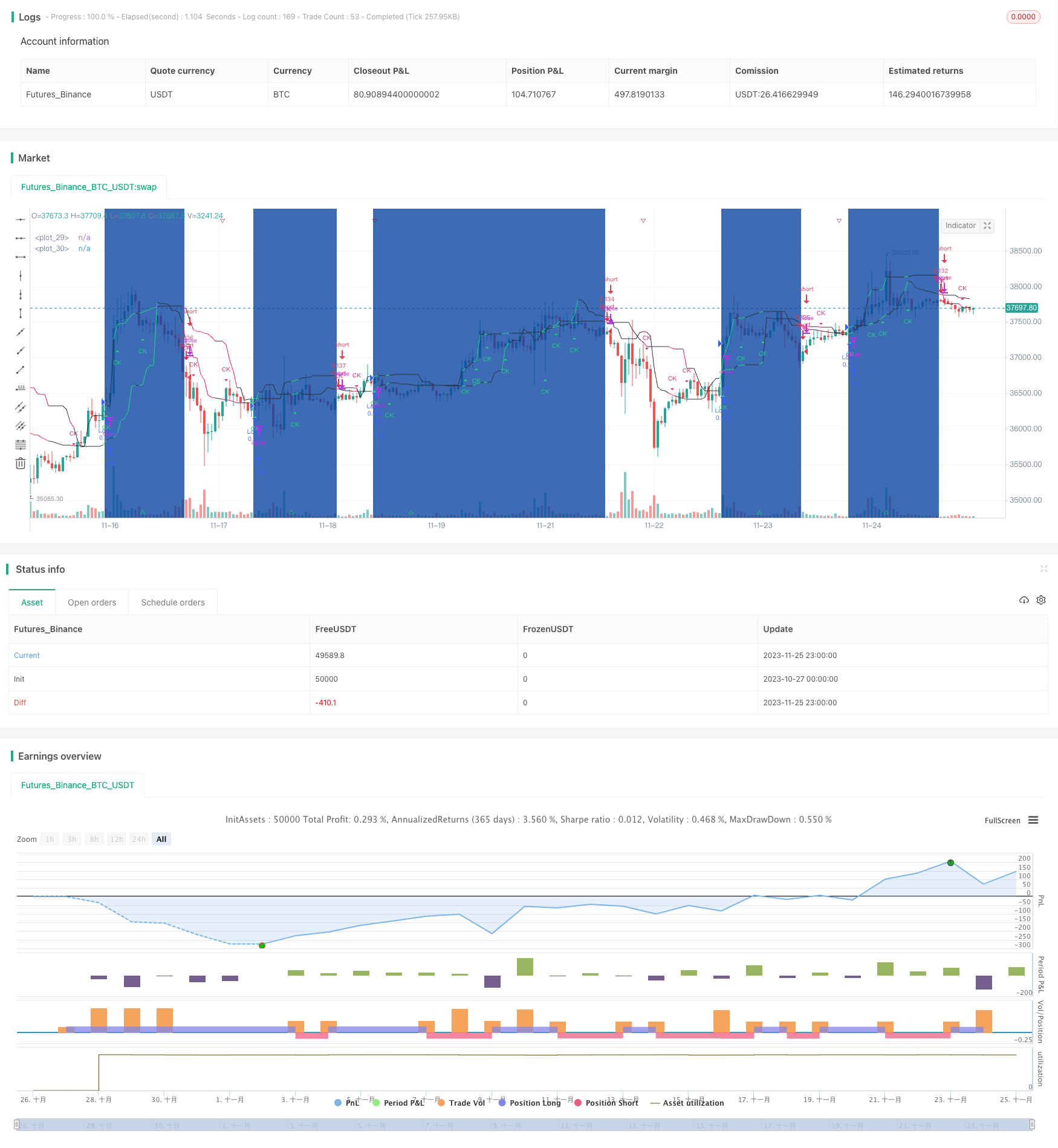

/*backtest

start: 2023-10-27 00:00:00

end: 2023-11-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

//study(title="Chande Kroll Stop", shorttitle="CK Stop", overlay=true)

strategy(title="Chande Kroll Stop", shorttitle="Chande Kroll Stop回測", overlay=true, initial_capital=100000, calc_on_every_tick=true,default_qty_type=strategy.percent_of_equity, default_qty_value=10)

br_red = #e91e63,Red = #f41818,n_green = #91dc16,dk_green = #004d40,lt_green = #16dc78,lt_blue = #0dbdd8,dk_blue = #0a3577,Blue = #034fed,br_orange = #f57c00,dk_orange = #e65100,dk_gray = #434651,dk_pink = #7c1df0,lt_pink = #e743f5,Purple = #5b32f3,lt_purple = #6b5797

hiP = input(9, "",inline="h")

hix = input(1,"" ,inline="h", step=0.1)

hiQ = input(7,"" ,inline="h")

loP = input(9,"" ,inline="h1")

lox = input(1,"" ,inline="h1", step=0.1)

loQ = input(5,"" ,inline="h1")

Xr=input(false,"反向操作:買/賣",inline="T"),

first_high_stop = highest(high, hiP) - hix * atr(hiP)

first_low_stop = lowest(high, loP) + lox * atr(loP)

stop_short = highest(first_high_stop, hiQ)

stop_long = lowest(first_low_stop, loQ)

cklow = stop_short

ckhigh = stop_long

Xdn = cklow < cklow[1] and ckhigh < ckhigh[1]

Xup = cklow > cklow[1] and ckhigh > ckhigh[1]

longcol = Xup ? lt_green : Xdn ? br_red : #2a2e39

shortcol = Xup? lt_green : Xdn ? br_red : #2a2e39

plot(stop_long, color=longcol)

plot(stop_short, color=shortcol)

plotshape(Xup and not Xup[1] , title="CK Stop Buy", text='CK', style=shape.triangleup, size=size.tiny, location=location.belowbar, color=lt_green, textcolor=lt_green,display=display.none)

plotshape(Xdn and not Xdn[1], title="CK Stop Sell", text='CK', style=shape.triangledown, size=size.tiny, location=location.abovebar, color=br_red, textcolor=br_red,display=display.none)

// , default_qty_type=strategy.percent_of_equity, default_qty_value=10, calc_on_every_tick=true)

tl=input(true,"Sig",inline="T"), sbg=input(true,"Bgtrend",inline="T"), vbuild="FIREHORSE XRPUSDT"

Xp = 0.0, Xp:=Xdn? -1 : Xup? 1 : Xp[1], Xdf = Xr? Xup and Xp[1] == -1 : Xdn and Xp[1] == 1 ,Xuf = Xr? Xdn and Xp[1] == 1: Xup and Xp[1] == -1

FY=input(2021,"年",inline="btf"),FM=input(9,"月",inline="btf"),FD=input(01,"日",inline="btf"),

TY = input(2032,"年",inline="to"),TM=input(01,"月",inline="to"),TDy=input(01,"日",inline="to"),

testTF = time>=timestamp(FY,FM,FD,00,00) and time <= timestamp(TY,TM,TDy,23,59)? true:false

plotchar(tl? Xuf:na,vbuild+" 生門","△",location.bottom, #14e540,10,0," " ,#14e540,1,size.tiny)// ︽ ︾

plotchar(tl? Xdf:na,vbuild+" 傷門","▽",location.top, #9b0842,10,0," ", #9b0842,1,size.tiny)

bgcolor(sbg ? Xp==1 ? #0d47a1 :na: na, transp=90),

alertcondition(Xuf,vbuild+ "Buy", "Long 💹 \n"+vbuild), alertcondition(Xdf, vbuild+ " Sell","Short 🈹\n"+vbuild)

if Xuf

alert("Long " + tostring(close)+"\nLong "+input("My Long Msg","Long Alert Msg")+vbuild, alert.freq_once_per_bar)

if Xdf

alert("Short " + tostring(close)+"\nShort"+input("My Short Msg","Short Alert Msg")+vbuild, alert.freq_once_per_bar)

if testTF

strategy.entry("Long ", strategy.long, comment=" Long ",when=Xuf), strategy.entry("Short", strategy.short, comment=" Short",when=Xdf )