Overview

The strategy named “DCA Booster (1 minute)” is a high-frequency trading strategy that operates on a one-minute timeframe. The strategy combines Bollinger Bands and Dollar-Cost Averaging (DCA) techniques to capitalize on market fluctuations by making multiple buys and sells, aiming to generate profits. The main idea of the strategy is: when the price falls below the lower Bollinger Band for two consecutive periods, it starts building positions using DCA; when the price rises above the upper Bollinger Band, it closes all positions. Additionally, the strategy allows pyramiding, meaning it can continue adding positions if the price keeps falling.

Strategy Principles

- Calculate Bollinger Bands: Use a simple moving average and standard deviation to calculate the upper and lower bands of Bollinger Bands.

- Set DCA parameters: Divide a fixed amount of money into multiple portions, each serving as the capital for each position.

- Entry conditions: When the closing price is below the lower Bollinger Band for two consecutive periods, start building positions. Depending on whether the price continues to stay below the lower band, the strategy can establish up to 5 positions.

- Exit conditions: When the price crosses above the upper Bollinger Band, close all positions.

- Pyramiding: If the price continues to fall, the strategy will keep adding positions, up to a maximum of 5 positions.

- Position management: The strategy records the entry status of each position and closes the corresponding position when the exit condition is met.

Strategy Advantages

- By combining Bollinger Bands and DCA techniques, the strategy can effectively capture market volatility and reduce the average cost of buying.

- Allowing pyramiding enables the strategy to continue building positions when the price keeps falling, increasing the chances of profitability.

- The exit condition is simple and straightforward, allowing for quick profit-taking.

- Suitable for use on short timeframes such as 1-minute, enabling high-frequency trading.

Strategy Risks

- If the market fluctuates drastically and the price quickly breaks through the upper Bollinger Band, the strategy may not be able to close positions in time, resulting in losses.

- Pyramiding may lead to overexposure when the price continues to fall, increasing risk.

- The strategy may not perform well in a choppy market, as frequent buying and selling can generate high trading costs.

Strategy Optimization Directions

- Consider adding a stop-loss in the exit conditions to control the maximum loss per trade.

- Optimize the pyramiding logic, such as adjusting the position size based on the magnitude of the price decline, to avoid overexposure.

- Incorporate other indicators, such as RSI and MACD, to improve the accuracy of entries and exits.

- Optimize the parameters, such as the period and standard deviation multiplier of Bollinger Bands, to adapt to different market conditions.

Summary

“DCA Booster (1 minute)” is a high-frequency trading strategy that combines Bollinger Bands and DCA. It aims to capture market fluctuations and generate profits by building positions when the price is below the lower Bollinger Band and closing positions when the price crosses above the upper Bollinger Band. The strategy allows pyramiding but also faces risks such as drastic market volatility and overexposure. By introducing stop-losses, optimizing the pyramiding logic, incorporating other indicators, and optimizing parameters, the performance of this strategy can be further improved.

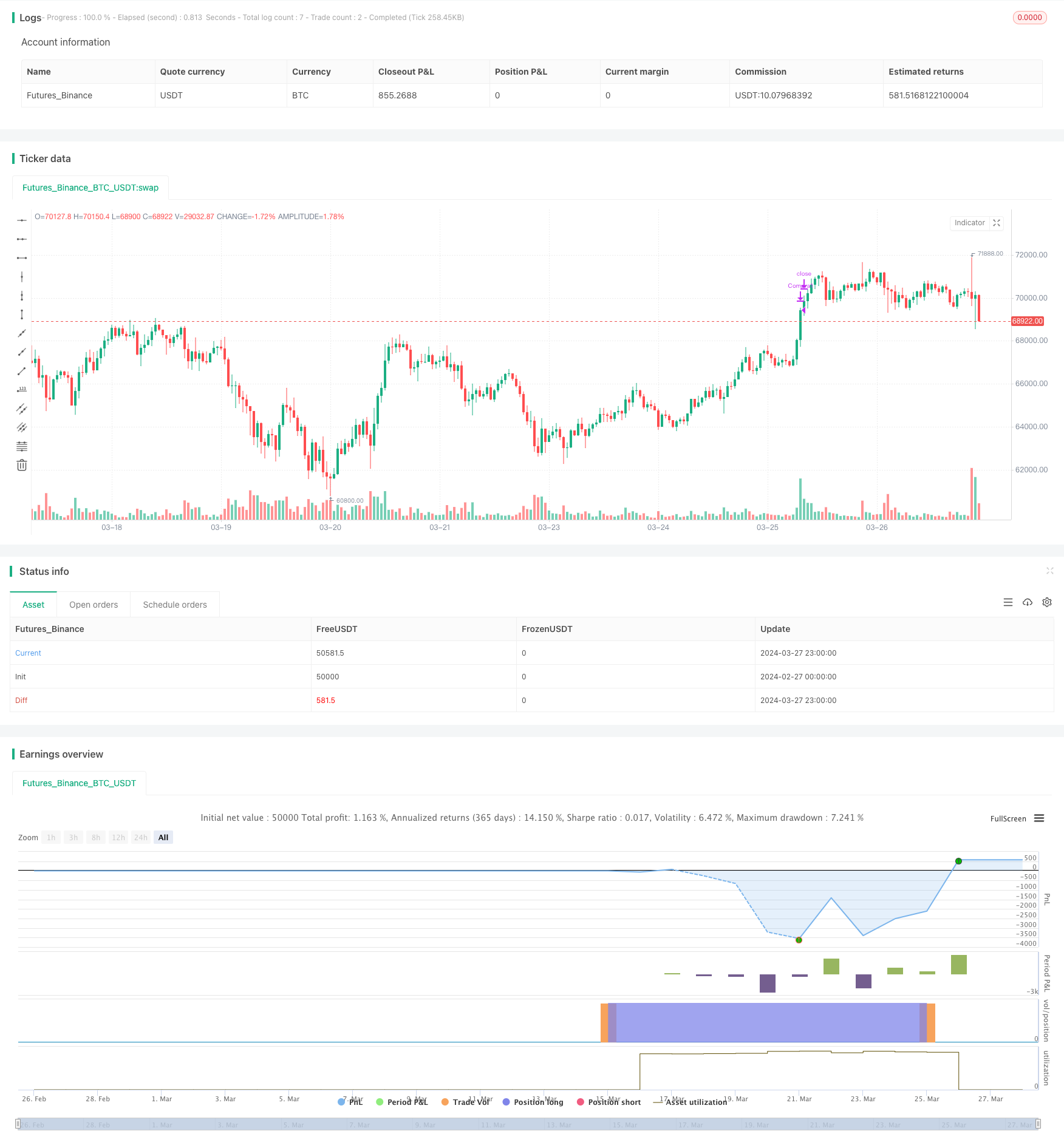

/*backtest

start: 2024-02-27 00:00:00

end: 2024-03-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DCA Booster (1 minute)",

overlay=true )

// Parameters for Bollinger Bands

length = input.int(50, title="BB Length")

mult = input.float(3.0, title="BB Mult")

// Bollinger Bands calculation

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Variables for DCA

cantidad_dolares = 50000

orden1 = cantidad_dolares / close

orden2 = orden1 * 1.2

orden3 = orden2 * 1.3

orden4 = orden3 * 1.5

orden5 = orden4 * 1.5

// Variables for tracking purchases

var comprado1 = false

var comprado2 = false

var comprado3 = false

var comprado4 = false

var comprado5 = false

// Buy conditions

condicion_compra1 = close < lower and close[1] < lower[1] and not comprado1

condicion_compra2 = close < lower and close[1] < lower[1] and comprado1 and not comprado2

condicion_compra3 = close < lower and close[1] < lower[1] and comprado2 and not comprado3

condicion_compra4 = close < lower and close[1] < lower[1] and comprado3 and not comprado4

condicion_compra5 = close < lower and close[1] < lower[1] and comprado4 and not comprado5

// Variables de control

var int consecutive_closes_below_lower = 0

var int consecutive_closes_above_upper = 0

// Entry logic

if condicion_compra1 and barstate.isconfirmed

consecutive_closes_below_lower := consecutive_closes_below_lower + 1

if consecutive_closes_below_lower >= 2

strategy.entry("Compra1", strategy.long, qty=orden1)

comprado1 := true

consecutive_closes_below_lower := 0

if condicion_compra2 and barstate.isconfirmed

consecutive_closes_below_lower := consecutive_closes_below_lower + 1

if consecutive_closes_below_lower >= 2

strategy.entry("Compra2", strategy.long, qty=orden2)

comprado2 := true

consecutive_closes_below_lower := 0

if condicion_compra3 and barstate.isconfirmed

consecutive_closes_below_lower := consecutive_closes_below_lower + 1

if consecutive_closes_below_lower >= 2

strategy.entry("Compra3", strategy.long, qty=orden3)

comprado3 := true

consecutive_closes_below_lower := 0

if condicion_compra4 and barstate.isconfirmed

consecutive_closes_below_lower := consecutive_closes_below_lower + 1

if consecutive_closes_below_lower >= 2

strategy.entry("Compra4", strategy.long, qty=orden4)

comprado4 := true

consecutive_closes_below_lower := 0

if condicion_compra5 and barstate.isconfirmed

consecutive_closes_below_lower := consecutive_closes_below_lower + 1

if consecutive_closes_below_lower >= 2

strategy.entry("Compra5", strategy.long, qty=orden5)

comprado5 := true

consecutive_closes_below_lower := 0

// Sell conditions

if close > upper and comprado1 and barstate.isconfirmed

strategy.close("Compra1")

comprado1 := false

if close > upper and comprado2 and barstate.isconfirmed

strategy.close("Compra2")

comprado2 := false

if close > upper and comprado3 and barstate.isconfirmed

strategy.close("Compra3")

comprado3 := false

if close > upper and comprado4 and barstate.isconfirmed

strategy.close("Compra4")

comprado4 := false

if close > upper and comprado5 and barstate.isconfirmed

strategy.close("Compra5")

comprado5 := false