SPARK Dynamic Position Sizing and Dual Indicator Trading Strategy

supertrend RSI ATR

Overview

The SPARK strategy is a quantitative trading strategy that combines dynamic position sizing with dual indicator confirmation. The strategy utilizes the SuperTrend indicator and the Relative Strength Index (RSI) to identify potential entry and exit points while employing a dynamic position sizing mechanism to optimize capital allocation. The strategy also offers flexible take profit and stop loss settings, as well as customizable parameters such as minimum trading frequency and directional preference.

Strategy Principles

The core of the SPARK strategy lies in the combined application of the SuperTrend indicator and the RSI indicator. The SuperTrend indicator determines the trend direction by comparing the closing price with dynamic support and resistance levels, while the RSI indicator is used to identify overbought and oversold market conditions. When both the SuperTrend and RSI indicators simultaneously meet specific criteria, the strategy generates an entry signal.

The strategy employs a dynamic position sizing mechanism to optimize capital allocation for each trade. By setting a portfolio percentage and leverage ratio, the strategy automatically calculates the optimal position size based on current market conditions and account balance. Additionally, the strategy offers flexible take profit and stop loss settings, allowing users to choose between fixed percentages or dynamically calculated levels.

Strategy Advantages

- Dual Indicator Confirmation: By combining the SuperTrend and RSI indicators, the SPARK strategy can more accurately identify potential entry and exit points, reducing the likelihood of false signals.

- Dynamic Position Sizing: The strategy employs a dynamic position sizing mechanism that automatically optimizes capital allocation for each trade based on portfolio percentage and leverage ratio, enhancing capital efficiency.

- Flexible Risk Management: The strategy offers flexible take profit and stop loss settings, allowing users to choose between fixed percentages or dynamically calculated levels based on their risk preferences, enabling precise risk control.

- Customizable Parameters: The strategy allows users to adjust multiple input parameters, such as ATR length, multiplier, and RSI thresholds, to adapt to different market conditions and trading preferences.

Strategy Risks

- Market Risk: Despite the SPARK strategy’s dual indicator confirmation and dynamic position sizing mechanism, it may still face the risk of losses under extreme market conditions.

- Parameter Optimization Risk: The strategy’s performance largely depends on the selection of input parameters. Inappropriate parameter settings may lead to suboptimal strategy performance.

- Overfitting Risk: If the strategy parameters are over-optimized, it may result in poor performance under future market conditions.

Strategy Optimization Directions

- Incorporating Additional Indicators: Consider incorporating other technical indicators, such as MACD, Bollinger Bands, etc., to further enhance the accuracy of signal confirmation.

- Optimizing Take Profit and Stop Loss Mechanisms: Explore more advanced take profit and stop loss strategies, such as trailing stops, dynamic take profit levels, etc., to better protect profits and limit losses.

- Adaptive Parameter Adjustment: Develop an adaptive mechanism that dynamically adjusts strategy parameters based on market conditions to adapt to the ever-changing market environment.

Summary

The SPARK strategy provides traders with a comprehensive quantitative trading solution by combining the SuperTrend and RSI indicators, employing a dynamic position sizing mechanism, and offering flexible risk management tools. Although the strategy may face certain risks, with continuous optimization and refinement, the SPARK strategy has the potential to deliver consistent performance across various market conditions.

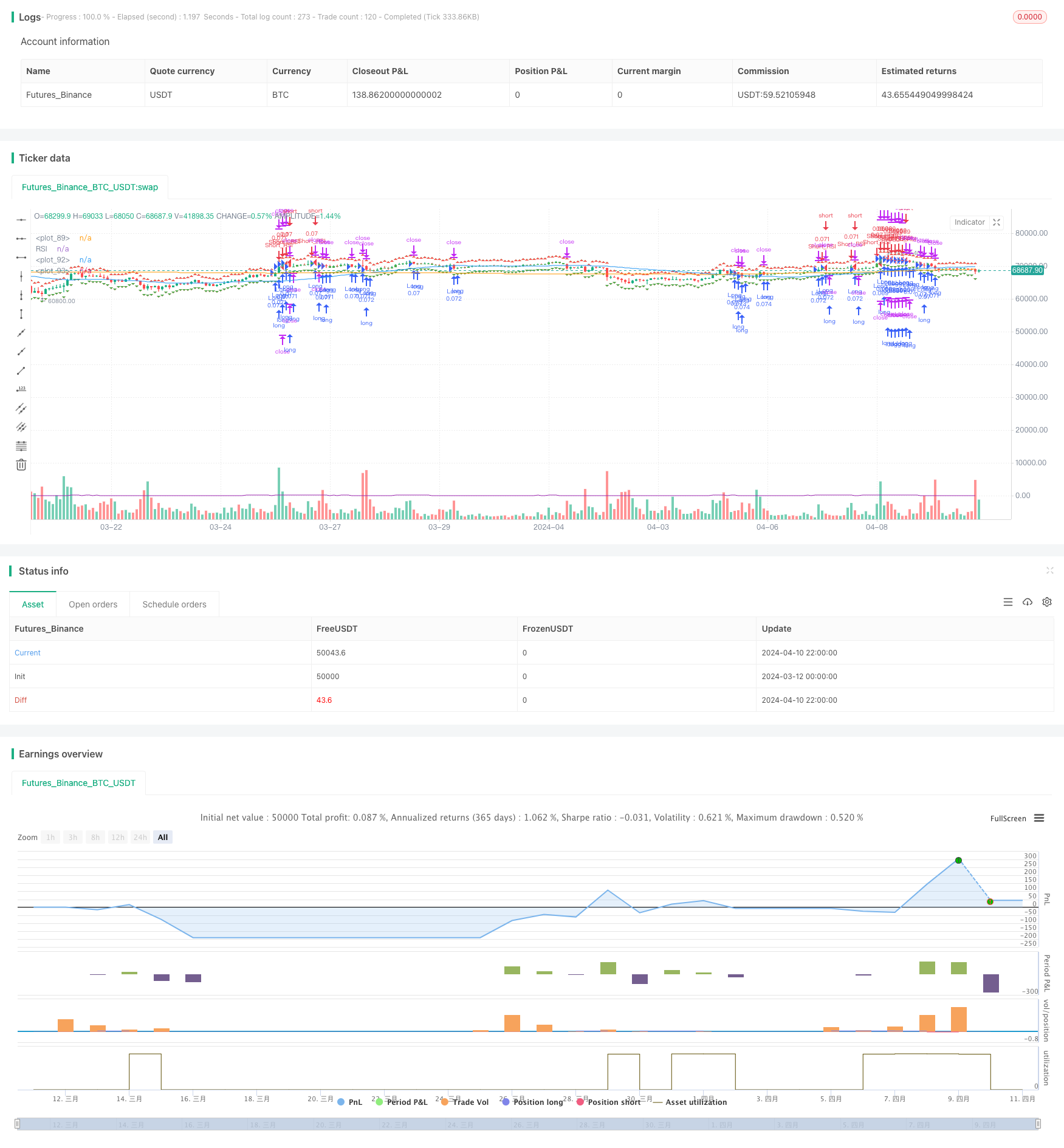

/*backtest

start: 2024-03-12 00:00:00

end: 2024-04-11 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SPARK", shorttitle="SPARK", overlay=true)

// Choose whether to activate the minimal bars in trade feature

minBarsEnabled = input(true, title="Activate Minimal Bars in Trade")

portfolioPercentage = input(10, title="Portfolio Percentage", minval=1, maxval=100)

// Leverage Input

leverage = input(1, title="Leverage", minval=1)

// Calculate position size according to portfolio percentage and leverage

positionSizePercent = portfolioPercentage / 100 * leverage

positionSize = (strategy.initial_capital / close) * positionSizePercent

// Take Profit and Stop Loss settings

useFixedTPSL = input(1, title="Use Fixed TP/SL", options=[1, 0])

tp_sl_step = 0.1

fixedTP = input(2.0, title="Fixed Take Profit (%)", step=tp_sl_step)

fixedSL = input(1.0, title="Fixed Stop Loss (%)", step=tp_sl_step)

// Calculate Take Profit and Stop Loss Levels

takeProfitLong = close * (1 + fixedTP / 100)

takeProfitShort = close * (1 - fixedTP / 100)

stopLossLong = close * (1 - fixedSL / 100)

stopLossShort = close * (1 + fixedSL / 100)

// Plot TP and SL levels on the chart

plotshape(series=takeProfitLong, title="Take Profit Long", color=color.green, style=shape.triangleup, location=location.abovebar)

plotshape(series=takeProfitShort, title="Take Profit Short", color=color.red, style=shape.triangledown, location=location.belowbar)

plotshape(series=stopLossLong, title="Stop Loss Long", color=color.red, style=shape.triangleup, location=location.abovebar)

plotshape(series=stopLossShort, title="Stop Loss Short", color=color.green, style=shape.triangledown, location=location.belowbar)

// Minimum Bars Between Trades Input

minBarsBetweenTrades = input(5, title="Minimum Bars Between Trades")

// Inputs for selecting trading direction

tradingDirection = input("Both", "Choose Trading Direction", options=["Long", "Short", "Both"])

// SuperTrend Function

trendFlow(src, atrLength, multiplier) =>

atr = atr(atrLength)

up = hl2 - (multiplier * atr)

dn = hl2 + (multiplier * atr)

trend = 1

trend := nz(trend[1], 1)

up := src > nz(up[1], 0) and src[1] > nz(up[1], 0) ? max(up, nz(up[1], 0)) : up

dn := src < nz(dn[1], 0) and src[1] < nz(dn[1], 0) ? min(dn, nz(dn[1], 0)) : dn

trend := src > nz(dn[1], 0) ? 1 : src < nz(up[1], 0)? -1 : nz(trend[1], 1)

[up, dn, trend]

// Inputs for SuperTrend settings

atrLength1 = input(7, title="ATR Length for Trend 1")

multiplier1 = input(4.0, title="Multiplier for Trend 1")

atrLength2 = input(14, title="ATR Length for Trend 2")

multiplier2 = input(3.618, title="Multiplier for Trend 2")

atrLength3 = input(21, title="ATR Length for Trend 3")

multiplier3 = input(3.5, title="Multiplier for Trend 3")

atrLength4 = input(28, title="ATR Length for Trend 4")

multiplier4 = input(3.382, title="Multiplier for Trend 4")

// Calculate SuperTrend

[up1, dn1, trend1] = trendFlow(close, atrLength1, multiplier1)

[up2, dn2, trend2] = trendFlow(close, atrLength2, multiplier2)

[up3, dn3, trend3] = trendFlow(close, atrLength3, multiplier3)

[up4, dn4, trend4] = trendFlow(close, atrLength4, multiplier4)

// Entry Conditions based on SuperTrend and Elliott Wave-like patterns

longCondition = trend1 == 1 and trend2 == 1 and trend3 == 1 and trend4 == 1

shortCondition = trend1 == -1 and trend2 == -1 and trend3 == -1 and trend4 == -1

// Calculate bars since last trade

barsSinceLastTrade = barssince(tradingDirection == "Long" ? longCondition : shortCondition)

// Strategy Entry logic based on selected trading direction and minimum bars between trades

if tradingDirection == "Long" or tradingDirection == "Both"

if longCondition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("TP/SL Long", from_entry="Long", stop=stopLossLong, limit=takeProfitLong)

if tradingDirection == "Short" or tradingDirection == "Both"

if shortCondition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("TP/SL Short", from_entry="Short", stop=stopLossShort, limit=takeProfitShort)

// Color bars based on position

var color barColor = na

barColor := strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : na

// Plot colored bars

plotcandle(open, high, low, close, color=barColor)

// Plot moving averages

plot(sma(close, 50), color=color.blue)

plot(sma(close, 200), color=color.orange)

// More customizable trading bot - adding a new indicator

// This indicator is the RSI (Relative Strength Index)

// RSI Inputs

rsi_length = input(14, title="RSI Length")

rsi_oversold = input(30, title="RSI Oversold")

rsi_overbought = input(70, title="RSI Overbought")

// Calculate RSI

rsi = rsi(close, rsi_length)

// Plot RSI

plot(rsi, color=color.purple, title="RSI")

// Entry Conditions based on RSI

rsi_long_condition = rsi < rsi_oversold

rsi_short_condition = rsi > rsi_overbought

// Strategy Entry logic based on RSI

if tradingDirection == "Long" or tradingDirection == "Both"

if rsi_long_condition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Long_RSI", strategy.long, qty=positionSize)

strategy.exit("TP/SL Long_RSI", from_entry="Long_RSI", stop=stopLossLong, limit=takeProfitLong)

if tradingDirection == "Short" or tradingDirection == "Both"

if rsi_short_condition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Short_RSI", strategy.short, qty=positionSize)

strategy.exit("TP/SL Short_RSI", from_entry="Short_RSI", stop=stopLossShort, limit=takeProfitShort)