I. Strategy Overview

The strategy is named “Ichimoku Kinko Hyo Indicator Based Breakout Strategy”. It utilizes the Tenkan-Sen, Kijun-Sen lines, Senkou Span lines and Kumo cloud from the Ichimoku Kinko Hyo indicator to determine the trend direction and implement breakout entry and exit signals.

II. Strategy Details

Calculate the components of the Ichimoku Kinko Hyo indicator:

- Tenkan-Sen: middle of highest and lowest prices

- Kijun-Sen: middle of highest and lowest prices

- Senkou Span A: middle of Tenkan-Sen and Kijun-Sen

- Senkou Span B: middle of highest and lowest prices

- Chikou Span: lagging span

Determine long signal:

- When Tenkan-Sen cross above Kijun-Sen;

- And close price break above the Kumo cloud;

- And Chikou Span break above the Kumo cloud.

Determine short signal:

- When Tenkan-Sen cross below Kijun-Sen;

- And close price break below the Kumo cloud;

- And Chikou Span break below the Kumo cloud.

III. Advantage Analysis

- Ichimoku Kinko Hyo is accurate in determining trends.

- Chikou Span avoids false breakouts.

- Allow long and short trading in both uptrend and downtrend.

- Customizable parameters for different periods.

IV. Risk Analysis

- Frequent losing trades during market consolidation.

- Missing best entry points due to multiple criteria.

- High turnover rate increases transaction costs.

Solutions

- Adjust parameters to avoid overtrading.

- Combine with other indicators to confirm signals.

- Extend holding period to decrease turnover.

V. Optimization Directions

- Add moving averages to confirm trading signals.

- Implement stop loss to limit downside risk.

- Optimize parameters to improve robustness.

VI. Strategy Summary

The strategy determines trend direction accurately using Ichimoku Kinko Hyo indicators and takes breakout signals as entry and exit points, allowing long and short trading. Compared with single indicator strategies, it has higher accuracy and avoids many false signals. There is also some lagging in capturing best entry price. In conclusion, the strategy is quite effective in determining trends and the risks are manageable. Further optimizations and walk-forward testing are recommended.

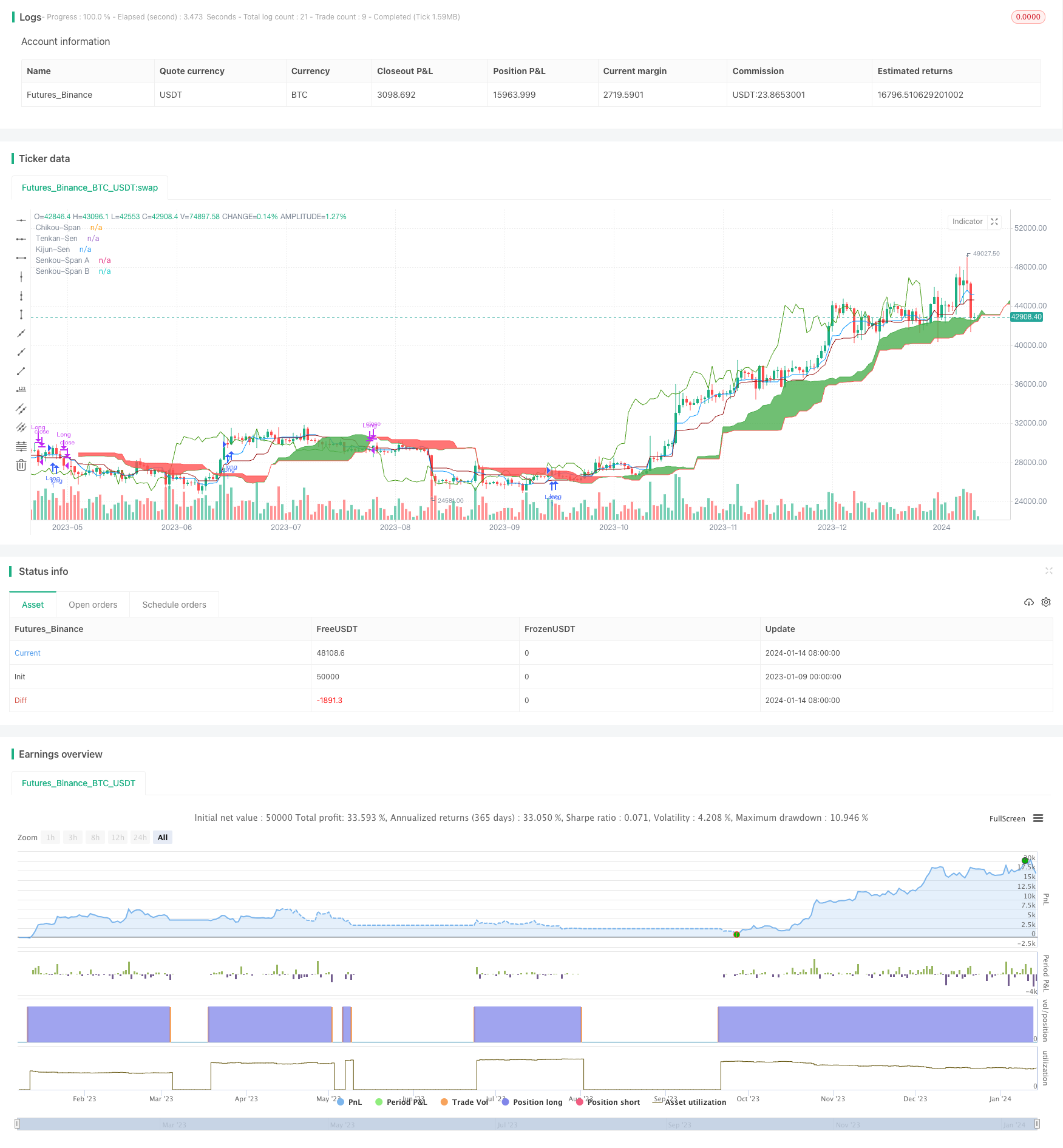

/*backtest

start: 2023-01-09 00:00:00

end: 2024-01-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Ichimoku Kinko Hyo: Basic Strategy', overlay=true)

//Inputs

ts_bars = input.int(7, minval=1, title='Tenkan-Sen Bars')

ks_bars = input.int(14, minval=1, title='Kijun-Sen Bars')

ssb_bars = input.int(28, minval=1, title='Senkou-Span B Bars')

cs_offset = input.int(14, minval=1, title='Chikou-Span Offset')

ss_offset = input.int(14, minval=1, title='Senkou-Span Offset')

long_entry = input(true, title='Long Entry')

short_entry = input(false, title='Short Entry')

middle(len) =>

math.avg(ta.lowest(len), ta.highest(len))

// Ichimoku Components

tenkan = middle(ts_bars)

kijun = middle(ks_bars)

senkouA = math.avg(tenkan, kijun)

senkouB = middle(ssb_bars)

// Plot Ichimoku Kinko Hyo

plot(tenkan, color=color.new(#0496ff, 0), title='Tenkan-Sen')

plot(kijun, color=color.new(#991515, 0), title='Kijun-Sen')

plot(close, offset=-cs_offset + 1, color=color.new(#459915, 0), title='Chikou-Span')

sa = plot(senkouA, offset=ss_offset - 1, color=color.new(color.green, 0), title='Senkou-Span A')

sb = plot(senkouB, offset=ss_offset - 1, color=color.new(color.red, 0), title='Senkou-Span B')

fill(sa, sb, color=senkouA > senkouB ? color.green : color.red, title='Cloud color', transp=90)

ss_high = math.max(senkouA[ss_offset - 1], senkouB[ss_offset - 1])

ss_low = math.min(senkouA[ss_offset - 1], senkouB[ss_offset - 1])

// Entry/Exit Signals

tk_cross_bull = tenkan > kijun

tk_cross_bear = tenkan < kijun

cs_cross_bull = ta.mom(close, cs_offset - 1) > 0

cs_cross_bear = ta.mom(close, cs_offset - 1) < 0

price_above_kumo = close > ss_high

price_below_kumo = close < ss_low

bullish = tk_cross_bull and cs_cross_bull and price_above_kumo

bearish = tk_cross_bear and cs_cross_bear and price_below_kumo

strategy.entry('Long', strategy.long, when=bullish and long_entry)

strategy.entry('Short', strategy.short, when=bearish and short_entry)

strategy.close('Long', when=bearish and not short_entry)

strategy.close('Short', when=bullish and not long_entry)