Overview

The Simple Moving Average Crossover strategy is based on the crossover of two moving averages, a faster moving average (fast MA) and a slower moving average (slow MA). It goes long (buys) when the fast MA crosses above the slow MA, and closes the long position when the fast MA crosses below the slow MA.

Principle

The strategy uses two moving averages. One is a short-term fast MA that responds quickly to price changes. The other is a long-term slow MA that filters out short-term fluctuations and reflects long-term trends better. When the fast MA crosses above the slow MA, it signals an upward trend in the short-term and is considered a golden cross buy signal. When the fast MA crosses below the slow MA, it signals a short-term downward trend and is considered a death cross sell signal.

Advantages

- Simple to implement and easy to understand with few parameters and less prone to overfitting.

- Moving averages smooth price fluctuations and have some predictive abilities to avoid being misled by noise.

- Relatively small drawdowns, maximum drawdown won’t be too large.

- Works well across most market conditions, especially trending markets.

Risks

- Prone to generating false signals during range-bound markets.

- Moving averages have lag and may miss the optimal entry and exit points of trends.

- No stop loss setting may lead to large losses.

- Improper parameter tuning affects strategy performance.

Risks can be controlled by setting stop loss. Choosing proper parameters can improve strategy performance.

Enhancement

- Test different MA length combinations to find optimal parameters.

- Add other technical indicators for filtration and signal quality improvement.

- Set dynamic stop loss to control risks.

- Incorporate volatility metrics to optimize entries and exits.

- Optimize position sizing and money management.

Conclusion

In summary, the Simple Moving Average Crossover is a simple and practical trend following strategy. It identifies trend changes using the indicator properties of moving averages. The main advantages are easy implementation, understandability, and relatively small drawdowns. The main disadvantages are potential false signals, lagging nature. The strategy can be improved further through parameter optimization, stop loss setting, and combining with other indicators.

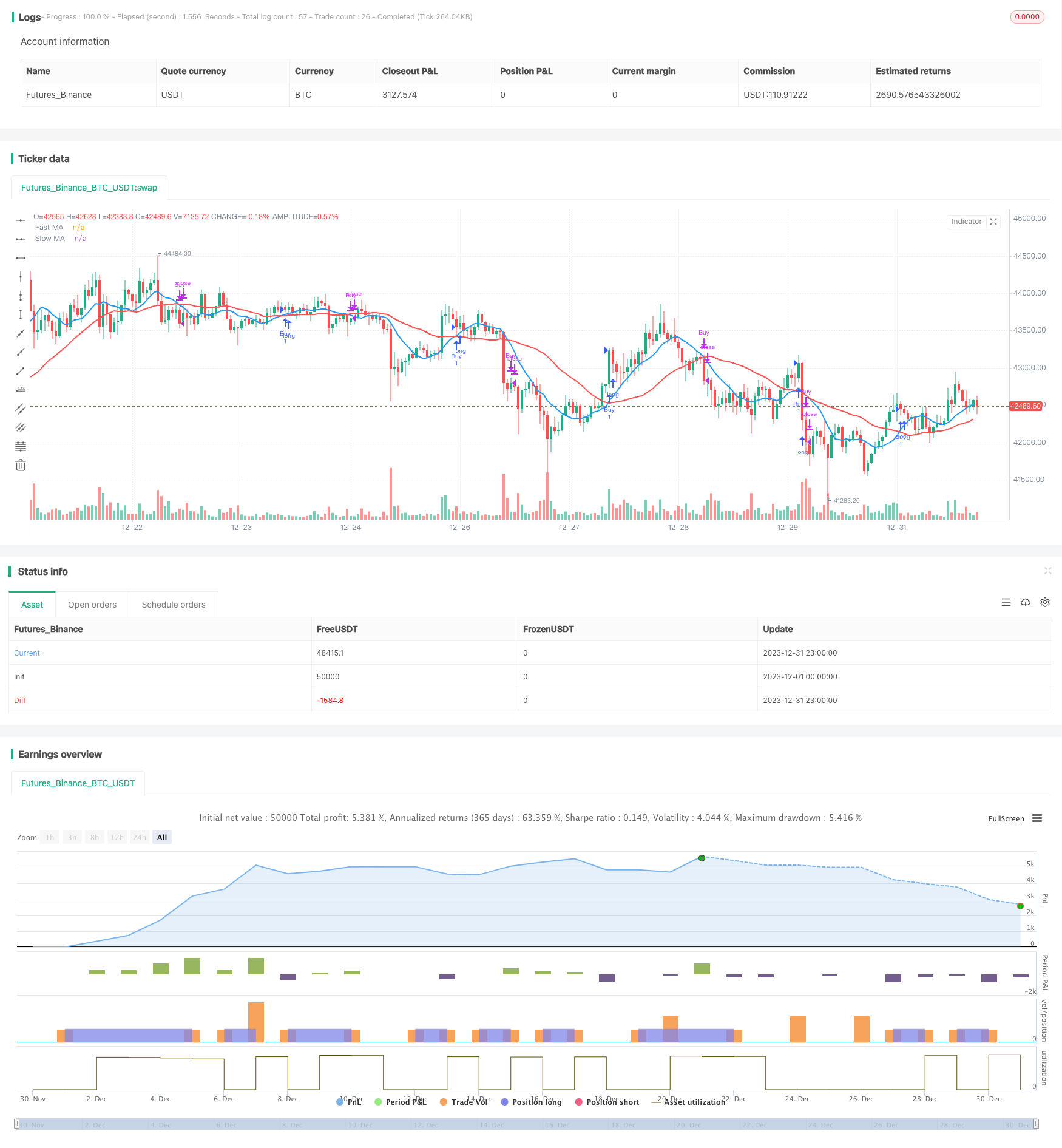

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(30, title="Slow MA Length")

stopLossPercent = input(1, title="Stop Loss Percentage")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Buy condition: Fast MA crosses above Slow MA

buyCondition = ta.crossover(fastMA, slowMA)

// Sell condition: Fast MA crosses below Slow MA

sellCondition = ta.crossunder(fastMA, slowMA)

// Plot moving averages as lines

plot(fastMA, color=color.blue, title="Fast MA", linewidth=2)

plot(slowMA, color=color.red, title="Slow MA", linewidth=2)

// Execute trades based on conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// Set stop loss level

stopLossLevel = close * (1 - stopLossPercent / 100)

strategy.exit("Sell", from_entry="Buy", loss=stopLossLevel)