Overview

This strategy combines dual EMA golden crosses, normalized ATR noise filter, and ADX trend indicator to provide more reliable buy signals for traders. It integrates multiple indicators to filter out false signals and identify more reliable trading opportunities.

Strategy Principle

The strategy uses 8-period and 20-period EMAs to build a dual EMA golden cross system. It generates buy signals when the shorter period EMA crosses above the longer period EMA.

In addition, the strategy has set up several auxiliary indicators for filtering:

14-period ATR, normalized to filter out minor price fluctuations in the market.

14-period ADX to identify the strength of trends. Trades are considered only in strong trends.

14-period SMA of volume to filter out time points with small trading volumes.

4⁄14-period Super Trend indicator to judge bullish or bearish market direction.

Only when the trend direction, normalized ATR value, ADX level and volume conditions are met, the EMA golden cross will eventually trigger the buy signal.

Strategy Advantages

- Reliability from multiple indicators combination

Integrating indicators like EMA, ATR, ADX and Super Trend forms a strong signal filtering system, higher reliability.

- More flexibility in parameter tuning

Threshold values of normalized ATR, ADX, holding period etc. can be optimized, higher flexibility.

- Distinguishing bull and bear markets

Identify bull and bear markets using Super Trend, avoid missing opportunities.

Strategy Risks

- Difficulty in parameter optimization

Too many parameters, difficulty in finding the optimum combination.

- Risk of indicator failure

There is still risk of false signals due to lagging nature of indicators. Proper stop loss theory needs consideration.

- Low trading frequency

Frequency tends to be low due to multiple filters, long no-trade duration possible.

Optimization Directions

- Optimize parameter combination

Finding optimum combination requires large amount of backtesting data.

- Incorporate machine learning

Use ML algorithms to automatically optimize parameters over time. Improve adaptiveness.

- Consider more market factors

Combining indicators of market structure, emotions etc. improves diversity.

Conclusion

This strategy comprehensively considers trend, volatility and volume price factors. Through multi-indicator filtering and parameter tuning, it forms a reliable trading system. The reliability is high and can be further improved via optimization.

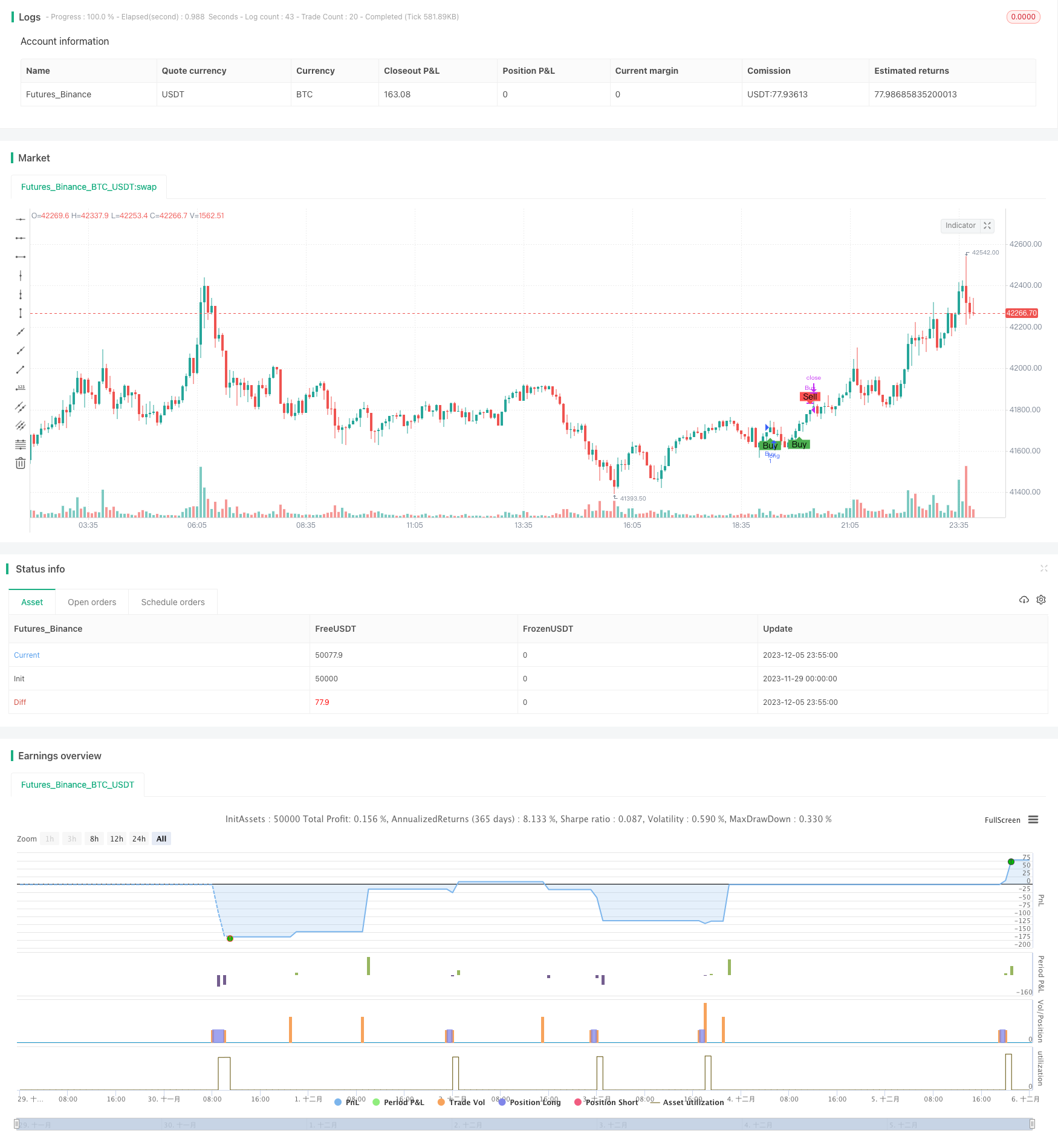

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-06 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Description:

//This strategy is a refactored version of an EMA cross strategy with a normalized ATR filter and ADX control.

//It aims to provide traders with signals for long positions based on market conditions defined by various indicators.

//How it Works:

//1. EMA: Uses short (8 periods) and long (20 periods) EMAs to identify crossovers.

//2. ATR: Uses a 14-period ATR, normalized to its 20-period historical range, to filter out noise.

//3. ADX: Uses a 14-period RMA to identify strong trends.

//4. Volume: Filters trades based on a 14-period SMA of volume.

//5. Super Trend: Uses a Super Trend indicator to identify the market direction.

//How to Use:

//- Buy Signal: Generated when EMA short crosses above EMA long, and other conditions like ATR and market direction are met.

//- Sell Signal: Generated based on EMA crossunder and high ADX value.

//Originality and Usefulness:

//This script combines EMA, ATR, ADX, and Super Trend indicators to filter out false signals and identify more reliable trading opportunities.

//USD Strength is not working, just simulated it as PSEUDO CODE: [close>EMA(50)]

//Strategy Results:

//- Account Size: $1000

//- Commission: Not considered

//- Slippage: Not considered

//- Risk: Less than 5% per trade

//- Dataset: Aim for more than 100 trades for sufficient sample size

//Note: This script should be used for educational purposes and should not be considered as financial advice.

//Chart:

//- The script's output is plotted as Buy and Sell signals on the chart.

//- No other scripts are included for clarity.

//- Have tested with 30mins period

//- You are encouraged to play with parameters, let me know if you

//@version=5

strategy("Advanced EMA Cross with Normalized ATR Filter, Controlling ADX", shorttitle="ALP V5", overlay=true )

// Initialize variables

var bool hasBought = false

var int barCountSinceBuy = 0

// Define EMA periods

emaShort = ta.ema(close, 8)

emaLong = ta.ema(close, 20)

// Define ATR parameters

atrLength = 14

atrValue = ta.atr(atrLength)

maxHistoricalATR = ta.highest(atrValue, 20)

minHistoricalATR = ta.lowest(atrValue, 20)

normalizedATR = (atrValue - minHistoricalATR) / (maxHistoricalATR - minHistoricalATR)

// Define ADX parameters

adxValue = ta.rma(close, 14)

adxHighLevel = 30

isADXHigh = adxValue > adxHighLevel

// Initialize risk management variables

var float stopLossPercent = na

var float takeProfitPercent = na

// Calculate USD strength

// That's not working as usd strenght, since I couldn't manage to get usd strength

//I've just simulated it as if the current close price is above 50 days average (it's likely a bullish trend), usd is strong (usd_strenth variable is positive)

usd_strength = close / ta.ema(close, 50) - 1

// Adjust risk parameters based on USD strength

if (usd_strength > 0)

stopLossPercent := 3

takeProfitPercent := 6

else

stopLossPercent := 4

takeProfitPercent := 8

// Initialize position variable

var float positionPrice = na

// Volume filter

minVolume = ta.sma(volume, 14) * 1.5

isVolumeHigh = volume > minVolume

// Market direction using Super Trend indicator

[supertrendValue, supertrendDirection] = ta.supertrend(4, 14)

bool isBullMarket = supertrendDirection < 0

bool isBearMarket = supertrendDirection > 0

// Buy conditions for Bull and Bear markets

buyConditionBull = isBullMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.2

buyConditionBear = isBearMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.5

buyCondition = buyConditionBull or buyConditionBear

// Sell conditions for Bull and Bear markets

sellConditionBull = isBullMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellConditionBear = isBearMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellCondition = sellConditionBull or sellConditionBear

// Final Buy and Sell conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

positionPrice := close

hasBought := true

barCountSinceBuy := 0

if (hasBought)

barCountSinceBuy := barCountSinceBuy + 1

// Stop-loss and take-profit levels

longStopLoss = positionPrice * (1 - stopLossPercent / 100)

longTakeProfit = positionPrice * (1 + takeProfitPercent / 100)

// Final Sell condition

finalSellCondition = sellCondition and hasBought and barCountSinceBuy >= 3 and isVolumeHigh

if (finalSellCondition)

strategy.close("Buy")

positionPrice := na

hasBought := false

barCountSinceBuy := 0

// Implement stop-loss and take-profit

strategy.exit("Stop Loss", "Buy", stop=longStopLoss)

strategy.exit("Take Profit", "Buy", limit=longTakeProfit)

// Plot signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=finalSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")