Overview

This strategy uses Bollinger Bands to track VWAP. It adopts a long position when VWAP breaks above the middle band, and closes position when VWAP breaks below the lower band. Pivot Point is also used as an auxiliary signal for entry, to avoid false breakouts.

Strategy Logic

- Calculate VWAP.

- Calculate Bollinger Bands of VWAP, including upper, middle and lower bands.

- Take long position when VWAP breaks above middle band and price is above Pivot Point.

- Set stop loss at 5%.

- If VWAP breaks below lower band, close long position. If stop loss is triggered, also exit.

Advantage Analysis

- VWAP has strong trend tracking ability. With BB, it accurately identifies trend start.

- Adding Pivot Point filters out false breakouts, avoiding unnecessary losses.

- Partial exit locks in some profits and controls risk.

- Backtests show great performance in bull market with good stability.

Risk Analysis

- Prone to losses from false breakouts in range-bound market.

- Pivot Points cannot fully avoid false signals. More filters needed.

- Increased trade frequency leads to higher transaction costs.

- Does not perform well in bear market. Good risk control required.

Optimization Directions

- Add indicators like MACD, KDJ to filter signals.

- Optimize BB parameters through backtests.

- Use machine learning to dynamically optimize BB parameters.

- Test different stop loss levels to find optimum.

- Add adaptive take profit based on market volatility.

Conclusion

A stable breakout system suitable for algorithm trading. Attention is needed on risk control. With further research and optimization, it could become an excellent breakout strategy.

Strategy source code

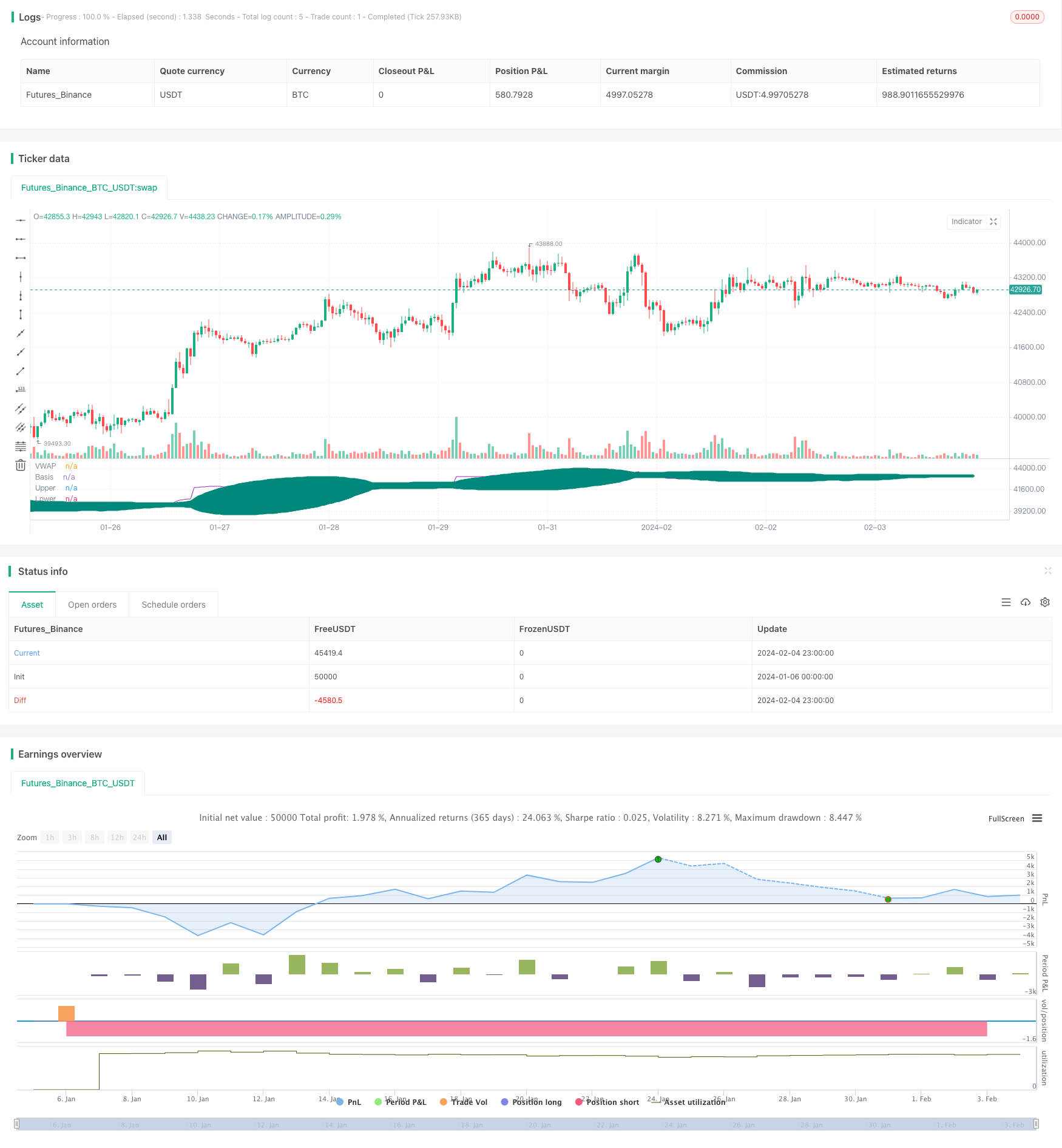

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ediks123

//@version=4

strategy("BBofVWAP with entry at Pivot Point", overlay=false, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, currency=currency.USD) //default_qty_value=10, default_qty_type=strategy.fixed,

// Function outputs 1 when it's the first bar of the D/W/M/Y

is_newbar(res) =>

ch = 0

if(res == 'Y')

t = year(time('D'))

ch := change(t) != 0 ? 1 : 0

else

t = time(res)

ch := change(t) != 0 ? 1 : 0

ch

//variables BEGIN

//smaLength=input(200,title="Slow MA Length")

bbLength=input(50,title="BB Length")

//bbsrc = input(close, title="BB Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

pp_period = input(title = "Pivot Period", type=input.string, defval="Week", options = ['Day', 'Week'])

pp_res = pp_period == 'Day' ? 'D' : pp_period == 'Week' ? 'W' : pp_period == 'Month' ? 'M' : 'Y'

riskCapital = input(title="Risk % of capital", defval=10, minval=1)

stopLoss=input(5,title="Stop Loss",minval=1)

//sma200=sma(close,smaLength)

//plot(sma200, title="SMA 200", color=color.orange)

myVwap=vwap(hlc3)

//bollinger calculation

basis = sma(myVwap, bbLength)

dev = mult * stdev(myVwap, bbLength)

upperBand = basis + dev

lowerBand = basis - dev

//plot bb

plot(basis, "Basis", color=color.teal, style=plot.style_circles , offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=color.teal, transp=95)

plot(myVwap, title="VWAP", color=color.purple)

//pivot points

// Calc High

high_cur = 0.0

high_cur := is_newbar(pp_res) ? high : max(high_cur[1], high)

phigh = 0.0

phigh := is_newbar(pp_res) ? high_cur[1] : phigh[1]

// Calc Low

low_cur = 0.0

low_cur := is_newbar(pp_res) ? low : min(low_cur[1], low)

plow = 0.0

plow := is_newbar(pp_res) ? low_cur[1] : plow[1]

// Calc Close

pclose = 0.0

pclose := is_newbar(pp_res) ? close[1] : pclose[1]

vPP = (phigh + plow + pclose) / 3

//pivot points

//Entry--

//Echeck how many units can be purchased based on risk manage ment and stop loss

qty1 = (strategy.equity * riskCapital / 100 ) / (close*stopLoss/100)

//check if cash is sufficient to buy qty1 , if capital not available use the available capital only

qty1:= (qty1 * close >= strategy.equity ) ? (strategy.equity / close) : qty1

strategy.entry(id="BB_VWAP_PP",long=true, qty=qty1, when= crossover(myVwap,basis) and close>=vPP )

bgcolor(strategy.position_size>=1?color.blue:na, transp=75)

barcolor(strategy.position_size>=1?color.green:na)

stopLossVal= strategy.position_size>=1 ? close * (1 - (stopLoss*0.01) ) : 0.00

//partial exit

//strategy.close(id="BBofVwap", qty=strategy.position_size/3, when=crossunder(myVwap,upperBand) and strategy.position_size>=1 ) //and close>strategy.position_avg_price)

//exit on lowerband or stoploss

strategy.close(id="BB_VWAP_PP", comment="P" , qty=strategy.position_size/3, when= crossunder(myVwap,upperBand) and strategy.position_size>=1 and close>strategy.position_avg_price) //

strategy.close(id="BB_VWAP_PP", comment="Exit All", when=crossunder(myVwap,lowerBand) and strategy.position_size>=1 )

//strategy.close(id="BBofVwapWithFibPivot", comment="Exit All", when=crossunder(close,vPP) and strategy.position_size>=1 )

strategy.close(id="BB_VWAP_PP", comment="Stop Loss Exit", when=crossunder(close,stopLossVal) and strategy.position_size>=1 )