Overview

The main idea of this strategy is to use the high and low points of the Asian session as breakout points. Within a few hours after the European and American markets open, if the price breaks above the Asian session high, it goes long; if it breaks below the Asian session low, it goes short. Stop loss and take profit are set to control risk. The strategy only opens one trade per day, with a maximum of 100,000 simultaneous positions.

Strategy Principle

- Determine the trading time of the Asian session. Users can customize the start and end times.

- During the Asian session, record the highest and lowest prices of the day.

- At a certain time (user-defined offset hours) after the European and American markets open, if the price breaks above the Asian session high, go long; if it breaks below the Asian session low, go short.

- Set stop loss and take profit. The number of points for stop loss and take profit can be customized.

- Only open one new trade per day, with a maximum of 100,000 simultaneous positions.

- If a position has already been opened for the day, no new trades will be opened.

Advantage Analysis

- By using the relatively calm characteristics of the Asian session and using the high and low points of the Asian session as breakout points, it can better capture the trend opportunities of the European and American sessions.

- Setting stop loss and take profit can effectively control risk, letting profitable trades run and quickly stopping losses on unprofitable trades.

- Limiting to only one trade per day and a maximum number of simultaneous positions can avoid overtrading and excessive use of funds.

- Users can flexibly set parameters such as Asian session time and offset hours according to their own needs.

Risk Analysis

- The high and low points of the Asian session may not be the true high and low points of the day. It is possible that after the European and American markets break through, they quickly retrace, causing losses.

- Fixed-point stop loss and take profit may not be able to cope with large fluctuations in the market. Sometimes the stop loss may be too early, and sometimes the take profit may be too early.

- In situations where the trend is not obvious or the market volatility is high, the strategy may experience frequent opening and stopping losses.

Optimization Direction

- Consider dynamically adjusting the number of points for stop loss and take profit based on volatility indicators such as ATR to adapt to different market conditions.

- Add some trend judgment indicators, such as MA, and only go long when the big trend is up and go short when it is down to improve the success rate.

- Consider setting different parameters for different time periods, such as using smaller stop loss and take profit at the beginning of the European and American trading sessions, and increasing stop loss and take profit when the trend is obvious.

Summary

This strategy uses the high and low points of the Asian session as breakout points for trading and is suitable for use on varieties with obvious trends in the European and American markets. However, fixed-point stop loss and take profit and standard breakout entry methods also have some limitations. By introducing some dynamic and trend-based indicators, the strategy can be optimized to obtain better results.

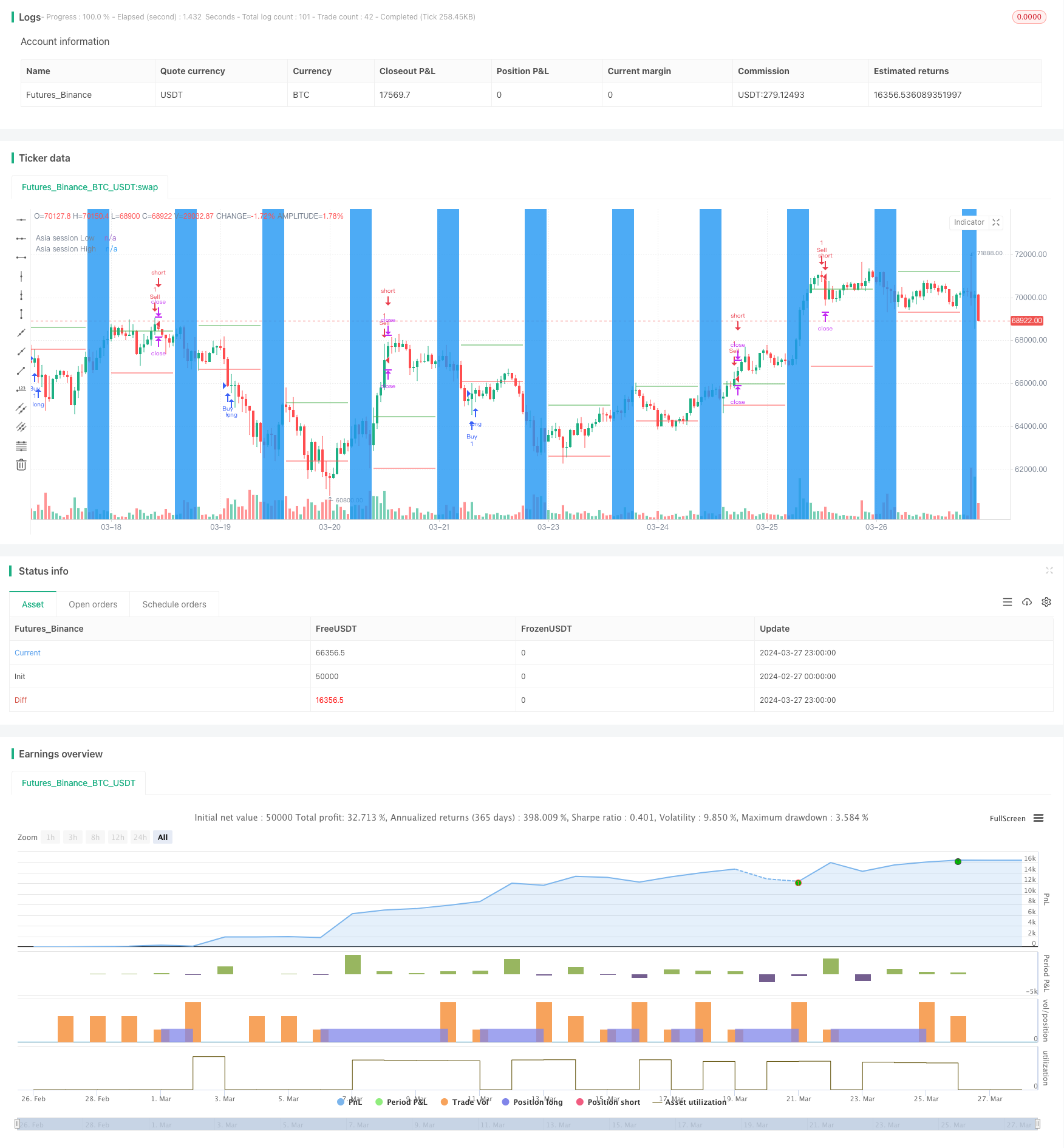

/*backtest

start: 2024-02-27 00:00:00

end: 2024-03-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Asia Session", overlay=true)

var hourSessionStart = input(19, "Asia session start hour", minval=0, maxval=23)

var hourSessionStop = input(1, "Asia session end hour", minval=0, maxval=23)

var offsetHours = input(3, "Offset hours after Asia session end")

var float hi = na

var float lo = na

var float plotHi = na

var float plotLo = na

var bool inSession = na

var bool enteringSession = na

var bool exitingSession = na

inSession := (hour >= hourSessionStart or hour < hourSessionStop)

enteringSession := inSession and not inSession[1]

exitingSession := not inSession and inSession[1]

if enteringSession

plotLo := na

plotHi := na

if inSession

lo := min(low, nz(lo, 1.0e23))

hi := max(high, nz(hi))

if exitingSession

plotLo := lo

plotHi := hi

lo := na

hi := na

bgcolor(inSession ? color.blue : na)

plot(plotLo, "Asia session Low", color.red, style=plot.style_linebr)

plot(plotHi, "Asia session High", color.green, style=plot.style_linebr)

// Implementazione delle condizioni di entrata

var float asiaSessionLow = na

var float asiaSessionHigh = na

var int maxTrades = 100000 // Impostiamo il massimo numero di operazioni contemporanee

var int tradesOpened = 0 // Variabile per tenere traccia del numero di operazioni aperte

var bool tradeOpened = false

var bool operationClosed = false // Nuova variabile per tenere traccia dello stato di chiusura dell'operazione

// Calcolo del range asiatico

if (inSession)

asiaSessionLow := lo

asiaSessionHigh := hi

// Apertura di un solo trade al giorno

if (enteringSession)

tradeOpened := false

// Condizioni di entrata

var float stopLoss = 300 * syminfo.mintick

var float takeProfit = 300 * syminfo.mintick

if (not tradeOpened and not operationClosed and close < asiaSessionLow and tradesOpened < maxTrades and hour >= hourSessionStop + offsetHours)

strategy.entry("Buy", strategy.long)

tradeOpened := true

tradesOpened := tradesOpened + 1 // Incrementiamo il contatore delle operazioni aperte

if (not tradeOpened and not operationClosed and close > asiaSessionHigh and tradesOpened < maxTrades and hour >= hourSessionStop + offsetHours)

strategy.entry("Sell", strategy.short)

tradeOpened := true

tradesOpened := tradesOpened + 1 // Incrementiamo il contatore delle operazioni aperte

// Impostazione dello stop loss e del take profit

strategy.exit("Stop Loss / Take Profit", "Buy", stop=close - stopLoss, limit=close + takeProfit)

strategy.exit("Stop Loss / Take Profit", "Sell", stop=close + stopLoss, limit=close - takeProfit)