Overview

The Ichimoku Kumo Twist Gold-Absorbing Strategy is a quantitative trading strategy that combines the Ichimoku market technical indicator and range filtering. It utilizes the Ichimoku indicator to determine market trends and important support and resistance levels, together with candlestick patterns to generate trading signals. Meanwhile, range filtering helps to control the trading frequency and risk.

Strategy Principle

The strategy is primarily based on the Ichimoku indicator and candlestick patterns to judge market trends. The Ichimoku contains the conversion line, base line and cloud lines, their crossover relationships indicate market trends. The cloud lines also act as support and resistance levels. The strategy sets up different parameter combinations to adjust the sensitivity of the Ichimoku lines. In addition, the strategy identifies patterns and generates buy signals when the conversion line crosses above the base line, and sell signals when crossing below.

Furthermore, the strategy has date range filters set up, so that it only trades within specified date ranges. This controls the trading frequency. Also, the stop loss setting helps to reduce risk by stopping the loss when price runs in an unfavorable direction.

Advantage Analysis

- Utilize Ichimoku indicator to judge market trends, parameters adjustable for sensitivity

- Clear trading signals from candlestick pattern recognition

- Date range filter controls trading frequency

- Stop loss setting for timely stop loss to reduce risk

Risk Analysis

- Ichimoku lagging may miss fast changing trends

- Date range filter may miss some trading chances

- Improper stop loss setting may expand losses

Methods like adjusting Ichimoku parameters, optimizing date range, amending stop loss points can improve and control risks.

Optimization Directions

- Test different parameter combinations to find optimal Ichimoku configuration

- Combine with other indicators to avoid Ichimoku lagging issues

- Backtest to optimize date range settings

- Set conditional dynamic trailing stop loss

Summary

The Ichimoku Kumo Twist Gold-Absorbing Strategy integrates the Ichimoku indicator, candlestick pattern recognition, range filtering to determine market trends. It can grasp trend directions quite clearly. Through means like parameter tuning, risk control etc, good strategy performance can be achieved. But the Ichimoku lagging problem should be noted, and continuous optimization adjustments made.

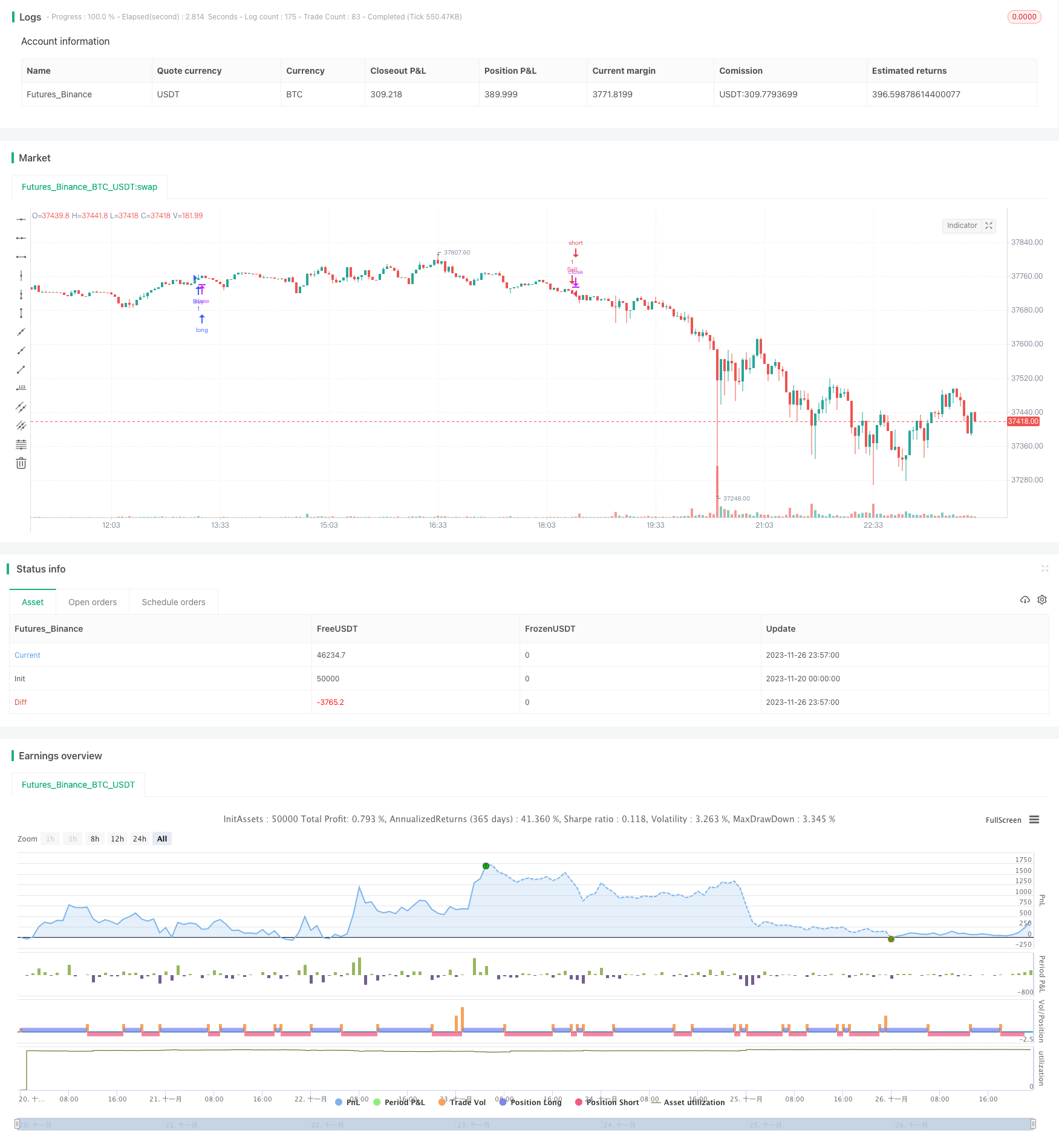

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Ichimoku Kumo Twist Strategy (Presets)", shorttitle="Kumo Twist Strategy", overlay=true)

xlowest_(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := min(x, v)

x

xlowest(src, len) =>

na(src[len]) ? xlowest_(src, len) : lowest(src, len)

xhighest_(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := max(x, v)

x

xhighest(src, len) =>

na(src[len]) ? xhighest_(src, len) : highest(src, len)

dropn(src, n) =>

na(src[n]) ? na : src

ichiConversionPeriods(presets) =>

if presets == "Cpt 20 60 120 30"

20

else

if presets == "Cpt 10 30 60 30"

10

else

if presets == "Std 18 52 104 26"

18

else

9

ichiBasePeriods(presets) =>

if presets == "Cpt 20 60 120 30"

60

else

if presets == "Cpt 10 30 60 30"

30

else

if presets == "Std 18 52 104 26"

52

else

26

ichiLaggingSpan2Periods(presets) =>

if presets == "Cpt 20 60 120 30"

120

else

if presets == "Cpt 10 30 60 30"

60

else

if presets == "Std 18 52 104 26"

104

else

52

ichiDisplacement(presets) =>

if presets == "Cpt 20 60 120 30"

30

else

if presets == "Cpt 10 30 60 30"

30

else

if presets == "Std 18 52 104 26"

26

else

26

scaling = input(title="Scaling", options=["Linear", "Log"], defval="Linear")

presets = input(title="Presets", options=["Cpt 20 60 120 30", "Cpt 10 30 60 30", "Std 18 52 104 26", "Std 9 26 52 26"], defval="Cpt 20 60 120 30")

dropCandles = input(1, minval=0, title="Drop first N candles")

showClouds = input(false, "Show Clouds")

stoploss = input(true, title="Stop Loss")

conversionPeriods = ichiConversionPeriods(presets)

basePeriods = ichiBasePeriods(presets)

laggingSpan2Periods = ichiLaggingSpan2Periods(presets)

displacement = ichiDisplacement(presets)

logScaling = scaling == "Log"

lows = dropn(low, dropCandles)

highs = dropn(high, dropCandles)

lowsp = logScaling ? log(lows) : lows

highsp = logScaling ? log(highs) : highs

donchian(len) =>

avg(xlowest(lowsp, len), xhighest(highsp, len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

// === BACKTEST RANGE ===

FromMonth = input(defval = 10, title = "From Month", minval = 1)

FromDay = input(defval = 3, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 2014)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 2014)

golong = crossover(leadLine1, leadLine2)

goshort = crossunder(leadLine1, leadLine2)

strategy.entry("Buy", strategy.long, when=(golong and (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))))

strategy.entry("Sell", strategy.short, when=(goshort and (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))))

conversionLinep = logScaling ? exp(conversionLine) : conversionLine

baseLinep = logScaling ? exp(baseLine) : baseLine

leadLine1p = logScaling ? exp(leadLine1) : leadLine1

leadLine2p = logScaling ? exp(leadLine2) : leadLine2

plot(showClouds ? conversionLinep : na, color=#0496ff, title="Conversion Line")

plot(showClouds ? baseLinep : na, color=#991515, title="Base Line")

p1 = plot(showClouds ? leadLine1p : na, offset = displacement, color=green, title="Lead 1")

p2 = plot(showClouds ? leadLine2p : na, offset = displacement, color=red, title="Lead 2")

fill(p1, p2, color = showClouds ? (leadLine1p > leadLine2p ? green : red) : na)