Overview

This strategy is based on the multi-timeframe moving average crossover to track middle-long term trends. It adopts a pyramiding position to chase rises and achieve exponential capital growth. The biggest advantage is being able to catch the mid-long term trends and pyramid entries in batches and stages to obtain excess returns.

Strategy Logic

- Build multiple timeframes based on 9-day MA, 100-day MA and 200-day MA.

- Generate buy signals when shorter period MA crosses above longer period MA.

- Adopt 7 staged pyramiding entries. Check existing positions before adding new entry, stop pyramiding when 6 positions already opened.

- Set fixed 3% TP/SL for risk control.

Above is the basic trading logic.

Advantages

- Effectively catch mid-long term trends and enjoy exponential growth.

- Multi-timeframe MA crossover avoids short-term noise.

- Fixed TP/SL controls risk for each position.

- Pyramid entries in batches to obtain excess returns.

Risks & Solutions

- Risk of huge loss if fail to cut loss in trend reversal. Solution is to shorten MA periods and quicken stop loss.

- Risk of margin call if loss beyond tolerance. Solution is to lower initial position size.

- Risk of over 700% loss if strong downtrend. Solution is to raise fixed stop loss percentage.

Optimization Directions

- Test different MA combinations to find optimal parameters.

- Optimize pyramiding stages quantity. Test to find best number.

- Test fixed TP/SL settings. Expand TP range for higher profitability.

Summary

The strategy is very suitable to catch mid-long term trends. Pyramid entries in batches can achieve very high risk-reward ratio. There are also some operation risks, which should be controlled by parameter tuning. Overall this is a promising strategy worth live trading verification and further optimization.

Strategy source code

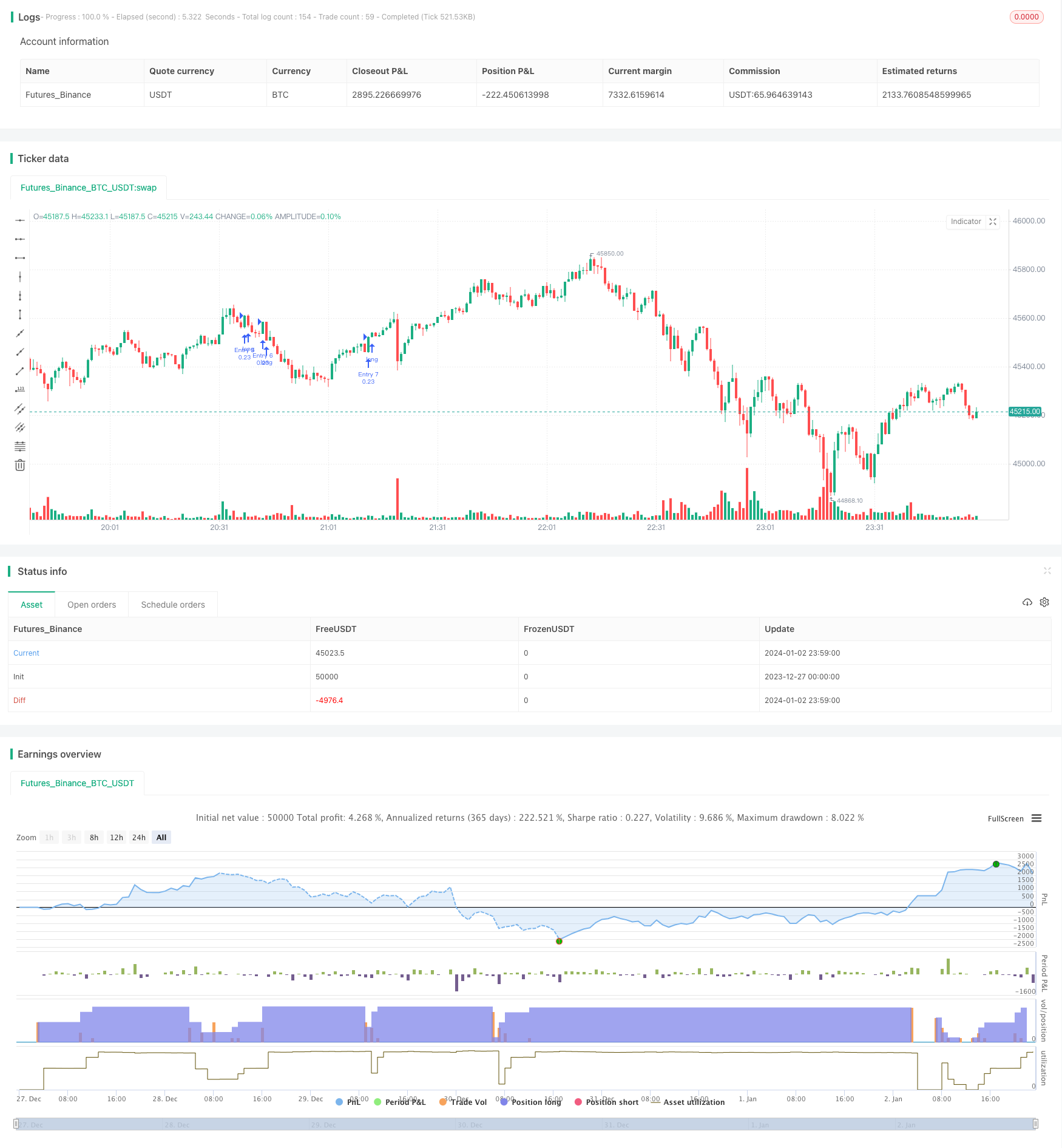

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=3

strategy(shorttitle='Pyramiding Entry On Early Trends',title='Pyramiding Entry On Early Trends (by Coinrule)', overlay=false, pyramiding= 7, initial_capital = 1000, default_qty_type = strategy.percent_of_equity, default_qty_value = 20, commission_type=strategy.commission.percent, commission_value=0.1)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month")

fromDay = input(defval = 10, title = "From Day")

fromYear = input(defval = 2020, title = "From Year")

thruMonth = input(defval = 1, title = "Thru Month")

thruDay = input(defval = 1, title = "Thru Day")

thruYear = input(defval = 2112, title = "Thru Year")

showDate = input(defval = true, title = "Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

//MA inputs and calculations

inSignal=input(9, title='MAfast')

inlong1=input(100, title='MAslow')

inlong2=input(200, title='MAlong')

MAfast= sma(close, inSignal)

MAslow= sma(close, inlong1)

MAlong= sma(close, inlong2)

Bullish = crossover(close, MAfast)

longsignal = (Bullish and MAfast > MAslow and MAslow < MAlong and window())

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = (close * (ProfitTarget_Percent / 100)) / syminfo.mintick

//set take profit

LossTarget_Percent = input(3)

Loss_Ticks = (close * (LossTarget_Percent / 100)) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when = (strategy.opentrades == 0) and longsignal)

strategy.entry("Entry 2", strategy.long, when = (strategy.opentrades == 1) and longsignal)

strategy.entry("Entry 3", strategy.long, when = (strategy.opentrades == 2) and longsignal)

strategy.entry("Entry 4", strategy.long, when = (strategy.opentrades == 3) and longsignal)

strategy.entry("Entry 5", strategy.long, when = (strategy.opentrades == 4) and longsignal)

strategy.entry("Entry 6", strategy.long, when = (strategy.opentrades == 5) and longsignal)

strategy.entry("Entry 7", strategy.long, when = (strategy.opentrades == 6) and longsignal)

if (strategy.position_size > 0)

strategy.exit(id="Exit 1", from_entry = "Entry 1", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 2", from_entry = "Entry 2", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 3", from_entry = "Entry 3", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 4", from_entry = "Entry 4", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 5", from_entry = "Entry 5", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 6", from_entry = "Entry 6", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 7", from_entry = "Entry 7", profit = Profit_Ticks, loss = Loss_Ticks)