Overview

This strategy is based on the Bollinger Bands indicator and identifies optimal buy and sell opportunities by analyzing price movements relative to the upper, lower, and middle Bollinger Bands. The strategy intelligently manages both long and short positions, allowing for profiting from all market directions. Strategy parameters are customizable to accommodate different risk tolerances and market approaches. The strategy provides clear visual indicators on charts and real-time alerts for buy and sell signals.

Strategy Principles

- Buy signals are generated when the price crosses above the lower Bollinger Band or the middle band, indicating a potential upward trend.

- Sell signals are triggered when the price crosses below the upper Bollinger Band or the middle band, signaling a possible downward trend.

- Short signals are initiated when the price crosses below the upper Bollinger Band or the middle band, allowing for capitalizing on declining markets.

- Cover signals are activated when the price crosses above the lower Bollinger Band or the middle band, prompting the closing of short positions to secure profits or minimize losses.

Strategy Advantages

- Built on solid technical analysis principles, rigorously tested to ensure reliability and effectiveness.

- Easy to implement and customize on TradingView, suitable for traders of all experience levels.

- Ongoing support and updates provided to adapt to evolving market conditions and maintain optimal strategy performance.

- Dynamic entry and exit points ensure entering and exiting trades at the most advantageous moments by analyzing price movements relative to the Bollinger Bands.

- Integrated long and short position management allows for profiting from all market directions.

Strategy Risks

- In choppy market conditions, frequent trading signals may lead to overtrading and potential losses.

- The strategy relies on historical data and statistical analysis, potentially missing irrational market behavior and black swan events.

- Improper parameter selection may result in suboptimal strategy performance. Careful optimization and backtesting of parameters are necessary to suit specific markets and trading styles.

- No single strategy excels in all market conditions. The Bollinger Bands strategy may underperform in certain scenarios, so combining it with other indicators and risk management techniques is recommended.

Strategy Optimization Directions

- Incorporate additional indicators for combination logic to identify more reliable trading signals, such as RSI, MACD, etc. This helps filter out noise and reduce false positives.

- Consider introducing adaptive volatility calculation to dynamically adjust the width of the Bollinger Bands based on market conditions. This can better capture opportunities in different volatility environments.

- Implement ATR-based or percentage-based stop-loss and take-profit mechanisms to better manage risk and protect profits. This helps limit potential losses and lock in realized gains.

- Explore dynamic position sizing based on market cycles or volatility states. Allocating capital according to different market scenarios can optimize risk-adjusted returns.

Summary

The Bollinger Bands strategy provides a robust framework for generating precise trading signals based on price movements relative to the Bollinger Bands. By integrating long and short position management, customizable parameters, and intuitive visual and alert features, the strategy empowers traders to confidently seize opportunities across various market conditions. While the strategy performs well, there is room for optimization, such as incorporating additional indicators, dynamic volatility calculations, robust risk management techniques, and adaptive position sizing based on market states. With continuous refinement and adjustment, the Bollinger Bands strategy can be a valuable addition to any trader’s toolbox, helping them navigate dynamic markets and maximize returns.

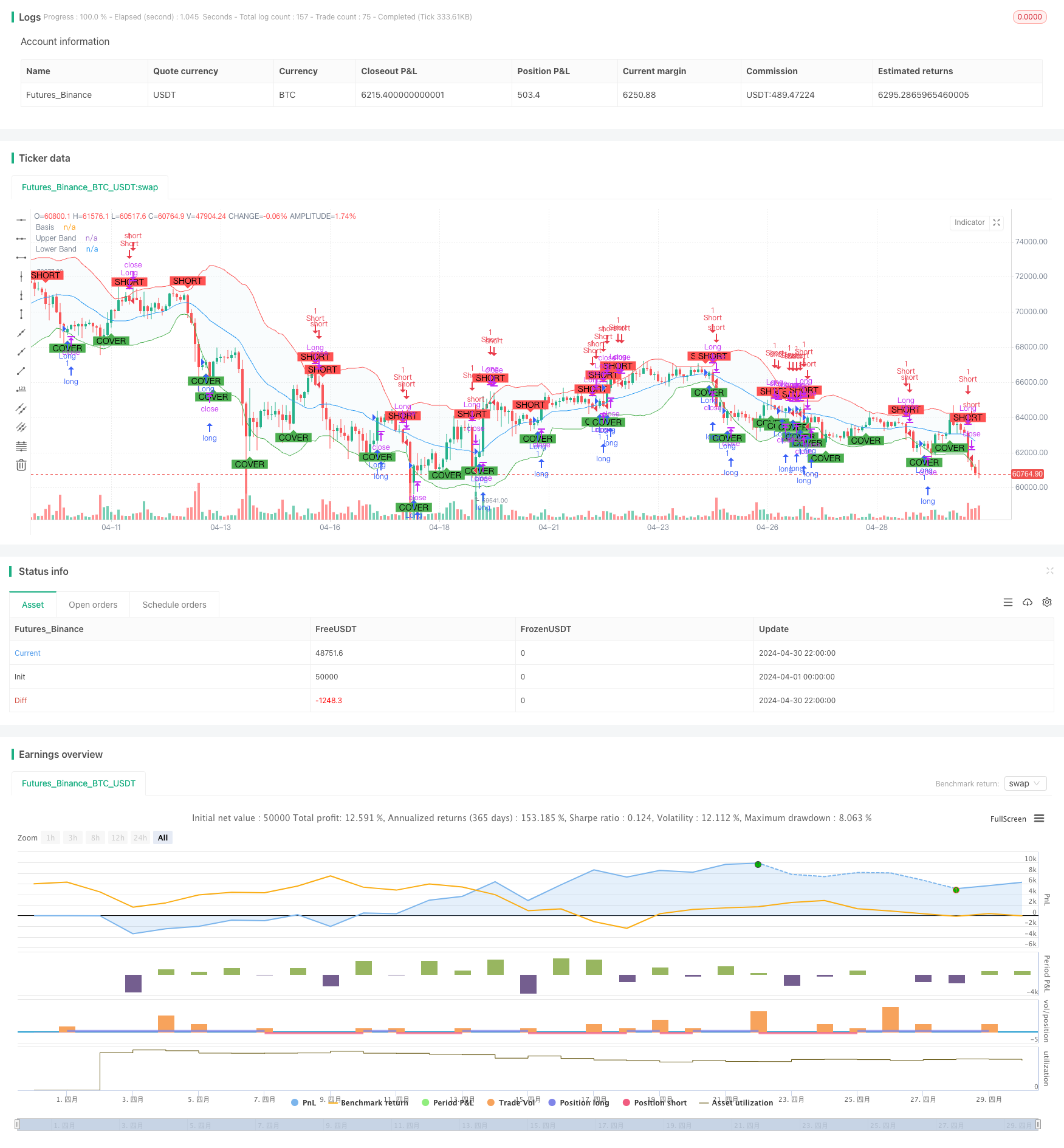

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Strategy with Long and Short", overlay=true)

// Bollinger Bands settings

length = input.int(20, title="BB Length")

src = input(close, title="Source")

mult = input.float(2.0, title="BB Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(basis, color=color.blue, linewidth=1, title="Basis")

p1 = plot(upper, color=color.red, linewidth=1, title="Upper Band")

p2 = plot(lower, color=color.green, linewidth=1, title="Lower Band")

fill(p1, p2, color=color.rgb(173, 216, 230, 90))

// Long Buy and Sell conditions

buyConditionLower = ta.crossover(src, lower)

sellConditionUpper = ta.crossunder(src, upper)

buyConditionBasis = ta.crossover(src, basis)

sellConditionBasis = ta.crossunder(src, basis)

// Combine long conditions

buyCondition = buyConditionLower or buyConditionBasis

sellCondition = sellConditionUpper or sellConditionBasis

// Short Sell and Buy conditions

shortConditionUpper = ta.crossunder(src, upper)

coverConditionLower = ta.crossover(src, lower)

shortConditionBasis = ta.crossunder(src, basis)

coverConditionBasis = ta.crossover(src, basis)

// Combine short conditions

shortCondition = shortConditionUpper or shortConditionBasis

coverCondition = coverConditionLower or coverConditionBasis

// Execute strategy orders for long

if (buyCondition)

strategy.entry("Long", strategy.long)

if (sellCondition)

strategy.close("Long")

// Execute strategy orders for short

if (shortCondition)

strategy.entry("Short", strategy.short)

if (coverCondition)

strategy.close("Short")

// Plot Buy and Sell signals for long

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", title="Buy Signal")

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", title="Sell Signal")

// Plot Sell and Cover signals for short

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SHORT", title="Short Signal")

plotshape(series=coverCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="COVER", title="Cover Signal")

// Alert conditions for long

alertcondition(buyCondition, title="Buy Alert", message="Price crossed above the lower Bollinger Band or Basis")

alertcondition(sellCondition, title="Sell Alert", message="Price crossed below the upper Bollinger Band or Basis")

// Alert conditions for short

alertcondition(shortCondition, title="Short Alert", message="Price crossed below the upper Bollinger Band or Basis")

alertcondition(coverCondition, title="Cover Alert", message="Price crossed above the lower Bollinger Band or Basis")