Overview

This strategy combines the Relative Strength Index (RSI) and Exponential Moving Average (EMA) technical indicators to implement a quantitative trading strategy based on trend following. It is mainly suitable for trending markets, entering when price reversals are identified to profit from the trend.

Strategy Logic

Indicator Selection

- EMA to determine current trend direction. The strategy uses 20-day, 50-day and 200-day EMA. When price is above these EMAs, an uptrend is identified.

- RSI to identify overbought/oversold levels. A standard 14-period RSI, with overbought threshold at 70 and oversold threshold at 30.

Entry Rules

Long entry signal:

- RSI below 30 level, indicating oversold conditions where price may rebound

- Price above either 20-day, 50-day or 200-day EMA, showing an upward trending market

When both criteria are met, a long position is entered.

Risk Management

Maximum loss for each trade is limited to 3% of total account value. Stop loss placement needs to consider market characteristics.

Position sizing at entry: Max Loss / (Entry Price - Stop Loss Price) = Position Size

This effectively controls per trade risk.

Exit Rules

Main exit signals:

- RSI rises above 70 level, price may fall due to overbought conditions

- Price drops below either 20-day, 50-day or 200-day EMA, trend reversal

When either signal occurs, the position is closed.

Advantage Analysis

The strategy combines the advantages of trend following and mean reversion. The EMA determines overall trend, then entry signals happen at potential reversal zones, benefiting from both trend and reversals for stability. RSI parameters can also be optimized for different markets, making the strategy robust.

The fixed max loss per trade protects capital by directly controlling trade risk level.

Risk Analysis

The strategy works well in obvious trending markets. In complex and volatile environments, using EMA for trend may have limitations. Also RSI has some lagging effect, needing confirmation from actual price action.

Stop loss placement is critical to PnL, needing careful testing for different markets. If too wide, single loss can expand; if too tight, noise may trigger unwanted stops. Live testing is required for ongoing optimization.

Optimization Directions

Testing different RSI parameters to fit more markets. Finding optimal trade size ratios. Adding other technical indicators to build more robust entry/exit systems. These are all options worth exploring.

Conclusion

The strategy integrates the strengths of trend following and mean reversion strategies. Entry happens on potential reversal while identifying the bigger trend. RSI optimization adapts it to more market regimes. The fixed trade risk level keeps operation stable over the medium to long term. Further improvements are possible through adjustments and robustness testing using different markets and styles.

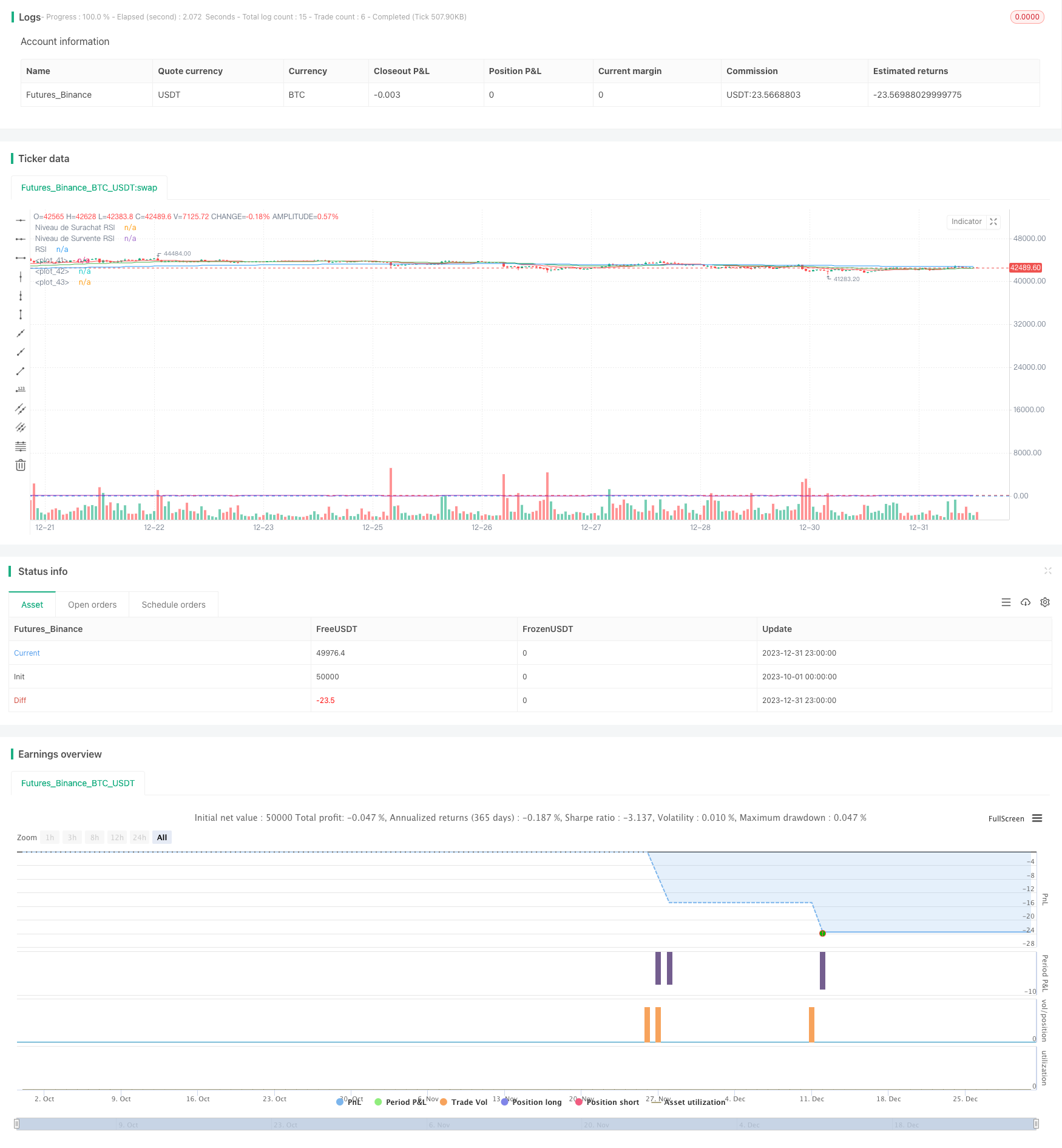

/*backtest

start: 2023-10-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Stratégie RSI et EMA avec Gestion du Risque", overlay=true)

// Paramètres de la stratégie

rsiLength = input(14, "Longueur du RSI")

rsiOverbought = input(70, "Niveau de Surachat RSI")

rsiOversold = input(30, "Niveau de Survente RSI")

// Calcul du RSI

rsiValue = rsi(close, rsiLength)

// Paramètres des EMA

ema20 = ema(close, 20)

ema50 = ema(close, 50)

ema200 = ema(close, 200)

// Paramètre du risque par trade

riskPerTrade = input(0.03, "Risque par Trade (3%)")

// Distance du stop-loss en pips (à ajuster selon votre stratégie)

stopLossPips = input(1, "Distance du Stop-Loss en pips")

// Calcul de la taille de position et du stop-loss

calculatePositionSize(entryPrice, stopLossPips) =>

stopLossPrice = entryPrice - stopLossPips * syminfo.mintick

riskPerTradeValue = strategy.equity * riskPerTrade

positionSize = riskPerTradeValue / (entryPrice - stopLossPrice)

positionSize

// Conditions d'entrée

longCondition = (rsiValue < rsiOversold) and (close > ema20 or close > ema50 or close > ema200)

if longCondition

strategy.entry("Long", strategy.long, qty=1)

// Conditions de sortie

exitCondition = (rsiValue > rsiOverbought) or (close < ema20 or close < ema50 or close < ema200)

if exitCondition

strategy.close("Long")

// Affichage des EMA et RSI sur le graphique

plot(ema20, color=color.red)

plot(ema50, color=color.green)

plot(ema200, color=color.blue)

hline(rsiOverbought, "Niveau de Surachat RSI", color=color.red)

hline(rsiOversold, "Niveau de Survente RSI", color=color.blue)

plot(rsiValue, "RSI", color=color.purple)