Overview

The Spaced Out Trading Strategy is a trend-following strategy based on moving averages. It utilizes a 30-day exponential moving average (EMA) to identify price trends and enters trades when prices break out above/below the EMA. It exits trades when prices fall back below/above the EMA line. This strategy works well with 30-min to daily timeframes.

Strategy Logic

The core logic relies on the relationship between price and the 30-day EMA to generate entry and exit signals. Specifically:

- Calculate the 30-day EMA as the benchmark for the trend.

- Enter long trades when prices break out above the EMA.

- Exit trades when prices fall back below the EMA.

By capturing trend breakouts, it aims to capitalize on momentum moves and trend-following opportunities.

Advantage Analysis

The main advantages of this strategy include:

- Simple logic that is easy to understand and implement at low costs.

- Smoothens price fluctuations using EMA and focuses on the main trend.

- The 30-day EMA provides a medium-term lens to capture both swing and long-term trends.

- Customizable parameters adaptable across products and market regimes.

Risks and Mitigations

Some of the key risks are:

- Whipsaw risk from prices reversing after temporary breakout of EMAs. Can use longer EMA periods.

- Risk of accumulated losses from sustained trend reversal. Can set stop-loss limits.

- Suboptimal EMA period risk. Can ensemble adaptive EMA or multiple EMAs.

Enhancement Opportunities

Some ways the strategy can be upgraded:

- Add adaptive EMAs tailored to market volatility and asset characteristics.

- Build multi-EMA systems combining short and long-term EMAs.

- Incorporate stop-loss mechanisms e.g. moving average stop, range bound stop.

- Combine with other indicators e.g. momentum, volatility for signal filtering.

- Parameter optimization via machine learning algorithms.

Summary

The Spaced Out Trading Strategy aims to capture trends by trading price breakouts of EMA levels. It is a simple and practical quantitative strategy. With customizable loss limits and judicious optimizations, it can be a stable strategy providing sustainable returns across medium to long-term holding periods.

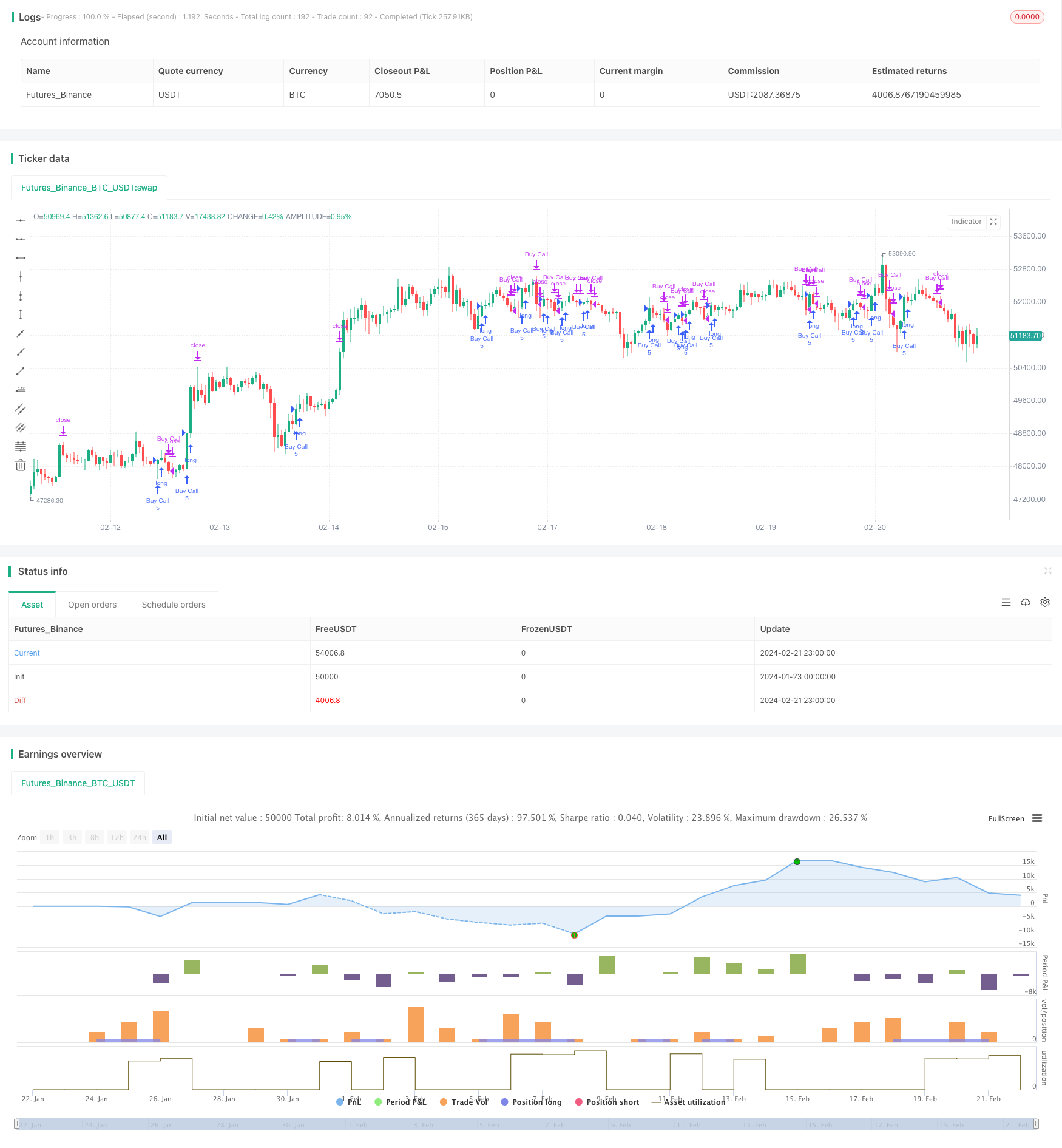

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Spaced Out Trading Strategy", overlay=true)

// Define strategy parameters

emaPeriod = input(30, title="EMA Period") // Longer EMA period for more spaced-out trades

stopLossPct = input(2.0, title="Stop Loss Percentage") // Stop loss percentage

takeProfitPct = input(3.0, title="Take Profit Percentage") // Take profit percentage

// Calculate EMA

emaValue = ta.ema(close, emaPeriod)

// Define entry and exit conditions

enterLong = ta.crossover(close, emaValue)

exitLong = ta.crossunder(close, emaValue)

// Place orders

contractsQty = 5 // Number of contracts to buy

var float lastTradePrice = na // Track the last trade price

if enterLong and strategy.position_size == 0

strategy.entry("Buy Call", strategy.long, qty = contractsQty)

lastTradePrice := close

else if exitLong and strategy.position_size > 0

strategy.close("Buy Call")

lastTradePrice := na

// Calculate stop loss and take profit

stopLossPrice = lastTradePrice * (1 - stopLossPct / 100)

takeProfitPrice = lastTradePrice * (1 + takeProfitPct / 100)

strategy.exit("Sell Call", "Buy Call", stop = stopLossPrice, limit = takeProfitPrice)