Overview

This strategy is named “Trend Tracking Strategy Based on Dual Vortex Indicator Combined with True Strength Index”. It opens long and short positions when the dual vortex indicator and true strength index issue buy and sell signals, and closes positions after a certain price movement to capture medium- to long-term trends.

Strategy Logic

This strategy uses both the dual vortex indicator and the true strength index (TSI). The dual vortex indicator consists of VI+ and VI- lines, reflecting the magnitude of upward and downward momentum respectively. The TSI has red and blue lines measuring the strength and direction of price changes.

When VI+ rises and VI- falls, indicating strengthening uptrend and weakening downtrend momentum, the dual vortex indicator generates a long signal. If at the same time, the TSI blue line crosses above the red line, TSI also issues a long signal. The strategy will open a long position when both indicators give out long signals simultaneously.

Conversely, when VI+ falls and VI- rises, signaling weakening upside momentum and strengthening downside momentum, the dual vortex gives out a short signal. If the TSI blue line crosses below the red line as well, the TSI produces a short signal too. The strategy then opens a short position upon receiving aligned short signals.

By combining signals from both indicators this way, the strategy is able to identify and track nascent medium- to long-term trends. Exit signals are generated when the trends end. Thus, this strategy can effectively capture large trend-following moves in the market.

Advantage Analysis

The main advantages of this strategy include:

- The dual indicator filter improves signal reliability and avoids false signals.

- Adopting medium- to long-term indicators allows catching larger trends. Short-term signals tend to be disturbed by market noise.

- Flexible adjustment of holding period through parameter tuning. This allows both trend tracking and single trade risk control.

- Balancing trend following and risk management. Indicators identify trends well. Risk is controlled by setting exit price waves.

Risk Analysis

Some risks also exist:

- Medium- to long-term holding may face whipsaw price actions for stop loss. This can be mitigated by reducing exit wave period or adjusting stop loss properly.

- Probability of false signals still exists despite the dual indicator filter. Additional indicator confirmation or parameter tuning helps.

- Relatively low capital usage efficiency because capital is held for longer holding periods. Position sizing could be adjusted to optimize fund utilization.

- Reliance on trending markets. Position sizes should be reduced in range-bound markets to avoid unnecessary losses.

Optimization Directions

Some ways to optimize the strategy include:

- Introducing more indicator combos to strengthen signal quality via multiple filtering.

- Optimizing parameters to suit different products’ characteristics better.

- Adding dynamic position sizing to extend positions in trending while reducing sizes in ranging markets.

- Incorporating stop loss mechanisms like trailing stop loss and partial close stop loss to control risks.

- Combining Elliott Wave analysis to identify larger degree trends as directional filter.

- Utilizing machine learning to auto-optimize parameters and rules for enhanced adaptiveness.

Conclusion

In summary, this strategy is an excellent medium- to long-term trend following approach. By leveraging the techniques of dual vortex indicator and TSI, it can recognize emerging mid- to long-term trends reliably. With proper parameter tuning, per trade risks can be managed. Further optimizations by incorporating more indicators and risk control techniques would lead to improved performance. It suits investors interested in mid- to long-term trend trading.

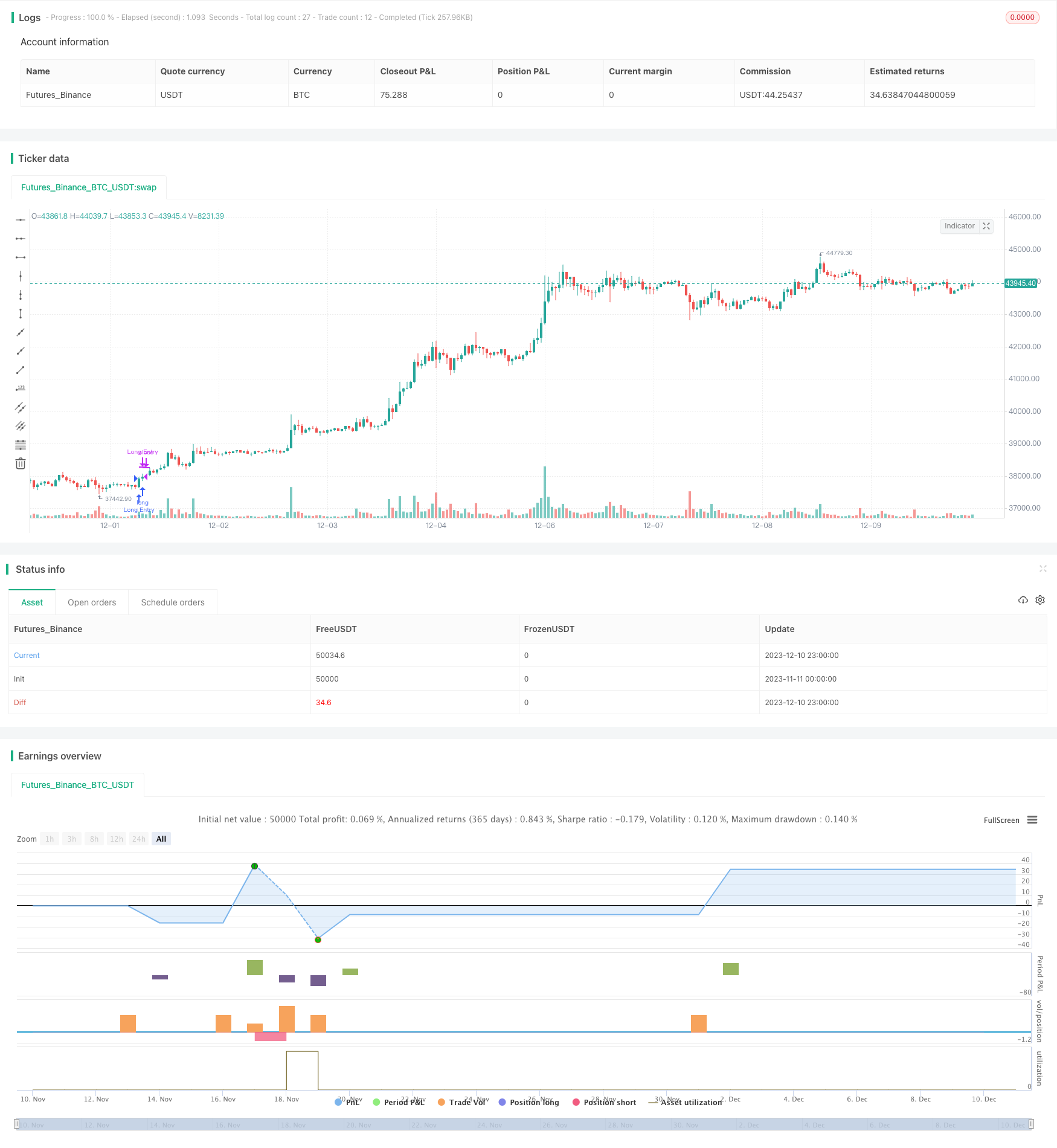

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hydrelev

//@version=4

strategy("Vortex TSI strategy", overlay=false)

///////////////////INDICATOR TSI

long = input(title="Long Length", type=input.integer, defval=25)

short = input(title="Short Length", type=input.integer, defval=13)

signal = input(title="Signal Length", type=input.integer, defval=13)

price = close

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_blue = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

tsi_red = ema(tsi_blue, signal)

// plot(tsi_blue, color=#3BB3E4)

// plot(tsi_red, color=#FF006E)

// hline(0, title="Zero")

/////////////////INDICATOR VI

period_ = input(14, title="Period", minval=2)

VMP = sum( abs( high - low[1]), period_ )

VMM = sum( abs( low - high[1]), period_ )

STR = sum( atr(1), period_ )

VIP_blue = VMP / STR

VIM_red = VMM / STR

// plot(VIP_blue, title="VI +", color=#3BB3E4)

// plot(VIM_red, title="VI -", color=#FF006E)

////////////////////STRATEGY

bar=input(1, title="Close after x bar", minval=1, maxval=50)

tsi_long = crossover(tsi_blue, tsi_red)

tsi_short = crossunder(tsi_blue, tsi_red)

vi_long = crossover(VIP_blue, VIM_red)

vi_short = crossunder(VIP_blue, VIM_red)

LongConditionOpen = tsi_long and vi_long ? true : false

LongConditionClose = tsi_long[bar] and vi_long[bar] ? true : false

ShortConditionOpen = tsi_short and vi_short ? true : false

ShortConditionClose = tsi_short[bar] and vi_short[bar] ? true : false

if (LongConditionOpen)

strategy.entry("Long Entry", strategy.long)

if (LongConditionClose)

strategy.close("Long Entry")

if (ShortConditionOpen)

strategy.entry("Short Entry", strategy.short)

if (ShortConditionClose)

strategy.close("Short Entry")