Overview

This is a trend-following strategy that combines 3 Exponential Moving Averages (EMAs) with the Directional Movement Index (DMI) and the Moving Average Convergence Divergence (MACD) indicator to determine the trend direction and generate buy/sell signals. The key components include EMA crossover signals, DMI for trend strength, and MACD for momentum confirmation.

Strategy Logic

The core logic relies on 3 EMAs - 34, 89, and 200 - calculated on the M5 timeframe to identify the overall trend. The 34-period EMA gives near-term direction, while the 89 and 200 EMAs define the medium and long-term trends respectively.

Buy signals are triggered when: - Close price crosses above 34 EMA - +DI (bullish directional movement) > 17 - ADX (trend strength) > -DI

Sell signals are generated when: - Close price crosses below 34 EMA - -DI (bearish directional movement) > 17 - ADX > +DI

Additional confirmation comes from the MACD indicator before entries.

Advantages

This strategy has several key advantages:

- Captures trend direction early using short-term EMA crossover

- Uses multiple EMAs to gauge trend strength on different timeframes

- DMI filters help avoid false signals by checking for strong directional movement

- MACD provides momentum confirmation for higher probability setups

- Combination of indicators improves accuracy and timing of entries

Risks

The main risks to consider:

- Whipsaws and false signals if using only EMA crossover

- Potential lag in signal generation from multiple confirmations

- Vulnerable to sudden trend reversals

Mitigation methods: - Use appropriate stop-loss, position sizing - Optimize EMA lengths for current market conditions - Watch price action for visual confirmation

Enhancement Opportunities

Further improvements for the strategy:

- Add additional filters like RSI for overbought/oversold levels

- Incorporate volume analysis for stronger signals

- Test and optimize indicators and settings based on asset and timeframe

- Employ machine learning to continually learn from new market data

Conclusion

In summary, this is a robust trend-following system combining simple yet powerful indicators to trade in the direction of the prevailing trend. The triple EMA configuration gauges multi-timeframe trends while DMI and MACD checks enhance timing and probability of profitable entries. With proper optimization and risk management, it can be an effective addition for trend traders.

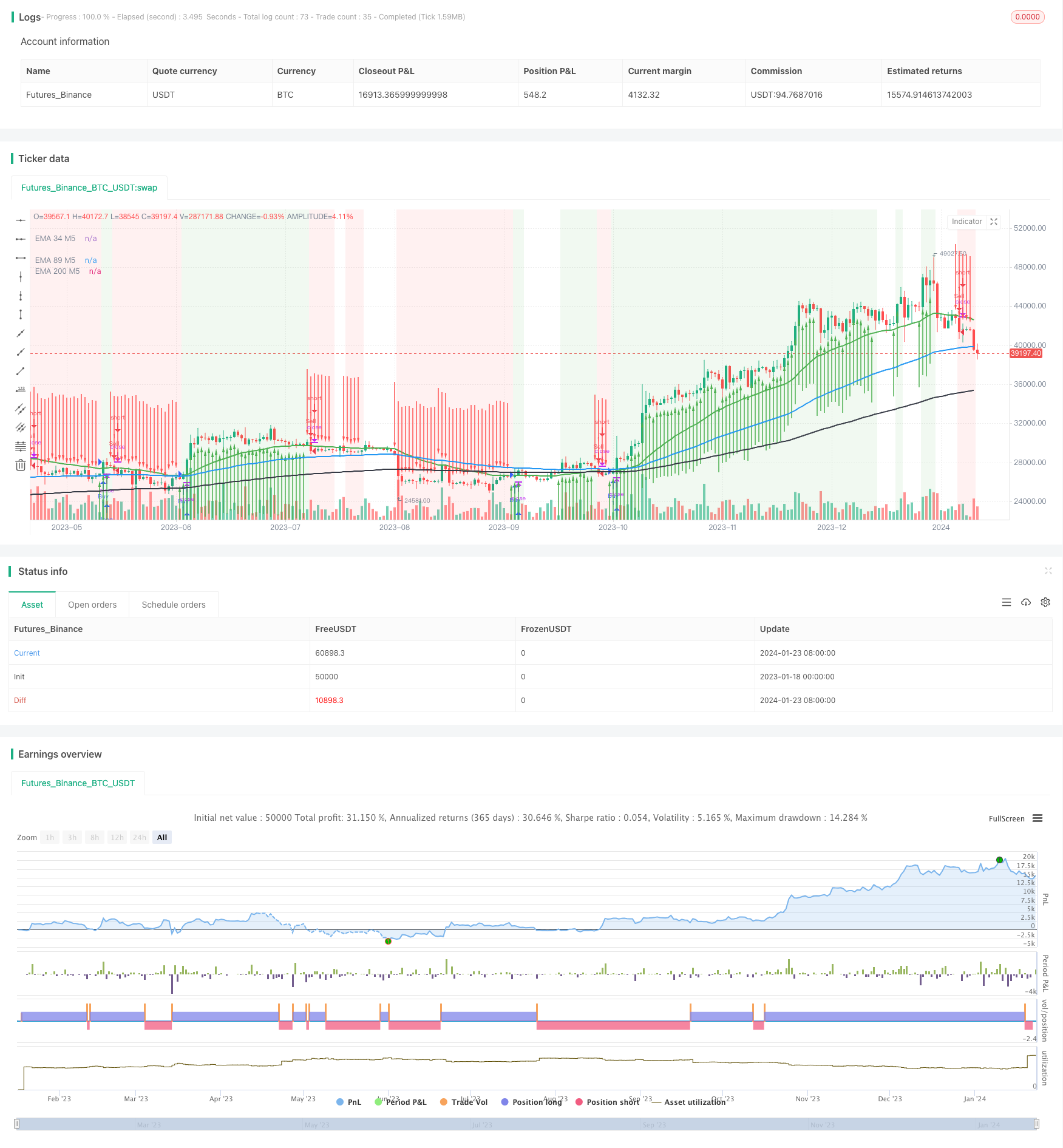

/*backtest

start: 2023-01-18 00:00:00

end: 2024-01-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("2 EMA di+ Buy Sell, strategy ", overlay=true)

// Define the EMA calculation function

ema(src, length) =>

ta.ema(src, length)

// Calculate and plot EMA on M5

ema34_M5 = ema(close, 34)

ema89_M5 = ema(close, 89)

ema200_M5 = ema(close, 200)

// Plot EMAs

plot(ema34_M5, color=color.green, title="EMA 34 M5", linewidth=2)

plot(ema89_M5, color=color.blue, title="EMA 89 M5", linewidth=2)

plot(ema200_M5, color=color.black, title="EMA 200 M5", linewidth=2)

// Define DMI parameters

len = input(14, title="DI Length")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plusDI = 100 * ta.rma(plusDM, len) / trur

minusDI = 100 * ta.rma(minusDM, len) / trur

// Calculate ADX

adxValue = 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI == 0 ? 1 : plusDI + minusDI), len)

// Define MACD parameters

fastLength = input(12, title="Fast Length")

slowLength = input(26, title="Slow Length")

signalLength = input(9, title="Signal Length")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Create buy/sell conditions

buyCondition = close > ema34_M5 and plusDI > 17 and adxValue > minusDI

sellCondition = close < ema34_M5 and minusDI > 17 and adxValue > plusDI

// Strategy logic

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.entry("Sell", strategy.short, when = sellCondition)

// Create alerts for buy/sell signals

alertcondition(buyCondition, title="Buy Signal", message="Buy Signal")

alertcondition(sellCondition, title="Sell Signal", message="Sell Signal")

// Plot buy/sell arrows on the price chart

bgcolor(buyCondition ? color.new(color.green, 90) : sellCondition ? color.new(color.red, 90) : na)

plotarrow(buyCondition ? 1 : sellCondition ? -1 : na, colorup=color.new(color.green, 0), colordown=color.new(color.red, 0), offset=-1)