Overview

This strategy utilizes multiple moving averages (MA) as the primary trading signals and incorporates the Average Directional Index (ADX) as a filter. The main idea behind the strategy is to identify potential long and short opportunities by comparing the relationships between the fast MA, slow MA, and average MA. Simultaneously, the ADX indicator is used to filter out market environments with sufficient trend strength, enhancing the reliability of trading signals.

Strategy Principle

- Calculate the fast MA, slow MA, and average MA.

- Identify potential long and short levels by comparing the closing price with the slow MA.

- Confirm long and short levels by comparing the closing price with the fast MA.

- Manually calculate the ADX indicator to measure trend strength.

- Generate a long entry signal when the fast MA crosses above the average MA, the ADX is above a set threshold, and a long level is confirmed.

- Generate a short entry signal when the fast MA crosses below the average MA, the ADX is above a set threshold, and a short level is confirmed.

- Generate a long exit signal when the closing price crosses below the slow MA; generate a short exit signal when the closing price crosses above the slow MA.

Strategy Advantages

- Using multiple MAs allows for a more comprehensive capture of market trends and momentum changes.

- By comparing the relationships between the fast MA, slow MA, and average MA, potential trading opportunities can be identified.

- Utilizing the ADX indicator as a filter helps avoid generating excessive false signals in choppy markets, improving the reliability of trading signals.

- The strategy logic is clear and easy to understand and implement.

Strategy Risks

- In situations where the trend is unclear or the market is choppy, the strategy may generate numerous false signals, leading to frequent trades and losses.

- The strategy relies on lagging indicators such as MA and ADX, potentially missing early trend formation opportunities.

- The performance of the strategy is significantly influenced by parameter settings (e.g., MA lengths and ADX threshold), requiring optimization based on different markets and instruments.

Strategy Optimization Directions

- Consider incorporating other technical indicators, such as RSI and MACD, to enhance the reliability and diversity of trading signals.

- Set different parameter combinations for various market environments to adapt to market changes.

- Introduce risk management measures, such as stop-loss and position sizing, to control potential losses.

- Combine fundamental analysis, such as economic data and policy changes, to gain a more comprehensive market perspective.

Summary

The MA Rejection Strategy with ADX Filter utilizes multiple MAs and the ADX indicator to identify potential trading opportunities and filter out low-quality trading signals. The strategy logic is clear and easy to understand and implement. However, when applying the strategy in practice, it is essential to consider market environment changes and combine other technical indicators and risk management measures for optimization.

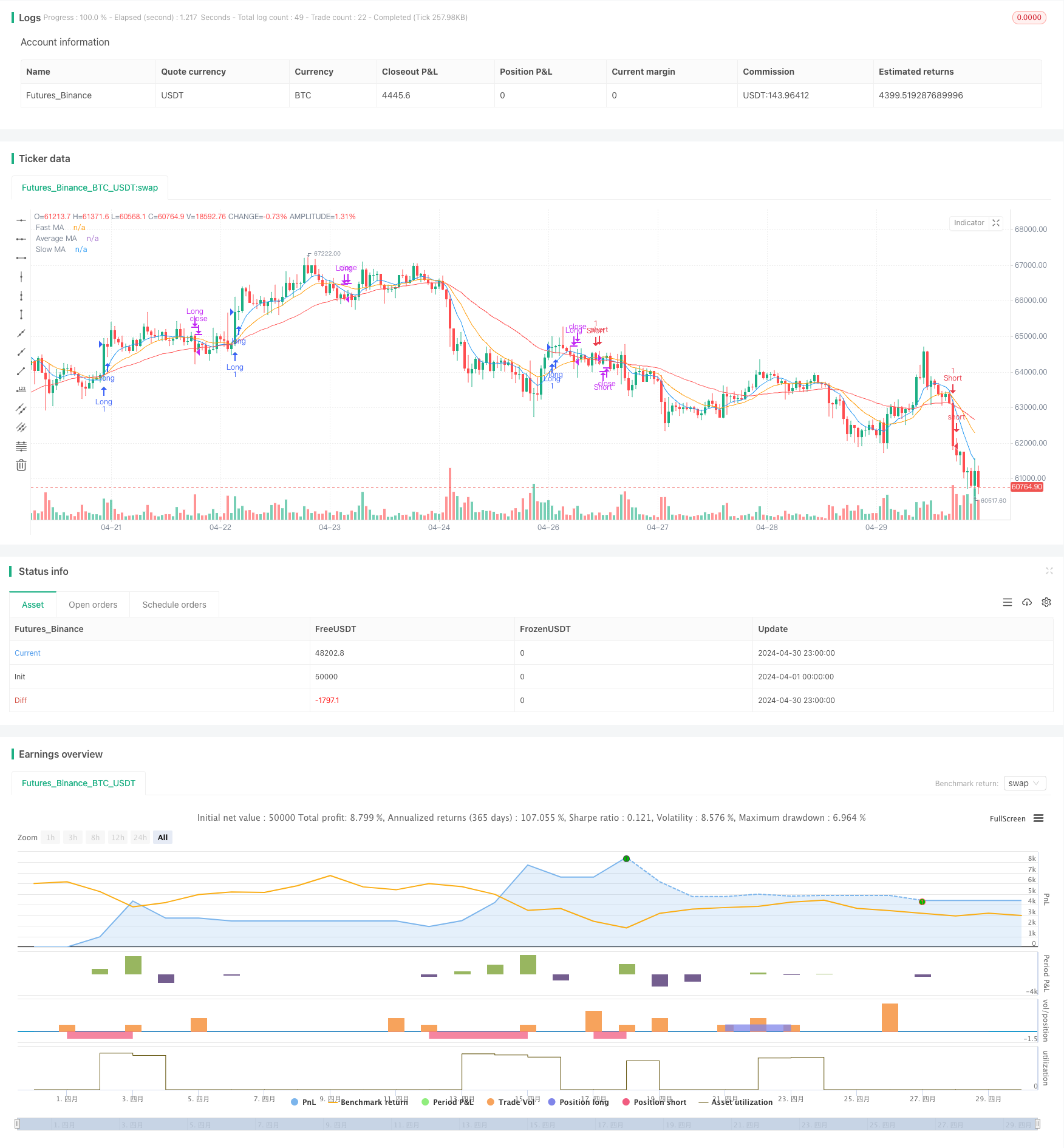

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gavinc745

//@version=5

strategy("MA Rejection Strategy with ADX Filter", overlay=true)

// Input parameters

fastMALength = input.int(10, title="Fast MA Length", minval=1)

slowMALength = input.int(50, title="Slow MA Length", minval=1)

averageMALength = input.int(20, title="Average MA Length", minval=1)

adxLength = input.int(14, title="ADX Length", minval=1)

adxThreshold = input.int(20, title="ADX Threshold", minval=1)

// Calculate moving averages

fastMA = ta.wma(close, fastMALength)

slowMA = ta.wma(close, slowMALength)

averageMA = ta.wma(close, averageMALength)

// Calculate ADX manually

dmPlus = high - high[1]

dmMinus = low[1] - low

trueRange = ta.tr

dmPlusSmoothed = ta.wma(dmPlus > 0 and dmPlus > dmMinus ? dmPlus : 0, adxLength)

dmMinusSmoothed = ta.wma(dmMinus > 0 and dmMinus > dmPlus ? dmMinus : 0, adxLength)

trSmoothed = ta.wma(trueRange, adxLength)

diPlus = dmPlusSmoothed / trSmoothed * 100

diMinus = dmMinusSmoothed / trSmoothed * 100

adx = ta.wma(math.abs(diPlus - diMinus) / (diPlus + diMinus) * 100, adxLength)

// Identify potential levels

potentialLongLevel = low < slowMA and close > slowMA

potentialShortLevel = high > slowMA and close < slowMA

// Confirm levels

confirmedLongLevel = potentialLongLevel and close > fastMA

confirmedShortLevel = potentialShortLevel and close < fastMA

// Entry signals

longEntry = confirmedLongLevel and ta.crossover(fastMA, averageMA) and adx > adxThreshold

shortEntry = confirmedShortLevel and ta.crossunder(fastMA, averageMA) and adx > adxThreshold

// Exit signals

longExit = ta.crossunder(close, slowMA)

shortExit = ta.crossover(close, slowMA)

// Plot signals

plotshape(longEntry, title="Long Entry", location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(shortEntry, title="Short Entry", location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Plot moving averages and ADX

plot(fastMA, title="Fast MA", color=color.blue)

plot(slowMA, title="Slow MA", color=color.red)

plot(averageMA, title="Average MA", color=color.orange)

// plot(adx, title="ADX", color=color.purple)

// hline(adxThreshold, title="ADX Threshold", color=color.gray, linestyle=hline.style_dashed)

// Execute trades

if longEntry

strategy.entry("Long", strategy.long)

else if longExit

strategy.close("Long")

if shortEntry

strategy.entry("Short", strategy.short)

else if shortExit

strategy.close("Short")