Overview

This strategy utilizes multiple moving average indicators and combines entry and exit timing based on trading hours to implement quantitative trading.

Strategy Logic

This strategy incorporates 9 types of moving averages including SMA, EMA, WMA etc. For long entry, the close price crosses above the selected moving average while the previous close was below the moving average. For short entry, the close price crosses below the moving average while the previous close was above. All trades are entered on Monday open only. Exit rules are either fixed take profit/stop loss or close all positions before Sunday close.

Advantage Analysis

This strategy combines the essence of multiple moving averages and users can pick different parameters based on varying market conditions. It only enters when a trend is confirmed, avoiding whipsaws. Also, it limits entries to Monday only and exits on Sunday close with stop loss/take profit, capping maximum trades per week and controlling trading risk.

Risk Analysis

The strategy relies mainly on moving averages to determine trend, thus faces the risk of being caught in reversals. Also, limiting entries to Monday only means missed profitable opportunities if a good setup appears later in the week.

To address these risks, dynamic average parameters could be used to shorten length during ranging periods. Also additional entry days could be allowed, like on Wednesday or Thursday.

Optimization Directions

The strategy can be improved in the following ways:

Add adaptive stop loss/take profit algorithms to dynamically adjust levels.

Incorporate machine learning models to better gauge trend in choppy markets.

Refine entry and exit logic to capture more trading opportunities.

Summary

This strategy combines multiple moving average indicators to determine trend direction and caps maximum weekly trades with Monday entry and Sunday exit rules. Strict stop loss/take profit further limits maximum loss per trade. In summary, it provides robust enhancements in both trend determination and risk control dimensions for quantitative trading.

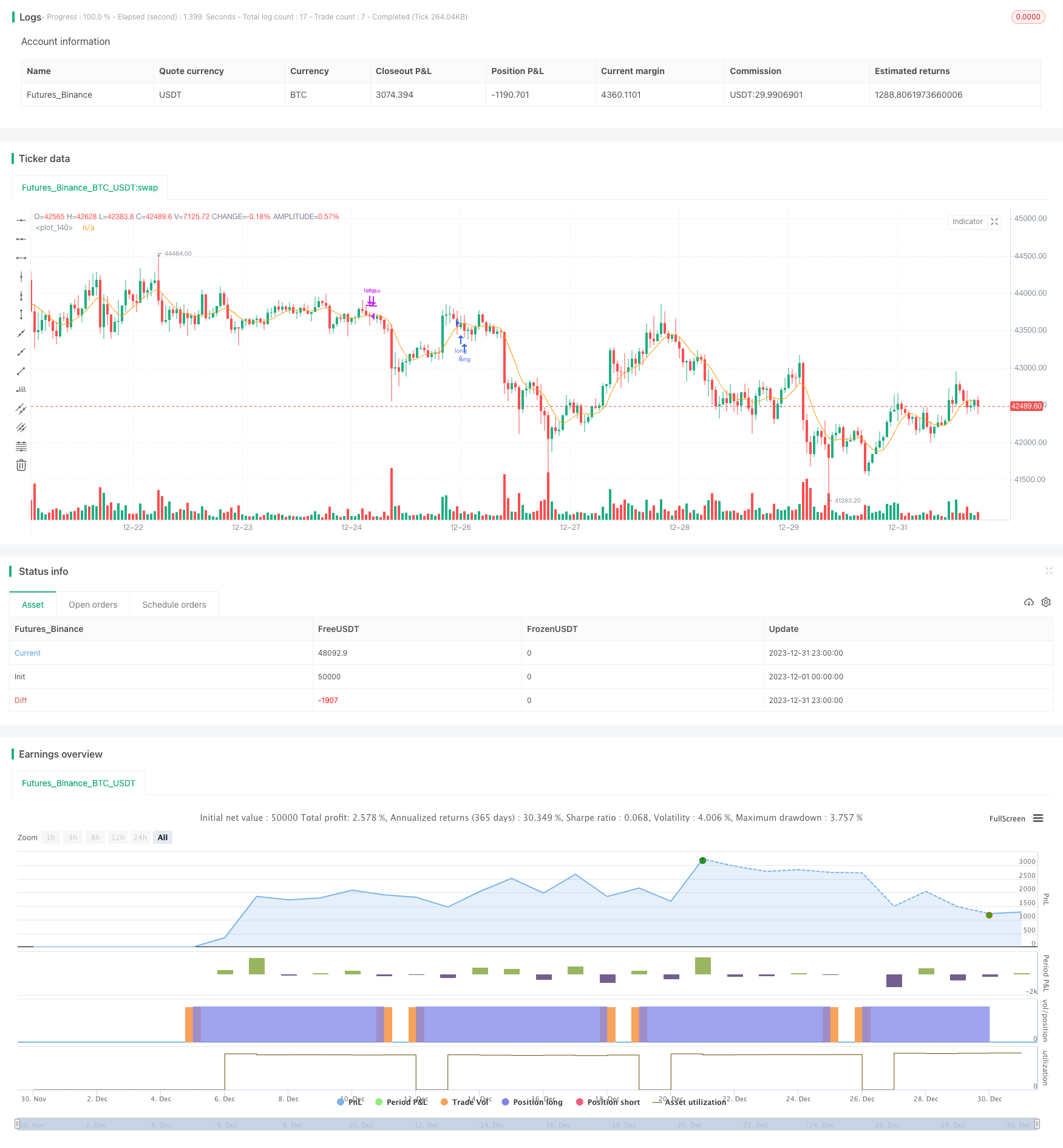

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy('Time MA strategy ', overlay=true)

longEntry = input.bool(true, group="Type of Entries")

shortEntry = input.bool(false, group="Type of Entries")

//==========DEMA

getDEMA(src, len) =>

dema = 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

dema

//==========HMA

getHULLMA(src, len) =>

hullma = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

hullma

//==========KAMA

getKAMA(src, len, k1, k2) =>

change = math.abs(ta.change(src, len))

volatility = math.sum(math.abs(ta.change(src)), len)

efficiency_ratio = volatility != 0 ? change / volatility : 0

kama = 0.0

fast = 2 / (k1 + 1)

slow = 2 / (k2 + 1)

smooth_const = math.pow(efficiency_ratio * (fast - slow) + slow, 2)

kama := nz(kama[1]) + smooth_const * (src - nz(kama[1]))

kama

//==========TEMA

getTEMA(src, len) =>

e = ta.ema(src, len)

tema = 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

tema

//==========ZLEMA

getZLEMA(src, len) =>

zlemalag_1 = (len - 1) / 2

zlemadata_1 = src + src - src[zlemalag_1]

zlema = ta.ema(zlemadata_1, len)

zlema

//==========FRAMA

getFRAMA(src, len) =>

Price = src

N = len

if N % 2 != 0

N := N + 1

N

N1 = 0.0

N2 = 0.0

N3 = 0.0

HH = 0.0

LL = 0.0

Dimen = 0.0

alpha = 0.0

Filt = 0.0

N3 := (ta.highest(N) - ta.lowest(N)) / N

HH := ta.highest(N / 2 - 1)

LL := ta.lowest(N / 2 - 1)

N1 := (HH - LL) / (N / 2)

HH := high[N / 2]

LL := low[N / 2]

for i = N / 2 to N - 1 by 1

if high[i] > HH

HH := high[i]

HH

if low[i] < LL

LL := low[i]

LL

N2 := (HH - LL) / (N / 2)

if N1 > 0 and N2 > 0 and N3 > 0

Dimen := (math.log(N1 + N2) - math.log(N3)) / math.log(2)

Dimen

alpha := math.exp(-4.6 * (Dimen - 1))

if alpha < .01

alpha := .01

alpha

if alpha > 1

alpha := 1

alpha

Filt := alpha * Price + (1 - alpha) * nz(Filt[1], 1)

if bar_index < N + 1

Filt := Price

Filt

Filt

//==========VIDYA

getVIDYA(src, len) =>

mom = ta.change(src)

upSum = math.sum(math.max(mom, 0), len)

downSum = math.sum(-math.min(mom, 0), len)

out = (upSum - downSum) / (upSum + downSum)

cmo = math.abs(out)

alpha = 2 / (len + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

vidya

//==========JMA

getJMA(src, len, power, phase) =>

phase_ratio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, power)

MA1 = 0.0

Det0 = 0.0

MA2 = 0.0

Det1 = 0.0

JMA = 0.0

MA1 := (1 - alpha) * src + alpha * nz(MA1[1])

Det0 := (src - MA1) * (1 - beta) + beta * nz(Det0[1])

MA2 := MA1 + phase_ratio * Det0

Det1 := (MA2 - nz(JMA[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(Det1[1])

JMA := nz(JMA[1]) + Det1

JMA

//==========T3

getT3(src, len, vFactor) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

c1 = -1 * math.pow(vFactor, 3)

c2 = 3 * math.pow(vFactor, 2) + 3 * math.pow(vFactor, 3)

c3 = -6 * math.pow(vFactor, 2) - 3 * vFactor - 3 * math.pow(vFactor, 3)

c4 = 1 + 3 * vFactor + math.pow(vFactor, 3) + 3 * math.pow(vFactor, 2)

T3 = c1 * ema6 + c2 * ema5 + c3 * ema4 + c4 * ema3

T3

//==========TRIMA

getTRIMA(src, len) =>

N = len + 1

Nm = math.round(N / 2)

TRIMA = ta.sma(ta.sma(src, Nm), Nm)

TRIMA

src = input.source(close, title='Source', group='Parameters')

len = input.int(17, minval=1, title='Moving Averages', group='Parameters')

out_ma_source = input.string(title='MA Type', defval='ALMA', options=['SMA', 'EMA', 'WMA', 'ALMA', 'SMMA', 'LSMA', 'VWMA', 'DEMA', 'HULL', 'KAMA', 'FRAMA', 'VIDYA', 'JMA', 'TEMA', 'ZLEMA', 'T3', 'TRIM'], group='Parameters')

out_ma = out_ma_source == 'SMA' ? ta.sma(src, len) : out_ma_source == 'EMA' ? ta.ema(src, len) : out_ma_source == 'WMA' ? ta.wma(src, len) : out_ma_source == 'ALMA' ? ta.alma(src, len, 0.85, 6) : out_ma_source == 'SMMA' ? ta.rma(src, len) : out_ma_source == 'LSMA' ? ta.linreg(src, len, 0) : out_ma_source == 'VWMA' ? ta.vwma(src, len) : out_ma_source == 'DEMA' ? getDEMA(src, len) : out_ma_source == 'HULL' ? ta.hma(src, len) : out_ma_source == 'KAMA' ? getKAMA(src, len, 2, 30) : out_ma_source == 'FRAMA' ? getFRAMA(src, len) : out_ma_source == 'VIDYA' ? getVIDYA(src, len) : out_ma_source == 'JMA' ? getJMA(src, len, 2, 50) : out_ma_source == 'TEMA' ? getTEMA(src, len) : out_ma_source == 'ZLEMA' ? getZLEMA(src, len) : out_ma_source == 'T3' ? getT3(src, len, 0.7) : out_ma_source == 'TRIM' ? getTRIMA(src, len) : na

plot(out_ma)

long = close> out_ma and close[1] < out_ma and dayofweek==dayofweek.monday

short = close< out_ma and close[1] > out_ma and dayofweek==dayofweek.monday

stopPer = input.float(10.0, title='LONG Stop Loss % ', group='Fixed Risk Management') / 100

takePer = input.float(30.0, title='LONG Take Profit %', group='Fixed Risk Management') / 100

stopPerShort = input.float(5.0, title='SHORT Stop Loss % ', group='Fixed Risk Management') / 100

takePerShort = input.float(10.0, title='SHORT Take Profit %', group='Fixed Risk Management') / 100

longStop = strategy.position_avg_price * (1 - stopPer)

longTake = strategy.position_avg_price * (1 + takePer)

shortStop = strategy.position_avg_price * (1 + stopPerShort)

shortTake = strategy.position_avg_price * (1 - takePerShort)

// strategy.risk.max_intraday_filled_orders(2) // After 10 orders are filled, no more strategy orders will be placed (except for a market order to exit current open market position, if there is any).

if(longEntry)

strategy.entry("long",strategy.long,when=long )

strategy.exit('LONG EXIT', "long", limit=longTake, stop=longStop)

strategy.close("long",when=dayofweek==dayofweek.sunday)

if(shortEntry)

strategy.entry("short",strategy.short,when=short )

strategy.exit('SHORT EXIT', "short", limit=shortTake, stop=shortStop)

strategy.close("short",when=dayofweek==dayofweek.sunday)