Overview

This is a universal trading strategy designed for the crypto market, aiming to find good entry opportunities when being bullish on cryptos for mid-to-long term holding. It combines various technical indicators like MFI, STOCH, VWMA to identify potential trend reversal based on hidden divergence.

Trading Logic

The strategy has two entry logics:

MFI hidden divergence + STOCH filter: When there’s a hidden divergence between price and MFI, i.e. price reaches new high but MFI does not, it indicates a potential trend reversal. To avoid false signals, we add STOCH>50% as a further filter.

STOCH/MFI trend system: When STOCH>50% and MFI crosses above 50, it signals an uptrend in action. We can ride the trend for better risk-adjusted returns.

To ensure the accuracy of trend detection, a trend system comprised of VWMA and SMA is constructed. Entries are only allowed when VWMA crosses over SMA, confirming an upward trend. Besides, OBV is used to check if the overall market is active or ranging. This further filters out some false signals.

ATR is used to determine if the market is ranging. We prefer to take entries on hidden divergence during range-bound markets. The stop loss is set based on recent support levels. Take profit exits when certain percentage of profits is reached based on entry price.

Advantage Analysis

The strategies combines various indicators to filter out market noise and avoid false signals. The hidden divergence system provides high-probability entries with controlled risk during ranging and corrective markets. The STOCH/MFI trend system generates additional profits when a clear trend establishes. Reasonable TP and SL settings prevent chasing momentum and stop hunts. The strategy suits the highly volatile crypto market very well for solid risk-adjusted returns.

Risk Analysis

The major risk is that hidden divergence does not always lead to an immediate reversal as it merely suggests shifting market sentiment. Noisy STOCH and other signals may result from bad parameter tuning. Overly tight TP/SL levels can also lead to excessive exits and re-entries, dragging down net profits.

We tackle these issues via additional trend and market condition filters, more tolerant TP/SL levels, etc. Still significant losses may occur in case of major black swan events or a failure to cut loss in time.

Optimization Directions

There remains room for improving this strategy:

Optimize MFI/STOCH parameters for better hidden divergence accuracy

Add ML models to determine market conditions and fine-tune parameters

Test dynamic TP/SL to balance profitability and risk control

Check cross-asset differences and set personalized parameters

Add stock selection filters for better quality picks

These efforts can potentially enhance the stability and profitability further.

Conclusion

This is a very practical crypto trading strategy. It judiciously applies various technical indicators to determine market conditions and delivers solid risk-adjusted profits. The main caveat is hidden divergence does not always precisely predict immediate reversals. We handle this issue via a sequence of filters. There remains room for boosting stability and returns. It offers fruitful ideas for quants to harvest consistent gains in the crypto space.

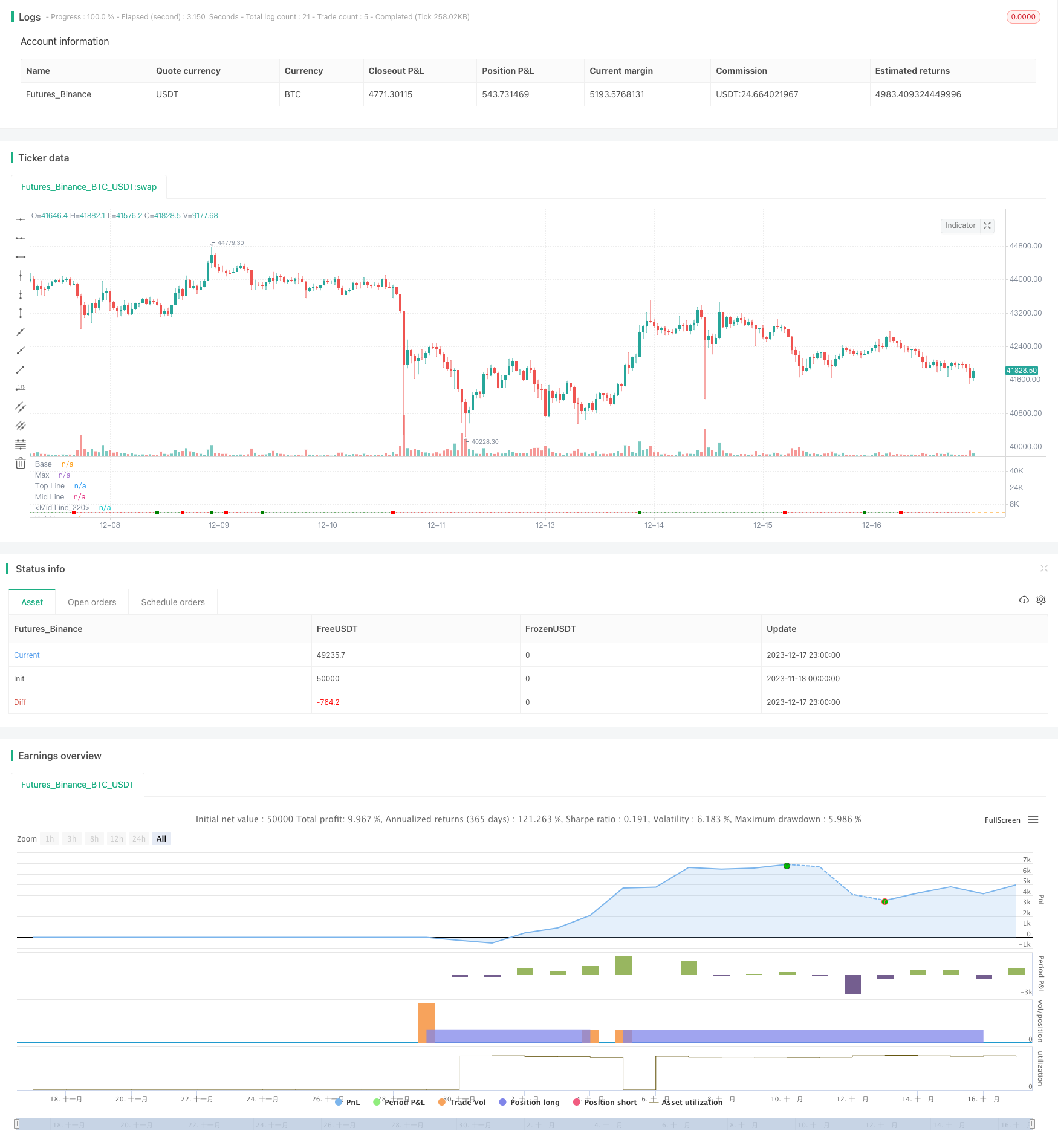

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kifier

//@version=4

strategy("Kifier's MFI/STOCH Hidden Divergence/Trend Beater", shorttitle = "Kifier's MFI/STOCH", overlay=false, margin_long=100, margin_short=100, default_qty_type = strategy.percent_of_equity, default_qty_value = 95, max_boxes_count = 500)

//Values

enb_date = input(false ,"Enable Date Range?", type = input.bool, inline = "1")

enb_current = input(true ,"Today as End Date" , type = input.bool, inline = "1")

i_start_date = input(timestamp("01 Jan 2021 00:00 +0300") ,"Start Date" , type=input.time)

i_end_date = input(timestamp("16 July 2021 00:00 +0300") ,"End Date" , type=input.time)

time_check = true

i_vwma_length = input(50, "VWMA Length" ,type = input.integer, group = "Indicator Settings", inline = "2")

i_sma_length = input(50, "SMA Length" ,type = input.integer, group = "Indicator Settings", inline = "2")

i_stoch_length = input(28, "Stoch Length" ,type = input.integer, group = "Indicator Settings", inline = "3")

i_mfi_length = input(7 , "MFI Length" ,type = input.integer, group = "Indicator Settings", inline = "3")

i_obv_length = input(100, "OBV Length" ,type = input.integer, group = "Indicator Settings")

i_atr_len = input(100, "ATR Ranging-trend len" ,type = input.integer, group = "Indicator Settings", tooltip = "This is the length of the ATR Emas that check when the market in a general trend or is just ranging")

i_div_price = input(5 ,"Price Divergant Pivots" ,type = input.integer, group = "Divergance Settings")

i_inacc = input(0.05 ,"Price Inaccuracy" ,type = input.float , group = "Divergance Settings")

i_div_length = input(3 ,"Divergance Valid Period" ,type = input.integer, group = "Divergance Settings")

i_mfi_left = input(5 ,"MFI Left/Right Pivots" ,type = input.integer, group = "Divergance Settings", inline = "4")

i_mfi_right = input(2 ,"" ,type = input.integer, group = "Divergance Settings", inline = "4")

tp_percentage = input(10 , "TP Percentage" ,type = input.float , group = "Exit Settings")/100

_inacc = input(0.03, "Support Inaccuracy" ,type = input.float, step = 0.01, group = "Exit Settings")

enb_stoch_mfi = input(true, "Use Stoch/MFI Trend" , type = input.bool, group = "Individual Entries")

enb_stoch_mfi_div = input(true, "Use Stoch/MFI Divergance ", type = input.bool, group = "Individual Entries")

c_mfi = input(color.yellow ,"MFI/STOCH Colour " , type = input.color, group = "Indicator Colours", inline = "os")

c_stoch = input(color.silver ,"" , type = input.color, group = "Indicator Colours", inline = "os")

c_buy = input(color.green ,"Buy/Sell Colour " , type = input.color, group = "Indicator Colours", inline = "pos")

c_sell = input(color.red ,"" , type = input.color, group = "Indicator Colours", inline = "pos")

c_flat = input(color.blue ,"Flat/Trending Colours" , type = input.color, group = "Indicator Colours", inline = "trend")

c_longtrend = input(color.green ,"" , type = input.color, group = "Indicator Colours", inline = "trend")

//Global Variables

var float tpprice = na

f_c_gradientAdvDec(_source, _center, _c_bear, _c_bull) =>

var float _maxAdvDec = 0.

var float _qtyAdvDec = 0.

bool _xUp = crossover(_source, _center)

bool _xDn = crossunder(_source, _center)

float _chg = change(_source)

bool _up = _chg > 0

bool _dn = _chg < 0

bool _srcBull = _source > _center

bool _srcBear = _source < _center

_qtyAdvDec :=

_srcBull ? _xUp ? 1 : _up ? _qtyAdvDec + 1 : _dn ? max(1, _qtyAdvDec - 1) : _qtyAdvDec :

_srcBear ? _xDn ? 1 : _dn ? _qtyAdvDec + 1 : _up ? max(1, _qtyAdvDec - 1) : _qtyAdvDec : _qtyAdvDec

_maxAdvDec := max(_maxAdvDec, _qtyAdvDec)

float _transp = 100 - (_qtyAdvDec * 100 / _maxAdvDec)

var color _return = na

_return := _srcBull ? color.new(_c_bull, _transp) : _srcBear ? color.new(_c_bear, _transp) : _return

//Simple Sup/Res

var float _pH = na

var float _pL = na

_ph = pivothigh(high,20,20)

_pl = pivotlow(low,20,20)

_high_inacc = _inacc * high

_low_inacc = _inacc * low

if _ph

_pH := high

if (high-_high_inacc) > _pH and _ph

_pH := high

_pH := nz(_pH)

if _pl

_pL := low

if (low+_low_inacc) < _pL[1]

_pL := low

_pL := nz(_pL)

broke_res = iff(crossover(close, _pH), true, false)

//Indicator Initialisation

s_stoch = stoch(close, high, low, i_stoch_length)

s_vwma = vwma(close,i_vwma_length)

s_sma = sma(close,i_sma_length)

//MONEY FLOW + BBW

atr1 =ema((atr(14)/close),i_atr_len/2)

atr2 =ema((atr(14)/close), i_atr_len)

is_ranging = iff(atr1 < atr2, true, false)

s_mfi = mfi(close,i_mfi_length)

overTop = iff(s_mfi >= 90, true, false)

underBot = iff(s_mfi <= 10, true, false)

//Price Divergance

ph = pivothigh(high, i_div_price,i_div_price)

pl = pivotlow(low,i_div_price,i_div_price)

var float pH = 0.0

var float pL = 0.0

high_acc = high * (i_inacc)

low_acc = low * i_inacc

if (high-high_acc) > pH or (high+high_acc < pH) and ph

pH := high

pH := nz(pH)

if (low+low_acc) < pL or (low-low_acc > pL) and pl

pL := low

pL := nz(pL)

higher_low = false

lower_low = false

//Filter out innacurate

if ph or pl

if pL < pL[1]

lower_low := true

if pL > pL[1]

higher_low := true

//MFI Divergance

mh = pivothigh(s_mfi, i_mfi_left,i_mfi_right)

ml = pivotlow(s_mfi, i_mfi_left,i_mfi_right)

bl = bar_index

var float mH = 0.0

var float mL = 0.0

var int bL = 0

if mh

mH := highest(nz(mh),i_mfi_left)

mH := nz(mH)

if ml

bL := bar_index

mL := ml

mL := nz(mL)

higher_low_m = false

lower_low_m = false

if ml

if mL < mL[1]

lower_low_m := true

if mL > mL[1]

higher_low_m := true

//Combintion

var int price_range = na

var int rsi_range = na

var int mfi_range = na

//Higher low on price, lower low on rsi, then check with stoch

mfi_div_bullish = iff(higher_low and higher_low_m, true, false)

if mfi_div_bullish

price_range := 0

rsi_range := 0

//VWMA/SMA/OBV

_src = s_vwma-s_sma

sd_src = stdev(_src,14)

pooled_src = (_src/sd_src)*2

sd_s_vwma = stdev(s_vwma,14)

sd_s_sma = stdev(s_sma,14)

longTrend = obv > ema(obv,100) and is_ranging == false

crossOver = crossover(s_vwma , s_sma)

crossingOver = (s_vwma > s_sma) and (close >= s_vwma)

crossUnder = crossunder(s_vwma, s_sma)

crossingUnder = (s_vwma < s_sma) and (close <= s_vwma)

hist_color = f_c_gradientAdvDec(s_vwma-s_sma, (s_vwma-s_sma)/2, color.new(c_sell,90), color.new(c_buy,80))

//Strategy Entries

mfi_stoch_trend = iff(enb_stoch_mfi, iff(s_stoch >= 50 and crossover(s_mfi, 50) and crossingOver and longTrend and is_ranging == false, true, false), false)

var buy_counter_rsi = 0

var buy_counter_mfi = 0

mfi_div = iff(enb_stoch_mfi_div, iff(mfi_div_bullish and crossingOver and s_stoch >= 50 and is_ranging, true, false), false)

if mfi_div

buy_counter_mfi := bar_index + 5

mfi_divergent_buy = iff(bar_index <= buy_counter_mfi and strategy.position_size == 0, true, false)

//Strategy Entries

order_fired = false

var float previousRes = 0.0

tpprice := strategy.position_avg_price * (1+tp_percentage)

if time_check

if mfi_stoch_trend

strategy.entry("Buy", true, comment = "[B] STOCH/MFI")

order_fired := true

if mfi_divergent_buy

strategy.entry("Buy", true, comment = "[B] MFI Hidden Divergance")

order_fired := true

if order_fired

previousRes := _pL

if strategy.position_size > 0

strategy.exit("Buy", limit = tpprice, comment = "TP")

if close <= previousRes

strategy.exit("Buy", stop = previousRes, comment = "SL")

//Drawings

hline(0, "Base", color.white)

hline(100, "Max", color.white)

p_stoch = plot(s_stoch, color = c_stoch)

p_mfi = plot(s_mfi, color = c_mfi)

hline(70, "Top Line")

p_mid = plot(50, "Mid Line", color.new(color.white,100))

hline(50, "Mid Line")

hline(30, "Bot Line")

fill(p_stoch, p_mid, color.new(c_stoch, 60))

plotshape(crossOver ? 5 : crossUnder ? -5 : na, style = shape.square, color = crossOver ? c_buy : crossUnder ? c_sell : na, size = size.tiny, location = location.absolute)

plot((_src/sd_src)*2, color = hist_color, style = plot.style_histogram)

//Boxes

// var string same = ""

// var box _box = na

// if longTrend and is_ranging == false and same != "longtrend"

// same := "longtrend"

// _box := box.new(bar_index, 105, bar_index, 100, bgcolor = c_longtrend,border_color = color.new(color.white, 100))

// else if is_ranging and same != "isranging"

// same := "isranging"

// _box := box.new(bar_index, 105, bar_index, 100, bgcolor = c_flat,border_color = color.new(color.white, 100))

// if not na(_box)

// box.set_right(_box,bar_index)

// //Div Lines

// var line _line = na

// if mfi_divergent_buy

// _line = line.new(bL[1] -6, s_mfi[bar_index-bL[1]], bar_index + 6, s_mfi, color = color.green, width = 3)