Overview

This strategy combines the moving average and trading volume indicators to design the long and short entry and exit rules, forming a complete quantitative trading strategy.

Strategy Principle

Key Indicators

- Moving Averages: Fast MA (Blue Line) and Slow MA (Red Line)

- Volume: 24-hour Volume (Purple) and 7-day Average Volume (Orange)

Strategy Conditions

Long Entry Conditions:

- Fast MA crosses above Slow MA

- 24-hour Volume below 50% of 7-day Average Volume

Short Entry Conditions:

Fast MA crosses below Slow MA

Entries and Exits

Long Entry: Go long when long conditions are met

Short Entry: Go short when short conditions are met

Take Profit and Stop Loss: Displayed take profit and stop loss levels for long position

Advantage Analysis

- Combining price and volume avoid false breakout

- Clear entry and exit rules

- Take profit and stop loss to control risk

Risk Analysis

- Frequent trading with moving average strategy

- Unreliable volume data quality

- Overoptimization in parameter tuning

Improvements:

- Adjust MA parameters to reduce trading frequency

- Verify signals with more data sources

- Strict backtesting to prevent overoptimization

Optimization Directions

- Add other indicators to filter signals

- Dynamic take profit and stop loss

- Multiple timeframe analysis to improve stability

Summary

This strategy integrates MA and volume indicators to design a complete quant strategy with clear entry conditions, take profit/stop loss, easy to operate. Need to prevent frequent trading issue, monitor volume data quality and overoptimization. NEXT steps are multivariate optimization, dynamic TP/SL and multiple timeframe analysis.

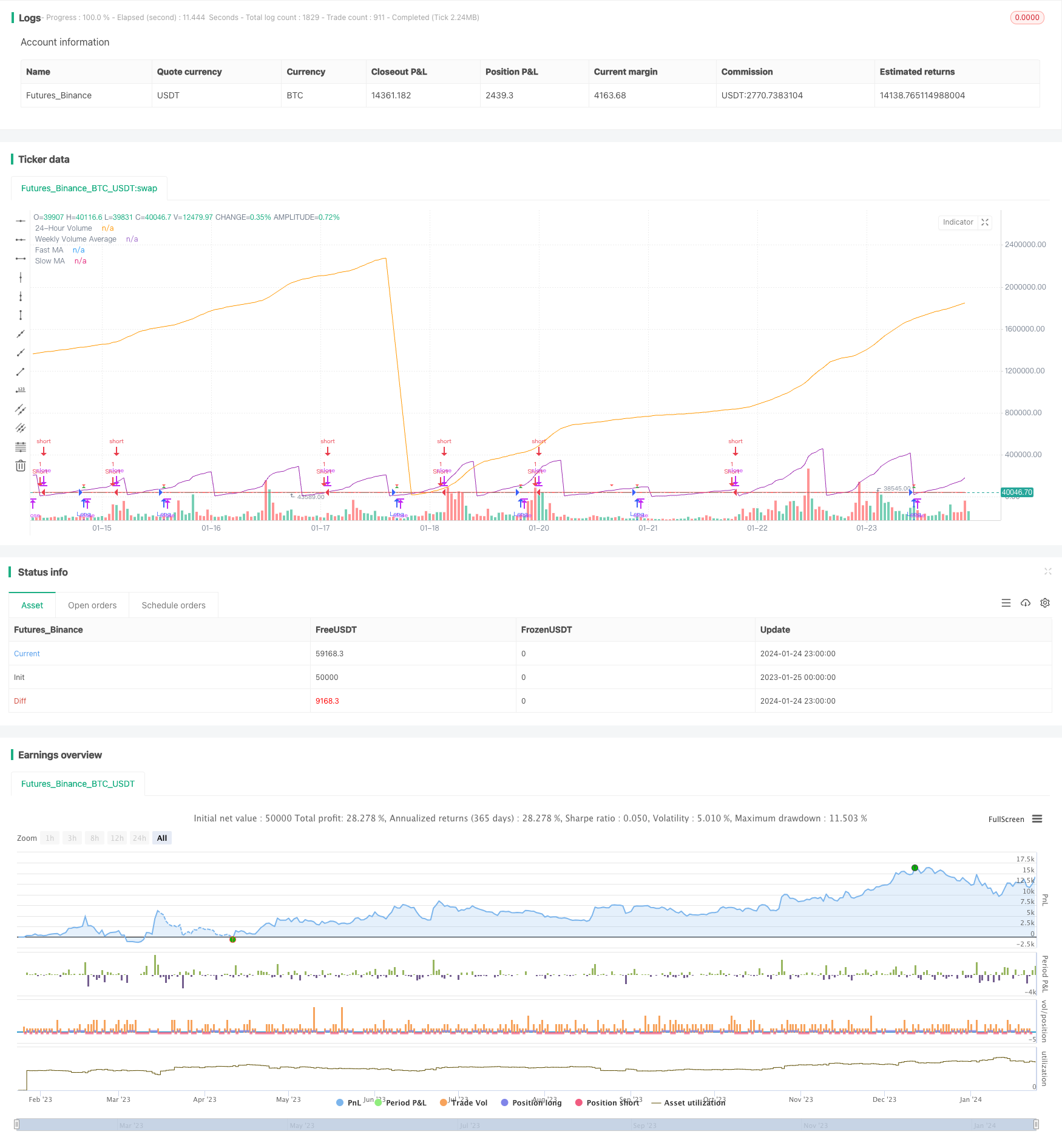

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA and Volume Strategy", overlay=true)

// Input parameters

fastLength = input(9, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

volumePercentageThreshold = input(50, title="Volume Percentage Threshold")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Calculate 24-hour volume and weekly volume average

dailyVolume = request.security(syminfo.tickerid, "D", volume)

weeklyVolumeAvg = ta.sma(request.security(syminfo.tickerid, "W", volume), 7)

// Strategy conditions

longCondition = ta.crossover(fastMA, slowMA) and dailyVolume < (weeklyVolumeAvg * volumePercentageThreshold / 100)

shortCondition = ta.crossunder(fastMA, slowMA)

// Set take profit and stop loss levels

takeProfitLong = close * 1.50

stopLossLong = close * 0.90

// Strategy orders

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Plot moving averages

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Plot 24-hour volume and weekly volume average

plot(dailyVolume, color=color.purple, title="24-Hour Volume", transp=0)

plot(weeklyVolumeAvg, color=color.orange, title="Weekly Volume Average")

// Plot entry signals

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, size=size.small)

// Plot take profit and stop loss levels only when a valid trade is active

plotshape(series=longCondition, title="Take Profit Long", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=longCondition, title="Stop Loss Long", color=color.red, style=shape.triangledown, size=size.small)