Overview

This article analyzes in depth a trend following strategy that combines the SuperTrend indicator with a Stochastic RSI filter for improved accuracy. It aims to generate buy and sell signals while considering the prevailing trend and reducing false signals. The Stochastic RSI filters out false signals during overbought and oversold conditions.

Strategy Logic

SuperTrend Calculation

First, True Range (TR) and Average True Range (ATR) are calculated. Then the upper and lower bands are computed using ATR:

Upper Band = SMA(Close, ATR Period) + ATR Multiplier * ATR Lower Band = SMA(Close, ATR Period) - ATR Multiplier * ATR

An uptrend is identified when close > lower band. A downtrend is identified when close < upper band.

During uptrend, SuperTrend is set to lower band. During downtrend, SuperTrend is set to upper band.

Filtering Mechanism

To reduce false signals, the SuperTrend is smoothed using a moving average to obtain the filtered SuperTrend.

Stochastic RSI

The RSI value is calculated, then Stochastic indicator is applied on it to generate Stochastic RSI. It shows whether RSI is overbought or oversold.

Entry and Exit Conditions

Long entry: Close crosses above filtered SuperTrend in uptrend and Stochastic RSI < 80 Short entry: Close crosses below filtered SuperTrend in downtrend and Stochastic RSI > 20

Long exit: Close crosses below filtered SuperTrend in uptrend

Short exit: Close crosses above filtered SuperTrend in downtrend

Advantages of the Strategy

This improved trend following strategy has the following edges over simple moving averages:

- SuperTrend itself has good trend identification and false signal filtering abilities.

- The filtering mechanism further reduces false signals resulting in more reliable signals.

- Stochastic RSI avoids false signals around important support/resistance levels during overbought/oversold conditions.

- The strategy considers both trend direction and overbought/oversold conditions leading to better balance between following the trend and avoiding false signals.

- Flexible parameter adjustment allows adaptation to different market environments.

Risks and Optimization

Potential Risks

- Stop loss can be hit during high volatility moves.

- Lagging issues with SuperTrend and filtering causing missing recent price changes.

- Incorrect Stochastic RSI parameter settings impacting strategy performance.

Risk Management

- Adjust stop loss appropriately or use trailing stop loss.

- Tune parameters like ATR period and filter period to balance lagging effect.

- Test and optimize Stochastic RSI parameters.

Optimization Opportunities

- Test different parameter combinations to find optimal parameters.

- Try different filtering mechanisms like EMA smoothing etc.

- Apply machine learning to auto-optimize parameters.

- Incorporate other indicators to supplement entry conditions.

Conclusion

This strategy combines the strengths of SuperTrend and Stochastic RSI for effective trend identification and quality trade signals, while also making the strategy robust to market noise through filtering mechanisms. Further performance improvement can be achieved through parameter optimization or combining with other indicators/models. Overall, this strategy demonstrates good trend following ability and some risk control for those seeking steady returns.

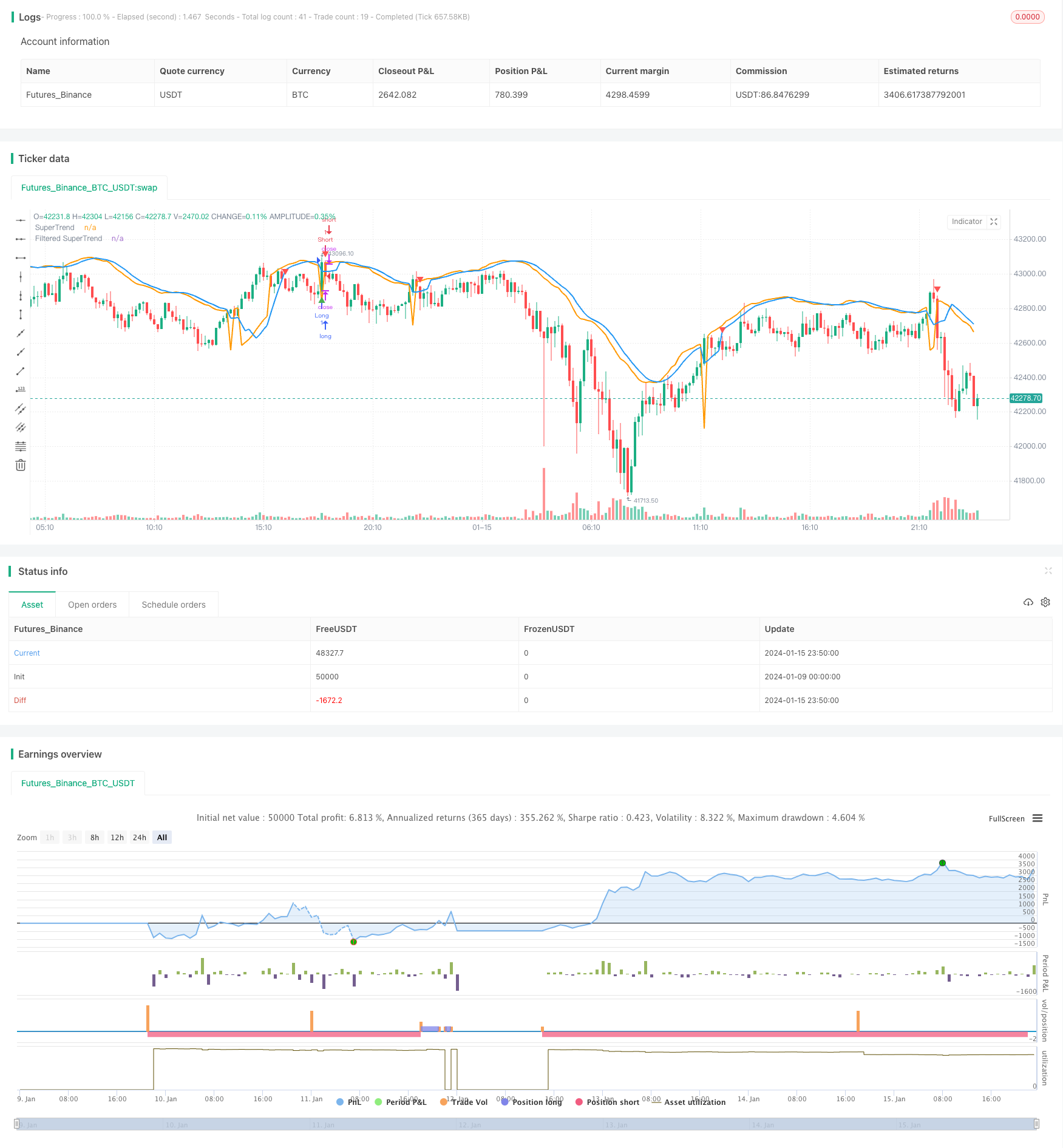

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved SuperTrend Strategy with Stochastic RSI", shorttitle="IST+StochRSI", overlay=true)

// Input parameters

atr_length = input(14, title="ATR Length")

atr_multiplier = input(1.5, title="ATR Multiplier")

filter_length = input(5, title="Filter Length")

stoch_length = input(14, title="Stochastic RSI Length")

smooth_k = input(3, title="Stochastic RSI %K Smoothing")

// Calculate True Range (TR) and Average True Range (ATR)

tr = ta.rma(ta.tr, atr_length)

atr = ta.rma(tr, atr_length)

// Calculate SuperTrend

upper_band = ta.sma(close, atr_length) + atr_multiplier * atr

lower_band = ta.sma(close, atr_length) - atr_multiplier * atr

is_uptrend = close > lower_band

is_downtrend = close < upper_band

super_trend = is_uptrend ? lower_band : na

super_trend := is_downtrend ? upper_band : super_trend

// Filter for reducing false signals

filtered_super_trend = ta.sma(super_trend, filter_length)

// Calculate Stochastic RSI

rsi_value = ta.rsi(close, stoch_length)

stoch_rsi = ta.sma(ta.stoch(rsi_value, rsi_value, rsi_value, stoch_length), smooth_k)

// Entry conditions

long_condition = ta.crossover(close, filtered_super_trend) and is_uptrend and stoch_rsi < 80

short_condition = ta.crossunder(close, filtered_super_trend) and is_downtrend and stoch_rsi > 20

// Exit conditions

exit_long_condition = ta.crossunder(close, filtered_super_trend) and is_uptrend

exit_short_condition = ta.crossover(close, filtered_super_trend) and is_downtrend

// Plot SuperTrend and filtered SuperTrend

plot(super_trend, color=color.orange, title="SuperTrend", linewidth=2)

plot(filtered_super_trend, color=color.blue, title="Filtered SuperTrend", linewidth=2)

// Plot Buy and Sell signals

plotshape(series=long_condition, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar)

plotshape(series=short_condition, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar)

// Output signals to the console for analysis

plotchar(long_condition, "Long Signal", "▲", location.belowbar, color=color.green, size=size.small)

plotchar(short_condition, "Short Signal", "▼", location.abovebar, color=color.red, size=size.small)

// Strategy entry and exit

strategy.entry("Long", strategy.long, when=long_condition)

strategy.entry("Short", strategy.short, when=short_condition)

strategy.close("Long", when=exit_long_condition)

strategy.close("Short", when=exit_short_condition)