Overview

The Fibonacci Golden Ratio Retracement Buying Strategy is a trading strategy based on Fibonacci retracement levels and trend-following stop-loss. The strategy utilizes Fibonacci retracement levels as potential support and resistance levels and combines them with a trailing stop loss to determine buying and selling opportunities. When the price retraces to a certain Fibonacci level during an uptrend and is above the trailing stop loss, the strategy generates a buy signal. When the price falls below the trailing stop loss or a certain Fibonacci level, the strategy generates a sell signal.

Strategy Principle

- Calculation of Fibonacci Retracement Levels: Based on the highest high and lowest low within a specified price range, the strategy calculates Fibonacci retracement levels at 0%, 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

- Identification of Swing Highs and Lows: The strategy identifies swing highs and lows within a specified number of trading periods.

- Calculation of Trailing Stop Loss: Based on whether the current close price is above the previous swing high or below the previous swing low, the strategy calculates the trailing stop loss price.

- Definition of Buy and Sell Conditions: When the close price is above the trailing stop loss and above a certain Fibonacci retracement level, a buy signal is generated. When the close price is below the trailing stop loss and below a certain Fibonacci retracement level, a sell signal is generated.

- Trade Execution: When the buy condition is met, the strategy enters a long position. When the sell condition is met, the strategy closes the position.

Strategy Advantages

- Combination of Technical Analysis and Trend Following: The strategy utilizes Fibonacci retracement levels as potential support and resistance levels while incorporating a trailing stop loss, effectively capturing trending opportunities and managing risk.

- Adaptability to Different Market Conditions: Fibonacci retracement levels have applicability in various market conditions and can provide reference for trading in both uptrends and downtrends.

- Clear Entry and Exit Rules: The strategy is based on well-defined buy and sell conditions, helping traders make objective decisions and avoid subjective emotional influences.

Strategy Risks

- Market Volatility Risk: In highly volatile market conditions, prices may quickly break through Fibonacci retracement levels and the trailing stop loss, leading to strategy errors or excessive stop-outs.

- Parameter Setting Risk: The performance of the strategy depends on the parameter settings for Fibonacci retracement levels and the trailing stop loss. Inappropriate parameters may result in suboptimal strategy performance.

- Trend Identification Risk: The strategy assumes that price movements follow trends, but in real markets, prices may exhibit fluctuations or reversals, leading to misjudgments in trend identification.

Strategy Optimization Directions

- Integration with Other Technical Indicators: Consider combining Fibonacci retracement levels with other technical indicators (such as moving averages, relative strength index, etc.) to enhance the reliability of the strategy.

- Dynamic Parameter Adjustment: Dynamically adjust the parameters for Fibonacci retracement levels and the trailing stop loss based on changing market conditions to adapt to different market environments.

- Introduction of Risk Management Measures: Incorporate risk management measures into the strategy, such as position sizing and stop-loss management, to control potential risk exposure.

Summary

The Fibonacci Golden Ratio Retracement Buying Strategy is a trading strategy that combines Fibonacci retracement levels with a trailing stop loss. The strategy utilizes Fibonacci retracement levels as potential support and resistance levels and incorporates a trailing stop loss to determine buying and selling opportunities. The advantages of the strategy lie in its combination of technical analysis and trend following, adaptability to different market conditions, and clear entry and exit rules. However, the strategy also faces risks such as market volatility risk, parameter setting risk, and trend identification risk. To optimize strategy performance, considerations include integrating other technical indicators, dynamically adjusting parameters, and introducing risk management measures.

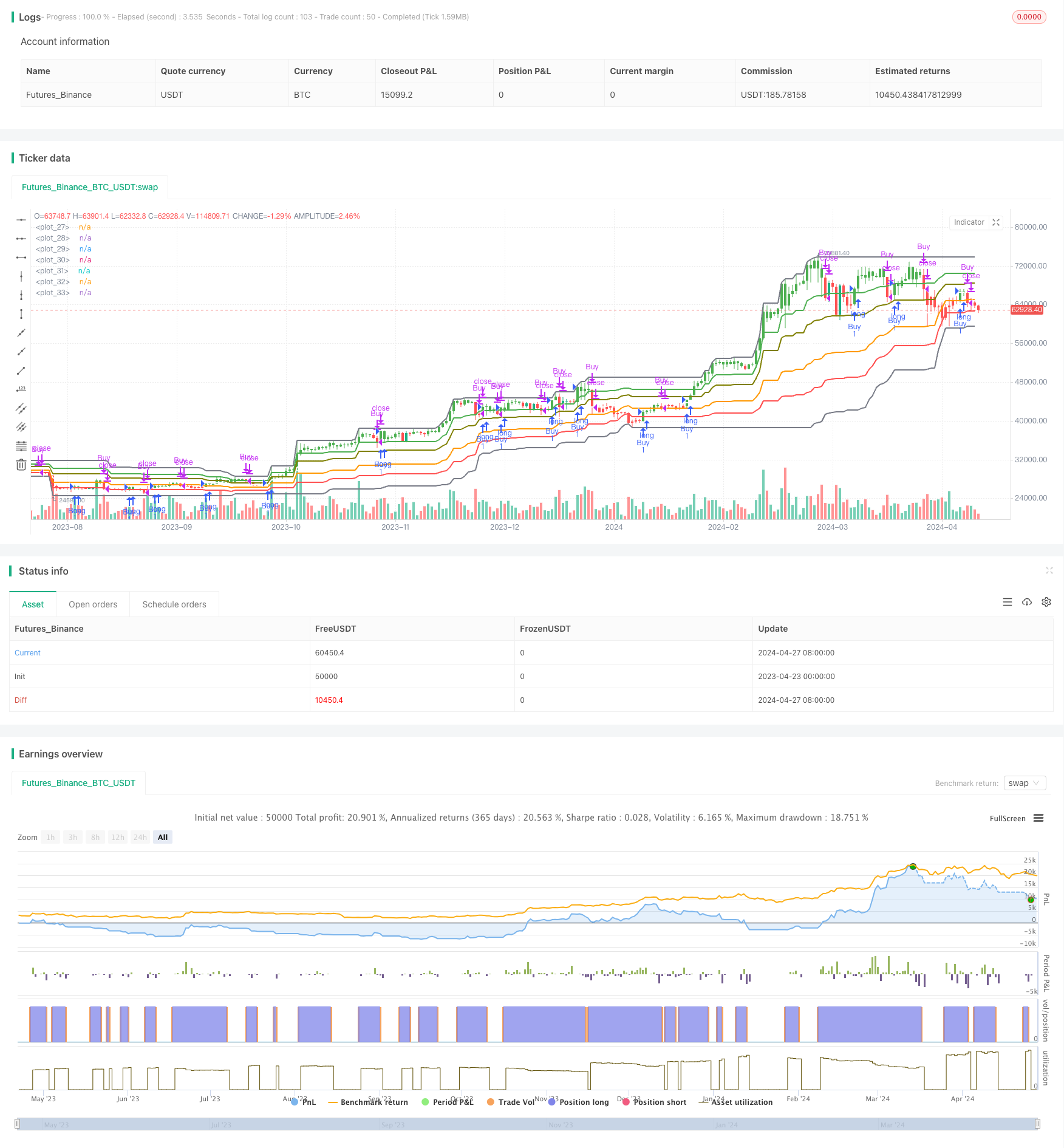

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Fibonacci BFSP', overlay=true)

// Define Fibonacci retracement levels

fib0 = input(0, title="Fibonacci 0% Level")

fib1 = input(1, title="Fibonacci 1% Level")

fib23 = input(0.236, title="Fibonacci 23.6% Level")

fib38 = input(0.382, title="Fibonacci 38.2% Level")

fib50 = input(0.5, title="Fibonacci 50% Level")

fib61 = input(0.618, title="Fibonacci 61.8% Level")

fib78 = input(0.786, title="Fibonacci 78.6% Level")

Price = input(50, title="Price")

// Calculate Fibonacci levels

priceHigh = ta.highest(high, Price)

priceLow = ta.lowest(low, Price)

priceRange = priceHigh - priceLow

fibRetracement0 = priceHigh - fib0 * priceRange

fibRetracement1 = priceHigh - fib1 * priceRange

fibRetracement23 = priceHigh - fib23 * priceRange

fibRetracement38 = priceHigh - fib38 * priceRange

fibRetracement50 = priceHigh - fib50 * priceRange

fibRetracement61 = priceHigh - fib61 * priceRange

fibRetracement78 = priceHigh - fib78 * priceRange

// Plot Fibonacci retracement levels

plot(fibRetracement0, color=color.gray, linewidth=2)

plot(fibRetracement1, color=color.gray, linewidth=2)

plot(fibRetracement23, color=color.green, linewidth=2)

plot(fibRetracement38, color=color.olive, linewidth=2)

plot(fibRetracement50, color=color.white, linewidth=2)

plot(fibRetracement61, color=color.orange, linewidth=2)

plot(fibRetracement78, color=color.red, linewidth=2)

// Inputs

no = input(1, title="Swing")

// Calculate swing highs and lows

res = ta.highest(high, no)

sup = ta.lowest(low, no)

// Calculate trailing stop loss

avd = close > res[1] ? 1 : close < sup[1] ? -1 : 0

avn = ta.valuewhen(avd != 0, avd, 0)

tsl = avn == 1 ? sup : res

// Define buy and sell conditions

buyCondition = (close > tsl) and (close > fibRetracement23 or close > fibRetracement38 or close > fibRetracement50 or close > fibRetracement61 or close > fibRetracement78)

sellCondition = (close < tsl) and (close < fibRetracement23 or close < fibRetracement38 or close < fibRetracement50 or close < fibRetracement61 or close < fibRetracement78)

// Entry strategy

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Exit strategy

if (sellCondition)

strategy.close("Buy")

// Color bars based on buy and sell conditions

barColor = buyCondition ? color.green : sellCondition ? color.red : na

barcolor(barColor)