Overview

This strategy is a high/low level strategy suitable for cryptocurrency markets. It integrates MACD, PSAR, ATR, Elliott Wave and other multiple indicators for trading at higher timeframes like 1 hour, 4 hours or 1 day. The advantage of this strategy lies in the high risk reward ratio with average profit factor ranging from 1.5 to 2.5.

Strategy Logic

The trading signals of this strategy come from the price high/low levels and composite judgments of multiple indicators. The specific logic is:

Judge if there is a high/low level range formed by successive higher highs or lower lows on the price chart.

Check the histogram level of MACD.

Check PSAR indicator for trend direction.

Check trend direction based on ATR and MA.

Confirm trend direction with Elliott Wave indicator.

If all the 5 conditions point to the same direction, long or short signals are generated.

Advantages

High risk reward ratio up to 1:30.

High average profit factor, usually between 1.5-2.5.

Combination of multiple indicators helps filter false breakouts effectively.

Risks

Relatively low win rate around 10%-20%.

Potential drawdown and whipsaw risks exist.

Indicator performance could be impacted by market regimes.

Need decent psychological endurance.

Corresponding Measures:

Increase capital to balance the win rate.

Set strict stop loss for each trade.

Adjust parameters based on different markets.

Strengthen psychology and control position sizing.

Optimization Directions

Test parameters based on different cryptos and markets.

Add stop loss and take profit to optimize money management.

Increase win rate with machine learning methods.

Add social sentiment filter for trading signals.

Consider confirmation across multiple timeframes.

Conclusion

In conclusion, this is an aggressive high risk high return cryptocurrency trading strategy. Its advantage lies in the high risk reward ratio and profit factor. The main risks come from the relatively low win rate which requires strong psychology. The future optimization directions could be parameter tuning, money management, increasing win rate and so on. Overall this strategy has practical value for cryptocurrency traders seeking high profits.

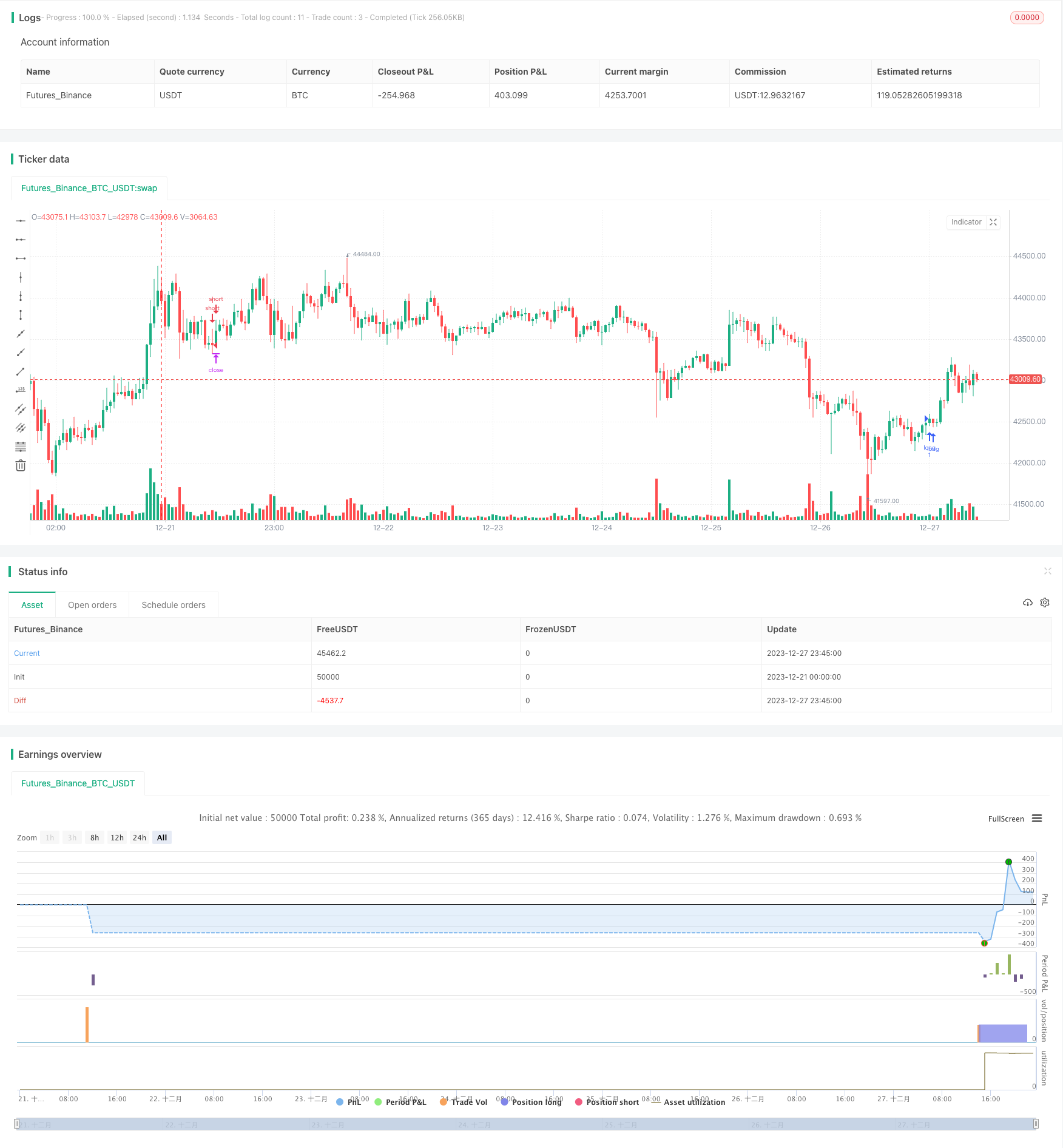

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Crypto strategy high/low", overlay=true)

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

//sar

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=0.0

x:=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=0.0

swap:=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?color.lime:color.red

swap3=thisCCI >=0 ?color.lime:color.red

swap4=original?swap3:swap2

//elliot wave

srce = input(close, title="source")

sma1length = input(5)

sma2length = input(35)

UsePercent = input(title="Show Dif as percent of current Candle", type=input.bool, defval=true)

smadif=iff(UsePercent,(sma(srce, sma1length) - sma(srce, sma2length)) / srce * 100, sma(srce, sma1length) - sma(srce, sma2length))

col=smadif <= 0 ? color.red : color.green

longC = high > high[1] and high[1] > high[2] and close[2] > high[3] and hist > 0 and uptrend and smadif < 0 and swap4==color.lime

//longC = high > high[1] and high[1] > high[2] and high[2] > high[3] and high[3] > high[4] and close[4] > high[5]

shortC = low < low[1] and low[1] < low[2] and close[2] < low[3] and hist < 0 and not uptrend and smadif > 0 and swap4==color.red

//shortC = low < low[1] and low[1] < low[2] and low[2] < low[3] and low[3] < low[4] and close[4] < low[5]

tp=input(0.15, title="tp")

sl=input(0.005, title="sl")

strategy.entry("long",1,when=longC)

strategy.entry("short",0,when=shortC)

strategy.exit("x_long", "long" ,loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick , alert_message = "closelong")

//strategy.entry("short",0, when= loss = close * sl / syminfo.mintick)

strategy.exit("x_short", "short" , loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick,alert_message = "closeshort")

//strategy.entry("long",1, when = loss = close * sl / syminfo.mintick)

//strategy.close("long",when= hist < 0)

//strategy.close("short", when= hist > 0)