Overview

This strategy is the actual code implementation of the famous Turtle trading system, using a 55-period channel for entry signals and a 20-period channel for exit signals to track longer-term trends, belonging to the trend-following strategy type.

Strategy Logic

The strategy is mainly based on two indicators: the 55-period highest price (HI) and lowest price (LO) to construct the entry channel, and the 20-period highest price (hi) and lowest price (lo) to construct the exit channel.

When the price breaks above the 55-period channel, a buy signal is generated; when the price breaks below the 55-period channel, a sell signal is generated. This is the typical trend-following entry logic.

When the price breaks below the 20-period channel, long positions are closed; when the price breaks above the 20-period channel, short positions are closed. This is the exit logic of the strategy.

The strategy also plots the 55-period channel and 20-period channel, which can visually see the entry and exit points of the strategy.

Advantage Analysis

The main advantages of this strategy are:

- Tracking mid-to-long-term trends with relatively small drawdowns

- Clear entry signals using channel principle and good drawdown control

- Strict exit mechanism to avoid losses from reversals

- Simple parameter settings, easy to implement

Risk Analysis

There are also some risks with this strategy:

- Unable to capture short-term opportunities, relatively weak profitability

- Unable to cope with sudden events, prone to stop loss

- Cannot effectively control excessive losses in one-way markets

- Very sensitive to parameters

The risks can be reduced through:

- Parameter optimization to find optimal combinations

- Adding stop loss strategies to control one-way market losses

- Combining other indicators to identify potential reversal opportunities

Optimization Directions

The strategy can be optimized in several aspects:

- Optimize parameters of entry and exit channels to find optimal combination

- Add volatility indicators to avoid choppy markets

- Combine trading volume indicators to ensure amplified volumes on entry signals

- Add moving stop loss strategies to follow dynamic stop loss lines

- Combine multiple timeframes for comprehensive multi-timeframe trading

Conclusion

In summary, this is a very typical trend-following strategy, using channels to capture mid-to-long term trends with good drawdown control. It also has some typical issues of trend-following strategies, like insufficient trend capturing ability and difficulty dealing with reversals. With comprehensive optimizations, the advantages can be fully realized to become a reliable quantitative strategy.

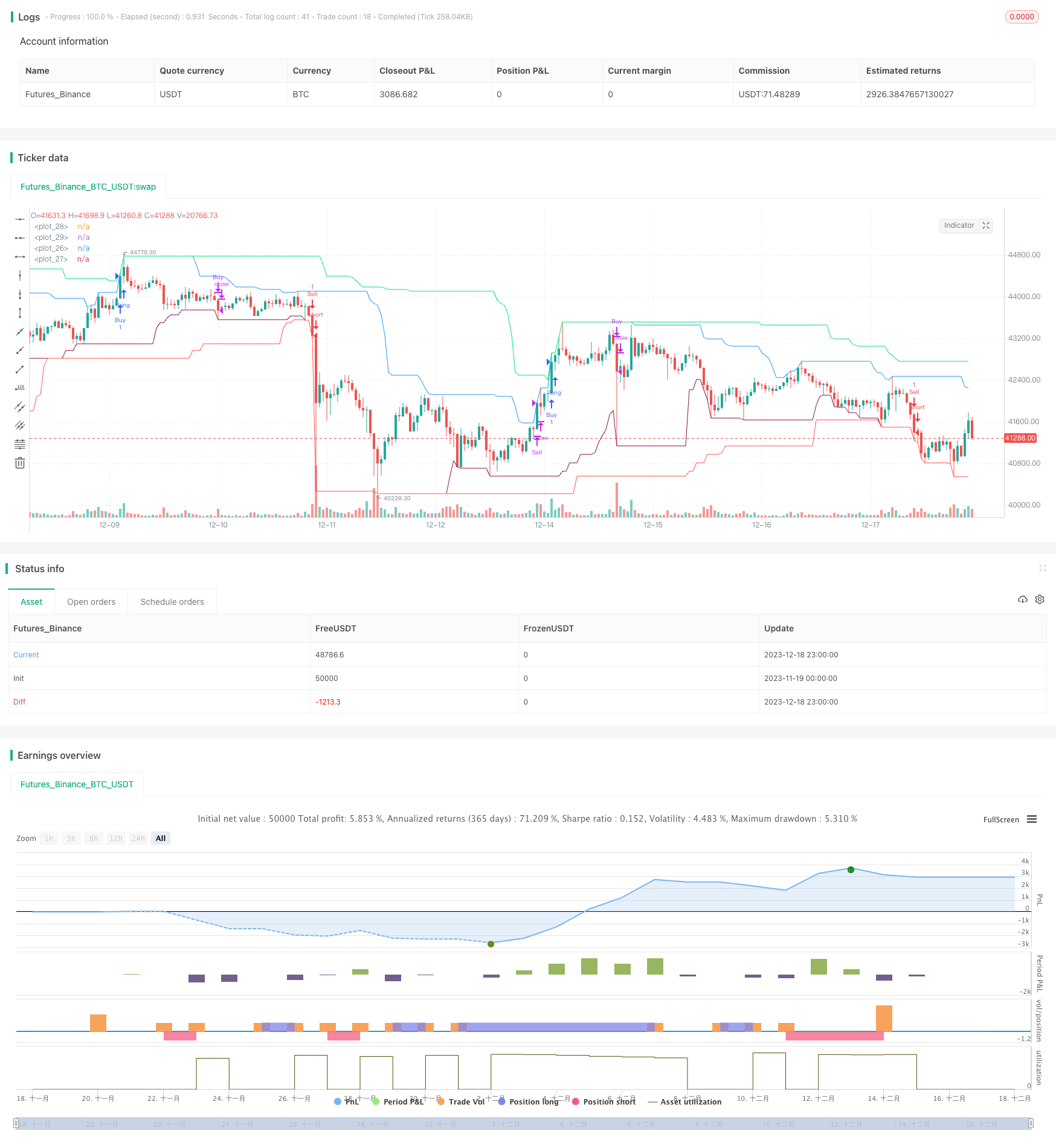

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © racer8

//@version=4

strategy("Turtle System", overlay=true)

n = input(55,"Entry Length")

e = input(20,"Exit Length")

HI = highest(n)

LO = lowest(n)

hi = highest(e)

lo = lowest(e)

if close>HI[1]

strategy.entry("Buy", strategy.long)

if close<LO[1]

strategy.entry("Sell", strategy.short)

if low<lo[1]

strategy.close("Buy")

if high>hi[1]

strategy.close("Sell")

plot(HI,color=color.lime)

plot(LO,color=color.red)

plot(hi,color=color.blue)

plot(lo,color=color.maroon)