Overview

This strategy combines multiple SMA lines with different periods to identify and follow the trend. The core idea is: compare the rising/falling directions of SMAs with different periods to determine the trend; go long when short-period SMA crosses over long-period SMA, and go short when short SMA crosses below long SMA. ZeroLagEMA is also used to confirm entries and exits.

Strategy Logic

- Use 5 SMA lines with periods of 10, 20, 50, 100 and 200 respectively.

- Compare the directions of these 5 SMAs to determine the trend. For example, when 10-, 20-, 100- and 200-period SMAs are rising together, it indicates an upward trend; when they are all falling, it indicates a downward trend.

- Compare the values of SMAs with different periods to generate trading signals. For example, when 10-period SMA crosses over 20-period SMA, go long; when 10SMA crosses below 20SMA, go short.

- Use ZeroLagEMA for entry confirmation and exit signals. Go long when fast ZeroLagEMA crosses over slow ZeroLagEMA, exit long when it crosses below. Judgment logic for shorts is the opposite.

Advantages

- Combining multiple SMAs with different periods can effectively determine the market trend.

- Comparing SMA values generates quantitative entry and exit rules.

- ZeroLagEMA filter avoids unnecessary trades and improves stability.

- Combining trend judgment and trading signals achieves trend following trading.

Risks and Solutions

- When market enters consolidation, frequent SMA crossovers may cause redundant losses.

- Solution: Increase ZeroLagEMA filter to avoid invalid signal entries.

- Solution: Increase ZeroLagEMA filter to avoid invalid signal entries.

- Judging from multiple-period SMAs has some lagging, failing to respond swiftly to sharp short-term price changes.

- Solution: Add faster indicators like MACD to assist judgment.

- Solution: Add faster indicators like MACD to assist judgment.

Optimization Directions

- Optimize SMA period parameters to find best combination.

- Add stop loss strategies like trailing stop to further limit losses.

- Add position sizing mechanism to increase bets in strong trends and decrease bets in consolidations.

- Incorporate more assisting indicators like MACD and KDJ to improve overall stability.

Conclusion

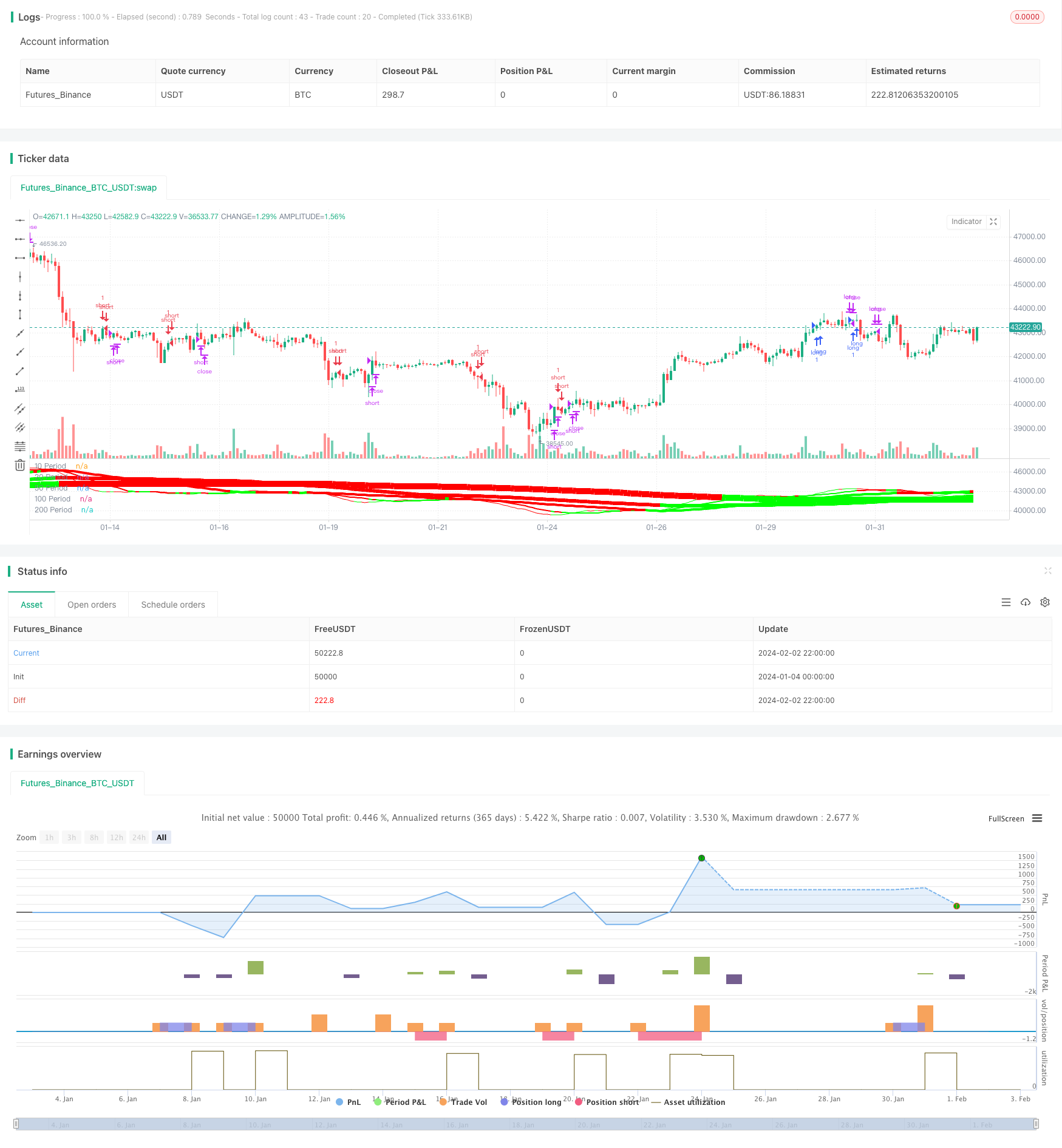

This strategy effectively determines the market trend by combining multiple-period SMAs, and generates quantified trading signals. ZeroLagEMA improves win rate. In summary, the strategy achieved quantitative trend following trading, with remarkable results. Further optimizing periods, stop loss, position sizing etc. can strengthen the strategy for live trading.

Strategy source code

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===